Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

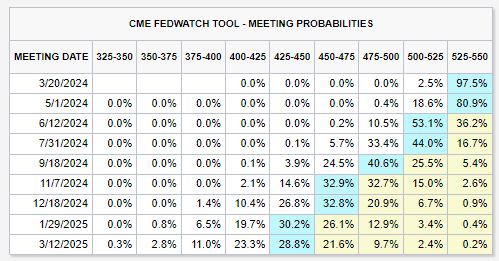

Interest rate cut expectations continue to scale back: Markets now see a ~38% chance of 4 interest rate cuts in 2024

Just over a month ago, the base case showed a 50%+ chance of 6 interest rate cuts in 2024. Meanwhile, odds of a March rate cut are down to 3% and odds of a May rate cut are down to 19%. For the first time in 2024, markets are close to the Fed's latest guidance of 3 cuts in 2024. Source: The Kobeissi Letter

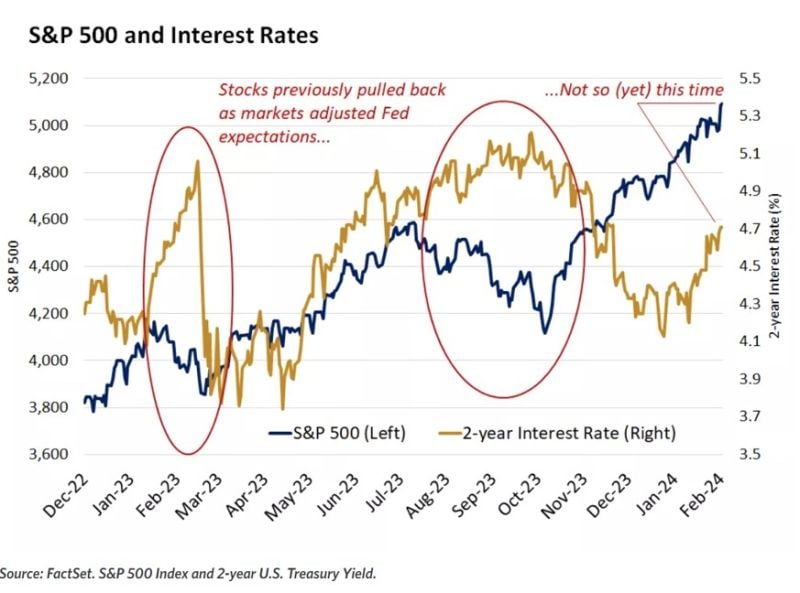

US equities are shrugging off higher rates.

The chart below shows the level of the S&P 500 Index and the 2-year U.S. Treasury yield. Yields have risen in 2024 but unlike prior episodes of rising yields last year, the S&P 500 has moved higher as well. Past performance does not guarantee future results. Source: Edward Jones

Goldman Sachs' analysts no longer expect a U.S. interest rate cut in May and see four 25 basis point cuts this year.

"Because there are only two rounds of inflation data and a little over two months until the May (Fed) meeting, the comments suggest to us that a rate cut as early as May, which we had previously expected, is unlikely," Goldman Sachs analysts said in a note. They now forecast an extra cut next year instead, with an unchanged terminal rate forecast of 3.25-3.5%." source : goldmansachs, reuters

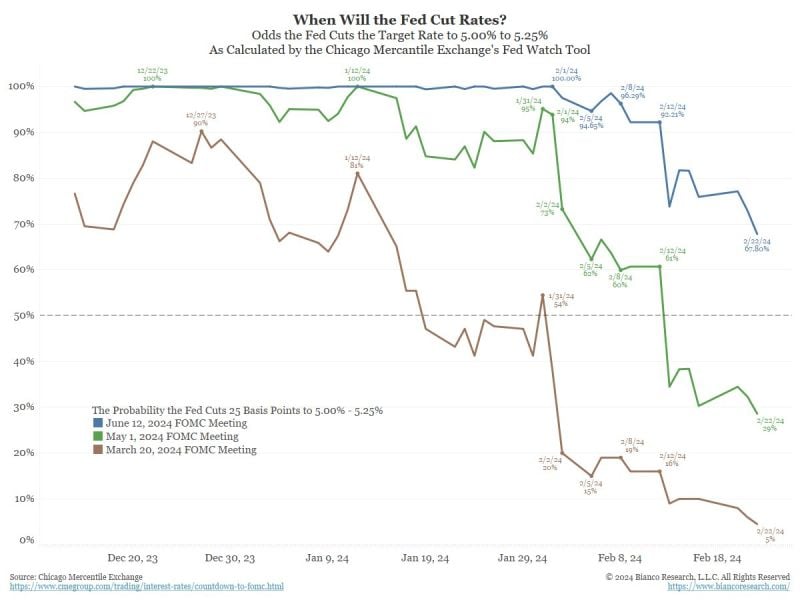

This chart shows the market pricing of a rate cut over the next three FOMC meetings.

March probability = 5% (was 80% at the start of the year) May probability = 29% (was 100% at the start of the year) June probability = 67% (was 100% at the start of the year) Source: Bianco Research

FOMC Minutes Show 'Most Officials Fear Risk Of Cutting Too Quickly'

The discussion came as policymakers not only decided to leave their key overnight borrowing rate unchanged but also altered the post-meeting statement to indicate that no cuts would be coming until the rate-setting Federal Open Market Committee held “greater confidence” that inflation was receding. The meeting summary indicated a general sense of optimism that the Fed’s policy moves had succeeded in lowering the rate of inflation, which in mid-2022 hit its highest level in more than 40 years. However, officials noted that they wanted to see more before starting to ease policy while saying that rate hikes are likely over. Members cited the “risks of moving too quickly” on cuts. Source: CNBC Activate to view larger image,

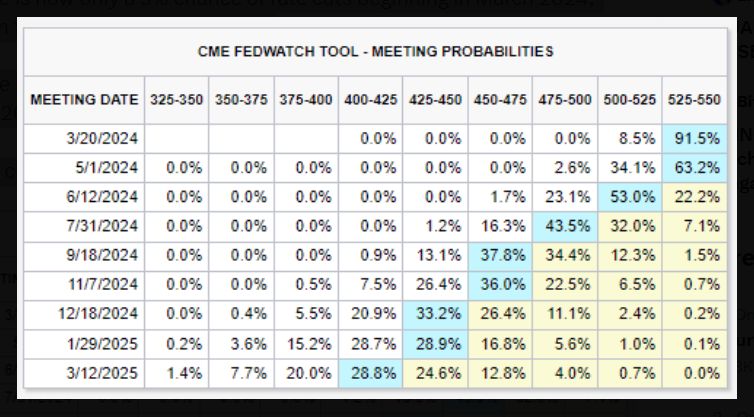

It's official, higher for longer is back! For the first time this year, markets are now pricing-in just 4 interest rate cuts in 2024.

Just 6 weeks ago, markets were expecting 6 interest rate cuts in 2024. More importantly, the timing of the first rate cut has been pushed all the way back to June 2024. There is now only a 9% chance of rate cuts beginning in March 2024, down from 90% just 6 weeks ago. There is also a ~63% chance that interest rates are unchanged through May 2024. Rate cuts are all but guaranteed. Source: The Kobeissi Letter

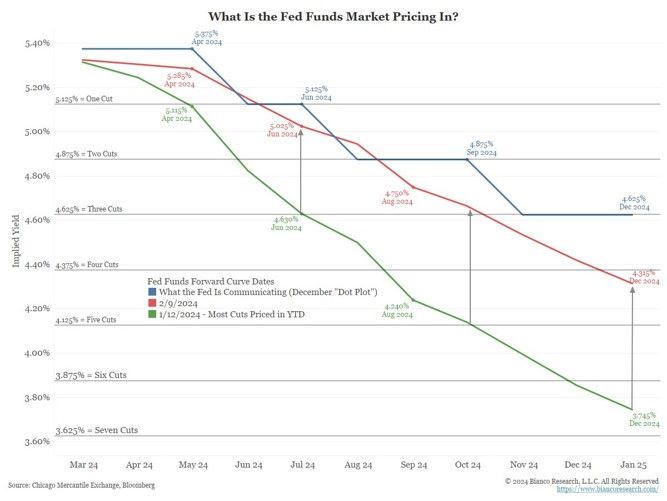

Four rate cuts are now priced in for 2024 (red), the LEAST number of cuts YTD.

This is down from seven rate hikes on January 12 (green), the MOST number of cuts (YTD). Source: Bianco Research

Here's the current expectation on Wall Street regarding the actions of the US Federal Reserve in 2024.

source : wsj, ntimiraos

Investing with intelligence

Our latest research, commentary and market outlooks