Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

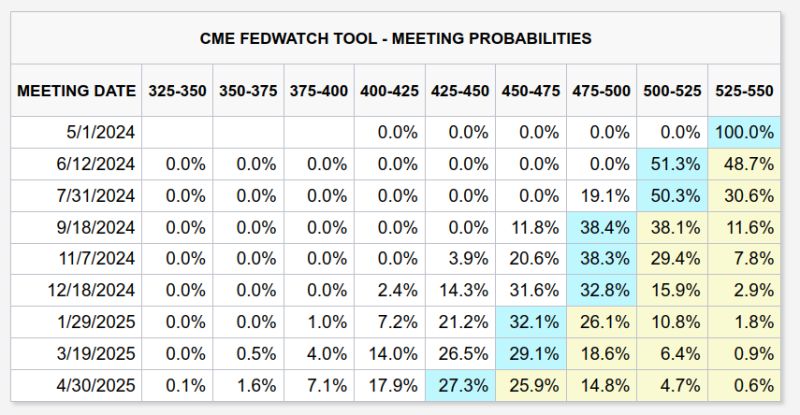

JUST IN: Federal Reserve will cut interest rates by 50 basis points as soon as June and 150 points by the end of this year, says State Street in call against Wall Street consensus

Source: Bloomberg, radar

From expecting 6 Fed rate cuts to just two in 2024 😉

Source: Markets & Mayhem

Jamie Dimon's 61 page annual shareholder letter is finally out for FY2023!

-A rate spike is very possible with stickier inflation. Interest rates could soar to 8% -Says Federal deficit is a real issue hurting business confidence (govt spending could keep rates high) -US economy resilient so far with consumer spending, but the economy has also been fueled by government deficit spending and past stimulus -Market is pricing in 70-80% chance of a soft landing/no landing...Dimon thinks that is too high -Inflation resurgence, political polarization are risks for this year (Ukraine, Middle East, China) - AI may be as impactful on humanity as the printing press Source: SpecialSitsNews, Barchart

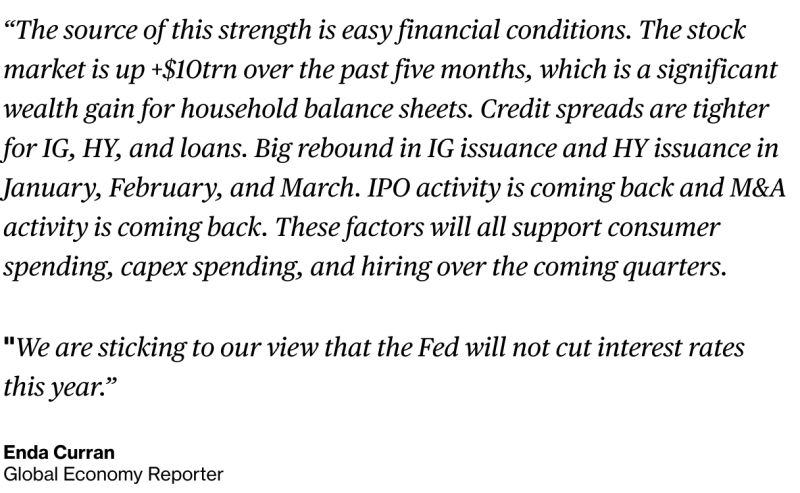

Torsten Slok at Apollo is sticking to his view that there will be no US rate cut this year...

Source: Markets & Mayhem, Apollo

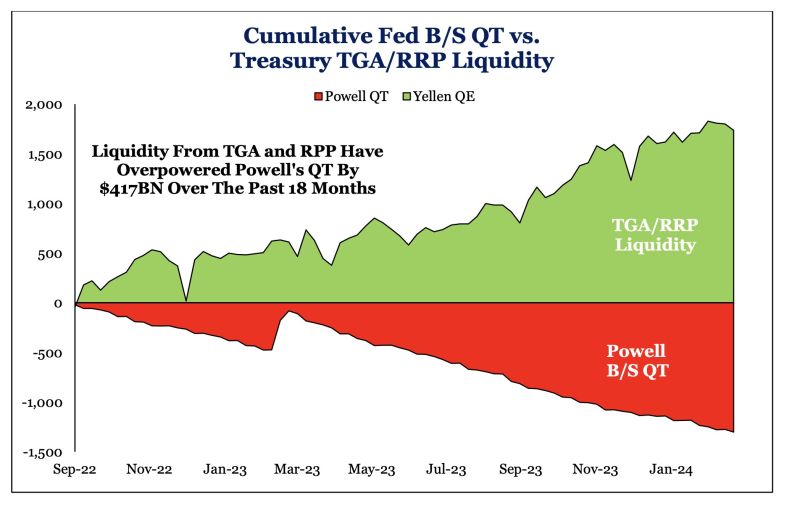

It's the liquidity, stupid! Yellen's stealth QE overpowering Powell's QT.

This probably helps risk assets performing well despite high interest rates and qt (Chart via SRP thru HolgerZ)

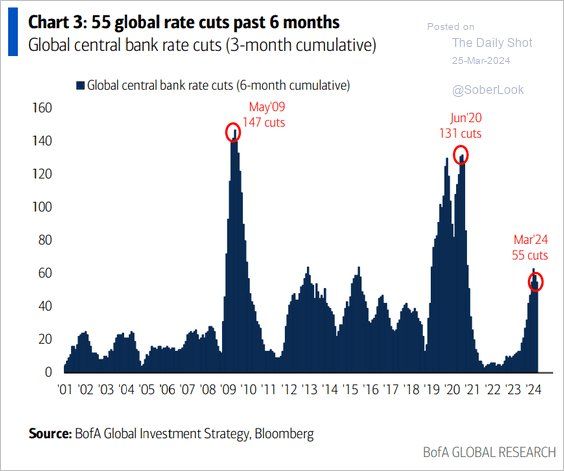

Central banks cut rates at the fastest pace since heading into the pandemic.

Source: BofA, The Daily Shot

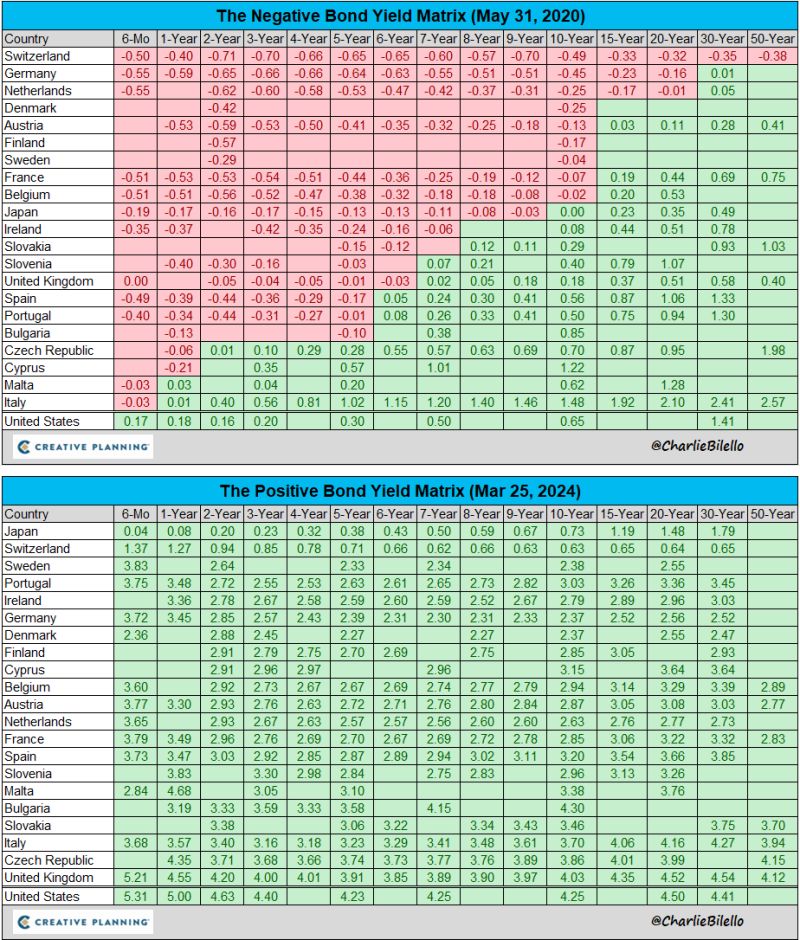

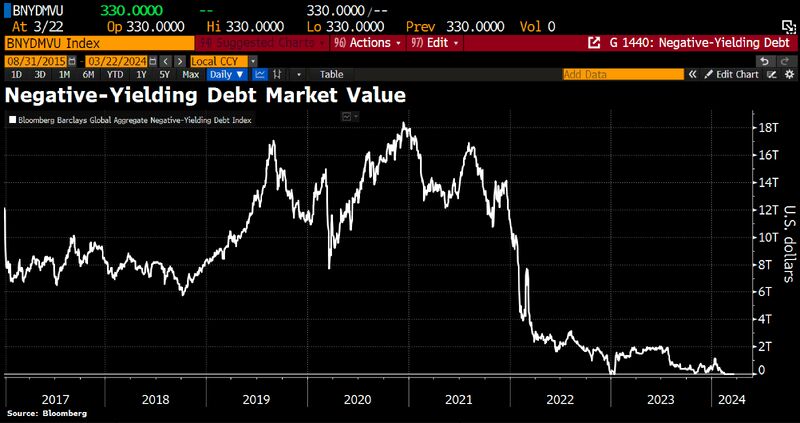

In May 2020, there were 21 countries with negative interest rates. Today there are none.

Sanity has returned to the global bond market... Source: Charlie Bilello

In case you missed it:

After bank of japan abolished negative interest rates this week for 1st time since 2016, the volume of bonds with negative interest rates has shrunk to $300mln. At its peak, there was a volume of $18tn worth of bonds with negative rates. But this weird experiment seems to be over – for now. Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks