Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The UAE is tokenizing almost all of its real estate.

Dubai Land Department has signed an agreement with Crypto.com to develop procedures that support digital real estate transactions, enabling investors to buy and sell property using digital currencies. The collaboration, which seeks to create a digital ecosystem that enables investor verification, custody, settlement and real estate tokenisation, supports the Dubai Real Estate Strategy 2033 and its Dh1 trillion ($272 billion) transaction target. Source: The National

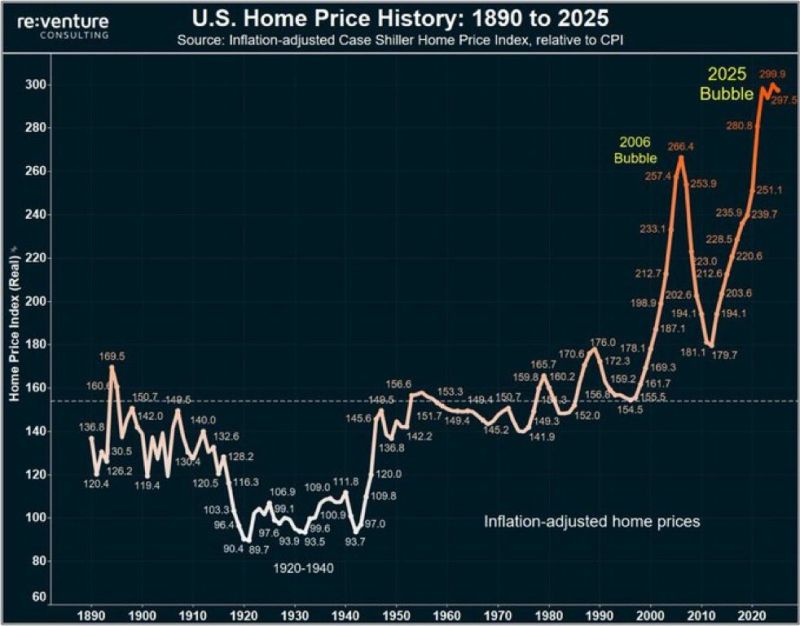

U.S. Housing Market has reached its most unaffordable level in history 🚨🚨

Source: Barchart, re:venture

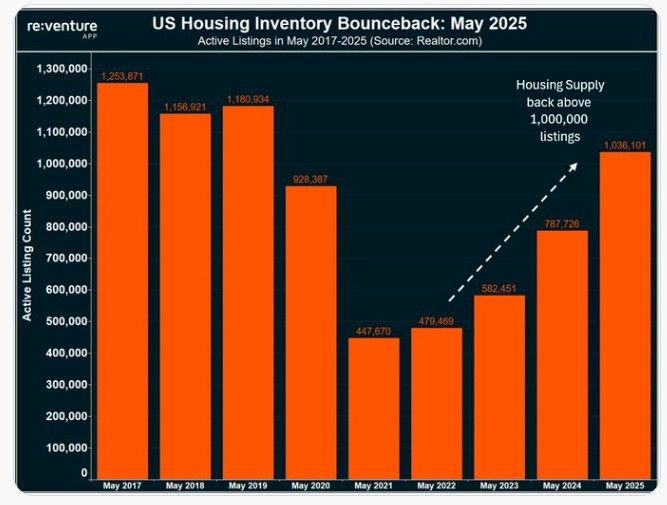

The U.S. housing market just broke 1,000,000 listings.

Excess inventory is piling up. Relative to buyer demand, we now have the highest inventory in close to a decade. Which is causing home prices to drop in over half the U.S. Source: Nick Gerli @nickgerli1

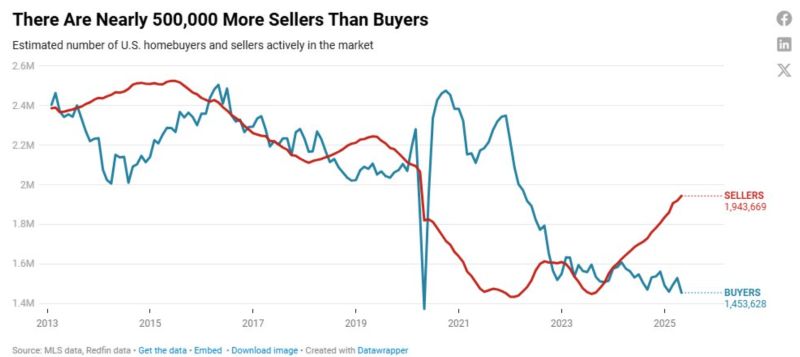

The U.S. Housing Market Has Nearly 500,000 More Sellers Than Buyers—the Most on Record.

That Will Likely Cause Home Prices to Fall - Redfin thru C.Barraud on X

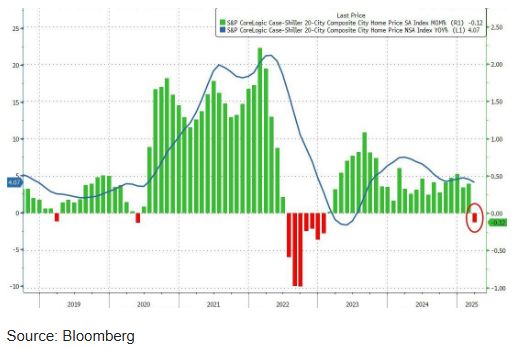

For the first time in more than 2 years, home prices saw a monthly decline (March)

Source: zerohedge

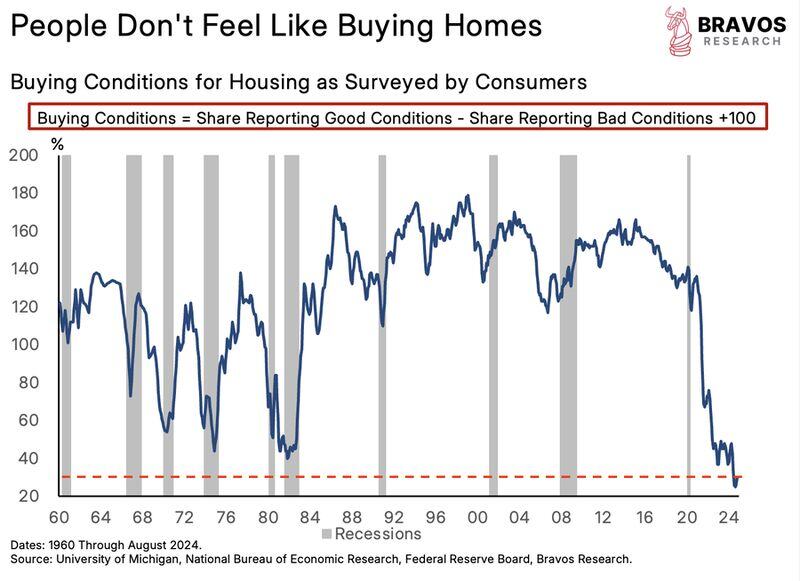

In the us, Home buying conditions have collapsed to levels NEVER seen in 65 years

Source: Bravos Research

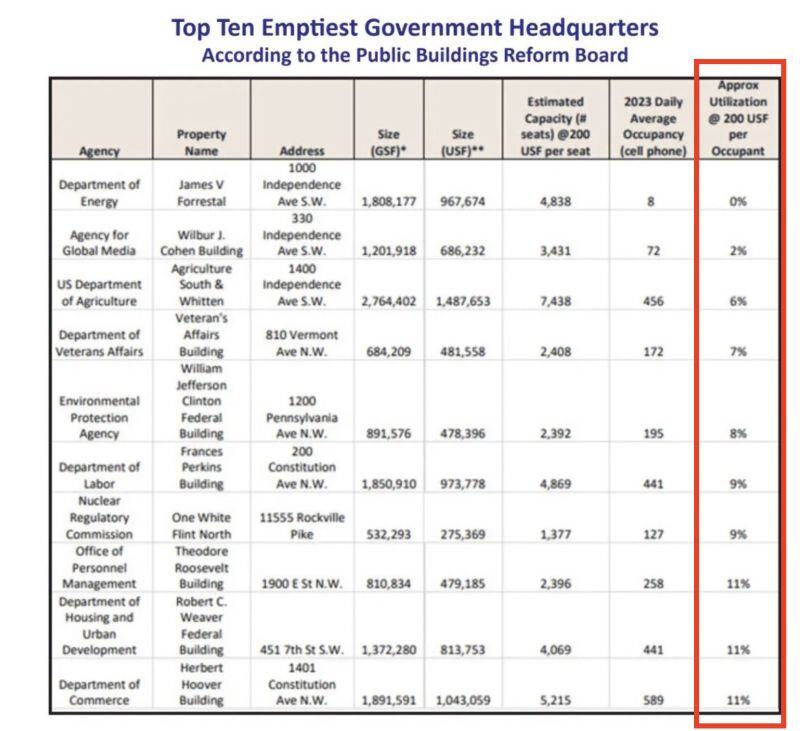

Shocking stat of the day: Not a single major US government agency is occupying even 50% of their office space.

As a result, the Trump Administration is reportedly considering selling TWO-THIRDS of US government office buildings, per WSJ. This comes at a time when office building prices have already fallen 30%+ from their highs. A mass liquidation of US government office buildings would flood the already weak commercial real estate sector with more supply... Source: The Kobeissi Letter

Spain proposes 100% tax on property purchases for non-EU buyers.

Spain is planning to impose a 100 per cent tax on real estate purchases for buyers from non-EU countries such as the UK in a bid to improve housing affordability by deterring foreign purchases. Prime Minister Pedro Sánchez announced the plan for the punitive property tax, which would apply to non-EU citizens who are not residents of the bloc, as part of a raft of measures aimed at tackling a “grave” housing crisis. Spain is one of many European countries where public anger is mounting over the difficulty of finding affordable housing to buy or rent as property prices soar and new construction lags far behind demand. Source: FT

Investing with intelligence

Our latest research, commentary and market outlooks