Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

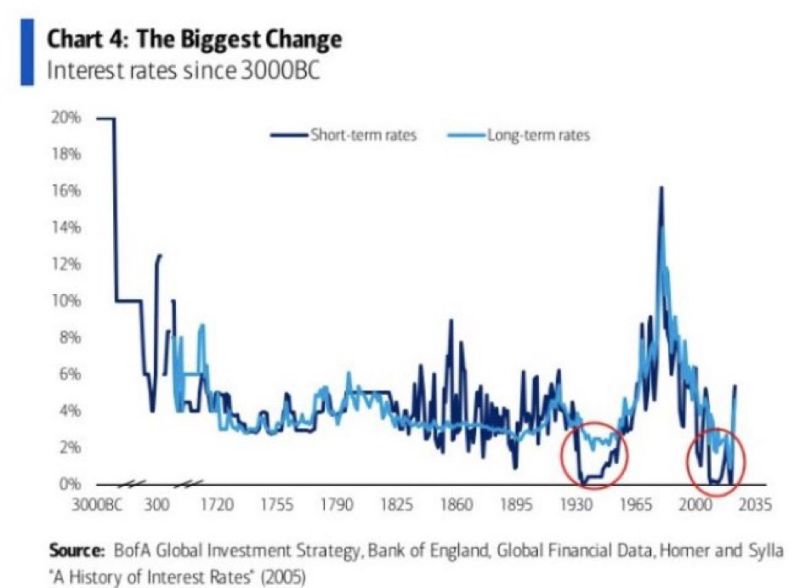

The longest time period chart on US interest rates you will ever find...

Source: BofA

While mega-caps tech stocks are recording huge returns on their cash pile thanks to the rise of interest rates, this is not the case for the rest of the market

Small cap companies are paying the most interest expense ever recorded and unfortunately their interest income is not keeping pace. This will become an even larger problem when small companies are forced to refinance at significantly higher rates. Source: FT, barchart

As highlighted in a tweet by HolgerZ, the S&P 500 is running in tandem with the Fed net liquidity

So it's not so much the peak or pause in rate hikes that matters, but rather what happens to the Fed balance sheet & reverse repo operations. Source: HolgerZ, Bloomberg

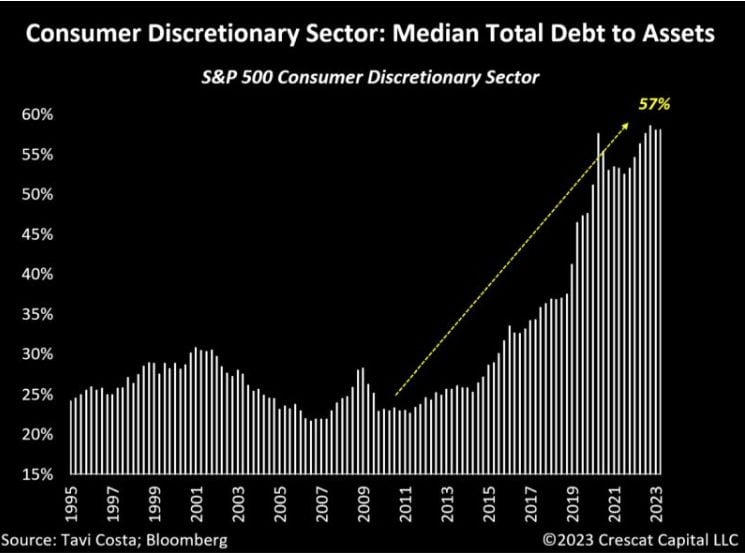

Consumer balance sheets are getting stretched

Accumulating debt during a low interest rates environment is one thing. But in light of the continuous surge of the price of money, the US consumer is probably starting to feel the pain Source: Crescat Capital, Bloomberg

World trade volumes fell at their fastest annual pace for almost three years in July

Closely watched figures signal rising interest rates are beginning to impact global demand for goods. Trade volumes were down 3.2 per cent in July compared with the same month last year, the steepest drop since the early months of the coronavirus pandemic in August 2020. The latest World Trade Monitor figure, published by the Netherlands Bureau for Economic Policy Analysis, or CPB, followed a 2.4 per cent contraction in June and added to evidence that global growth was slowing. After booming during the pandemic, demand for global goods exports has weakened on the back of higher inflation, bumper rate rises by the world’s central banks in 2022, and more spending on domestic services as economies reopened following lockdowns. The about-turn in export volumes was broad based, with most of the world reporting falling trade volumes in July. China, the world’s largest goods exporter, posted a 1.5 per cent annual fall, the eurozone a 2.5 per cent contraction, and the US a 0.6 per cent decrease. Source: FT

Private equity firms are redirecting their focus from mega buyouts to businesses such as private credit as higher interest rates disrupt their strategies

Over the past year, buyouts have been halted due to the impact of higher rates, resulting in private equity firms being burdened with portfolio companies acquired at high prices. In response to this challenging environment, some of the industry’s largest firms are venturing into new areas, including lending to companies, which has become more lucrative as central banks raise interest rates to combat inflation. Top executives from Apollo and Blackstone recently highlighted the potential of private credit and infrastructure investing at the annual IPEM industry conference in Paris. https://lnkd.in/exw5bqWp. Source: https://lnkd.in/eSMS2Q-k

SNB unexpectedly leaves policy rate unchanged at 1.75%.

The Swiss national bank unexpectedly leaves its policy rate unchanged at 1.75%. Market was estimating the probability of a 25bps hike at more than 70% yesterday.

USDCHF broke the 200 daily moving average of 0.9036 and now trading higher over 0.9060.

EURCHF also trading higher at 0.9650.

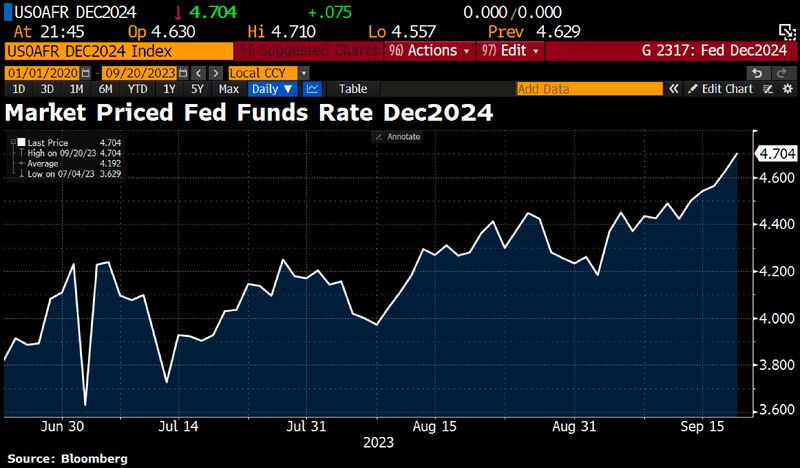

This chart tells the story:

The rate priced in for the Fed’s December 2024 meeting hit a new high for this cycle at 4.7%, meaning investors have sharply trimmed their hopes of interest rate cuts in 2024. Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks