Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

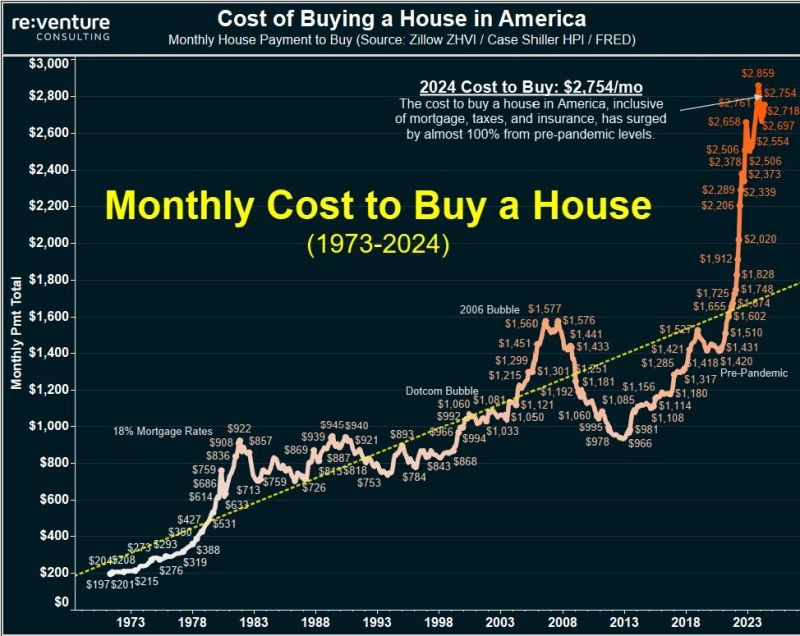

The cost of buying a home in the US rises to $2,750/month, the second highest ever recorded, according to Reventure.

Prior to the pandemic in 2022, the average home in the US would cost $1,400/month. In other words, it is now 100% MORE expensive to buy a home in 2024 compared to 2020. Even at the peak of the 2008 Financial Crisis, the average home payment peaked at $1,550/month. The average US family would need to spend 44% of their PRE-TAX income to buy a home today. Source: The Kobeissi Letter, re.venture

BREAKING 🚨: St. Louis Commercial Real Estate

The Former AT&T Building in St. Louis just sold for $3.6 million. In 2006, it sold for $205 million. A total loss of more than 98%. Source: Barchart

Price cuts in Florida just surged up to the highest level

In http://Realtor.com's data set: 30.1% of all house listings had a price reduction in March 2024. Indicating substantial "selling pressure". Source: Nick Gerli, Re.venture

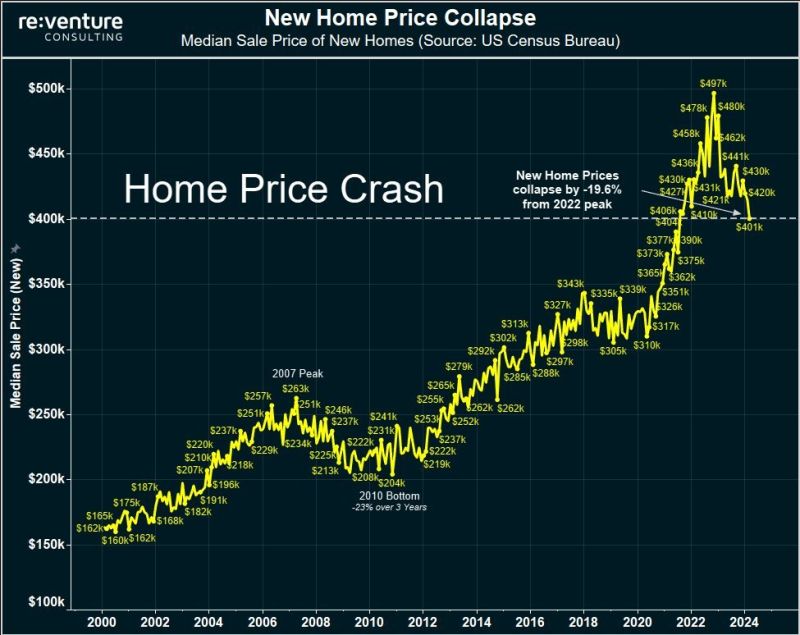

BREAKING: US new home prices are now down 20% from their highs, in bear market territory, and falling faster than rates seen in 2008, according to Reventure.

New home prices peaked in late-2022 at $497,000 and have fallen to $401,000 as of the latest data. In the financial crisis, new home prices dropped by 23% from 2007-2010, according to Reventure. US Home prices are down roughly the same amount in just 1.5 years, or half the amount of time. Still, new home prices are ~20% above pre-pandemic levels and existing home supply is near record lows. Is the hashtag#us housing market beginning to crack? Source: The Kobeissi Letter, Re-venture

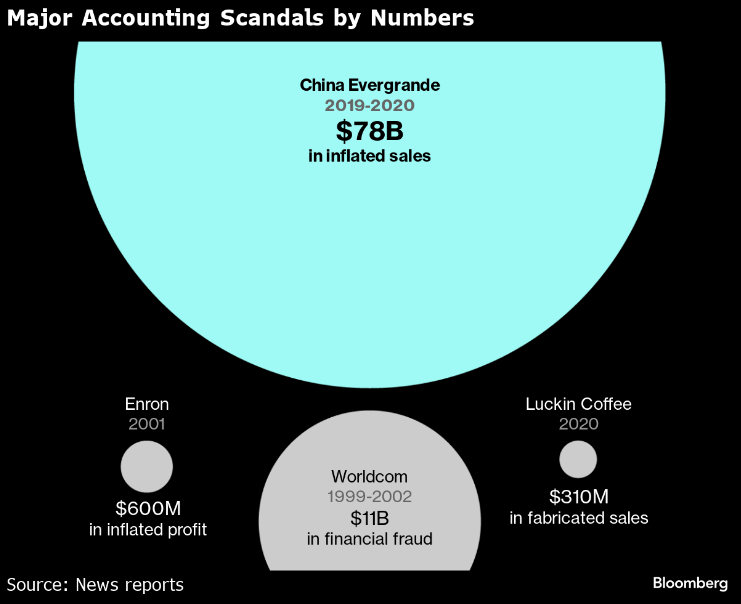

China scrutinizes PwC role in $78 billion Evergrande fraud case

Chinese authorities are examining the role of PWC in China Evergrande Group’s accounting practices after the developer was accused of a $78 billion fraud, ramping up pressure on the global accounting giant that audited a slew of developers before the sector’s meltdown.

Source: Bloomberg

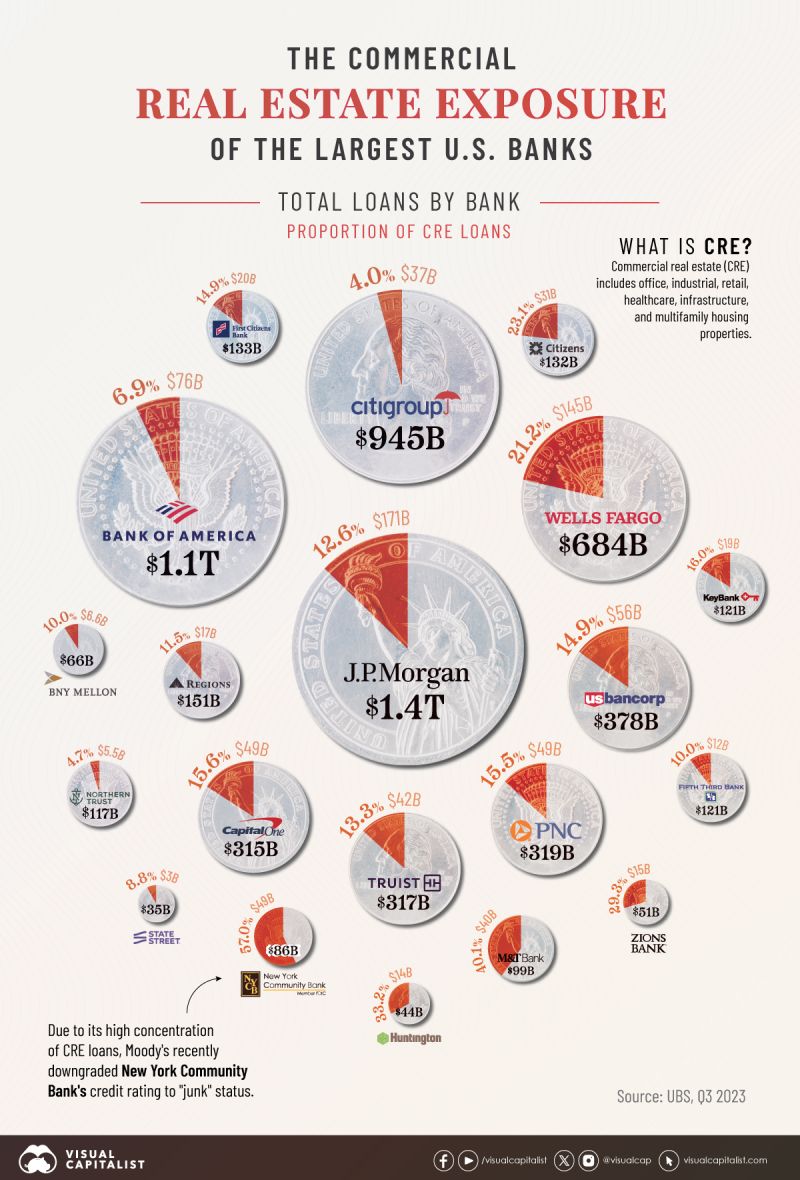

Major U.S. Banks, by Commercial Real Estate Exposure

This graphic shows the 20 largest U.S. banks by assets, and their exposure to commercial real estate as a percentage of total loans. source : visualcapitalist

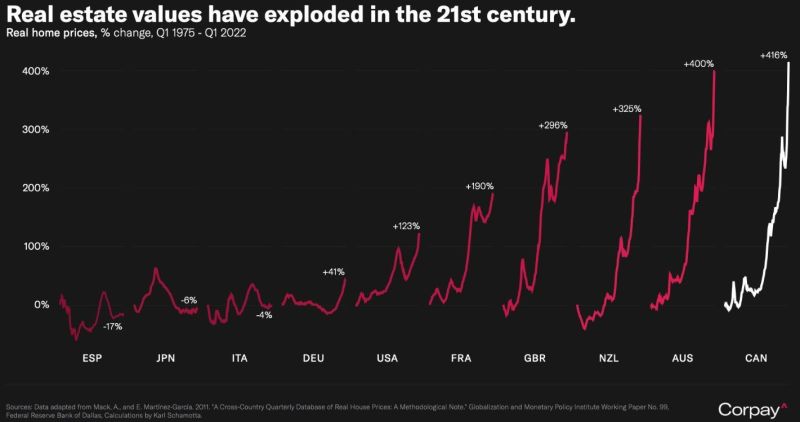

House prices adjusted for inflation since 1975.

The charts for Canada, Australia, New Zealand, and the UK look like a s**tcoin during a pump. The Japanese real estate bubble of the 1990s is barely visible as a comparison... Source: Bloomberg, MacroAlf

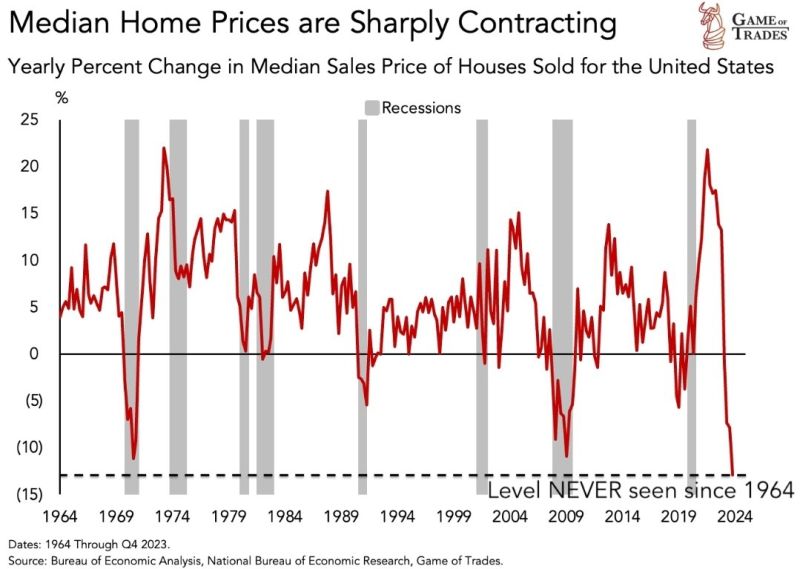

Median home prices are now contracting at levels NEVER seen in 60 years

Source: Win Smart

Investing with intelligence

Our latest research, commentary and market outlooks