Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

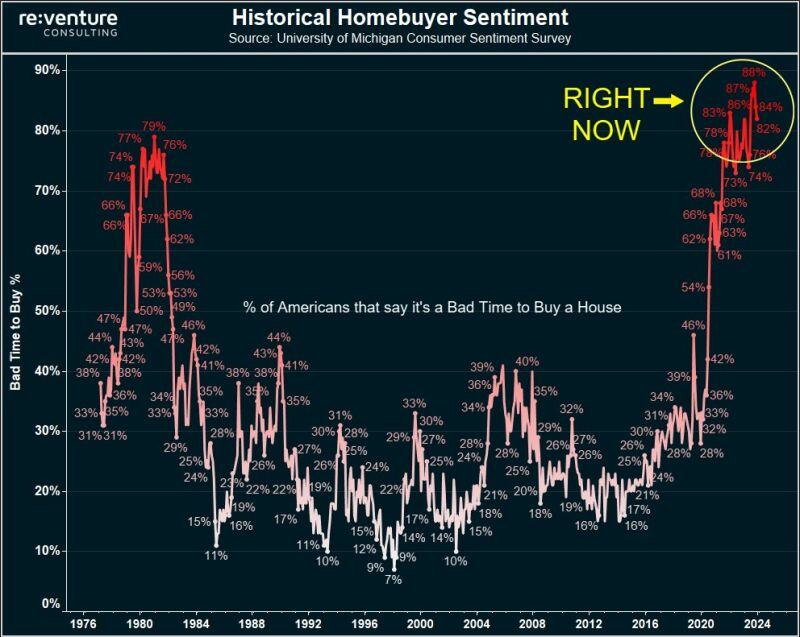

82% of Americans say it's a bad time to buy a house in late 2024.

That's the most pessimistic homebuyers have ever been about the housing market. Helps explain why homebuyer demand is so low. Source: Nick Gerli, re:venture

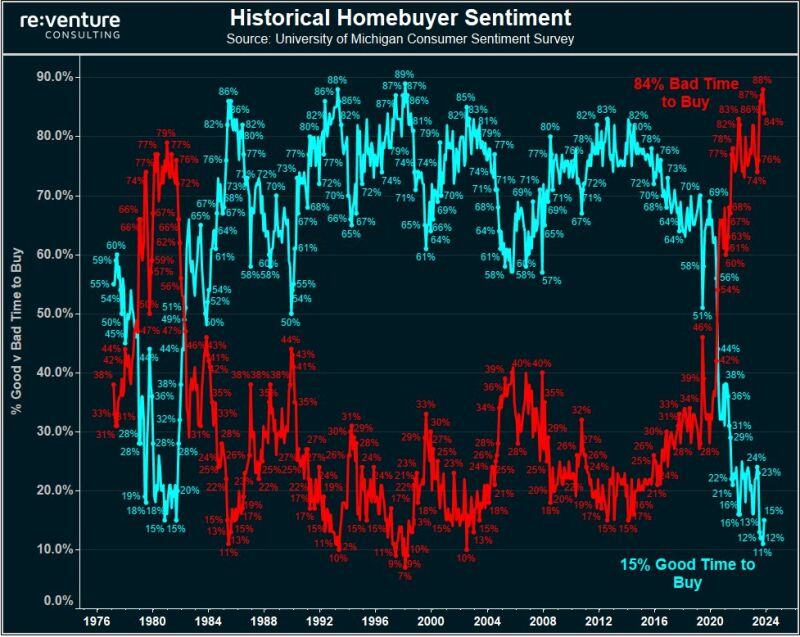

US HOUSING AFFORDABILITY HAS NEVER BEEN WORSE

84% of US consumers believe it is a bad time to buy a home, near the most on record. The share is greater than in the 1980s when rates were sky-high and as much as 20% versus 4.5% now. House prices are also near record highs. Source: Global Markets Investor

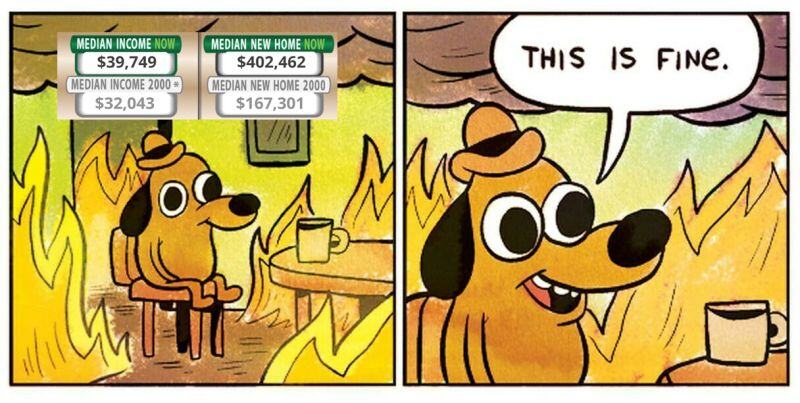

Between 2000 and 2024:

US Income +24% US House prices +140% Source: Trend Spider

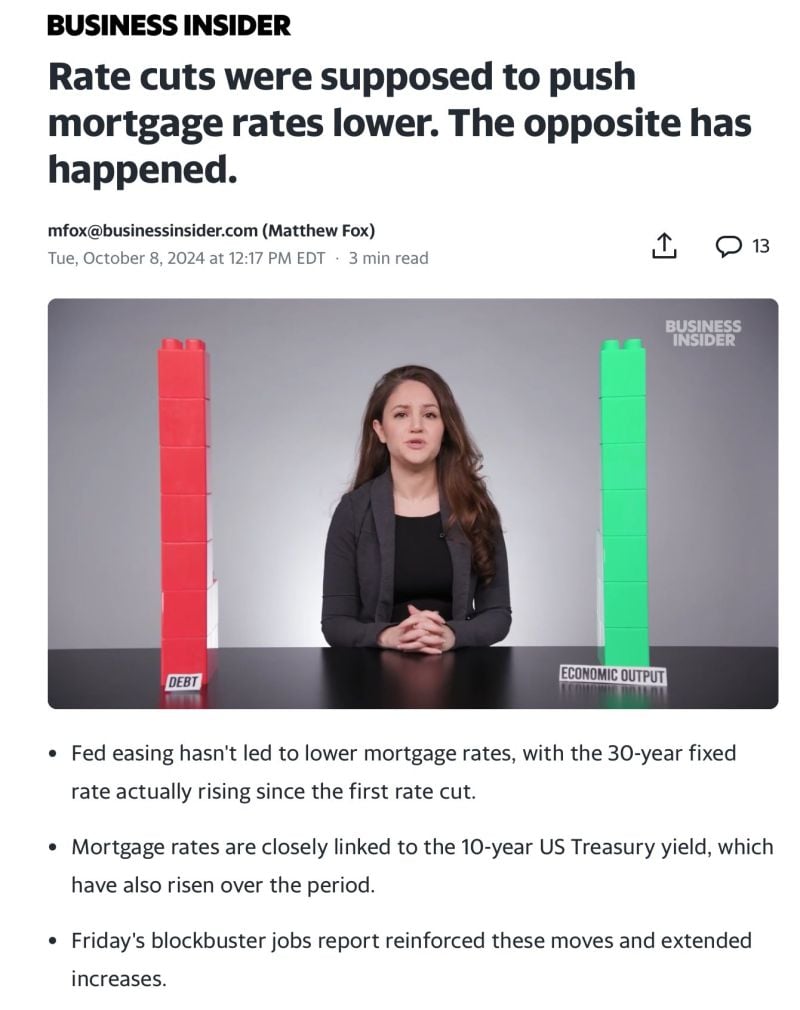

One of the reasons mentioned by many analysts to explain the aggressive rate cut (50bps) by the Fed in September was the following:macr

Shelter is the sticky component of inflation. If the Fed cut rates, we should see a drop in the mortgage rate which will enable more real estate supply and thus lower shelter inflation. Well, the Fed cut rates but mortgage rates are not declining. They are even moving higher? Has the Fed lost control of the bond market?

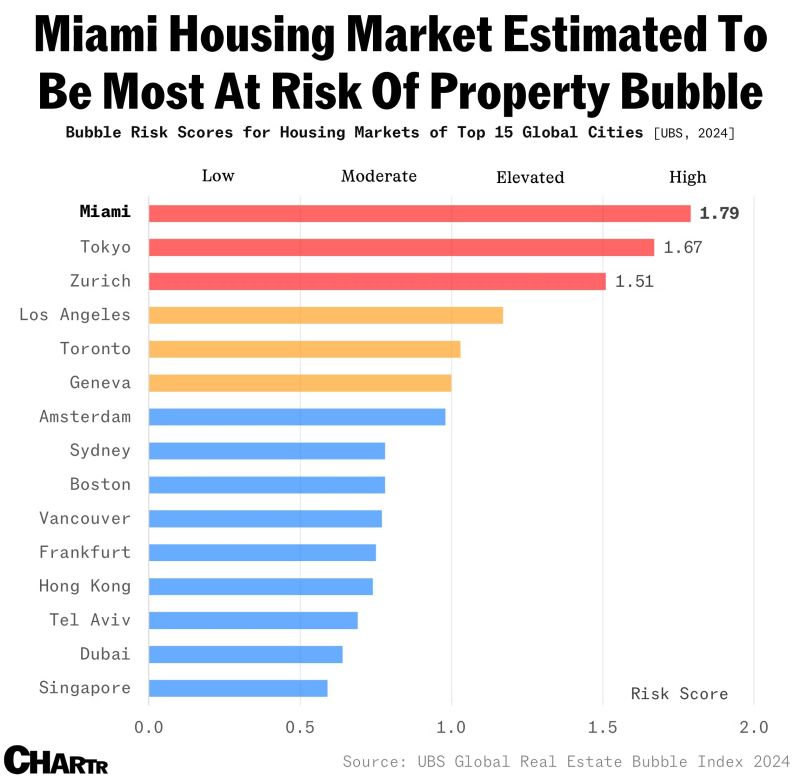

Miami tops a global list of cities most at risk of a housing bubble.

The annual UBS Global Real Estate Bubble Index for 2024, which analyzes residential property prices in 25 major cities worldwide, revealed that Miami’s soaring housing market had the highest bubble risk with an index score of 1.79 — beating Tokyo and Zurich for the top spot. Source: Chartr, UBS

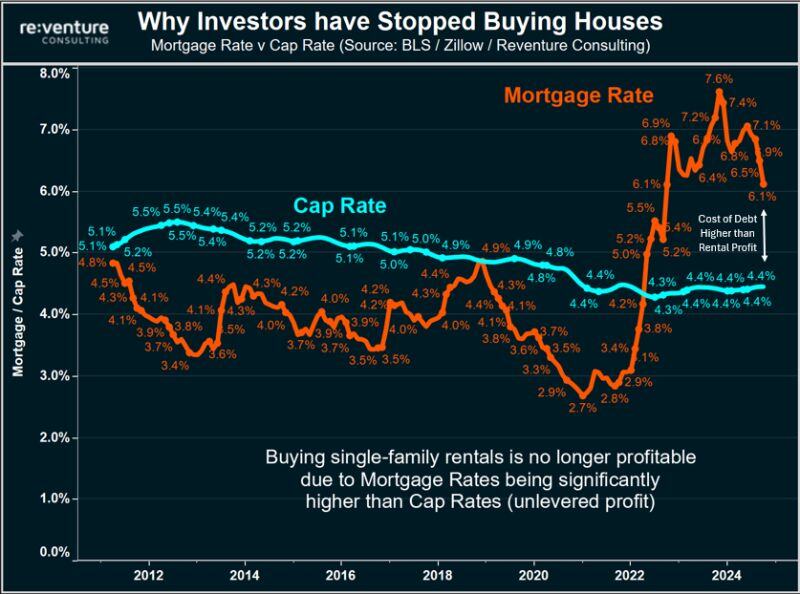

Buying a rental property in America is no longer profitable.

Because the current mortgage rate (6.1%) is significantly higher than the profit/cap rate (4.4%) of rentals. This means that any investor who uses debt to finance their purchase is likely losing money on cash flow from Day 1. Note how from 2012-2022, the opposite was true. Cap Rates were higher than mortgage interest. Which is why so many people piled into single-family rentals. This is no longer the case... Will the Fed jumbo rate cut start to fix this? Source: Nick Gerli, re:venture

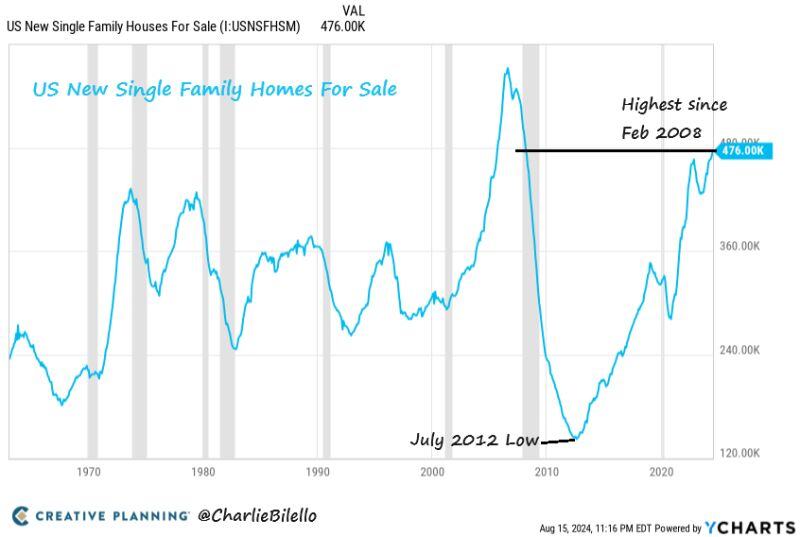

There are now 476,000 new homes for sale in the US, the highest inventory since February 2008.

Source: Charlie Bilello

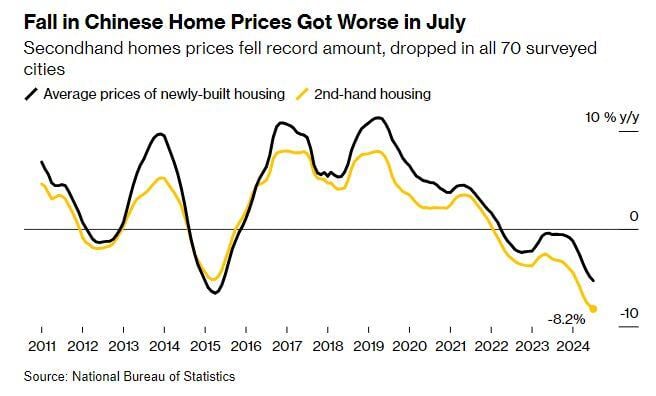

BREAKING: China

Chinese Home Prices declined by the largest amount in history last month Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks