Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

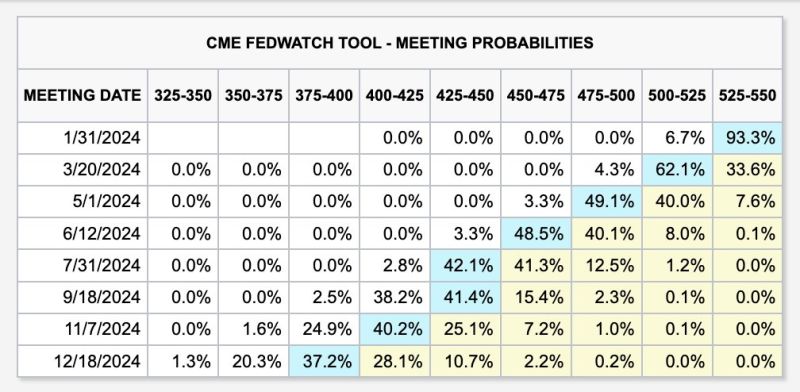

US interest rate futures are beginning to shift back in the less dovish direction

Odds of 7 or 8 interest rate cuts in 2024 have halved this week. Also, odds of rate cuts beginning this month are down to just 7%. However, the base case still shows 6 rate cuts for a total of 150 basis points in 2024. This is double the 3 rate cuts forecasted at the Fed's latest meeting. Source: The Kobeissi Letter

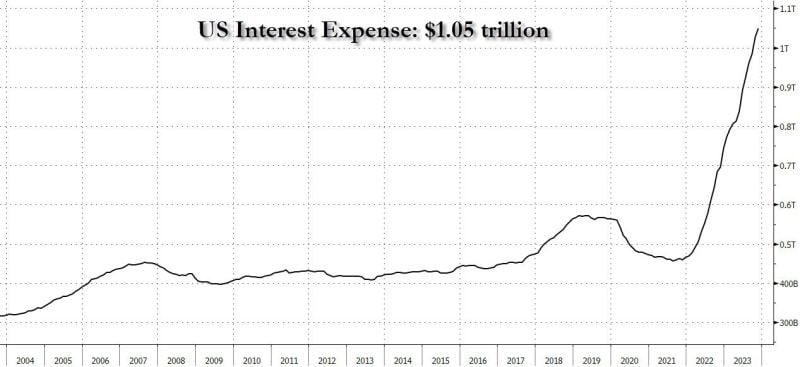

US Interest expense ~$1.1 trillion as of today

That's $250BN more than the Defense Budget; $250BN more than spending on Medicare, $200BN more than spending on health, and will surpass the $1.35 trillion spending on Social Security this year, becoming the single biggest outlay Source: www.zerohedge.com

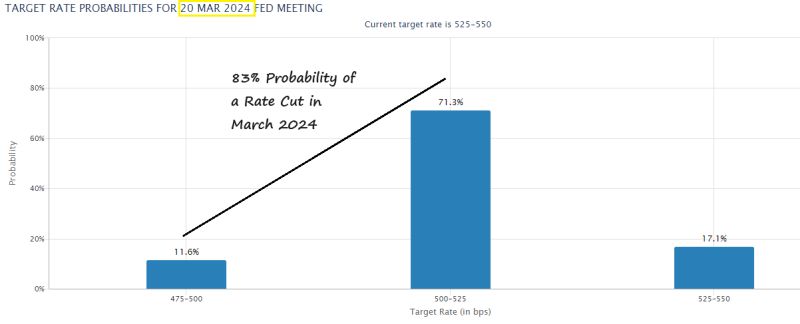

The probability of a Fed rate cut in March 2024 has jumped up to 83%. A month ago the odds were only 29%.

Source: Charlie Bilello

BREAKING >>>New York Fed President John Williams CNBC interview: The Fed "isn't really" talking about rate cuts right now

Mr. Williams said: - The Fed "isn't really" talking about rate cuts right now. - Committee members submit projections regarding path of interest rates. Inflation and economy is still uncertain, but base cases are looking pretty good. - Policy focused on getting inflation down to 2%. - Market reaction to all news events have been larger than normal. - Fed should be ready to hike again if needed. - Fed is at or near right place for monetary policy. - The policy restraints should be dialed back slowly over the next three years.

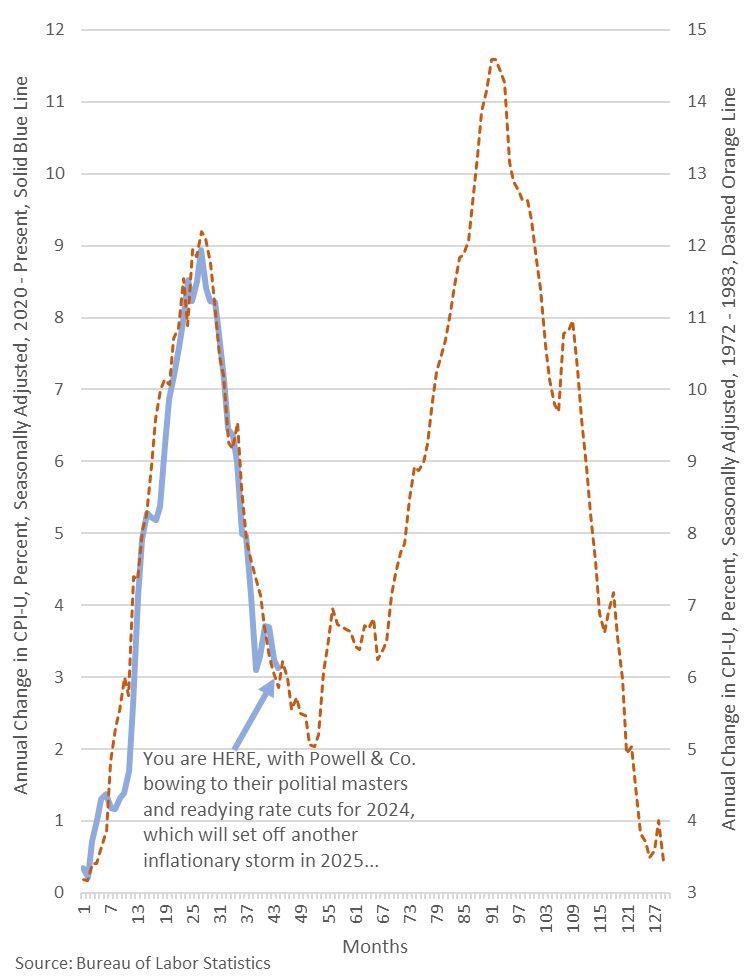

Is Fed making the same error as the mid 1970s?

In the 1970s they also thought they had beat inflation in 1974-1975, they lowered rates and then inflation roared back to even higher levels in the late 1970s. Inflation on came down in early 1980s because of two factors. 1) massive new oil (energy) supply from Alaska, Gulf of Mexico, North Sea and huge new fields in Mexico coming online. 2) 18% interest rates crushed the economy. Source: Wall Street Silver

The European Central Bank held interest rates steady for the second meeting in a row, as it revised its growth forecasts lower and announced plans to shrink its balance sheet

ECB's Lagarde: We did not discuss rate cuts at all BUT markets price in 5.3 cuts for 2024. “The Governing Council’s future decisions will ensure that its policy rates will be set at sufficiently restrictive levels for as long as necessary,” it said in a statement. Source: Bloomberg, CNBC

The Fed is still behind the curve...

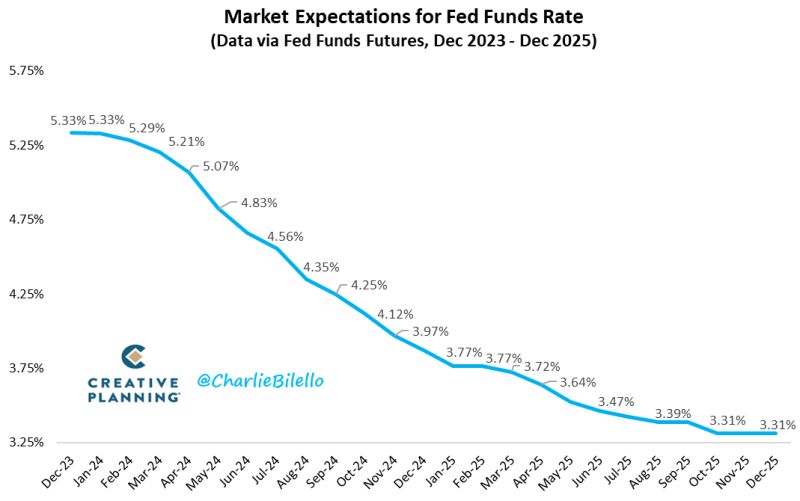

The market is now pricing in a Fed Funds Rate of 3.8% by the end of 2024, expecting significantly more easing than the Fed's projection of a move down to 4.6%. Source: Charloe Bilello

Investing with intelligence

Our latest research, commentary and market outlooks