Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

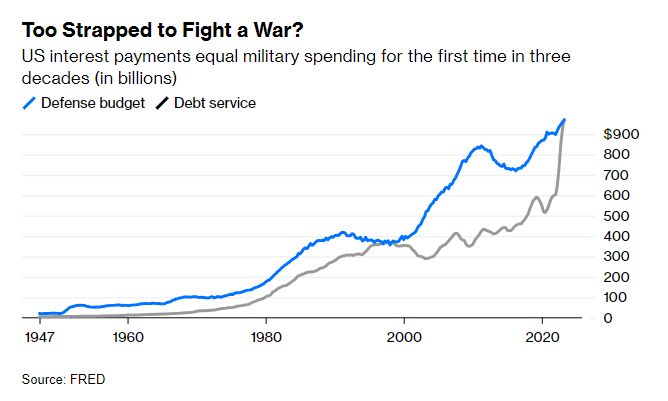

U.S. interest payments equal military spending for the first time in 3 decades (~1.9 Trillion combined)

Source: Barchart, FRED

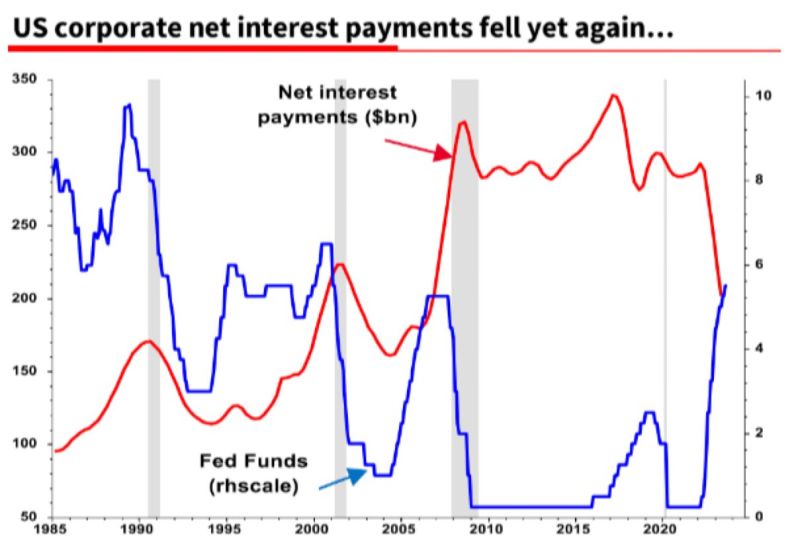

One of the reasons we are not in recession yet. Despite rate hikes US corporate net interest payments are going down so far👇

Source: Michel A. Arouet

Next FOMC rate hike probabilities:

No hike → 93% 25 bps hike → 7% Source: Game of Trades

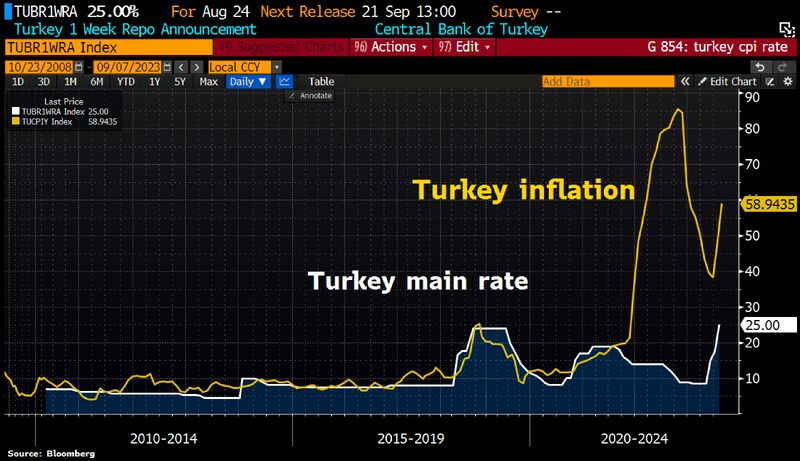

Turkey inflation has reaccelerated despite sharply increased key interest rates.

Source: Bloomberg

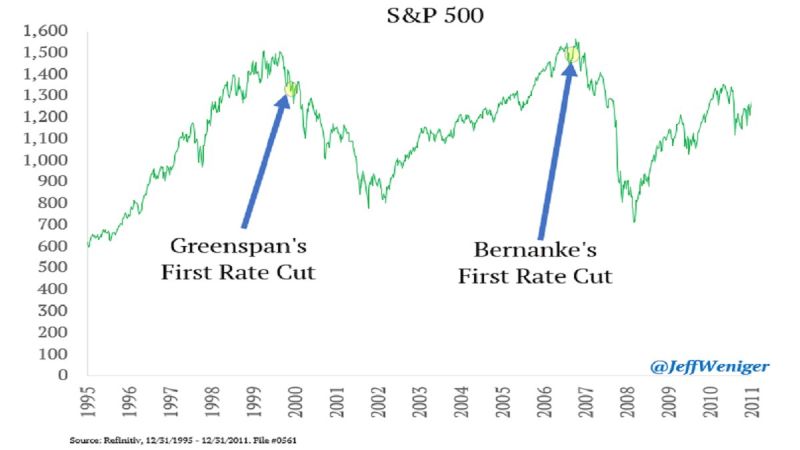

If the Fed cuts rates next year, is that a good thing?

Source: Jeff Weniger

A BAZOOKA CUT BY THE NATIONAL BANK OF POLAND...

Is it the most dovish central bank around? Despite roughly 10% inflation, The National Bank of Poland cut rates by 75bp to 6%, versus expectations of a 25bp cut. - Poland’s central bank delivered a surprisingly steep interest rate cut in a bid to boost a slowing economy less than six weeks before a tightly-contested election, weakening the zloty and hammering banking stocks. - The decision to lower the benchmark rate by three quarters of a percentage point — the most since the fallout from the great financial crisis in 2009 — to 6% caught economists off guard. Most had predicted a quarter point reduction. - The decision takes on a political dimension coming so close to the Oct. 15 election and has left investors guessing at the next move, with some predicting that the easing cycle has ended as soon as it began. Source: Bloomberg

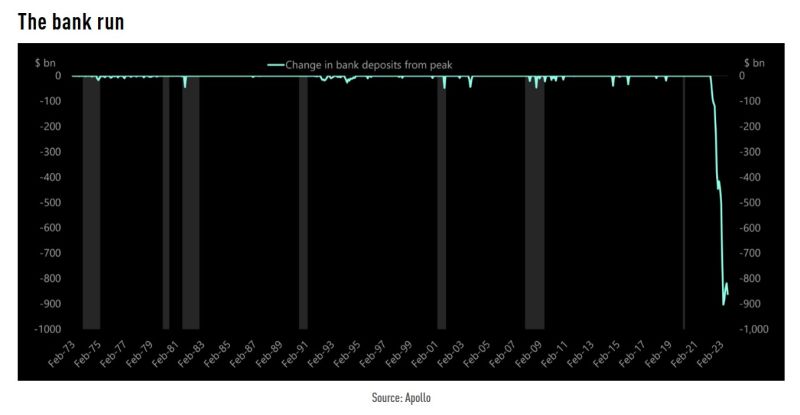

$862bn in deposits have left the banks since the Fed began to raise interest rates

Source: Apollo, TME

Trafigura says ‘fragile’ oil market may be prone to price spikes as higher interest rates and underinvestment squeeze the market according to a Bloomberg article

- The consensus view is for prices to remain near current levels, but the market is “more fragile than it looks,” Ben Luckock, the co-head of oil trading said in an interview at APPEC in Singapore. Brent crude is nearing $90 a barrel after OPEC+ heavyweights reduced supply — curbs that could continue further. - “One reason is underinvestment in new oil production,” he said on Monday. “Combined with higher interest rates, which make it more expensive to hold oil in storage, it means there isn’t much slack or flex in the system. Put all together, and you have a market that’s susceptible to price spikes.” - Oil options traders are showing confidence in the recent sustained surge in prices, bolstering wagers that crude will rally toward $100, even as questions remain over China’s outlook. However, Luckock and other attendees at the conference said it wasn’t all bad when it came to nation’s economy.

Investing with intelligence

Our latest research, commentary and market outlooks