Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

ECB raised rates by 25bps as expected

Deposit rate to 3.75pct, higher since April 2001. The main refinancing rate is now 4.25pct, highest since 2008. It is the 9th consecutive hike in a cycle that started exactly one year ago. APP portfolio is declining at a measure and predictable pace. Balance sheet should thus continue to shrink By stating that inflation Is coming down but is staying above target for an extended period means that the ECB keeps the door open to further rate hiles. A slight tweak in the statement: the ECB interest Rates will be SET at sufficiently restrictive levels for as long as necessary … (instead of BROUGHT at sufficiently…) NEW: the ECB decided that going forward, the minimum reserves banks need to hold won‘t receive any interest. In this way, the ECB could prevent the losses of the ECB and the national central banks from increasing too much. Bank shares like DB drop following the News Source: Bloomberg, HolgerZ, www.zerohedge.com

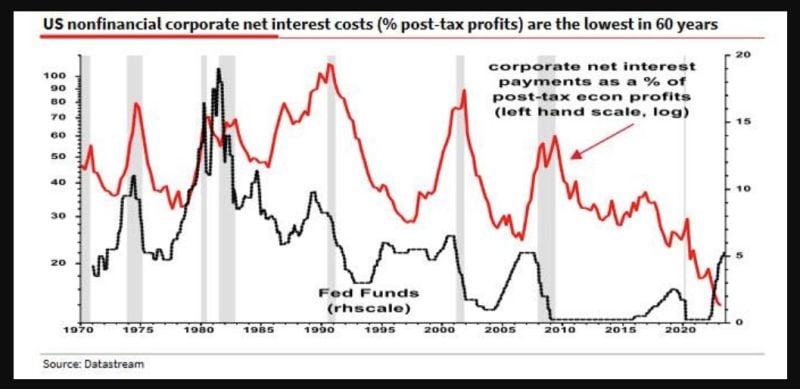

Albert Edwards from SG explains in one chart why this time is different and how the rise #interestrates hasn't triggered a recession yet.

Indeed, as shown on the chart below, Corporate NET interest payments as a % of post-tax economic profits (red line) has been going DOWN despite Fed Funds (black line) going UP! Edwards frames it as such: "We can see clearly from the Fed’s Z1 (table L103) that the US corporate sector is a massive net borrower. Normally when interest rates rise, so too do net debt payments, squeezing profit margins and slowing the economy. BUT NOT THIS TIME. Corporate net interest payments have instead collapsed (...) something very strange has happened, and it helps explain the recession’s tardy." So what has happened? As Edwards concludes, a sizeable proportion of the "huge, fixed rate borrowings during 2020/21 still survives on company balance sheets in variable rate deposits" meaning that corporations continue to benefit from locking in the ultra low rates of 2020 and 2021 even as their cash interest income are soaring. Indeed, as the SocGen strategist adds, "companies have effectively played the yield curve in reverse and become net beneficiaries of higher rates, adding 5% to profits over the last year instead of deducting 10%+ from profits as usual". Putting it all together, Edwards says that "it’s not just ‘Greedflation’ that has boosted US profit margins and delayed the recession (...) Interest rates simply aren’t working as they once did. It is indeed a mad, mad world" Source: www.zerohedge.com, SocGen

For the 1st time since Feb’21, rate hikes are no longer exceeding rate cuts in Emerging markets.

Source: BofA, TME

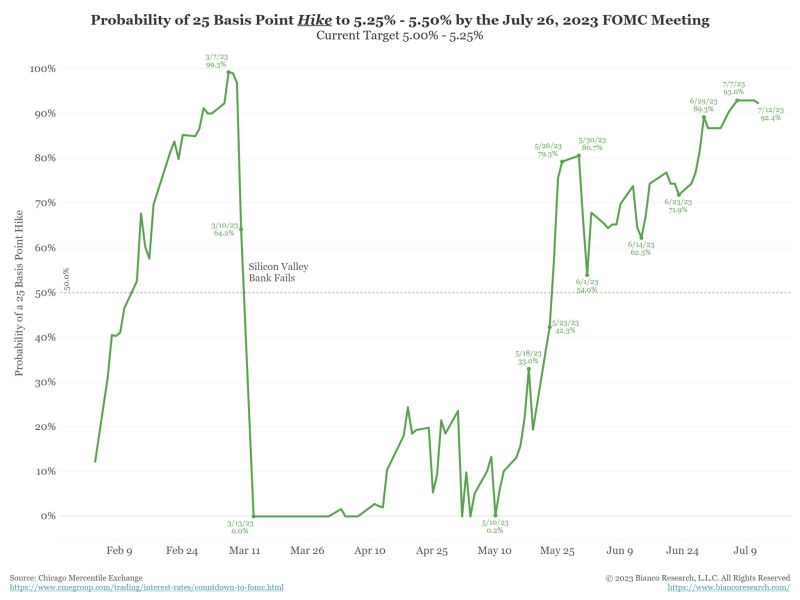

The probability of a July 26 rate of 25 basis points to 5.25% to 5.50% barely moved

Despite the better-than-expected CPI report today, the probability of a July 26 rate of 25 basis points to 5.25% to 5.50% barely moved. The market is strongly expecting a hike in two weeks. Source: Jim Bianco

Israel pauses after 10 rate hikes but signals it may not be done

Israel’s central bank left interest rates

unchanged for the first time in over a year, halting an

unprecedented cycle of monetary tightening but signaling it’s

still on alert for the threat of faster inflation.

Source: Bloomberg

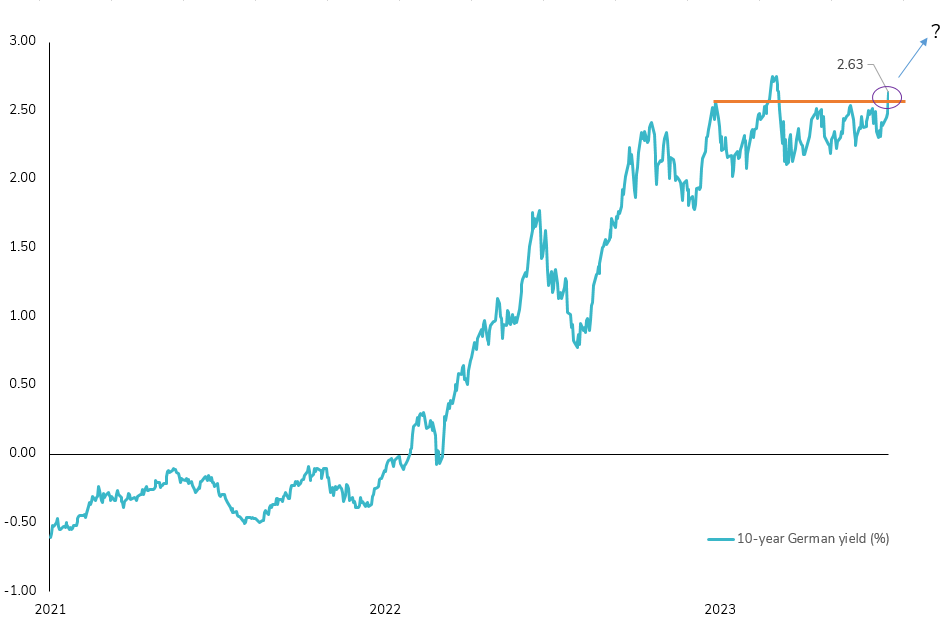

10-year German yield : a key technical breakout triggered?

The German 10-year yield has experienced a significant surge of almost 30 basis points since the start of July, marking a notable technical breakout. This breach of the 2.5% resistance level has the potential to alter short-term market sentiment and pave the way for higher rates. The upward momentum has been fueled by several factors, including the synchronized hawkishness observed in developed countries such as the US, Eurozone, and the UK last week. Additionally, hawkish FOMC minutes (release yesterday) and resilient hard data, including strong employment figures in the US and robust industrial production in Europe, have contributed to the yield's upward trajectory. It is worth noting the emergence of a catching-up effect in soft data, as indicated by the latest report on the U.S. ISM composite index. Tomorrow's release of the June NFP report could further ignite the discussion. Will we test the year's highs (2.75%) in this early summer period?

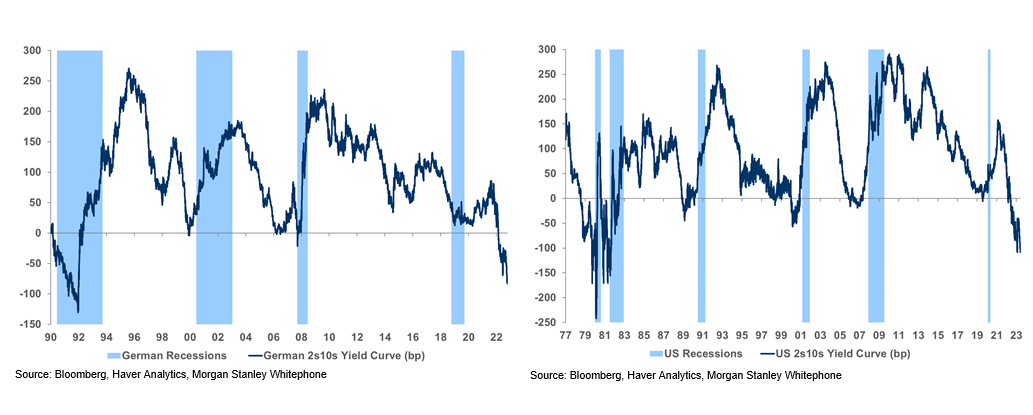

German and US yield curves are deeply diving into low levels of inversion

US Curves flattened further, with the 2s10s curve hitting -109bp, in-line with the lowest level in 42 years.

Bund yields rose, while the 2s10s curve dropped to -83bp, the most inverted level in over 30 years.

Source: Bloomberg, Haver Analytics, Morgan Stanley Whitephone

Shifting Dynamics in 3-Month US Futures: A Hawkish Turn

The recent shift in the 3-month US futures market has grabbed investors' attention. FED Governor Powell's increasingly hawkish tone has sparked a repricing frenzy, altering market expectations for rate cuts. The latest data shows a significant turnaround, with futures no longer projecting any cuts in 2023 and only one in the first half of 2024. This remarkable repricing indicates a growing sentiment of an extended period of higher interest rates. The resurgence of the 3-month SOFR Future June 24 contract to pre-SVB crisis levels further underscores the market's confidence in this new direction. Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks