Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

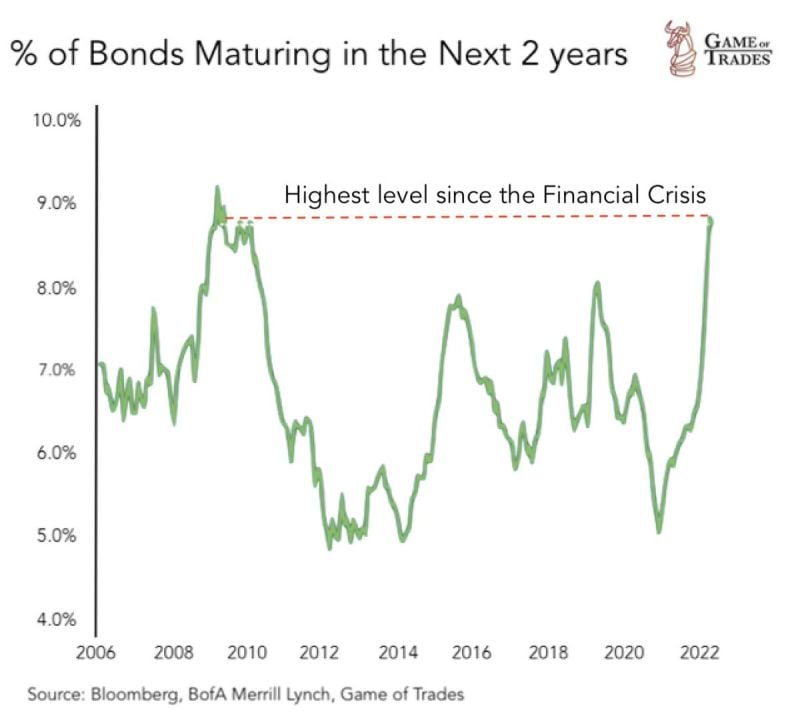

9% of bonds are set to mature in the next 2 years → The highest level since the Financial Crisis

High interest rates will make refinancing more difficult Source: Game of Trades

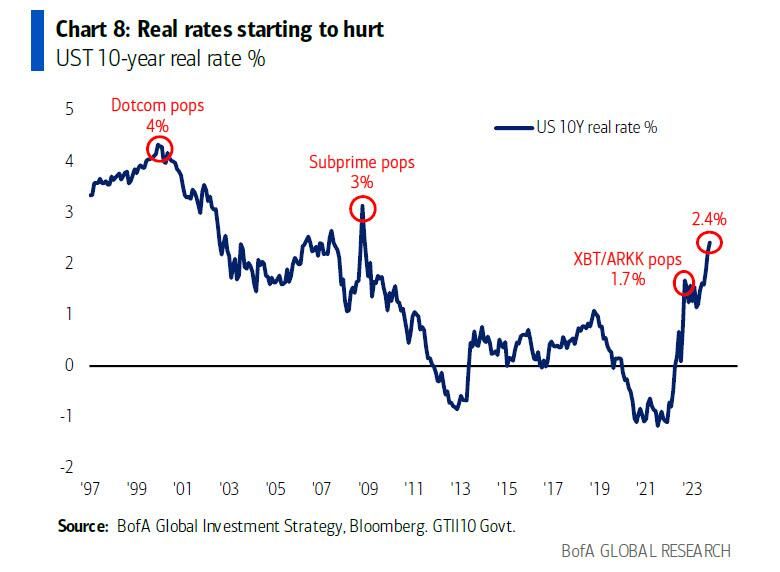

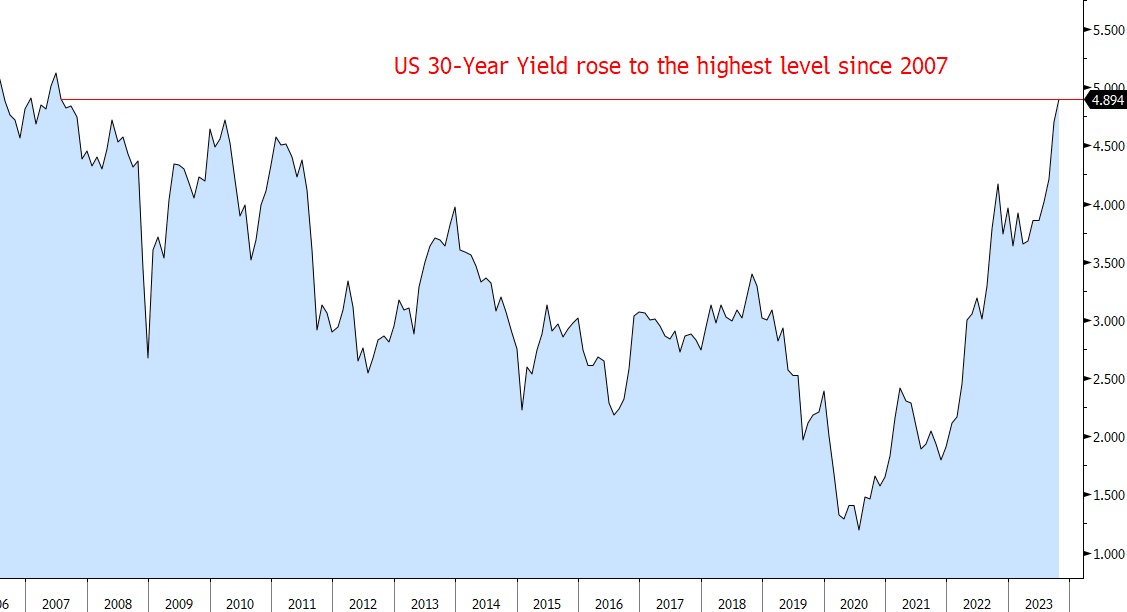

Rising real rates are going to inflict real pain on a variety of asset classes, particularly longer duration risk

BofA, Markets & Mayhem 🤖

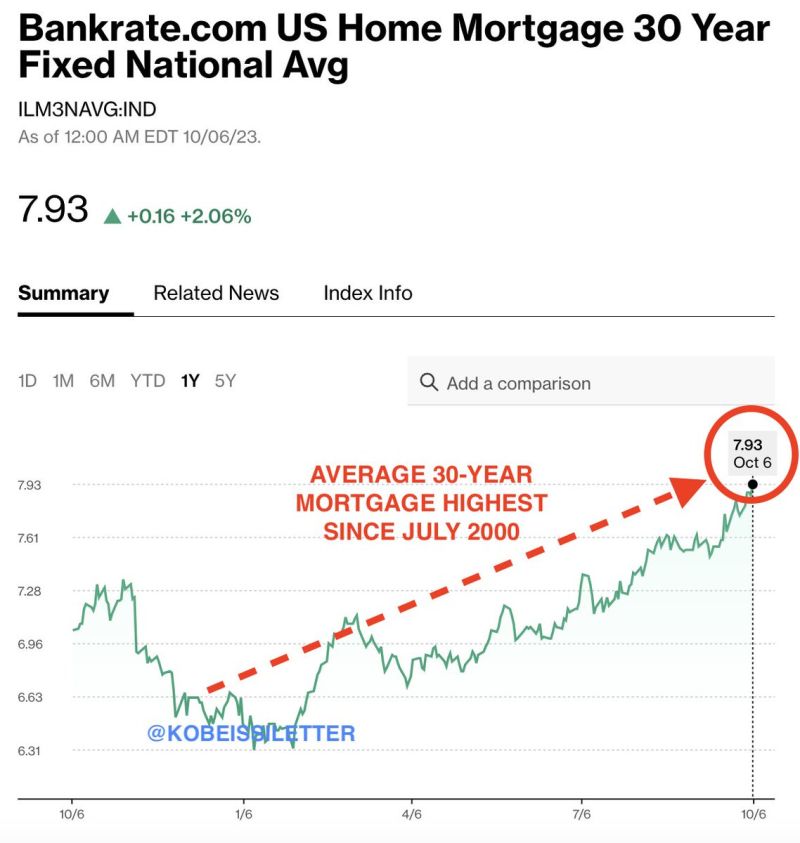

BREAKING: Average interest rate on a 30-year mortgage rises to 7.93%, its highest since July 2000

Since January 2021, less than 3 years ago, interest rates have gone from 2.65% to 7.93%. This means that homebuyers just 3 years ago would see their interest rate TRIPLE if they decided to move. This is exactly why existing home sales are at their lowest since 2010. The average new home is about to cost LESS than the average existing home for the first time since 2005. You know something is wrong when old costs more than new. Why sell if your mortgage rate triples? From The Kobeissi Letter

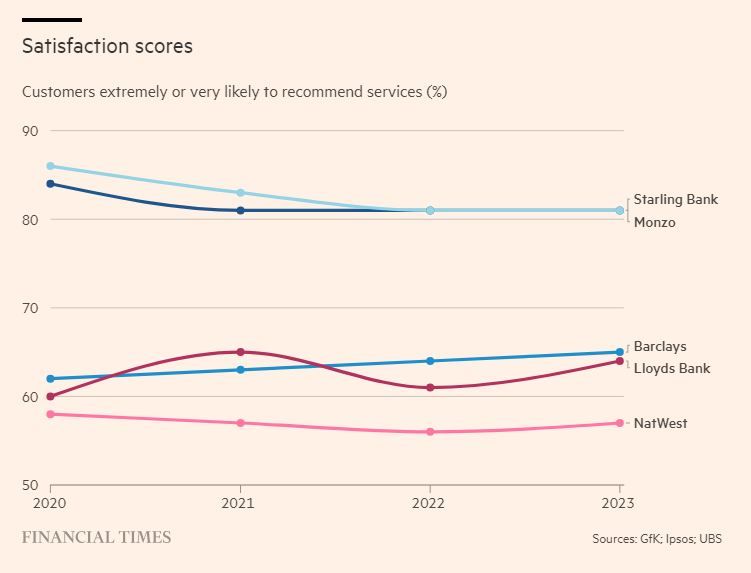

Interesting FT article on UK neobanks: "UK fintech: neobanks may end up blending in"

Low fees mean profits have remained elusive. But higher interest rates are now compensating for that, not least with better returns on client money put out on deposit. Satisfaction scores by customers are also much higher than traditional banks. Some lessons need to be learned. Source: https://lnkd.in/emZyY76d

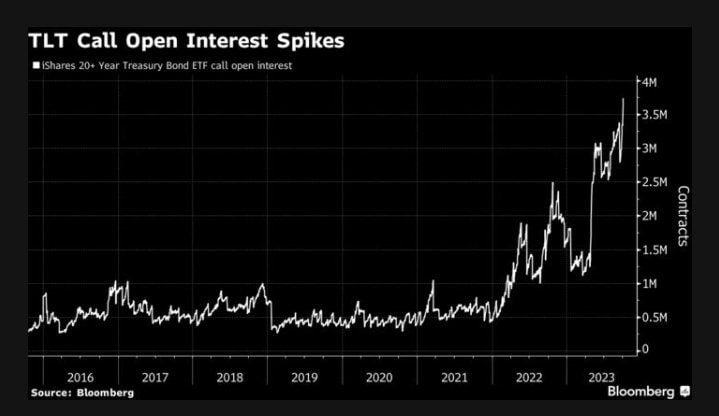

Open interest for bullish call contracts has soared to an all-time high for $TLT

Traders see an end to the market rout that has led to TLT’s longest streak of weekly losses since 2022. Source: Credit From Macro to Micro

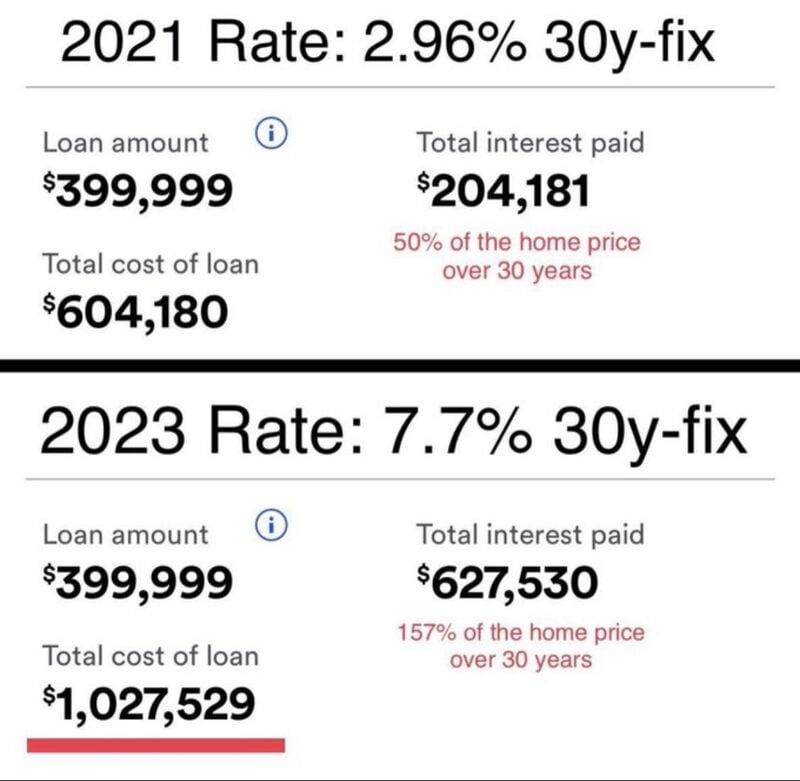

The impacts of rising interest rates on the costs of your mortgage over the life of the loan

In the US, A $400,000 house now costs over $1,000,000, with interest rates now at 7.7% from 3%. Source: WallStreet Sliver

Investing with intelligence

Our latest research, commentary and market outlooks