Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Prospective California homeowners currently in the market would need to make $221,200 annually to qualify to purchase a median-price, single-story home in California, typically costing $843,600

The latest figures show that California’s housing affordability rates continue to decrease. The figures released during the third quarter are down from 16% in the second quarter of 2023. For comparison, about 56% of California home buyers could afford a home during the first quarter of 2012, the index’s peak high. Source: Wall Street Silver

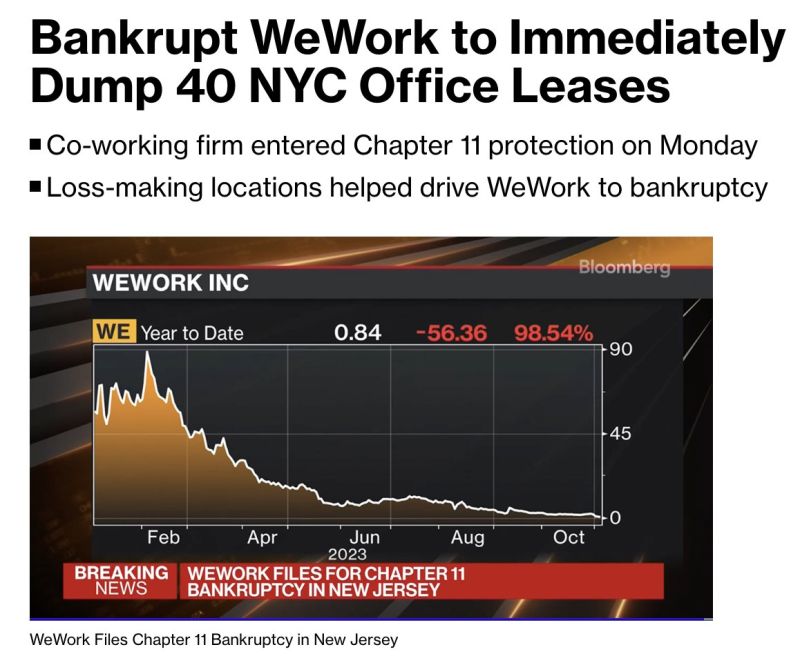

From The Kobeissi Letter -> Bankruptcy documents show that WeWork, $WE, will immediately break 40 office leases in New York City

Documents also show that WeWork plans to break leases on 70 properties in New York City. Note that 40 of these locations are completely empty. Once a $47 billion company, WeWork still has 700 locations world wide. Could this bankruptcy worsen the commercial real estate crisis?

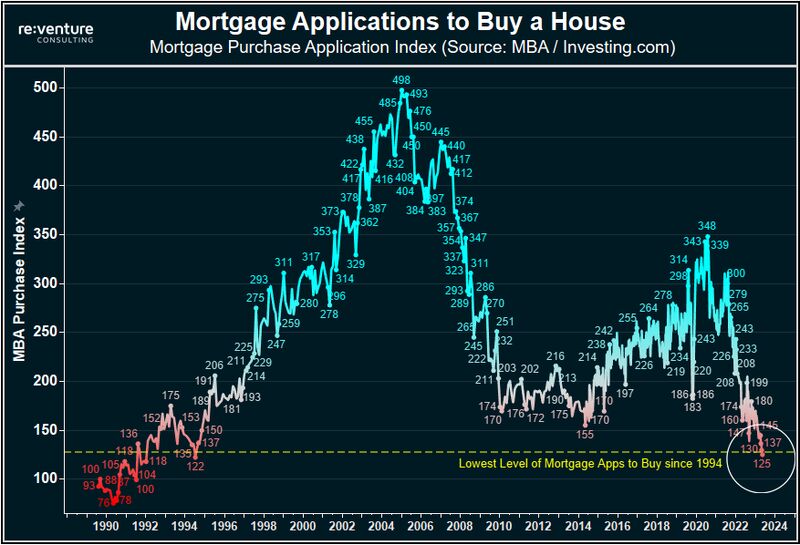

Mortgage demand is now down 50% from pre-pandemic levels and at its lowest level since 1994

From its peak in 2021, mortgage demand is down ~64%. Current mortgage demand is ~75% below the 2005 peak. The most incredible part of this? Mortgage rates are still only at their historical average. Housing market activity is coming to a halt. Source: The Kobeissi Letter

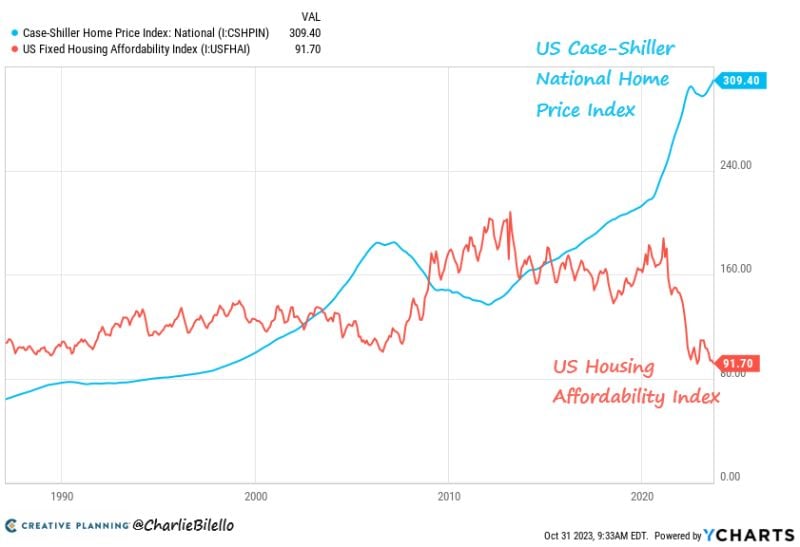

US Home Prices hit a new all-time high in August while affordability has plummeted to record lows...please explain...

Source: Charlie Bilello

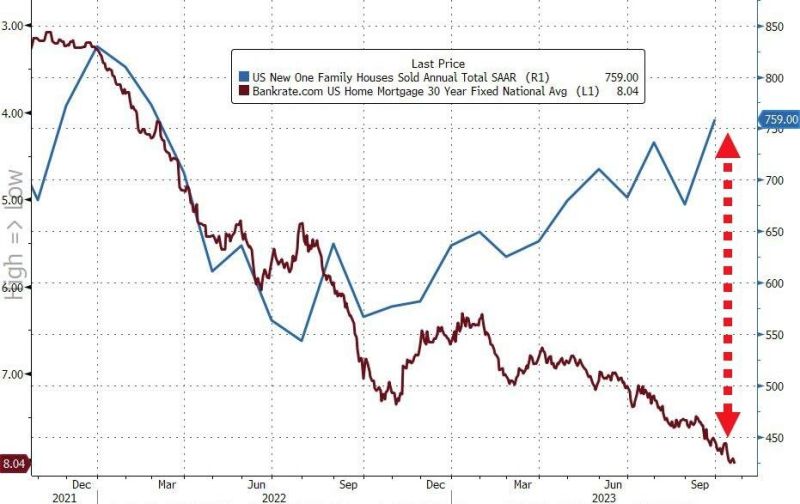

The US housing market conundrum ->

New home sales just surged 12.3% month-over-month in September, the largest jump since August 2022. Even as mortgage rates push above 8% for the first time in 23 years, new home sales are surging. The gap between new home sales and mortgage rates has never been wider. Why is this happening? Explanation by The Kobeissi Letter: -> Homebuilders are taking on some of the cost of higher mortgages AND existing home sales are at their lowest since 2010. New homes are the only option for buyers and homebuilders are helping pay for it. Source: The Kobeissi Letter, www.zerohedge.com

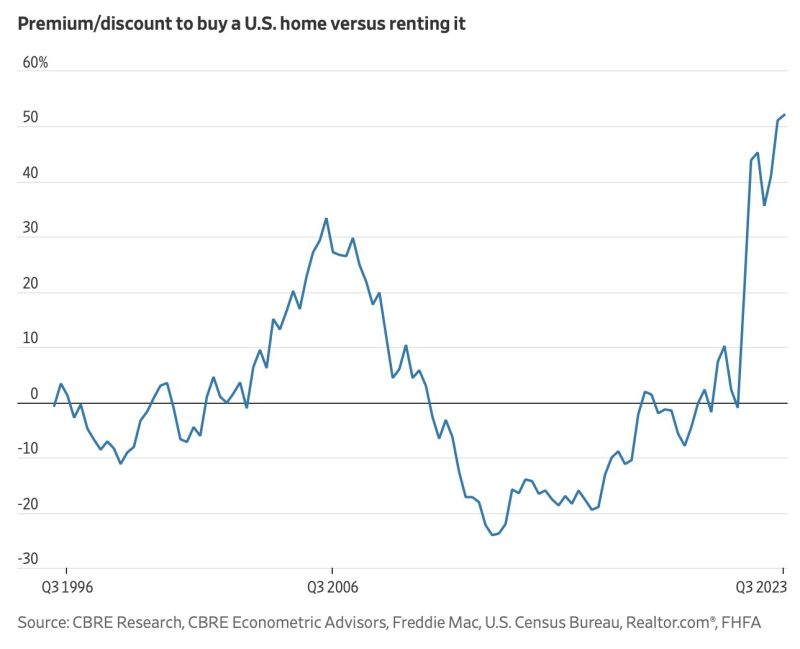

The premium to buy a home vs. rent one has soared to 52%, the highest level ever recorded

Even in 2008, the premium to own peaked at 33%. Source: barchart

As mortgage rates hit 8% for the first time in 23 years, affordability continues to fall off a cliff

The Housing Affordability Index just hit a fresh record low, at ~90. This means that housing affordability is officially down 50% since 2021. Since then peak in 2012, housing affordability is down nearly 70%. Buying a home has become a luxury. Source: The Kobeissi Letter, www.zerohedge.com

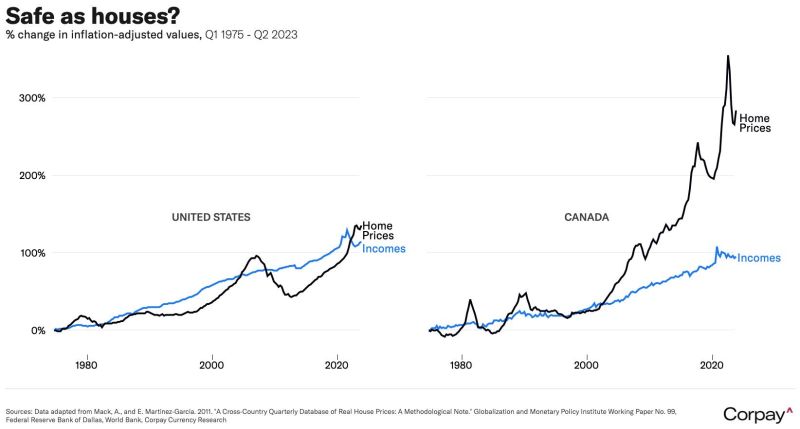

Amazing chart about Canada housing market (on the right) vs. US housing market (on the left).

Source: Michel A.Arouet

Investing with intelligence

Our latest research, commentary and market outlooks