Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

The Fed is finally giving up...

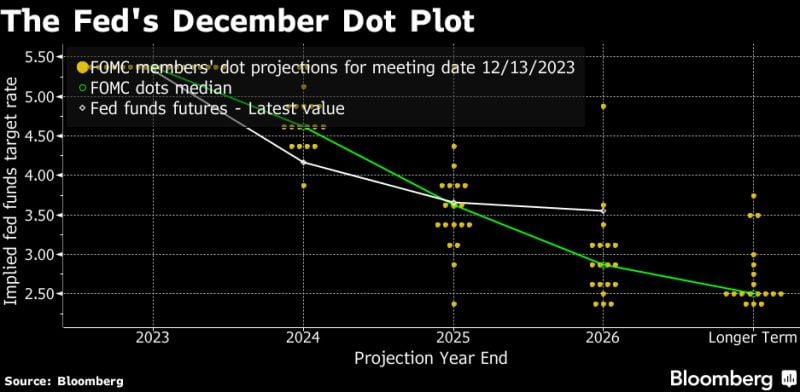

Fed holds rates steady but indicates three cuts coming in 2024. Indeed, the Dot Plot is adjusted down significantly more dovishly than expected, narrowing the gap to the market's expectation significantly... The US 10 year is down 20bp to 4%, the Dow surges by 300 points!

⚠️BREAKING:

*FED'S POWELL: IT IS NOT LIKELY WE WILL HIKE FURTHER *POWELL: POLICYMAKERS ARE THINKING AND TALKING ABOUT WHEN IT WILL BE APPROPRIATE TO CUT RATES Source: www.investing.com

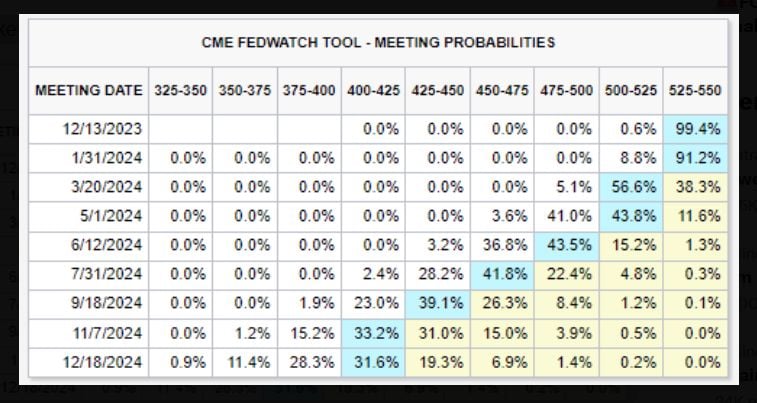

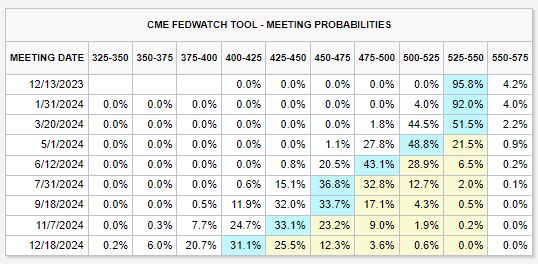

Interest rate futures shift to showing a ~57% chance of rate CUTS beginning in March 2024

Markets also see a growing 9% chance of rate cuts beginning as soon as next month. Futures are projecting a total of FIVE rate cuts in 2024. There's a 28% chance of 6 cuts and an 11% chance of 7 cuts in 2024. Meanwhile, the Fed just said they see just 3 rate cuts in 2024. So markets are still "fighting" the Fed. But the Fed is starting to adjust... Source: The Kobeissi Letter

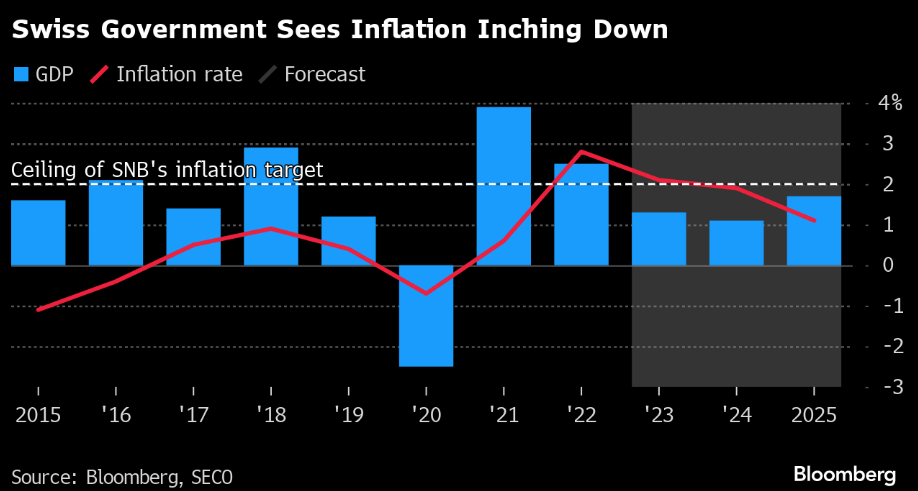

Switzerland’s inflation forecast backs SNB rate staying on hold

Switzerland’s government sees next year’s

inflation within the central bank’s target range, the latest evidence supporting a likely hold from policymakers this week. Consumer prices will grow at an annual 1.9% in 2024, in line with the previous forecast, the State Secretariat for Economic Affairs said on Wednesday.

Source: Bloomberg

The average credit card interest rate right now has risen to 27.81%

And that's with U.S. credit card debt hitting new record highs north of $1,000,000,000,000 Source: Hedgeye

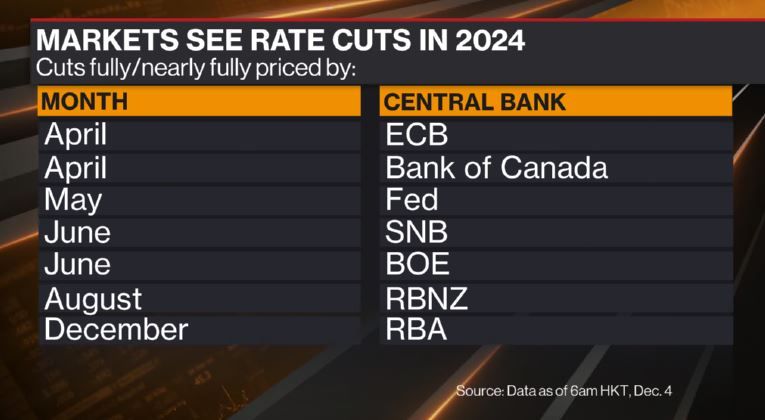

2024 is expected to be a year of interest rate cuts

Here's what's currently priced in markets of who does what when. Source: Bloomberg, David Ingles

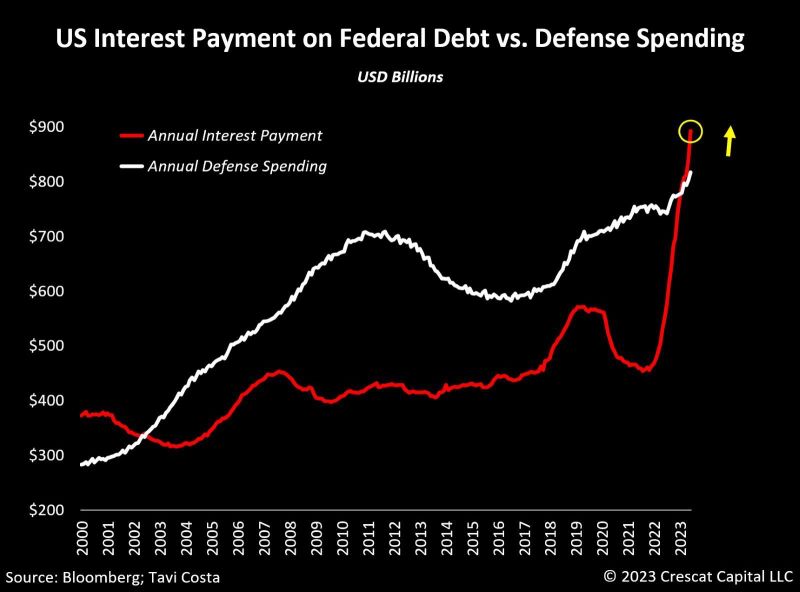

As highlighted in the Kobeissi Letter and in the chart below from Tavi Costa >>> Annualized interest expense on US Federal debt is nearing $1.1 TRILLION

To put this in perspective, 2023 defense spending was $821 billion. This means the US is on track to spend 34% MORE on interest expense than defense spending. In 2023, the US government produced $4.4 trillion in revenue. This means that 25% of receipts in the entire 2023 are equivalent to Uncle Sam's annual interest expense. Rising rates and falling tax revenue are both occurring at the same time. A tricky combination

Futures are now showing a ~45% chance that FED rate CUTS begin as soon as March 2024

There's also a growing (but small) chance that rate cuts begin in January 2024, at 4%. Prior to the most recent CPI inflation data, the base case showed rate cuts beginning in June 2024. There was also a 50% chance of another rate HIKE in 2024. This has been a quick turnaround... Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks