Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

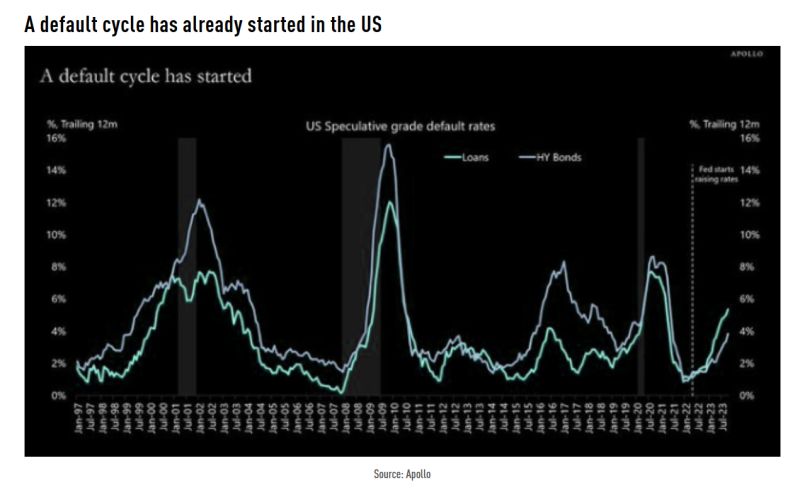

Since the Fed started raising rates in March 2022, default rates have gone from 1% to 5%+

Source: Apollo, TME

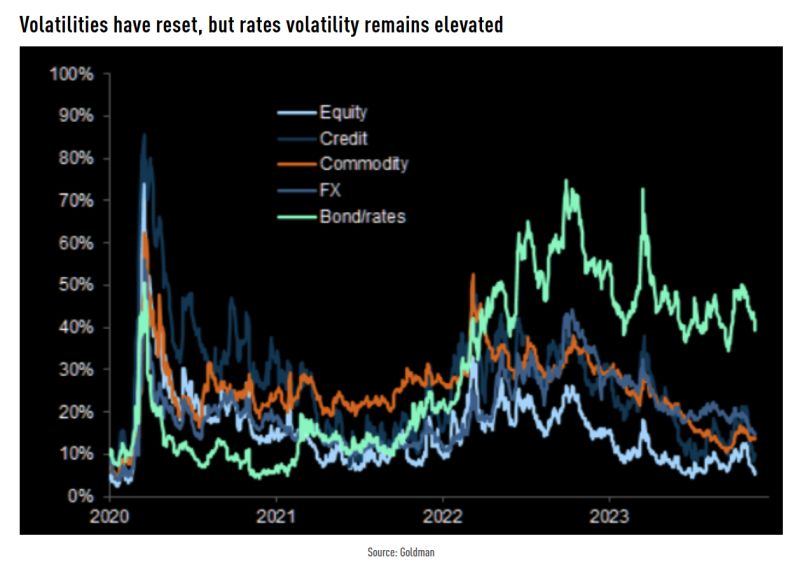

Below the average 3-month ATM implied volatility (max/min range since 2008)

Source: TME, GS

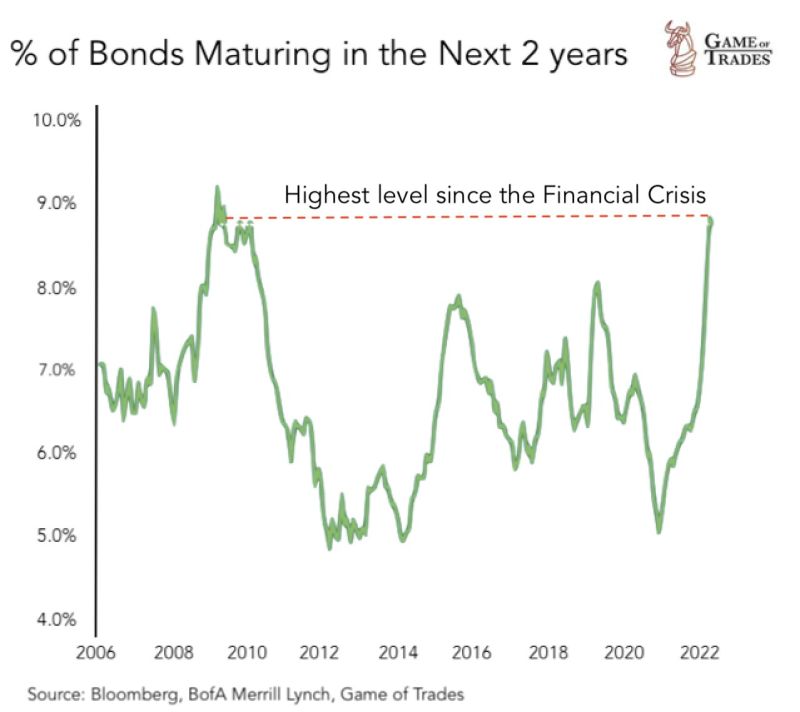

Something to keep in mind for 2024?

Source: Michel A.Arouet

This level was last seen during the Financial Crisis

9% of bonds are due to mature within the next 2 years. High interest rates will make it harder to refinance. Source: Game of Trades

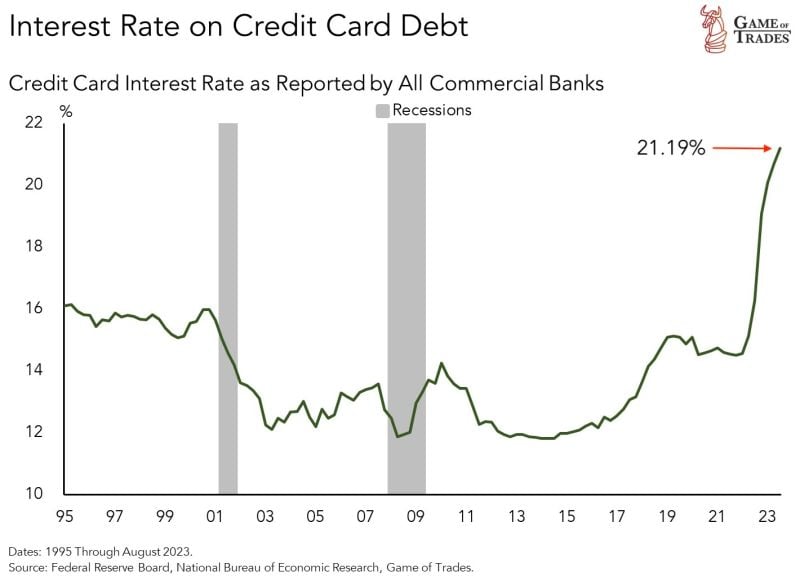

Interest rate on credit card debt has risen to 21.19%

To put this in perspective, this rate was at 14.56% in early 2022. That’s a 6% + jump in less than 2 years. Current levels have NEVER been seen in over 25 years. This is happening at a time when credit card debt has crossed the $1 trillion threshold. To make things worse, personal interest payments have crossed $500 billion. Source: Game of Trades

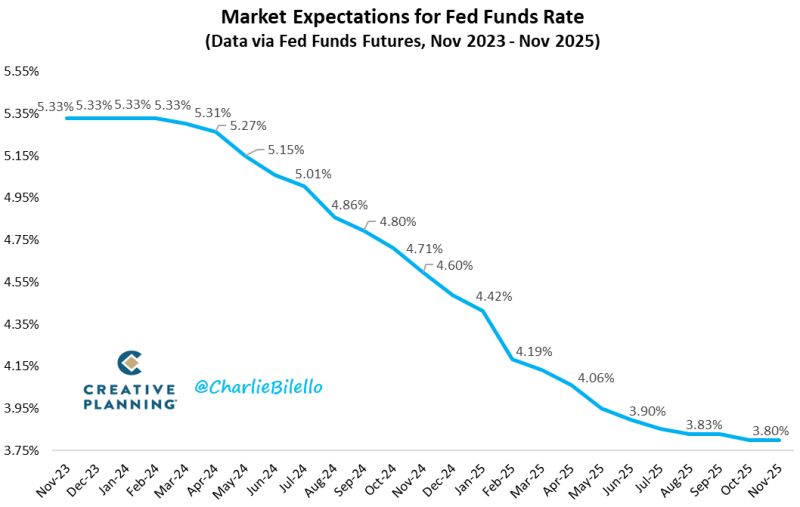

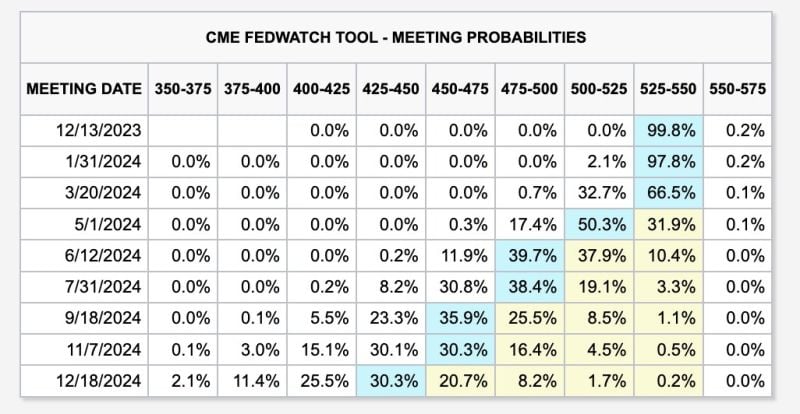

Ahead of Fed minutes... The market is now pricing in a 0% probability of a rate hike in December and rate cuts starting in May 2024

Source: Charlie Bilello

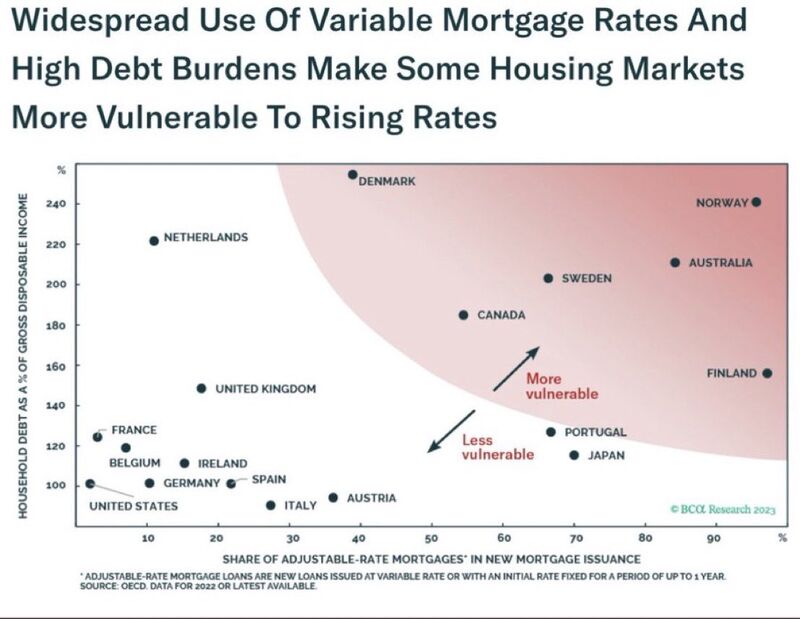

Which countries have the most rate sensitive household sectors?

Source: BCA, The Longview

JUST IN: Futures now show a 0% chance of additional rate hikes with rate cuts beginning in May 2024

Prior to today's CPI report, there was a 30% chance of at least one more rate hike ahead. Rate cuts were expected to begin in June 2024. Now, markets are pricing-in at least 4 rate CUTS in 2024. Markets are betting that the Fed is done. Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks