Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

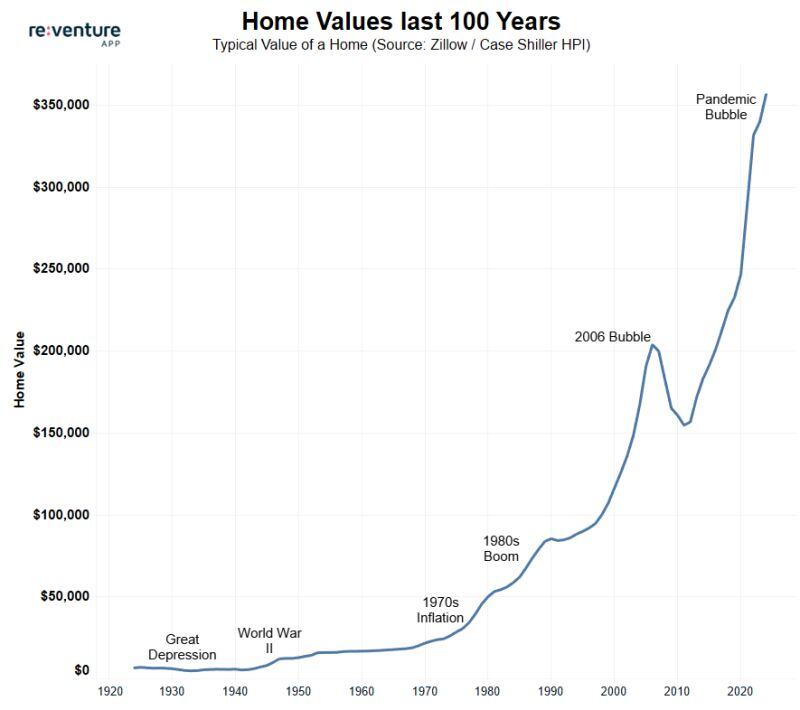

The value of a home in America since 1924.

Real estate is one way to protect your wealth against money debasement Source chart: re-venture

BREAKING 🚨: China

The Chinese Property Market has seen a total loss of $18 Trillion over the past 3 years, surpassing the losses suffered by the U.S. during the Global Financial Crisis. Source: Barchart

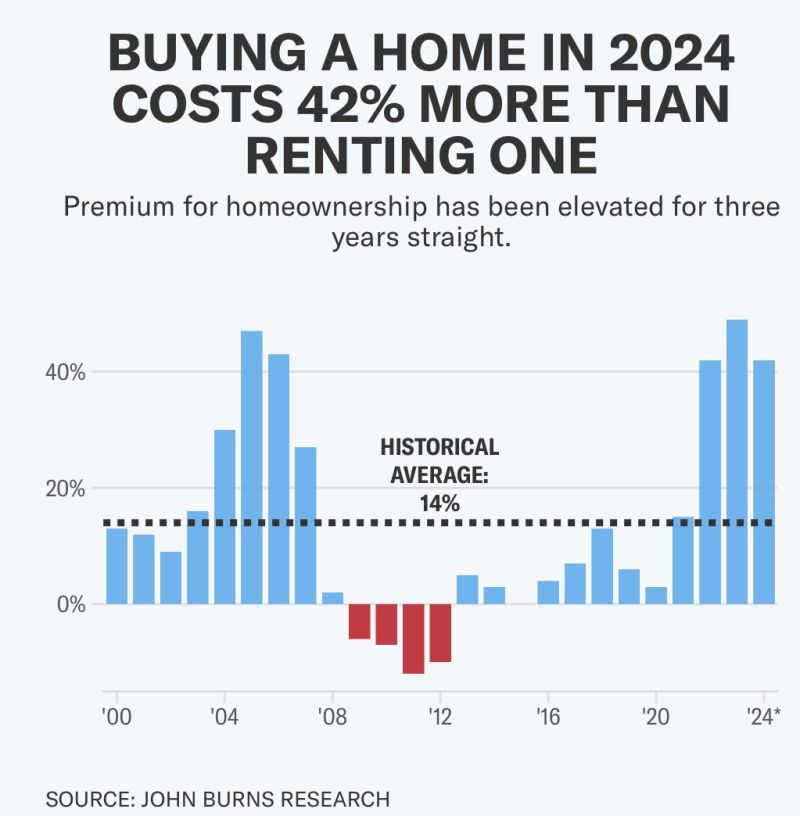

In the US, buying a home in 2024 costs 42% more than renting one

Source: John Burns Research

What has happened in Poland is nothing short of an economic miracle. Hard work and entrepreneurial spirit pay off.

30 years ago Poles were emigrating due to economic reasons. Today many Poles buy real estate in places like Marbella. Source: Michel A.Arouet

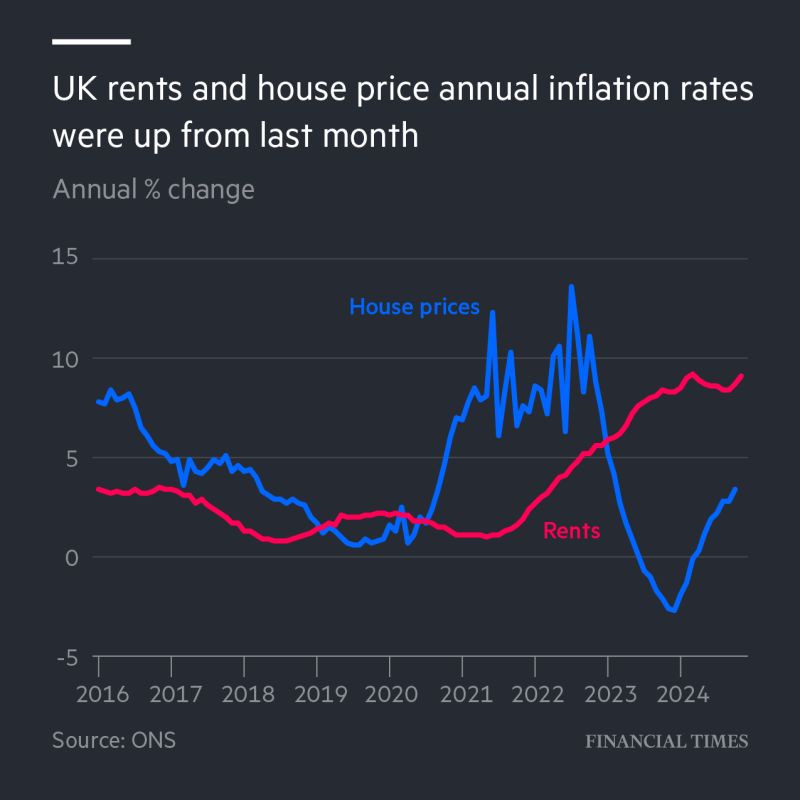

‘Renting is nothing short of brutal. Rents are rising at an astronomical and unsustainable rate.’

Rents in London increased by 11.6% in the 12 months to November 2024. Source: FT

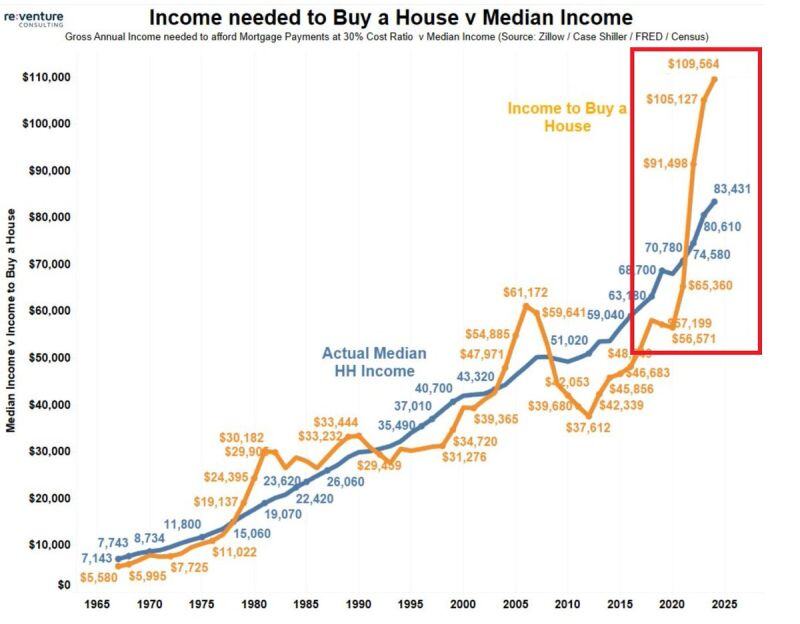

THE ISSUE WITH US HOUSING AFFORDABILITY IN ONE CHART...

Annual income needed to buy a house in the US hit a whopping $109,564, an all-time high. This has DOUBLED in just 4 years... At the same time, median income earned is just $83,431. The difference between the two has NEVER been greater. Source: Global Markets Investor

US rent prices are falling:

Median asking rent in the US declined 0.7% year-over-year in November to $1,595, the lowest since March 2022. 1-bedroom apartment rent prices fell 1.7%, to $1,450, reaching the lowest level in 3 years. 2-bedroom apartment rent prices declined 1.1%, to $1,671, to the lowest in 9 months. Furthermore, the median asking rent price per square foot dropped 2.2% to $1.79, the lowest since December 2021. This marks the 19th consecutive monthly decrease. Rent prices are cooling off. Source: The Kobeissi Letter

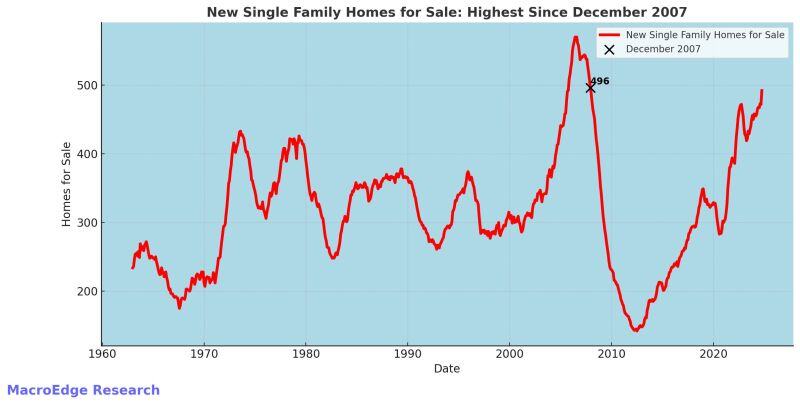

Total unsold US (single family) new homes for sale now at its highest level since...December 2007.

The increase in unsold homes takes place as housing affordability is near all-time low (mortgage rates AND prices are too high). A few remarks though: -There is a lack of inventory in some states while in other states inventory is building up due to population loss. - The chart is NOT normalized by population. The US population is about twice that compared to 1960. If you normalize the number from today compared to 1960, they might actually be the same. Source: Don Johnson @DonMiami3

Investing with intelligence

Our latest research, commentary and market outlooks