Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

THE US REAL ESTATE MARKET IS MAKING HISTORY...

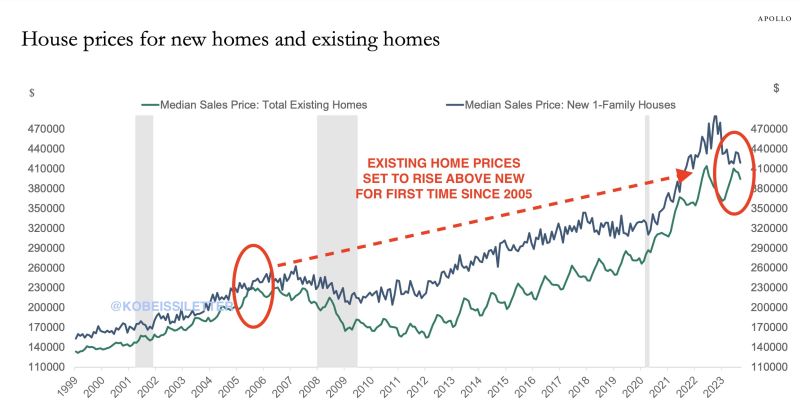

As highlighted by The Kobeissi Letter -> For the first time since 2005, new home prices are set to drop below existing home prices. In other words, new will be selling for LESS than old. The median new home price is down to ~$410,000 while the median existing home prices is nearing $400,000. Why is this happening? ~90% of mortgages outstanding currently have an interest rate that is below 5%. Many mortgage rates are BELOW the current inflation rate. A mortgage issued in 2020 or 2021 is effectively an asset now. Truly historic. Source: The Kobeissi Letter

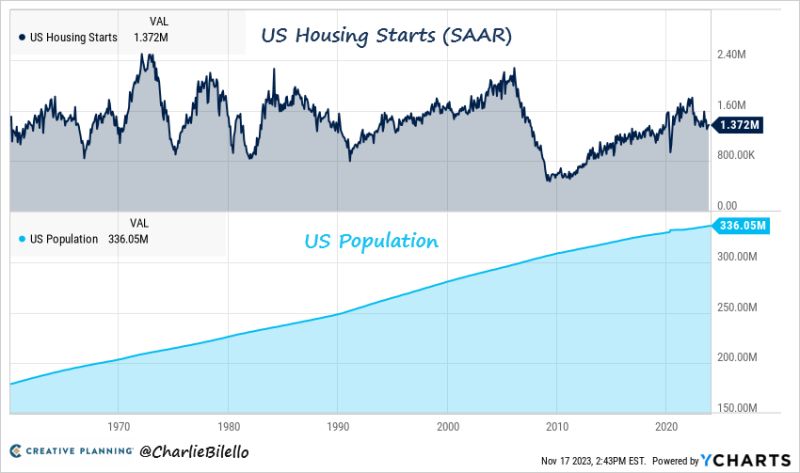

The US population has increased 87% since 1960 but fewer homes are being built today than back then

Source: Charlie Bilello

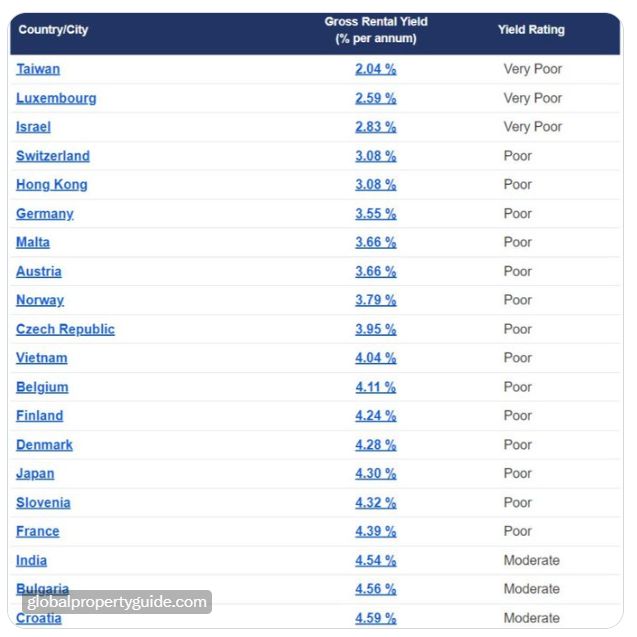

Global Property Guide

Q2 2023 gross rental yields for apartments/condos in over 250 cities across 60+ countries: Dublin: 7.70% Istanbul: 6.21% Dubai: 6.13% Warsaw: 6.02% Madrid: 5.27% Athens: 5.25% Amsterdam: 5.00% Singapore: 4.78% Vienna: 3.29% Zurich: 3.11% Hong Kong: 3.08% Source: https://lnkd.in/eTaAkcHM

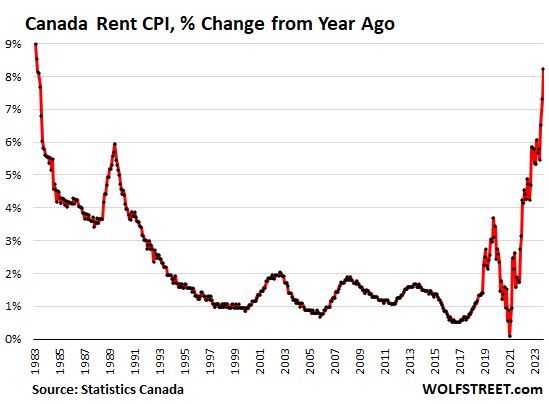

Compared to a year ago, the CPI for rent spiked by 8.2% in October, up from 7.3% in September, and the biggest year-over-year spike since April 1983

Soure: Wolfstreet.com, WallStreetSilver

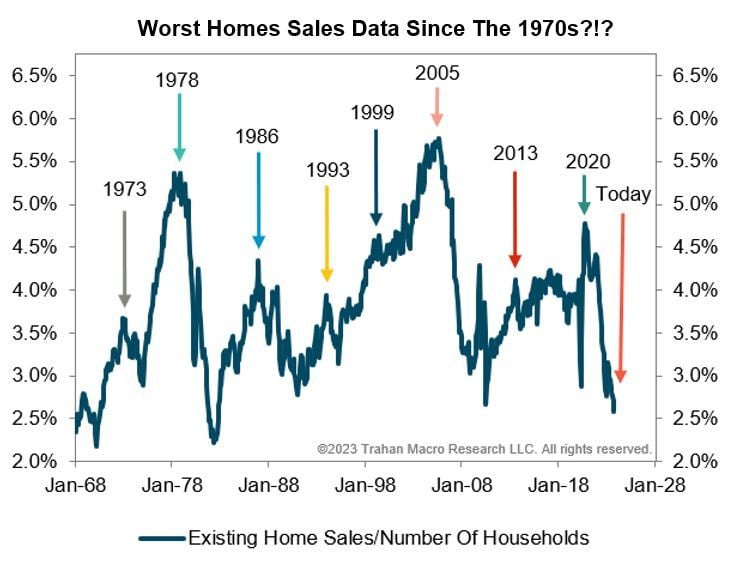

Existing Home Sales Crash To Slowest Since 2010

Sales actually fell 4.1% MoM (far worse than expected and down for the 20th time in the last 23 months) with September's 2.0% MoM decline revised even lower to -2.2% MoM. That decline left existing home sales down 14.6% YoY... Fewer US existing homes are selling today than at any point since 2010. The 3.79 million annual rate is even below the lowest level of sales during the 2020 covid shutdowns (4.01 million). The chart below by Francois Trahan puts things in greater perspective and shows that when adjusting for population, this is one of the worse housing profiles we have seen in decades. On this "per household" basis October existing home sales data was worse than the lowest reading seen at the depths of the GFC. Source: François Trahan

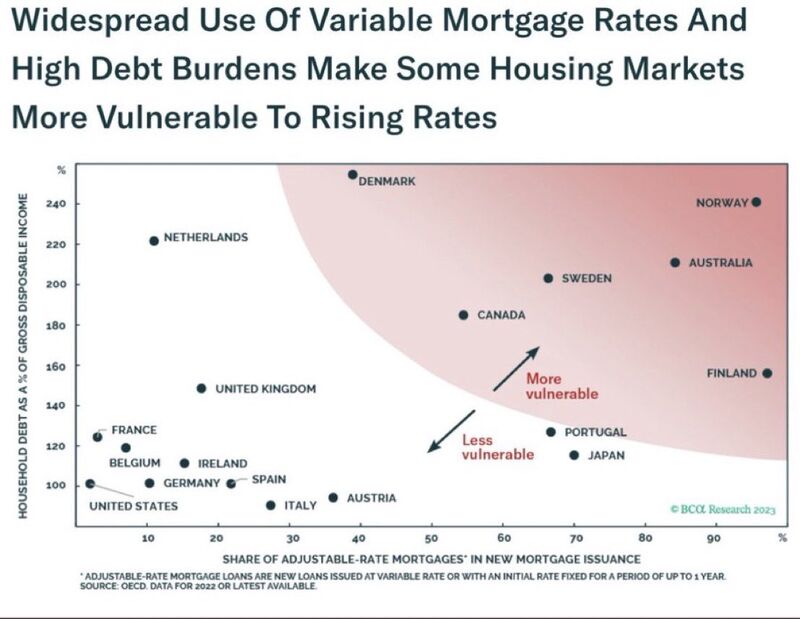

Which countries have the most rate sensitive household sectors?

Source: BCA, The Longview

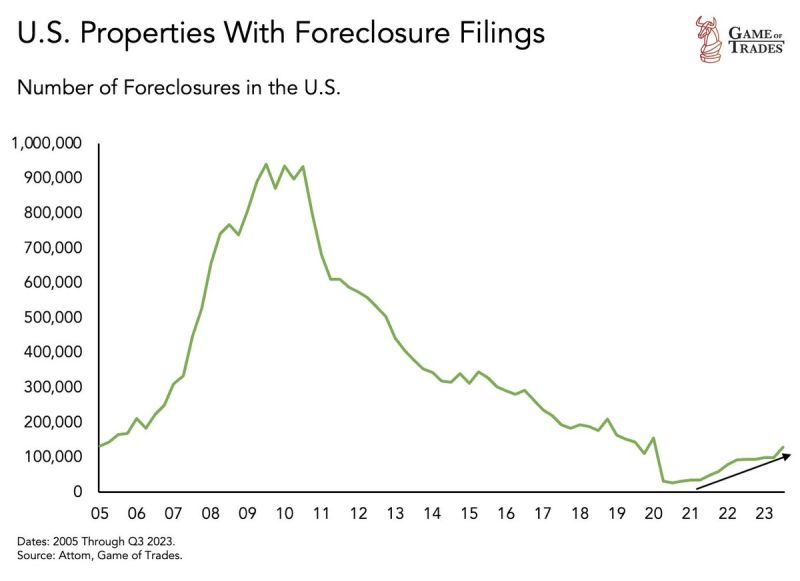

Property foreclosure filings have been increasing recently

This is the result of high interest rates resulting in rising mortgage defaults. Source: Game of Trades

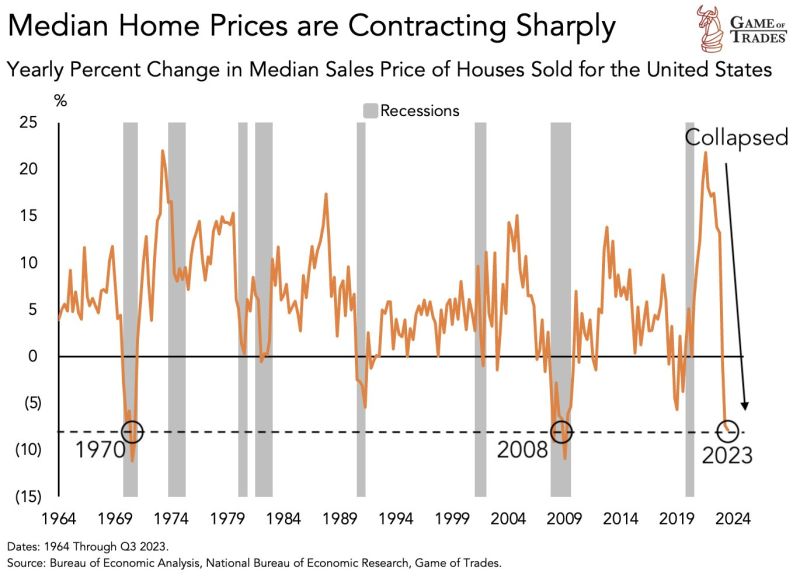

US median home prices are contracting aggressively. In just 2 years, the % has gone from over 20% to -7.9%. This is THE sharpest collapse on record

Current levels have occurred ONLY 2 times in the last 60 years: 1. 1970 2. 2008 Both instances ended with equities declining more than 30%. Source: Game of Trades

Investing with intelligence

Our latest research, commentary and market outlooks