Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

Fed Expected to Cut Rates by 25 Basis Points After Inflation Data; Bitcoin Remains Stable

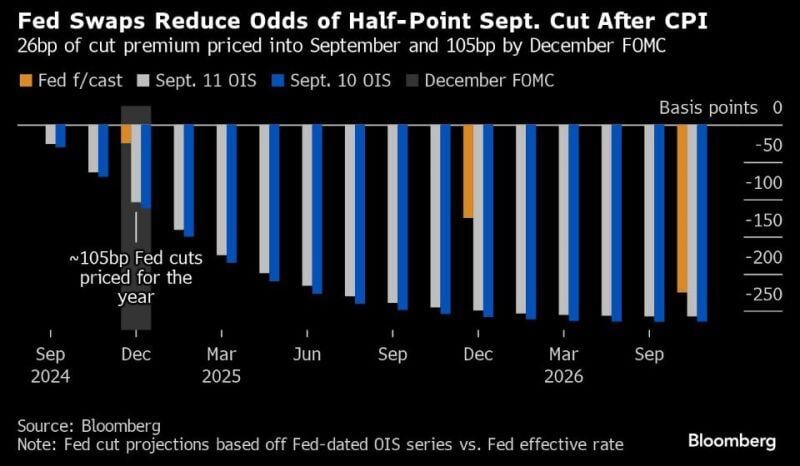

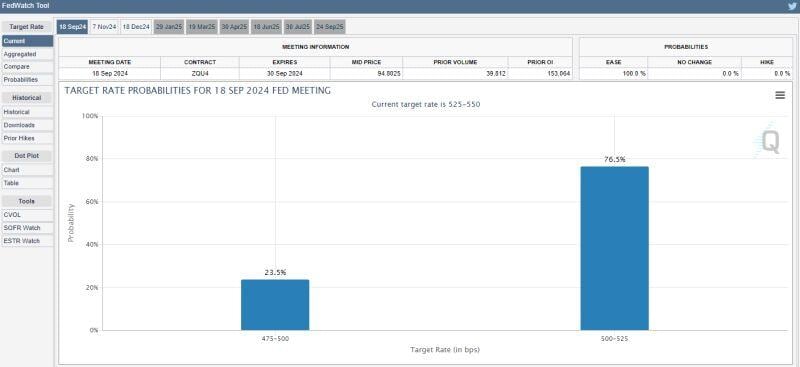

U.S. inflation came in as expected, increasing the likelihood of a 25 basis point Fed rate cut, with market expectations rising to 83%. A 50 basis point cut is now only 17% likely. The bond market now expects a 25 bps Fed rate cut this month, not 50 bps. The 2-year yield hit 3.69%, and the hashtag#Fed's held rates at 5.25%-5.5% since July 2023. Investors eye 140 bps in cuts by Jan '25. Source: Luc Sternberg, coinoptix, Bloomberg

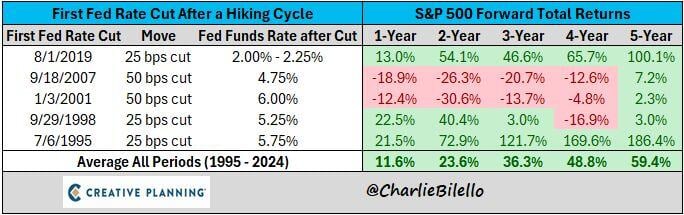

Those calling for a 50 bps rate cut next week should take a look back at January 2001 & September 2007 when the Fed started cutting cycles with a 50 bps move

If the Fed feels the need to go big because of a weakening economy, that's not bullish. Source: Charlie Bilello

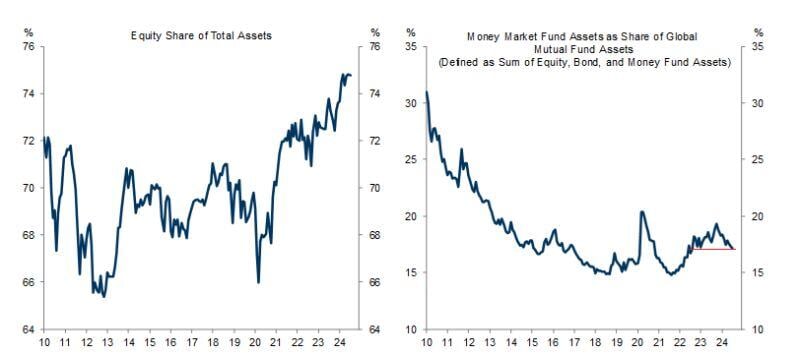

Ahead, of interest rates cut, how does the average asset allocation look like?

Are we going to see cash moving out of money markets into risk assets? Well, according to this chart by Mike Zaccardi, CFA, CMT, MBA, as a percent of total assets, money market fund holdings are now at 2-year LOWS !!!

China weighs cutting mortgage rates in two steps to shield banks

Source: Bloomberg

BREAKING: Odds of a 50 basis point interest rate cut at the September Fed meeting rise to 23%

There's now a 95%+ chance that interest rates are cut in September with a 78% chance of a 25 bps rate cut, according to @Kalshi Source: The Kobeissi Letter

BREAKING 🚨 Jerome Powell will indicate that the Fed is open to a 50 bps rate cut during his speech at the Jackson Hole, according to analysts from Evercore

BULLS, GET EVEN MORE EXCITED... Source: Stocktwits, www.investing.com

JUST IN 🚨: Odds of a 50 bps interest rate in September has plummeted to less than 25%

Source: Barchart

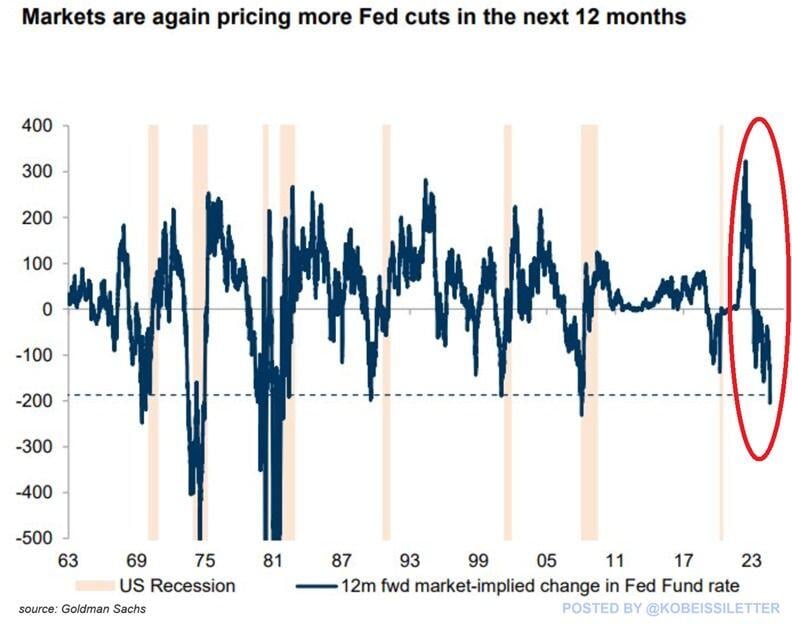

Interest rate futures are now pricing in 8 Fed rate cuts over the next 12 months, the most since the 2008 Financial Crisis.

Market expectations have sharply shifted over the last week toward more cuts in anticipation of economic weakness. Over the last 60 years, every time the market expected 200 basis points of rate cuts, a recession in the US followed within several months. Source: The Kobeissi Letter, Goldman Sachs

Investing with intelligence

Our latest research, commentary and market outlooks