Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

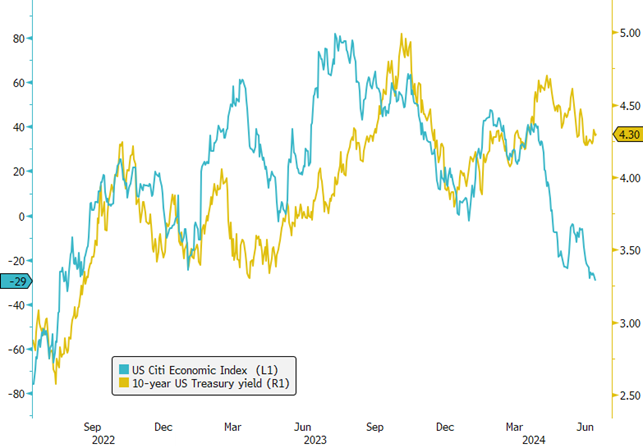

Q2 Fixed Income Review Chart: US Treasury Yields Resilient Amid Mixed Economic Signals!

As the second quarter of 2024 unfolded, a noticeable normalization of the US economy became evident, marked by a significant downturn in the US Citi Economic Index from 33 to -29, reaching its lowest level in nearly two years. Despite these economic headwinds, the 10-year US Treasury yields closed the quarter slightly higher at 4.30%, a 10-basis point increase. This apparent contradiction between economic normalization and rising yields can be largely attributed to substantial US Treasury issuances, necessary to fund the expansive US fiscal deficit. Furthermore, persistent inflationary pressures have prompted the central bank to delay the anticipated rate cut from July to November 2024, adjusting expectations amid changing economic conditions. As we approach a typically low-liquidity summer period, any shifts in interest rates could be magnified. Additionally, with the US presidential election on the horizon, market sentiments could be further influenced by electoral outcomes. The looming question is: Which will have a greater impact on third-quarter rates—the slowdown in the US economy, the ongoing inflationary and supply pressures, or the unfolding political landscape? #Finance #Economy #TreasuryYields #EconomicIndicators #Inflation #FiscalPolicy #InterestRates #USPresidentialElection #MarketAnalysis Source: Bloomberg

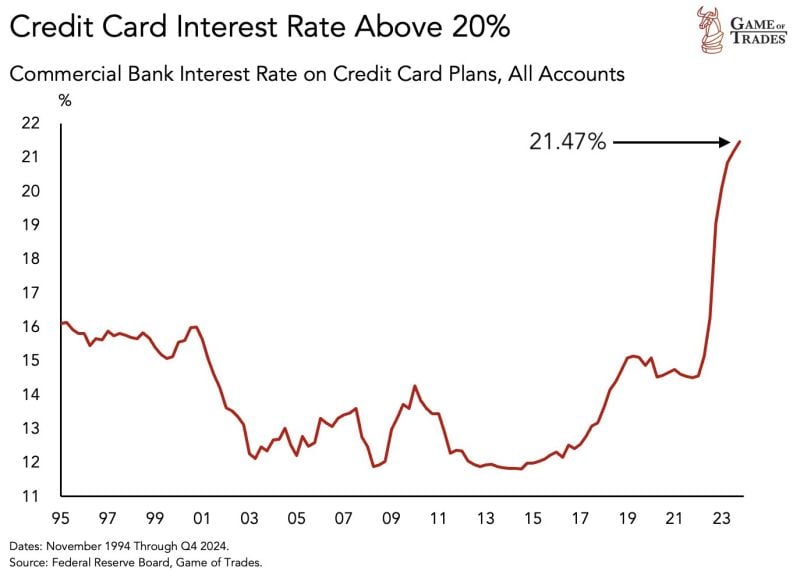

CAUTION: In the US, Credit card interest rates have skyrocketed to a shocking 21.47%

Moreover, credit card debt has crossed the $1 trillion mark. And personal interest payments have risen to over $500 billion. To make things worse, excess savings have now run out Source: Game of Trades

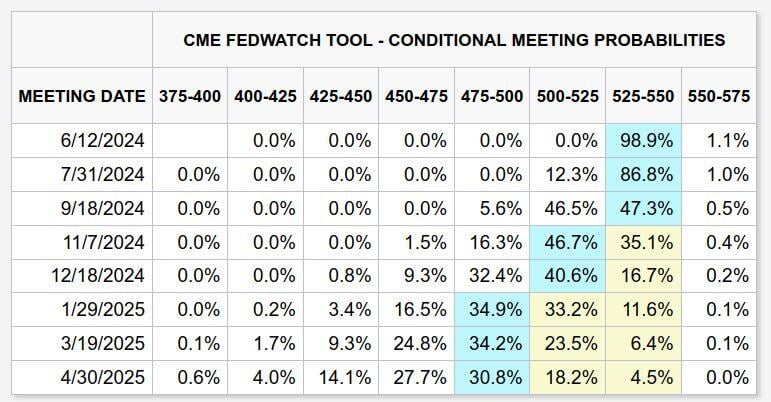

After the hotter than expected Flash PMI prints yesterday, the market is pricing in one cut for this year to occur in November or December, and another in early 2025.

Source: Markets & Mayhem

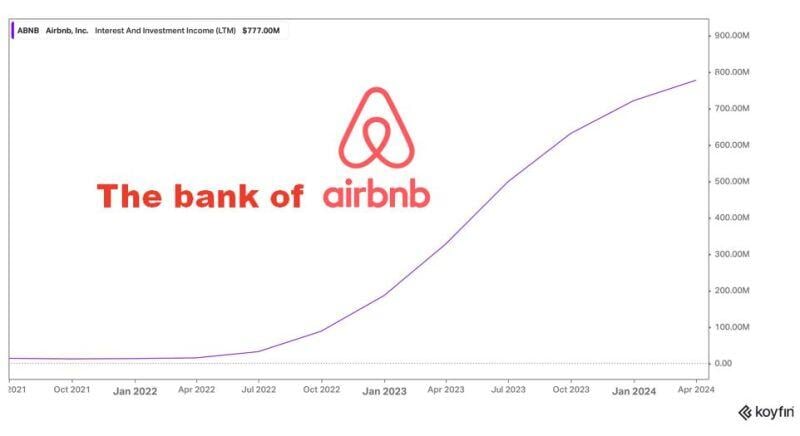

The Bank of Airbnb $ABNB by Wolf of Harcourt Street

ABNB's interest income has skyrocketed to $777 million over the past 12 months. This return is more akin to a bank than a travel company. ABNB benefits from being the Merchant of Record which means that it is the party that processes and distributes the actual payment for a product or service. When a customer makes a booking on Airbnb, Airbnb receives the cash in advance. This cash is held on behalf of the host and paid out once the service has been provided. With the interestrate hikes over the past year, Airbnb was able to benefit from investing the cash in short-term US Treasury bills before paying it out to hosts. Source: Wolf of Harcourt Street

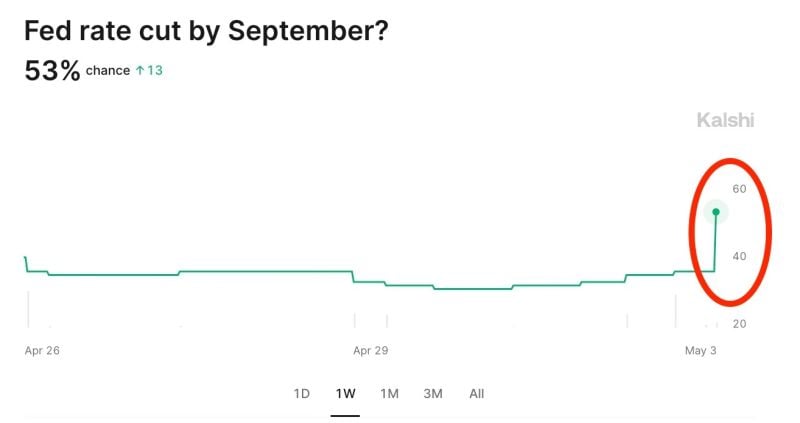

Odds of a September 2024 rate cut jump to 53% after the weaker than expected jobs report, according to Kalshi.

The base case now shows TWO interest rate cuts in 2024, up from ONE prior to the report. On Wednesday, Fed Chair Powell specifically said weakening of the labor market could spur rate cuts. Market implied odds of zero interest rate cuts this year have dropped from 35% to 27%. The Fed rollercoaster ride continues. Source: The Kobeissi Letter

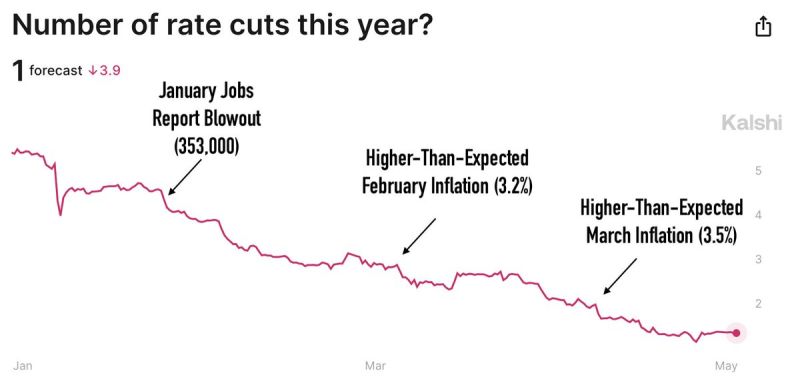

Interest rate futures have been wildly inaccurate over the last 12 months.

In September, just 2 rate cuts were expected by December 2024. In January, 6 rate cuts were expected by December 2024. Now, we will be lucky to get one rate cut over the next year or so. In fact, prediction markets are showing a 40% chance of ZERO rate cuts in 2024. Prediction markets also see an 11% chance of a rate HIKE in 2024 despite Powell saying he thinks it's unlikely. Source: The Kobeissi Letter, Kalshi

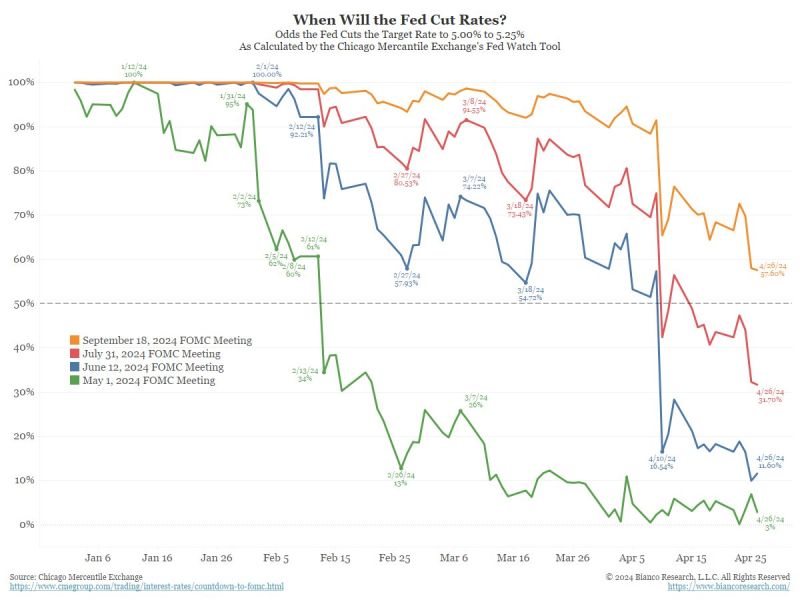

Fed Cut Probability Update - Jim Bianco (Bianco Research)

- May 1 FOMC meeting (green) less than 50% (meaning no move) - June 12 FOMC meeting (blue) less than 50% (meaning no move) - July 31 FOMC meeting (red) less than 50% (meaning no move) - September 18 FOMC meeting (orange) less than 60% (since it is 5 months away, effectively a coin-toss) After this, the next FOMC meeting is Thursday, November 7, two days after the election.

Investing with intelligence

Our latest research, commentary and market outlooks