Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

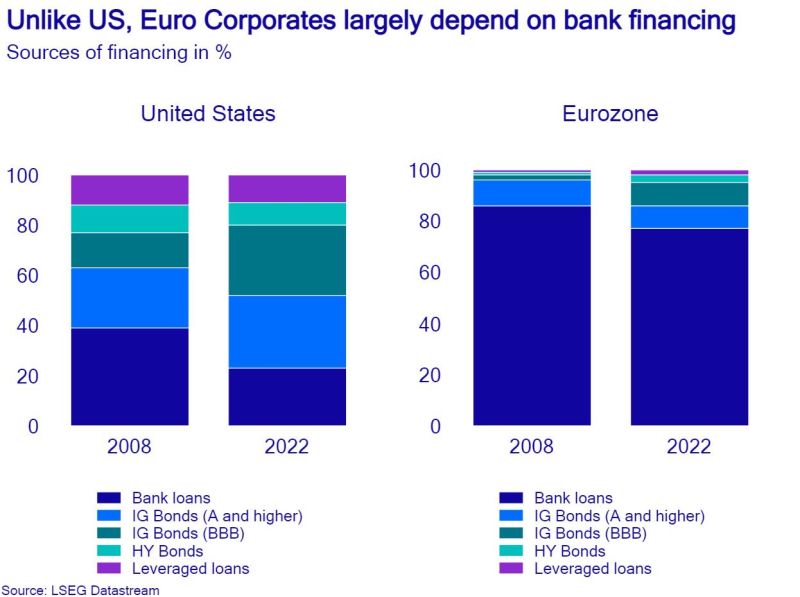

The reason why tighter bank lending conditions bite Eurozone economy faster, while US companies still don’t suffer under higher rates due to longer duration.

Source: Patrick Krizan, Michel A.Arouet

Nice cartoon by hedgeye...

Let see how long Powell will resist not cutting rates... Trump seems to have already decided about his faith anyway...

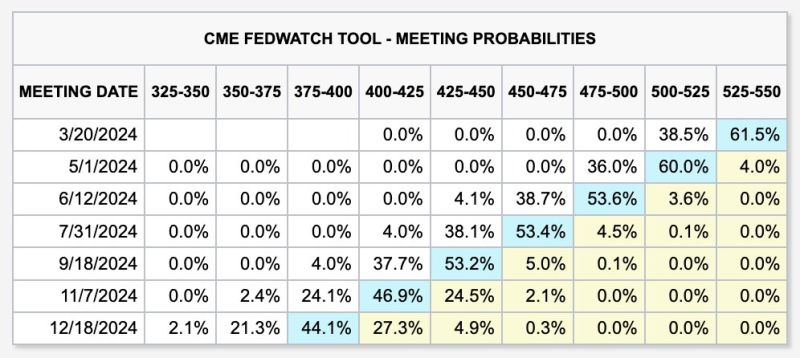

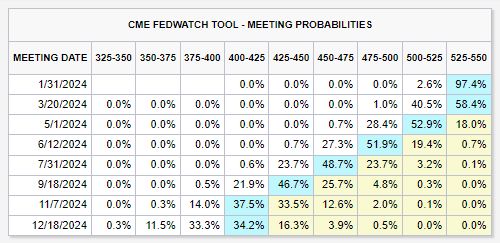

The Fed said that a March rate cut is "unlikely," yet futures are still pricing in a 39% chance it happens

Even as the Fed said they cannot cut rates until inflation is comfortably moving to 2%, markets still see 6 cuts in 2024. There's even a growing 23% chance of 7 interest rate cuts this year. Markets are pricing in a rate cut at EVERY remaining Fed meeting this year. As highlighted by the Kobeissi Letter, if the Fed is on track for a "soft landing," why do we need to many rate cuts? Source: The Kobeissi Lette

Divided Bank of England boe leaves policy unchanged, says interestrates are ‘under review’

- Inflation is projected to fall temporarily to the Bank’s 2% target in the second quarter of this year before rising again in the third and fourth, due to the varying contribution of energy prices to annual comparisons. - Headline inflation is not expected to return to target again until late 2026, the Bank’s newest Monetary Policy Report projected. - Bank of England: 6 votes to hold rates, 2 votes to hike, 1 vote to cut This is the 6th time in the BoE's 295 meeting history that we've seen a 3 way split vote. On most occasions (except for '06) - the doves have won & BoE have gone on to cut rates sharply https://lnkd.in/e64nMDB6

Powell “stayed away from addressing the banking sector but the sharp decline in regional shares is certainly getting attention at the Fed.”

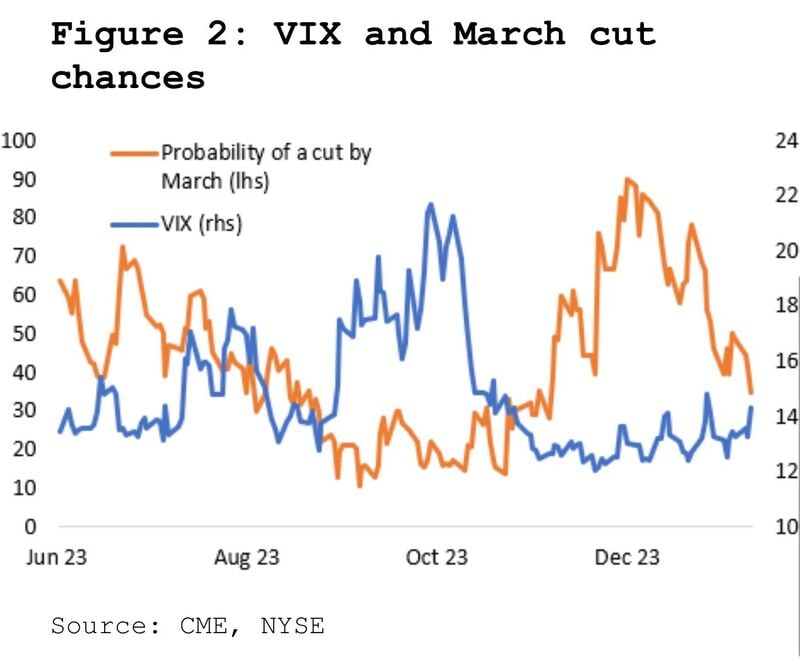

Could the combo "March cut is fully priced out + regional bank stress building" trigger a temporary spike of the VIX? Source: Carl Quintanilla

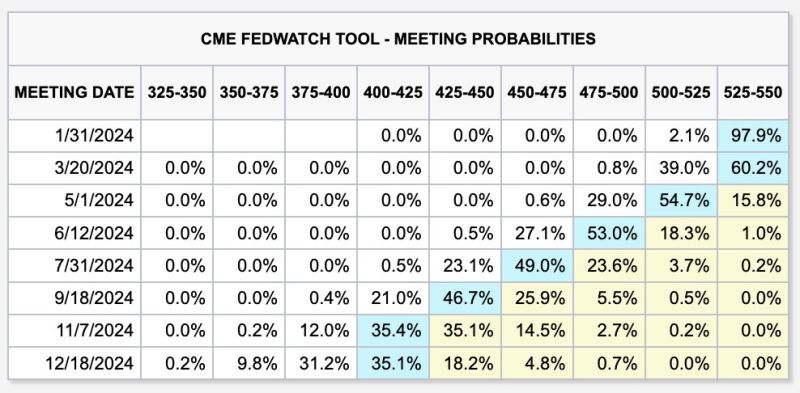

As we are less than 24 hours away from the first Fed meeting of 2024, odds of rate cuts are pulling back

Odds of a rate cut this week are down to 2% and odds of a rate cut in March are down to ~40%. This is the lowest probability of a March rate cut since November 2023. Still, futures are pricing-in a base case of 6 rate cuts for a total of 150 bps in 2024. - All eyes will be on Fed guidance on June 30zh Source: The Kobeissi Letter

It's official: markets are no longer expecting a FED rate cut in March 2024.

There's still a ~42% chance of rate cuts beginning in March, but this is a major shift in expectations. Just two weeks ago, markets saw a 90% chance of rate cuts beginning in March. Odds of rate cuts beginning at next week's Fed meeting are now down to ~2%. We are still seeing ~150 bps of interest rate cuts priced-in to futures. But, Fed pivot hopes are slowly pulling back. Source: The Kobeissi Letter

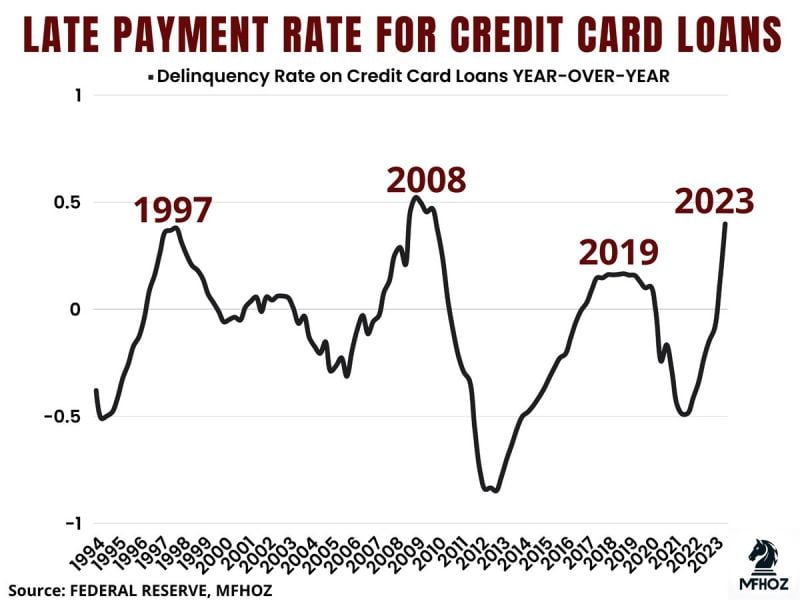

🟥 The delinquency rate for credit card loans in 2023 has risen sharply

Which, based on historical patterns, suggests that the economy might be heading towards a recession.

Investing with intelligence

Our latest research, commentary and market outlooks