Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

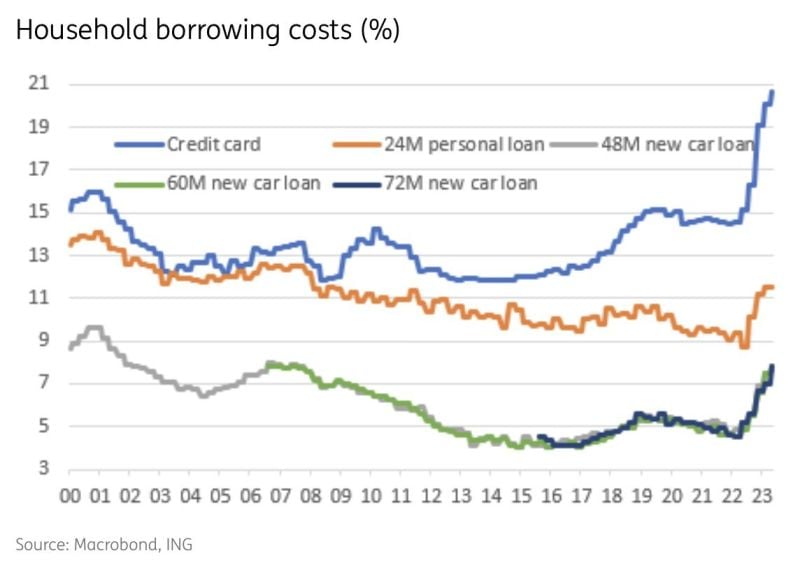

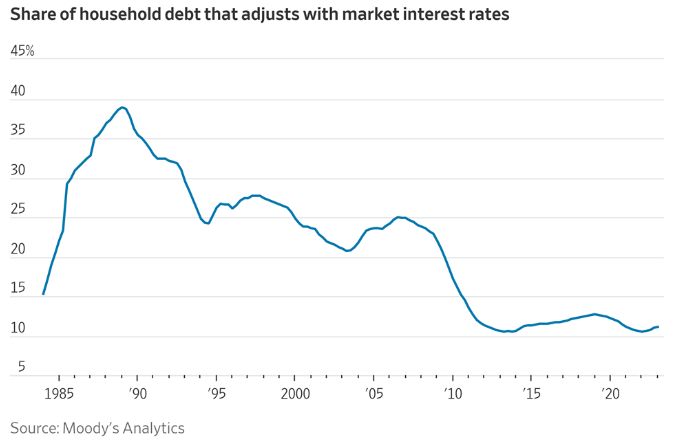

In the US, interest rates on household items are skyrocketing

In just 1 year, the average interest rate on credit card debt has gone from 14% to 21%+. New car loan rates went from 4% to 8% while used car loan rates are at 12%+. Mortgage rates are at a fresh high of 7.2%, up from 2.7% in 2021. Will the US consumer be able to absorb all these debt servicing costs? Source: The Kobeissi Letter, Macrobond, IN

The lagging effects of higher interest rates ?

Yellow Corp. filed for bankruptcy and will remain shuttered after the trucking firm’s long-running financial woes (rising bond & loan payments) were compounded by a dispute with its labor force (wage inflation). The firm closes after nearly 100 years and leaves 30k employees jobless (this will likely be reflected in a lower payroll print for August). Source: Bloomberg

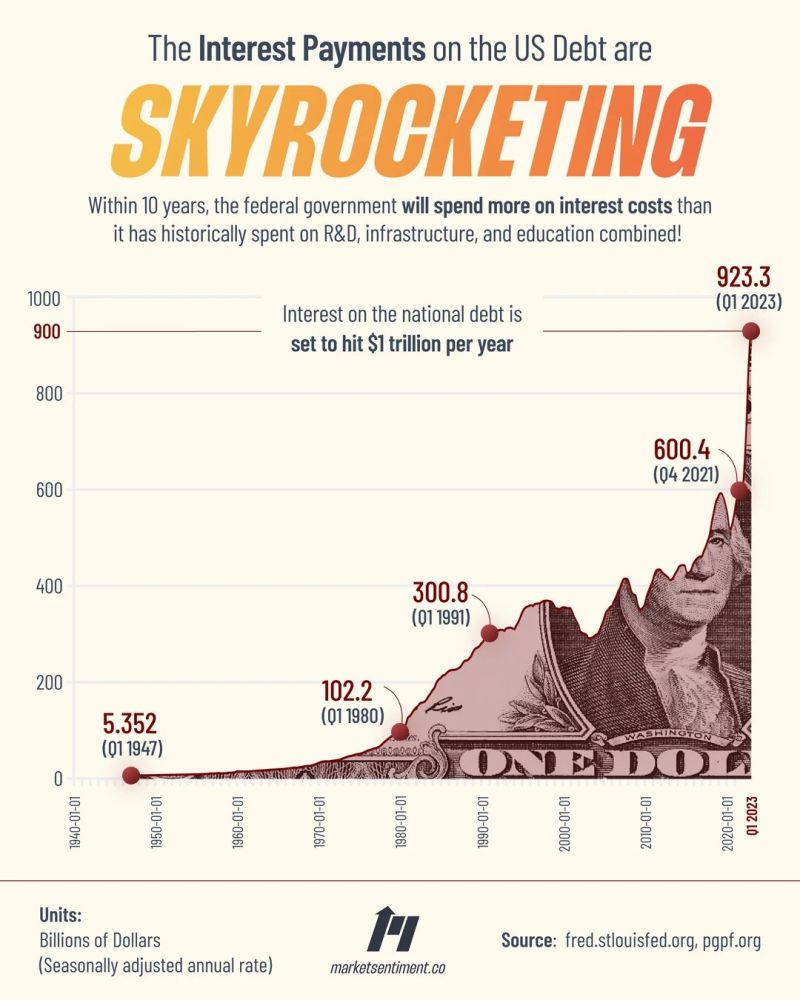

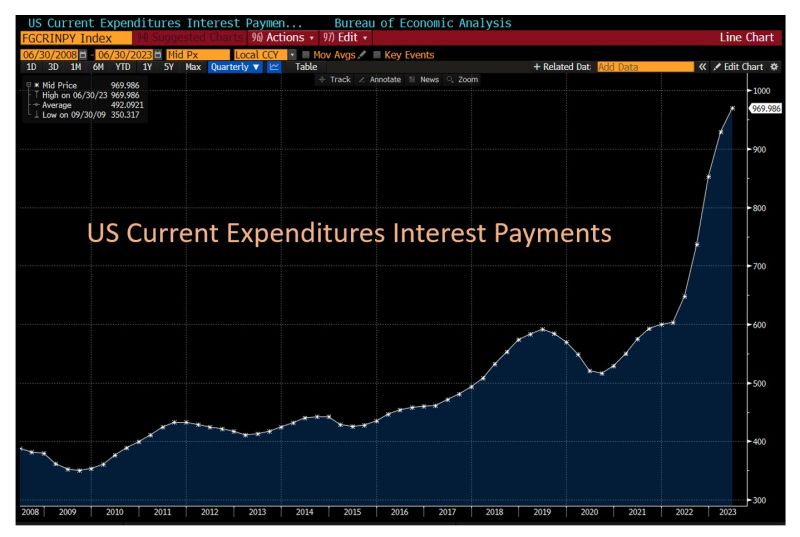

Interest payments on US government debt are soaring

source: Markets & Mayhem

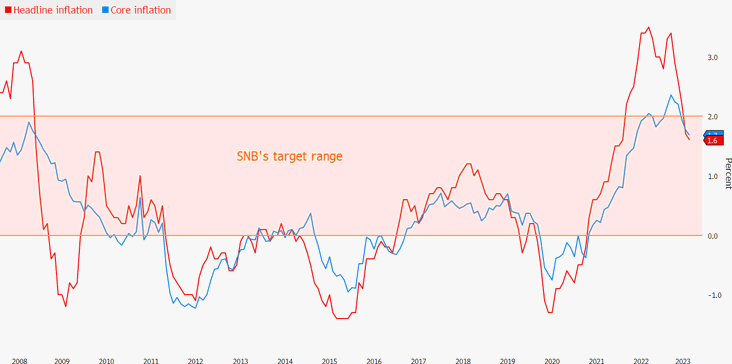

Swiss inflation slows further as SNB mulls september rate hike

Swiss inflation slowed to the lowest rate in one and a half years, testing the determination of SNB officials who have signaled that a further tightening step in September is likely.

Consumer prices rose 1.6% in July from a year earlier, down from 1.7% the previous month.

Source: Bloomberg, Swiss Fed statistical office

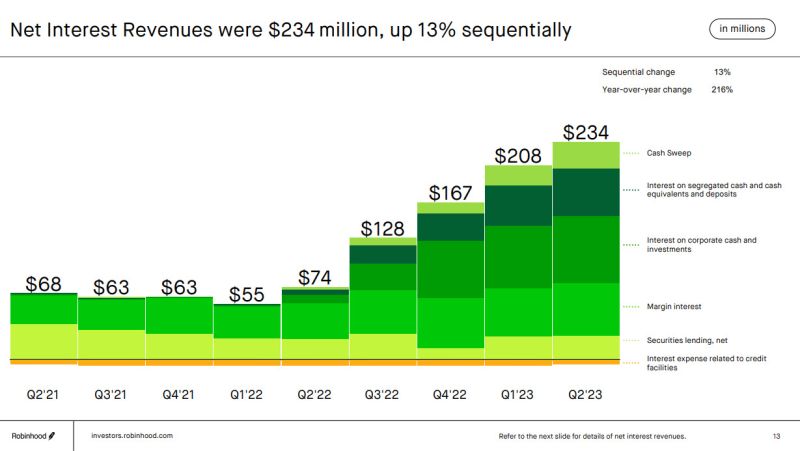

Robinhood now makes much more collecting interest on client cash than from its core business.

This is $234 million that RH's customers should be collecting but they are currently handling to the Trading App. Source: www.zerohedge.com, Robinhood

US interest expenses have surged by about 50% in the past year, to nearly $1 trillion on an annualized basis

Source: Lisa Ambramowicz, Bloomberg

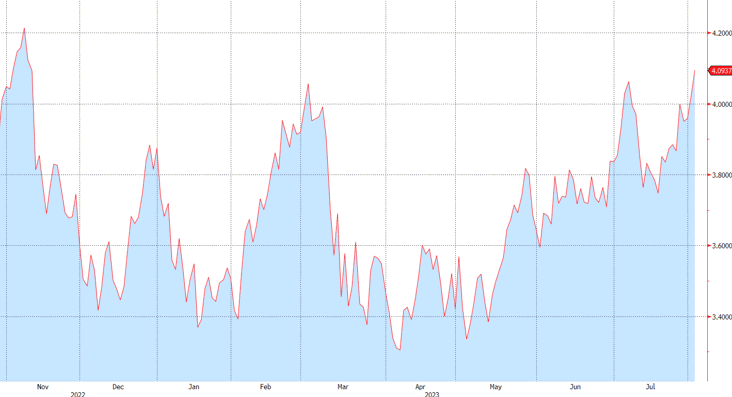

US Treasury 10-Year yield increases to highest level since november 2022

Treasuries fell across the curve, pushing the 10-year yield to the highest level since November as traders digest an uptick in US government issuance, a sovereign credit downgrade and a stronger-than-expected private job report.

Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks