Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

On the timing of the first cut, Waller said he believes that the FOMC will be able to lower the funds rate “this year.”

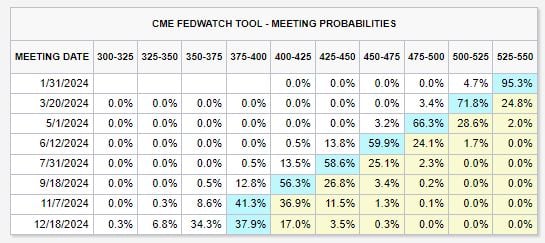

Main culprits from yesterday's pullback in Wall Street were comments by Governor Waller in a speech and discussion as they raised the risk that the first cut could come slightly later than the market's expectation of March and that the pace of cuts could be quarterly from the outset, rather than the market's more aggressive forecast of three initial consecutive cuts followed by a switch to a quarterly pace. On the speed of cuts, Waller said the funds rate “can and should be lowered methodically and carefully” and that he sees “no reason to move as quickly or cut as rapidly as in the past,” when the FOMC was combating recessions. Waller also noted that next month's scheduled revisions to CPI inflation (the seasonal factors will be revised on February 9) could influence his thinking on rates cuts, especially if the revised data show a less clear deceleration recently. The result was most evident in the drop in the market's expectations for a rate-cut in March...

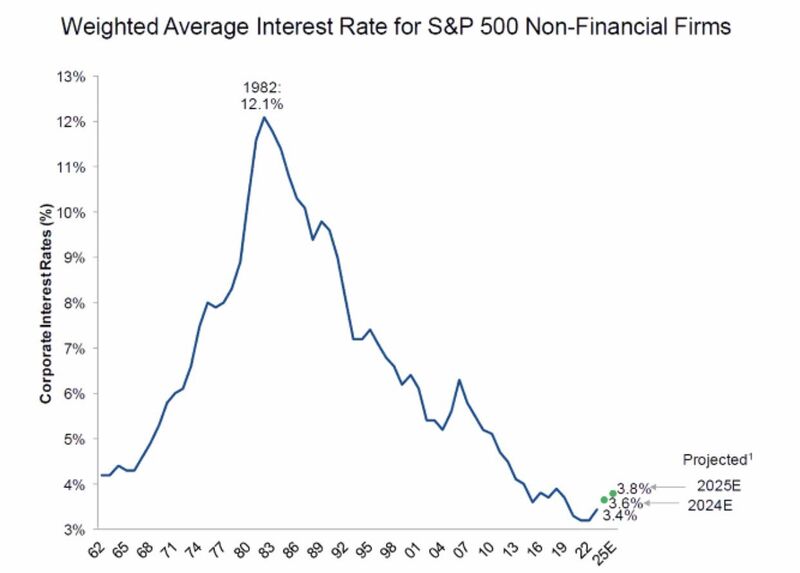

Weighted Average interestrate for sp500 non-financial firms is expected to pick-up in 2024e and 2025e but remains quite low by historical standard.

Source: Michel A.Arouet

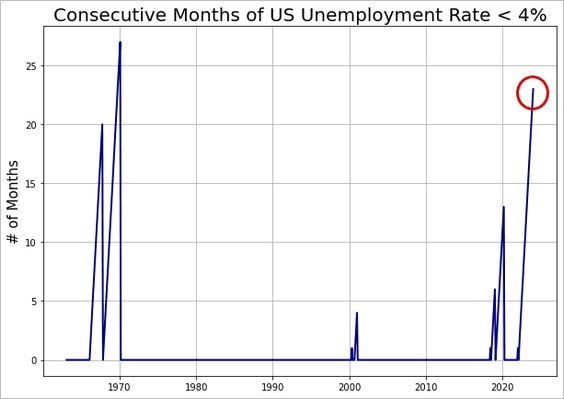

Is this the reason why the Fed might be forced to cut rates in March?

We could have: 1. Reverse repo ends (see chart below) 2. BTFP expires 3. Fed cuts (allegedly) 4. QT ends (allegedly) I.e 3 and 4 could counter-balance 1 and 2

Uranium 16-Year High: Uranium going parabolic as it hits its highest price since November 2007

Source: barchart

Surprise, surprise... Even with a hot jobs report and inflation rising to 3.4%, market expectations regarding timing and number of rate cuts have shifted more dovish.

Markets are now pricing-in a rate cut at EVERY Fed meeting this year beginning in March 2024 until December 2024. Effectively, markets are saying that us interestrates will move in a straight-line lower. Source: The Kobeissi Letter

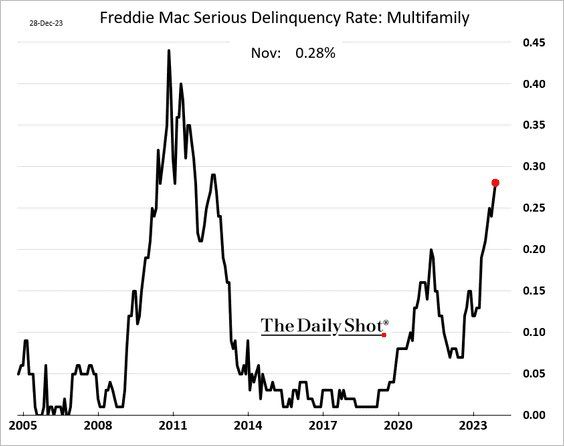

Freddie Mac Serious delinquency rate US multifamily homes

thru The Daily Shot

Goldman believes that the 5% EPS forecast for sp500 is too low as a strong economy and falling interest rates should lead to positive surprises

Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks