Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

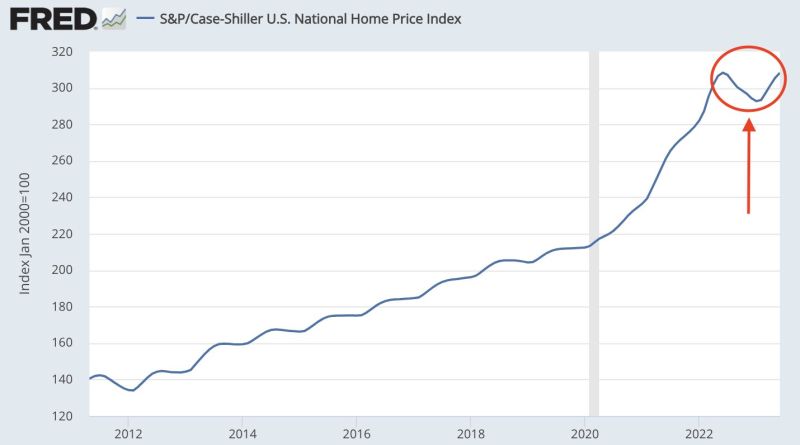

Despite surging mortage rates, US home prices are RISING to ALL-TIME-HIGHS

Higher rates are having an INVERSE effect on price. Rather than prices falling with higher rates, they are actually rising. Why is this happening? As explained by The Kobeissi Letter, as rates rise, existing home sales are falling, now down 16.6% at their lowest since 2010. Borrowers are locked-in to sub-3% mortgages and do not want to sell their homes to get a 2.5x higher rate. We need LOWER rates for LOWER prices... Truly a historic occurrence... Source: FRED, The Kobeissi Letter

Treasury yields extend retreat from year’s highs after GDP data

Short-maturity yields led the move, with two-year yields declining about five basis points to around 4.85%, and most yields reached the lowest levels in more than two weeks. The

benchmark 10-year note’s yield touched 4.085%, the lowest level since Aug. 11.

Following downward revisions to the economy’s Q2 growth rate and related inflation measures, swap contracts tied to Fed meeting dates priced in slightly less than a 50% chance of another rate increase this year. Source: Bloomberg

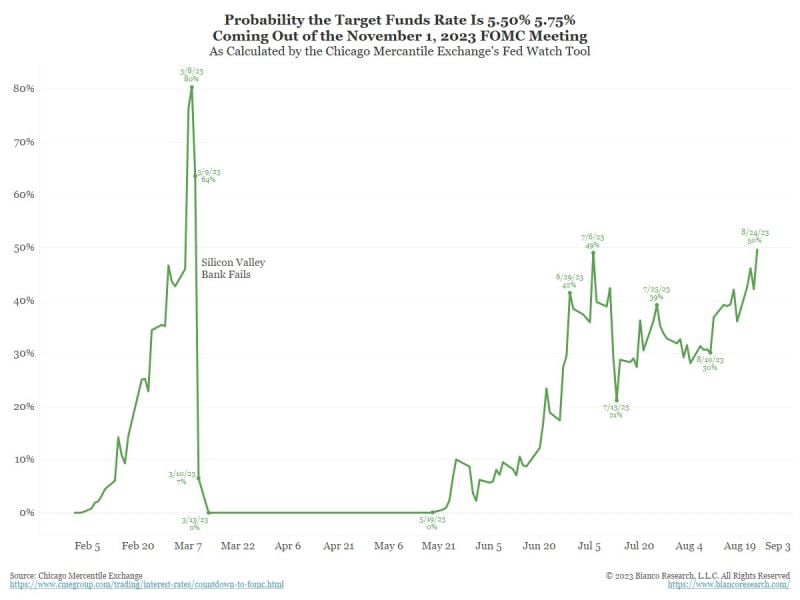

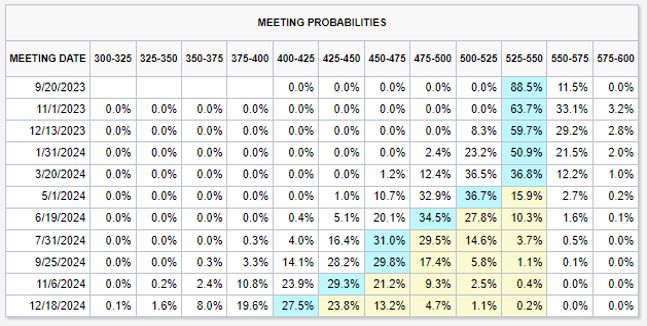

Going into Jackson Hole, the probability of a September hike is just 20%, well below 50%, so not likely. But, as shown below, the probability of a hike in November (see below) is now 50/50

What will it be when Jay is done? Source: Jim Bianco

Treasury 10-Year real yield tops 2% for first time since 2009

The yield on 10-year inflation-protected Treasuries extended its ascent from year-to-date lows near 1%.

Rising real yields reflect firmer economy and higher deficit.

Source: Bloomberg

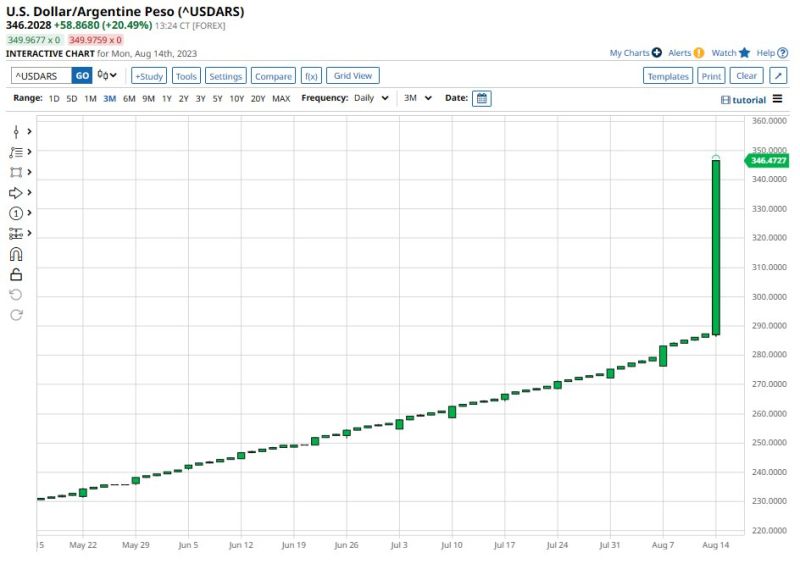

Argentine Peso having a rough day. An 18% devaluation to 350 pesos per dollar (chart) accompanied by a 21 percentage point hike in interest rates to 118% …

Source: Barchart

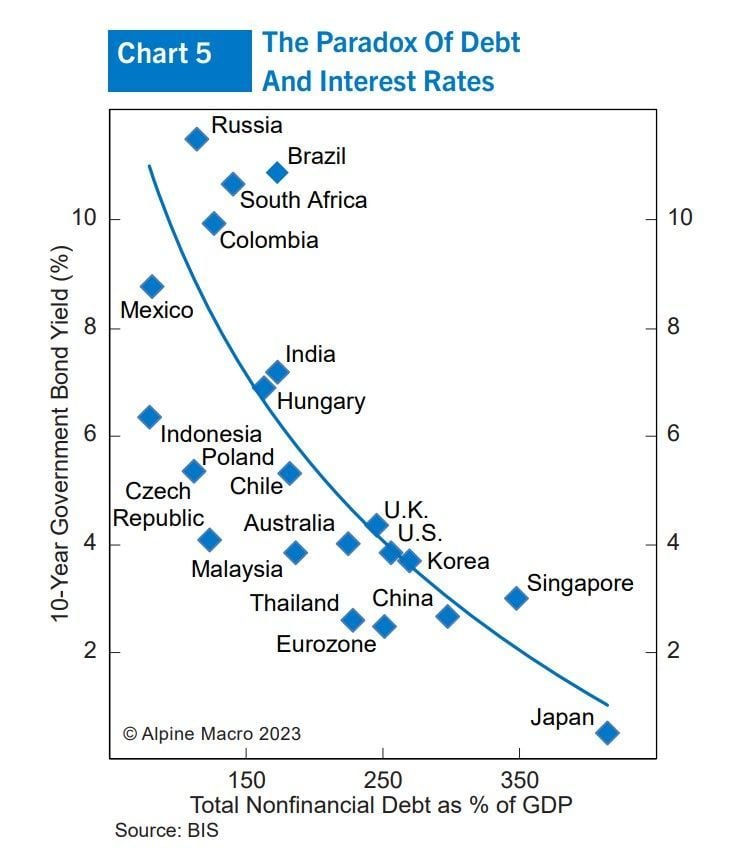

The countries that have rarely borrowed, such as Brazil or Mexico, often pay much higher interest rates than those that have much higher debt ratios, like Japan or China.

Intriguing chart by Alpine Macro

What are the latest moves when it comes to market expectations on Fed rates ?

A Fed HIKE of 25 bps by NOVEMBER moved from 30% to 33%. It is still below 50%. So not priced in. But a 3% increase (30% to 33%) is the biggest up move in a month. Furthermore, odds of rate CUTS are dropping. Markets now do not see any rate cuts until May 2024 in the base case. 3 months ago, markets expected 4 rate cuts in 2023. Markets seem to be bracing for a long Fed "pause." Source: The Kobeissi Letter, Bianco Research

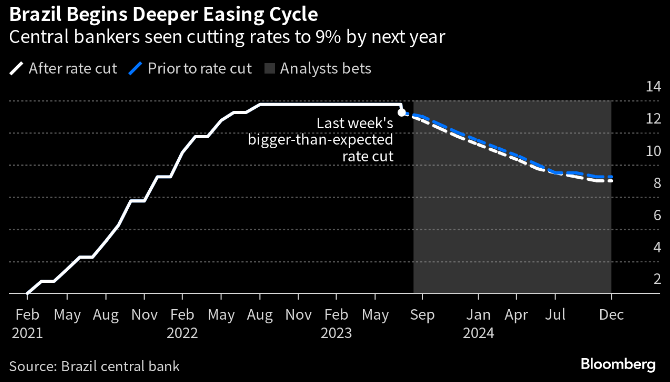

Brazil central bank says faster key rate cuts are Unlikely

“The Committee judges that there is low probability of an additional intensification in the pace of adjustment,” central bankers wrote in the minutes of their Aug. 1-2 meeting published on Tuesday.

Source: Brazil Central Bank, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks