Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

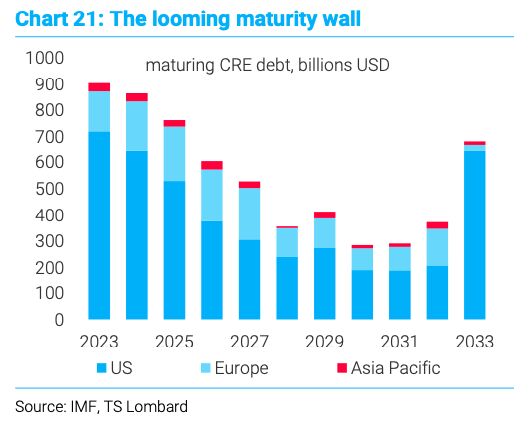

Billions of commercial real estate debt mature this year

Unlike US home loans, CRE debt is almost entirely interest-only. Borrowers tend to have low monthly payments but face a balloon payment equal to original loan on maturity. Source: Dabiel Baeza, TS Lombard

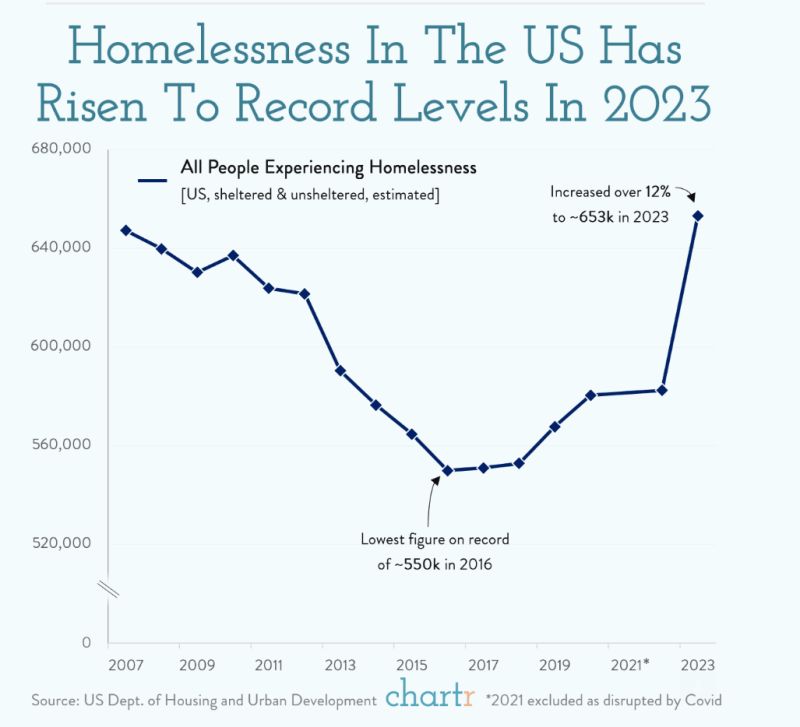

Homelessness in the US has grown to the highest level since the Department of Housing and Urban Development (HUD) started tracking the figure back in 2007

With a record 653,104 people experiencing homelessness at the latest annual count. The number of people experiencing unsheltered homelessness — those living on sidewalks or in abandoned buildings, bus stations, etc. — was up around 47k from last year, while the figure for people staying in emergency shelters, transitional housing programs, or safe havens grew 23k in the same period. Source: Chartr

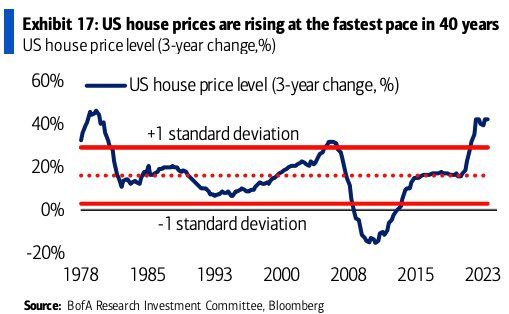

After 2 years of the most aggressive FED rate hike cycle since the 1980s, the price of US houses (3 years change) is rising at the fastest pace in 40 years...

that sounds a bit counterintuitive at first glance as most surveys show that the housing affordability is at record low Source: BofA

An overview of European real estate price indices by Bloomberg / HolgerZ:

A shortage of housing has led to record real estate prices in ireland. The national property price index has now reached a value of 170.0, which is 3.9% above its bubble peak in April 2007. Property prices have increased by 113% in past 10yrs. Recent Dublin riots exposed the anger of Irish Youth facing a housing crisis resulting from the high housing & rent prices. Note the decline in German house prices (in purple) and steady markets in Italy / Portugal / Spain.

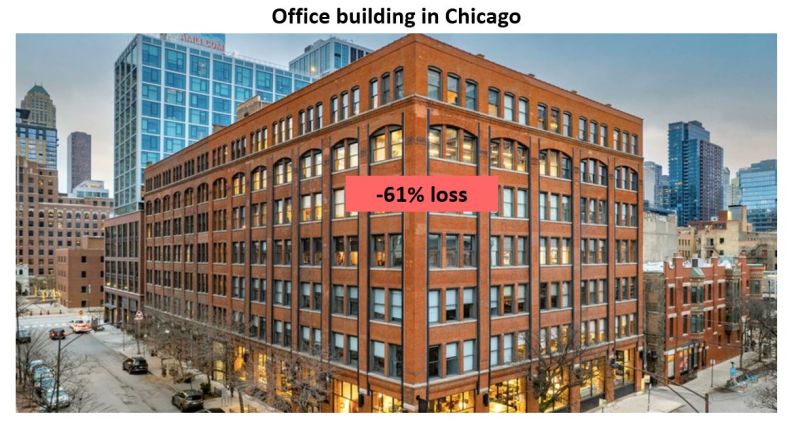

Here's one illustration of the US commercial real estate market meltdown: values of commercial real estate continues to get destroyed in Chicago...

A 155k SF office building in Chicago just sold for $17 million, or $109 per SF The seller took a huge 61% loss, paying $44 million for the building in 2017 Here's a worrying snippet from Crain's: "Thanks to remote work and higher interest rates, real estate investors can buy downtown office buildings on the cheap these days. Add a motivated seller trying to unload all of its office stock and the discount gets even steeper. Many office properties in the heart of the [Chicago] are now worth less than the mortgages tied to them, fueling a historic wave of distress." It will be interesting to see how bad the US commercial real estate meltdown gets (particularly in office) but it's certainly a story to keep an eye on in 2024 as big opportunities emerge". Source: TripleNetInvest

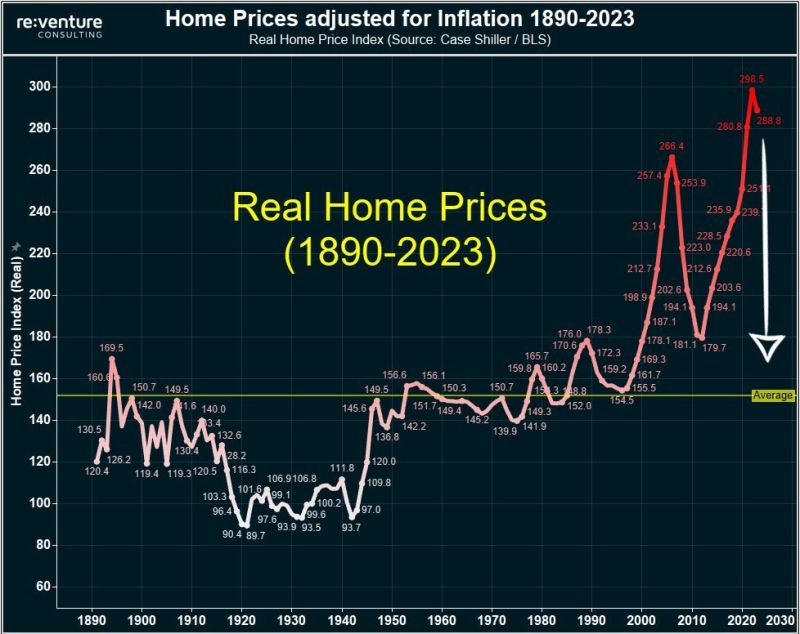

As highlighted by The Kobeissi Letter, the US housing market is having its historical moment

The US housing market is having its historical moment. Indeed, Real home prices in the US are currently almost 10% MORE expensive than they were in 2008. In fact, real home prices are now 80% ABOVE the 130-year historical average, according to Reventure. This means that even on an inflation adjusted basis, home prices have never been more expensive. Meanwhile, housing supply is 40% below the historical average. All while mortgage demand is at its lowest since 1994 and the median homebuyer now has a $3000/month payment. Source: The Kobeissi Letter, Reventure

Buying a home is now 52% more expensive than renting, the highest premium on record (note: the premium peaked at 33% during the last housing bubble in 2006)

Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks