Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

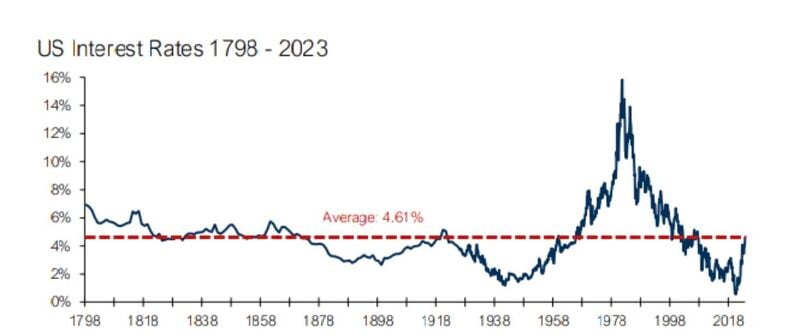

The chart below shows the distribution of interest rates on outstanding US mortgages

Over 30% of borrowers have rates below 3%, up from just ~5% of borrowers prior to the pandemic. Virtually no new mortgages are being taken out at 7%+ interest rates that we currently see. real estate market seems to be frozen Source: The Kobeissi Letter, ICE

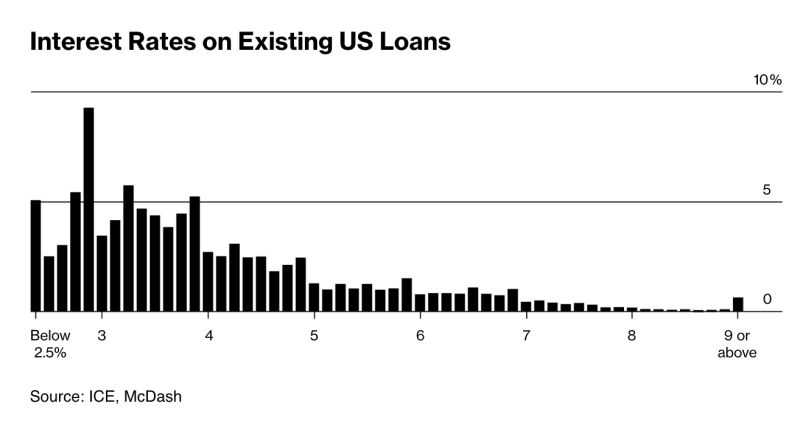

Interest costs as a share of US corporate profits are near the lowest levels in 40 years

This is partly because many companies have locked in long-term financing at low rates. This has kept profit margins elevated. Maybe companies are better to manage their debt schedule than the US Treasury... Source: The daily shot, Lance Roberts

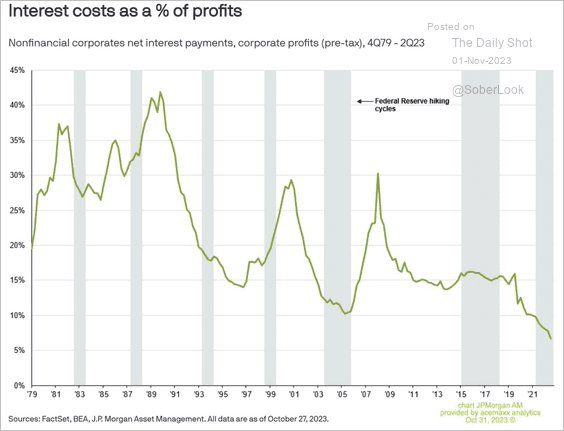

The end of the rate hikes is typically followed by plateaus before rate cuts begin

The end of the rate hikes may not be here yet, and the Fed has already said a many times for months that the plateau is going to be “higher for longer". How long will the plateau be this time? Source: Wolfstreet

No change as expected

Nothing really new except that they acknowledge strong growth and strong wage gains versus September, effectively upgrading their economic assessment. This is the 3rd time they upgrade their view on growth. Our view is unchanged: we are due for a long pause. High rates is the new normal.

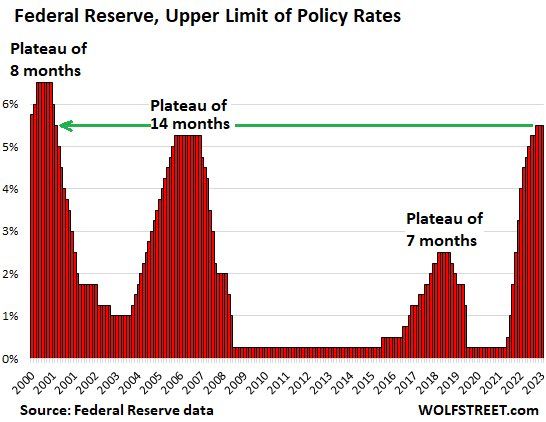

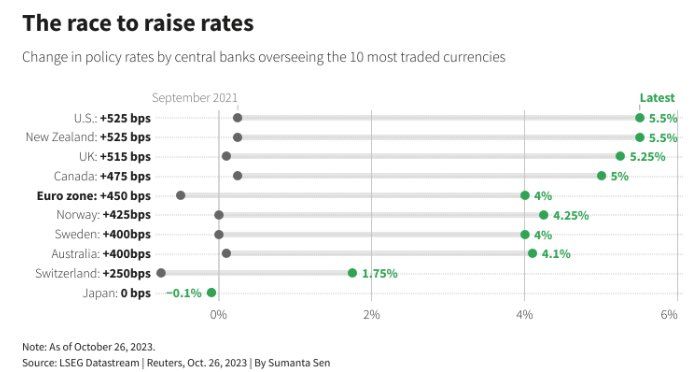

The race to raise rates summarized in one chart

Source: LSEG Datastream, Reuters

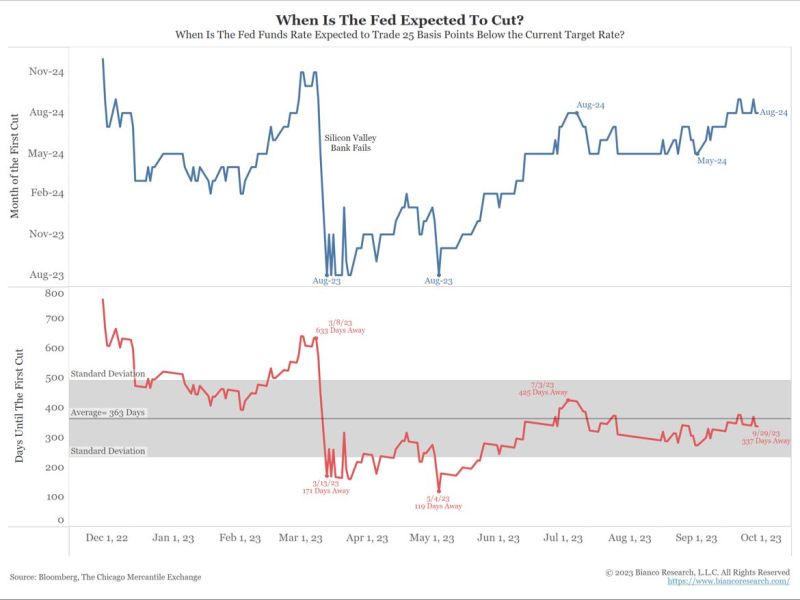

When will the Fed start cutting rates?

This chart from James Bianco is derived from market pricing. The first cut is currently priced for August 2024 (top panel), or 337 days away (bottom panel). Notice the first cut is always about 10 to 12 months away. It never gets any closer.

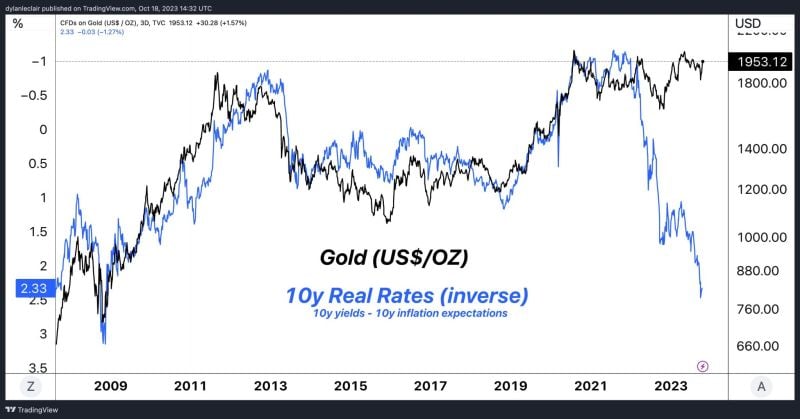

Here's the downside risk on gold. Either this longstanding correlation is broken or inflation is grossly understated and real rates remain negative

Source: Henry Smith

Investing with intelligence

Our latest research, commentary and market outlooks