Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

If you cannot afford your rent, you are in good company.

According to Harvard University, half of all renters in the United States are paying more in rent than they should. That is defined as using up more than 30% of your income. The good news is rent is coming down in most of the country. The median asking rent is just above $1,700, which is down $63 from its peak in July 2022. That number is going to vary from city to city, but even in Manhattan, rents dropped for the first time in more than two years in November. https://lnkd.in/e_dmjidG

A Hong Kong court has ruled that Evergrande, China's largest real estate developer, must be liquidated

The stock is now down another 20% today on the news and trading has been halted. Evergrande is now considered the most indebted property developer in the world. This comes at a time when China's HY Real Estate Index is down 85% in 2 years. China is also preparing hundreds of billions in economic stimulus along with considering a ban on short selling. Source: The Kobeissi Letter

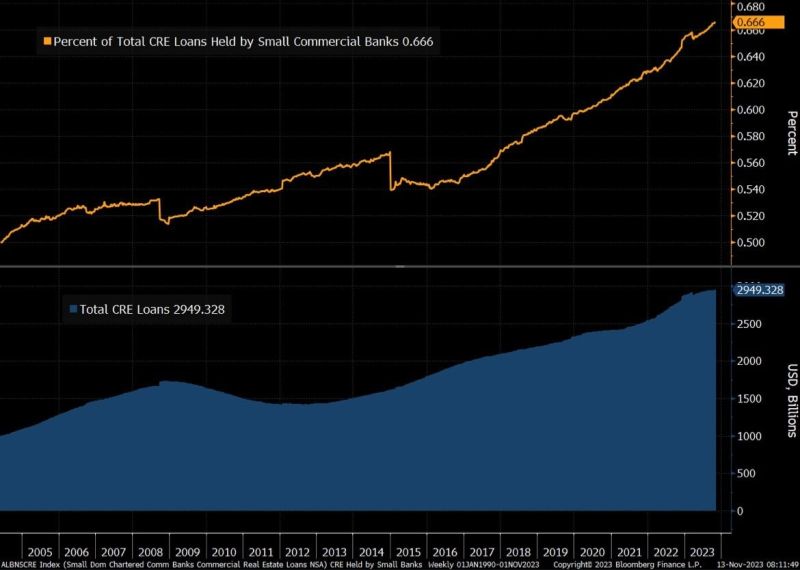

BREAKING: 14% of all commercial real estate (CRE) loans and 44% of office building loans are now in "negative equity."

In other words, the debt is now greater than the property value on all of these properties. Currently, US banks hold over $2.9 trillion of CRE debt, the majority of which is held by regional banks. Office building prices are down 40% from their highs and CRE as a whole is down over 20%. All as rates rise and many of these loans are due CRE is beyond bear market territory.

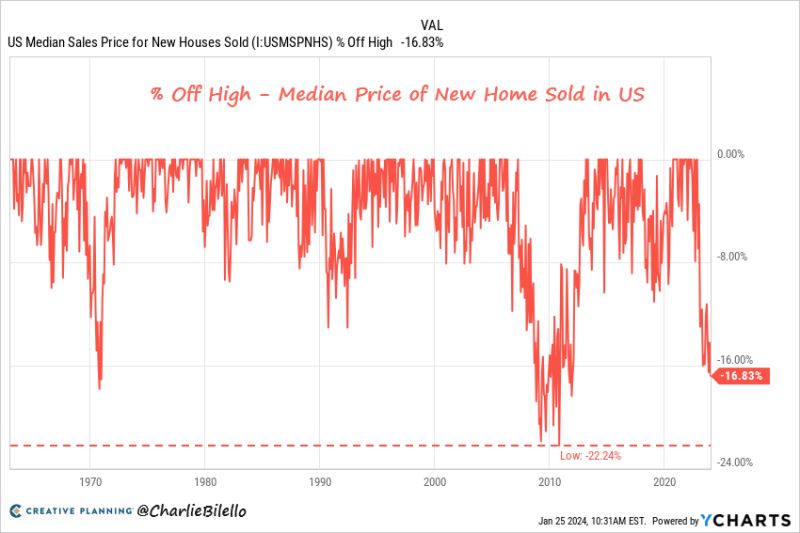

The median price of a new home sold in the US is down 17% from its peak in October 2022 (from $496,800 to $413,200)

After the last housing bubble peak the median new home price fell 22% nationally before bottoming. Source: Charlie Bilello

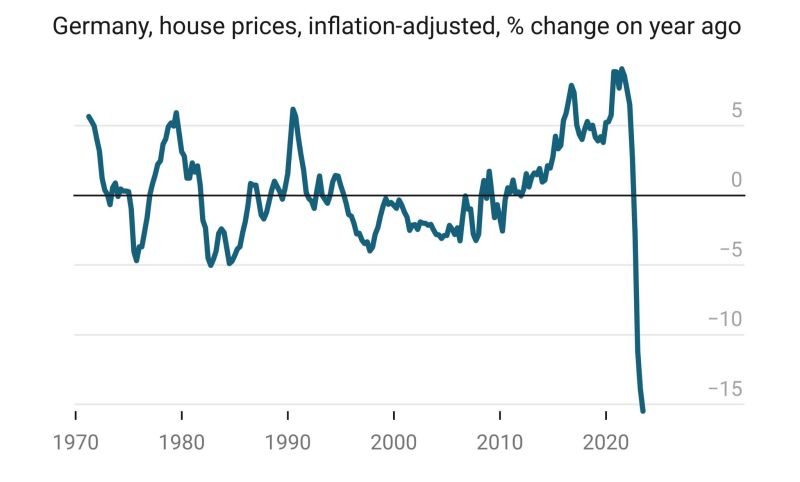

Real estate as inflation protection in one chart, updated

Source: Michel A.Arouet

Why are homes so expensive in Canada?

Source: Wall Street Silver, The Economist

44% of office loans carry outstanding loan balances higher than the property value and are at risk of default according to a paper from the National Bureau of Economic Research

Source: Barchart

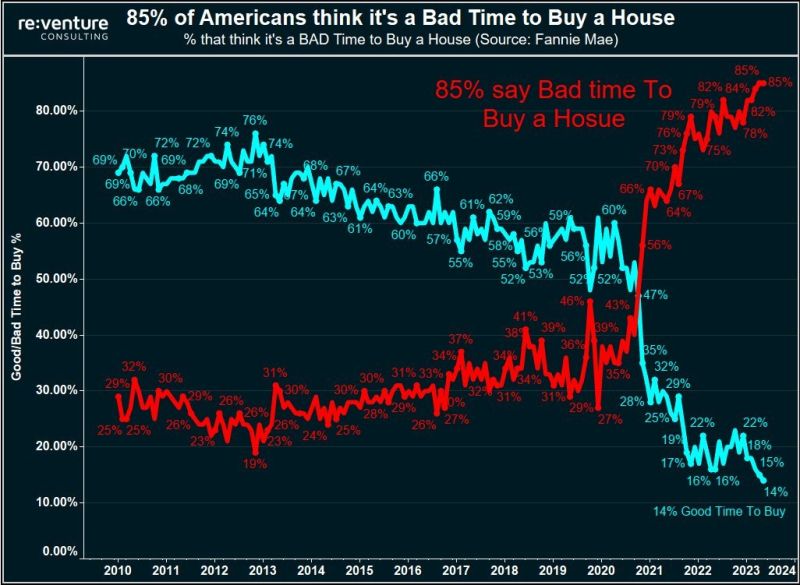

A record 85% of Americans now say it's a bad time to buy a house, according to Reventure

Two years ago, just ~30% of Americans thought it was a bad time to buy a home. Even in 2008, during the worst housing crisis of all time, this metric did not top 85%. In a market with high rates and supply levels 40% below the historical average, affordability is at all time lows. Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks