Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

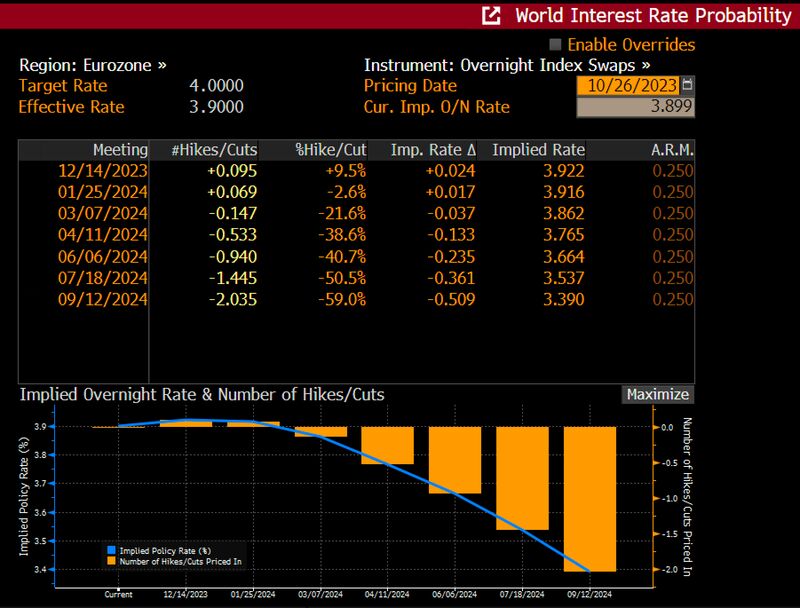

ECB's Lagarde: "Rate cuts weren't discussed, would be totally premature".

Meanwhile, markets see the first ECB cut at April 2024 meeting. Source: Bloomberg, HolgerZ

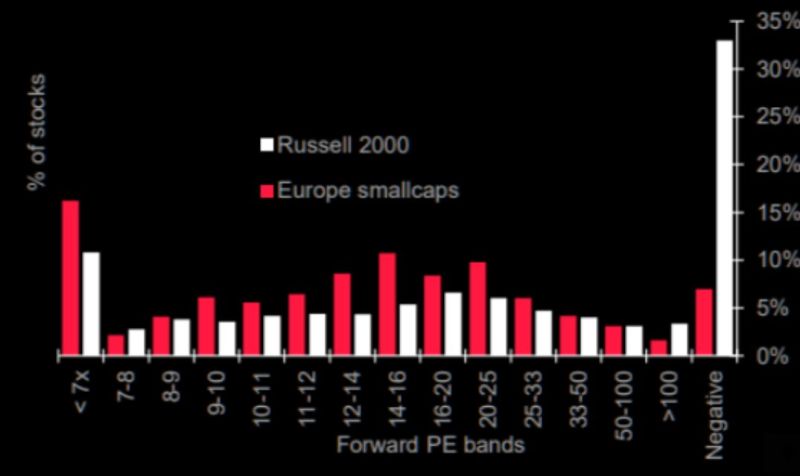

Welcome to Zombie Land

"There are some serious problems in small-caps, especially in the US. Good luck paying interest without profits. Great chart via Soc Gen showing the distribution of stock forward P/E valuations in the MSCI Europe small cap and Russell 2000 index. Source: SG, Themarketear, Lance Roberts

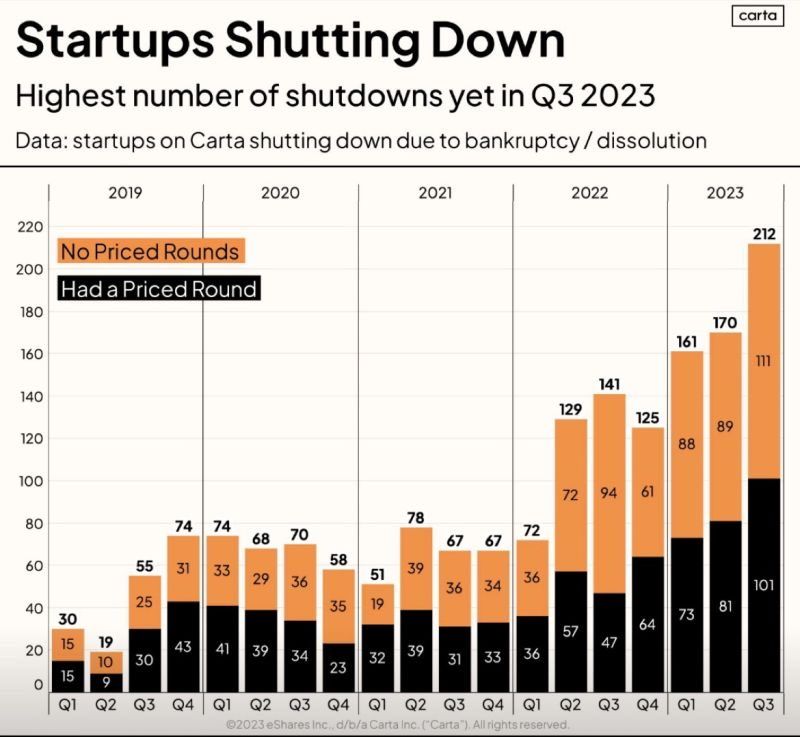

Startups are increasingly shutting down

Rising rates, lower liquidity and reduced risk appetite are hurting funding. Difficult business conditions are eroding viability further. Source: Markets & Mayhem

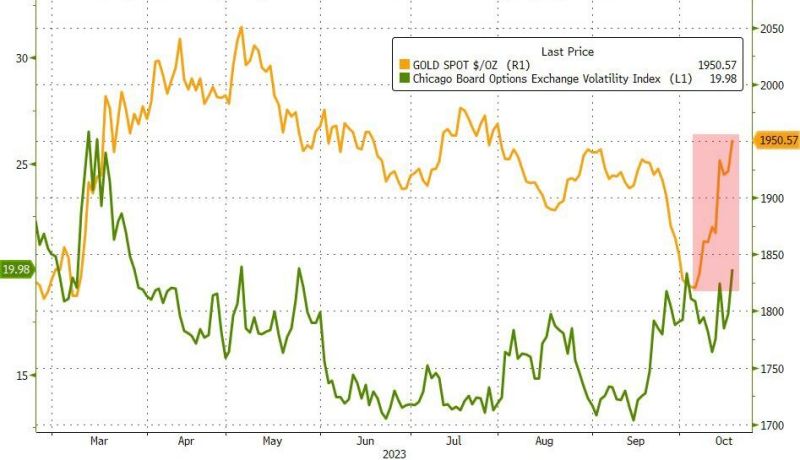

Gold (in yellow) vs. VIX (in green). Is gold the new 'fear index'?

It has systemically decoupled from real rates for sure. Source: Bloomberg

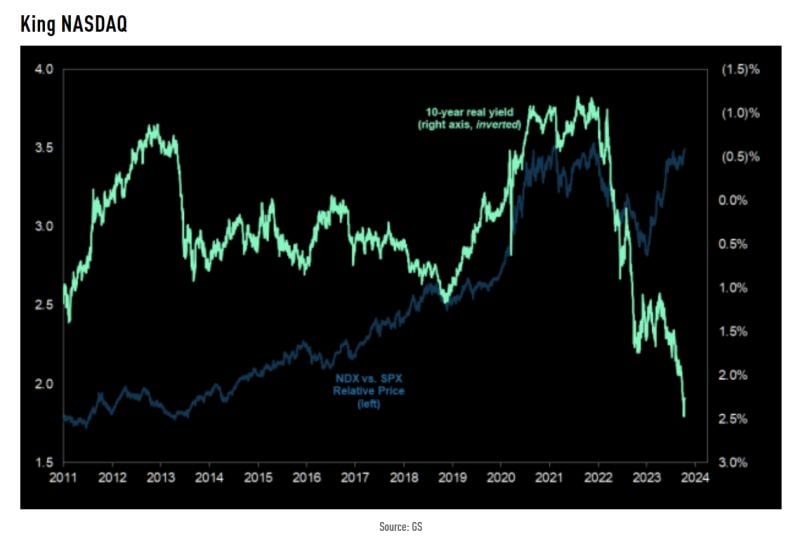

The relative Nasdaq 100 bull does not care about no rates moving higher...

Source: TME, Goldman Sachs

Wondering why high interest rates hasn't hurt sp500 performance so far?

Just have a look at the chart below courtesy of Linas Beliūnas. The S&P 500 heavy weights are full of cash and have been benefiting from the higher yield paid on short-term deposits. E,g Apple is making $1 billion on their cash holdings doing absolutely nothing...

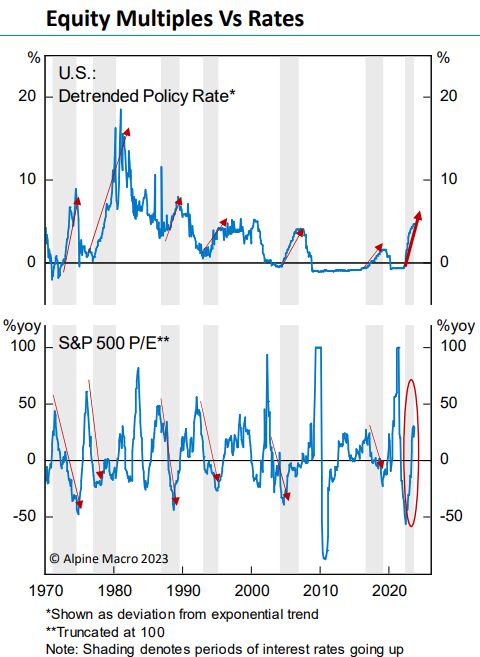

For the first time in the last 5 decades, rising interest rates have failed to cause Stock P/E multiples to contract

Source: Barchart

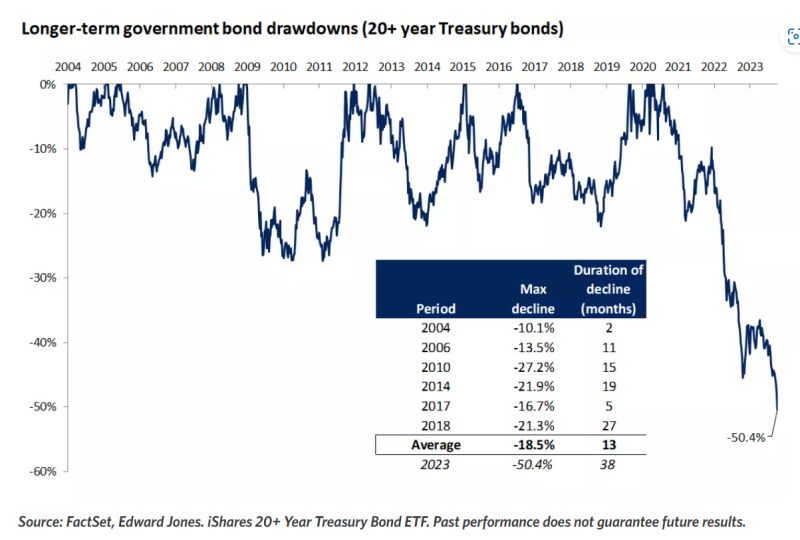

Big opportunities ahead for fixed income investors?

The past three years' pain in bonds could indeed be setting the stage for outsized gains ahead. To put the decline into perspective, long-term government bonds, with maturities greater than 20 years, have dropped 50% from their 2020 peak, a drawdown that is comparable to the 56% decline in stocks during the height of the Global Financial Crisis in 2008 Source: Edward Jones

Investing with intelligence

Our latest research, commentary and market outlooks