Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

BREAKING: A HAWKISH PAUSE BY THE FED

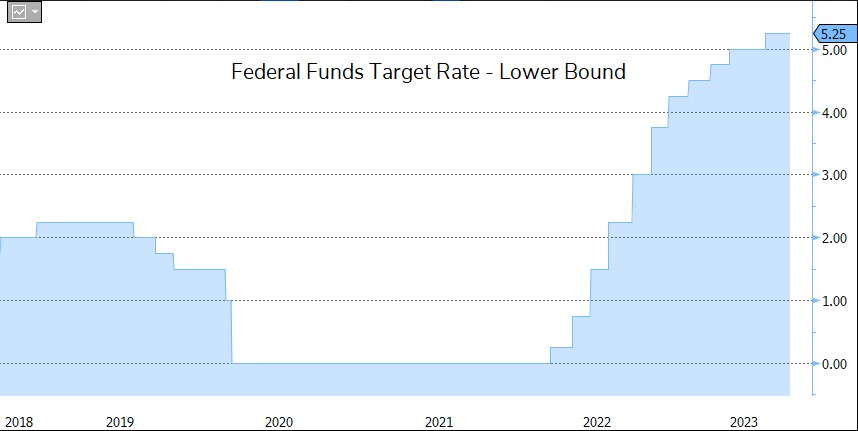

FOMC KEEPS RATES UNCHANGED AS EXPECTED BUT MAKES CLEAR THAT HIGHER RATES ARE THE NEW NORMAL...US 2y yields hit highest since 2006 after somewhat hawkish Fed. Bottom-line: #Fed futures now no longer show rate CUTS beginning until September 2024. To put this in perspective, three months ago futures were expecting 4 rate CUTS in 2023. Now, interest rates are expected to PAUSE for at least 1 year... One remark: Fed estimates that r* (the real short-term interest rate expected to prevail when an economy is at full strength and inflation is stable) remains at 0.5%, and yet rates in 2026, when US debt may hit $50 trillion will be 3%. This means that blended interest on US debt will be ~$2 trillion, double where it is now. Source: Bloomberg, The Kobeissi Letter, HolgerZ, www.zerohedge.com

FED leaves rates unchanged, signals one more hike this year

The Federal Reserve left its benchmark interest rate unchanged while signaling one more hike this year. FOMC repeated language saying officials will determine the “extent of additional policy firming that may be appropriate.” The FOMC held its target range for the federal funds rate at 5.25% to 5.5%, while projections showed 12 of 19 officials favored another rate hike in 2023.

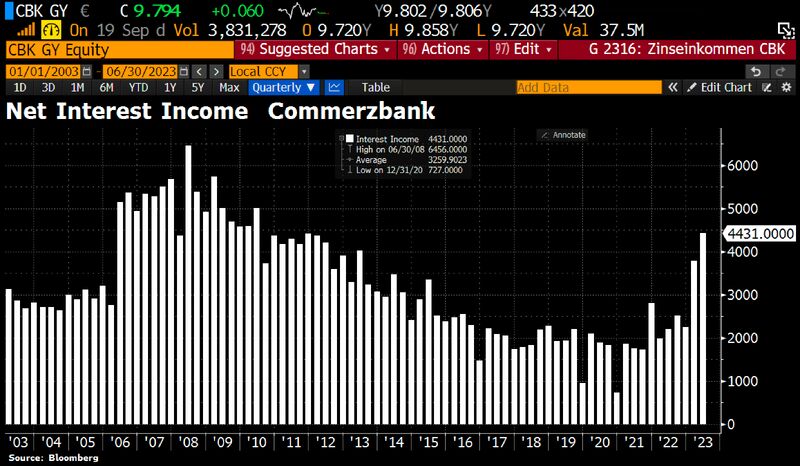

German banks are NOT passing on the increased interest rates to their customers

Commerzbank, Germany's 2n-largest retail bank, has announced it will increase net interest income to €8bn. Commerzbank has increased its deposit beta - a measure of how much of a rate increase it passes along to savers - slower than initially expected. The bank will end this year with something around a deposit beta of avg 40%. Source: HolgerZ, Bloomberg

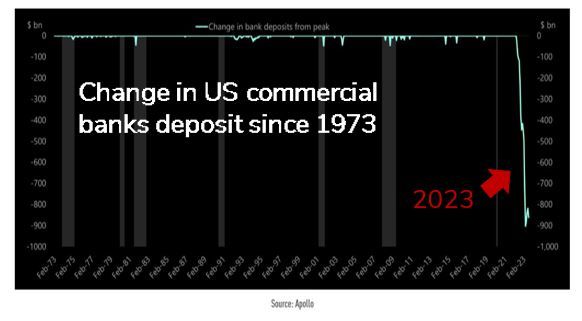

In the US, the slow motion bank run continue...

Interest Rates on Deposits, by Bank: 1. Wells Fargo: 0.15% 2. Citibank: 0.05% 3. Chase: 0.01% 4. Bank of America: 0.01% 5. US Bank: 0.01% Rates on Alternatives to Bank Deposits: 1. CDs: 5.0% 2. Money Market: 4.5% 3. Treasury Bonds: 4.0% Deposits continue to flow out of banks at a historic pace with $1 trillion+ withdrawn over the last year. The era of "free" money for large US banks is coming to an end. They must raise interest paid on deposits or capital will continue to leave. Source: The Kobeissi Letter, Apollo

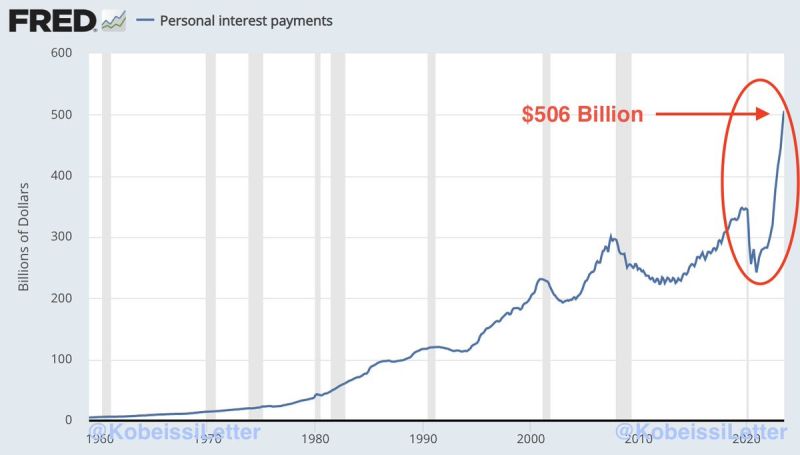

JUST IN: Personal interest payments in the US hit a record $506 BILLION in July

During the first 7 months of 2023, Americans paid a total of $3.3 TRILLION in personal interest. This is up a staggering 80% since 2021 and nearly above the entire 2022 total. The worst part? These numbers do NOT include interest on mortgage payments. Source: The Kobeissi Letter, FRED

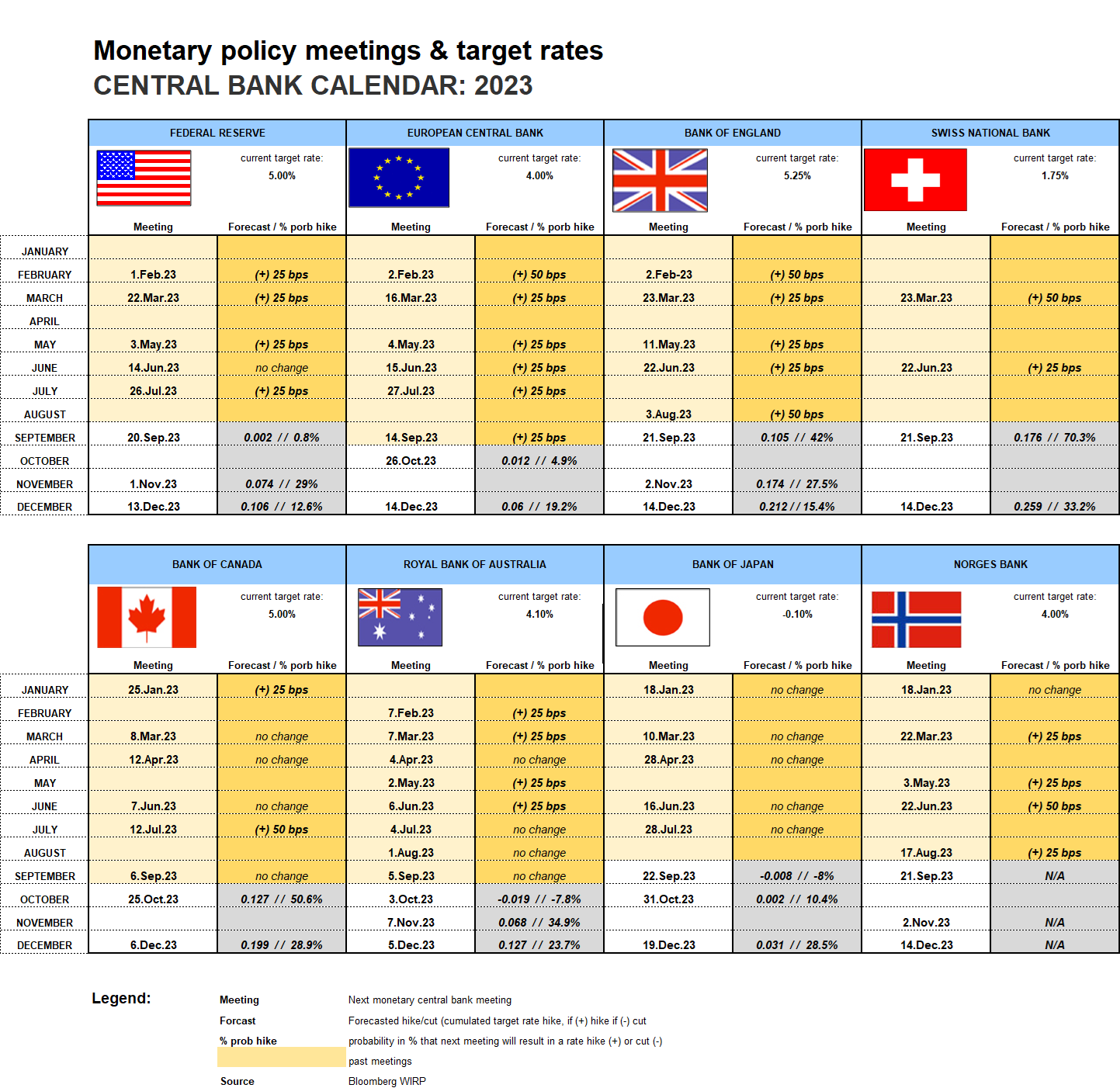

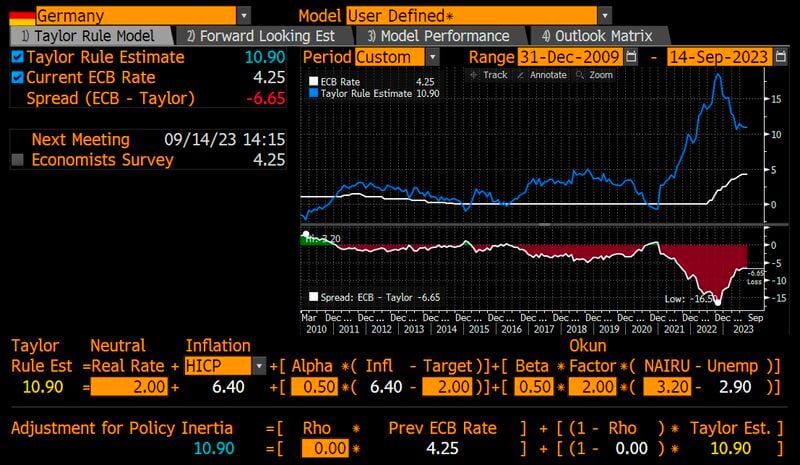

Today is ECB day

What is the Taylor rule telling us when it comes to theoretical interest rates based on German data? Key interest rate should be at 10.9%, so 6.6% higher than current rate, according to Taylor Rule with German inflation at 6.4% & unemployment below NAIRU. Howeverm the spread between Taylor Rule rate & ECB key rate is lower than it has been since 2021. This might suggest that hike cycle could soon come to an end. Source: Bloomberg, HolgerZ

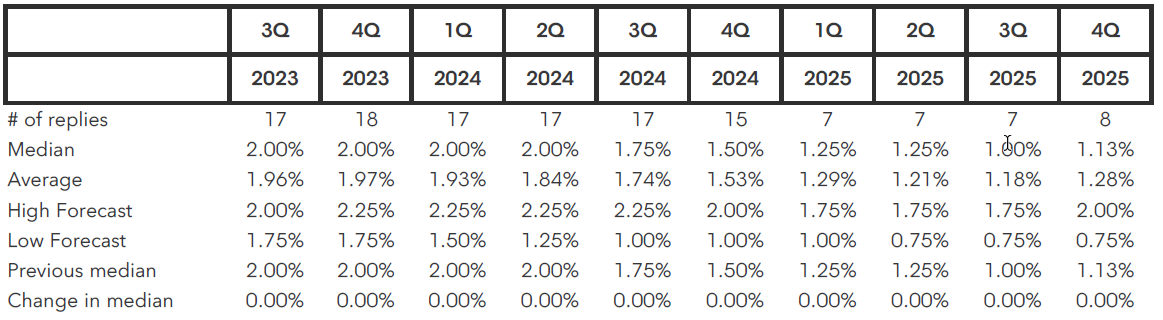

SNB Policy rate at 2.00% by end-Q3 2023 - Survey

The following table shows economists’ forecasts for Switzerland’s benchmark central bank rate as surveyed by Bloomberg News from Sept. 1st to Sept. 7th. All figures are as of the end of the quarter.

Current SNB Policy Rate: 1.75%

Sourcce: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks