Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

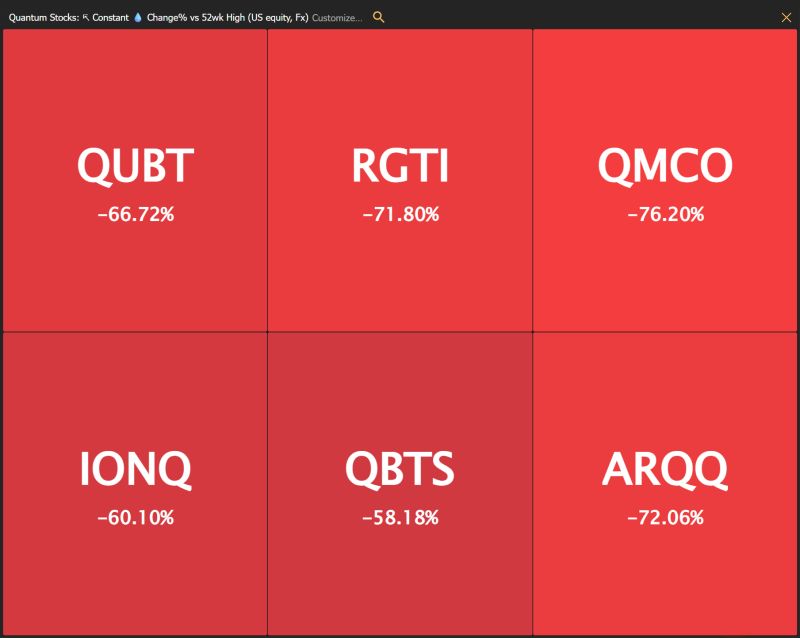

Quantum stocks are down substantially from their 52-week highs...

Source: Trend Spider

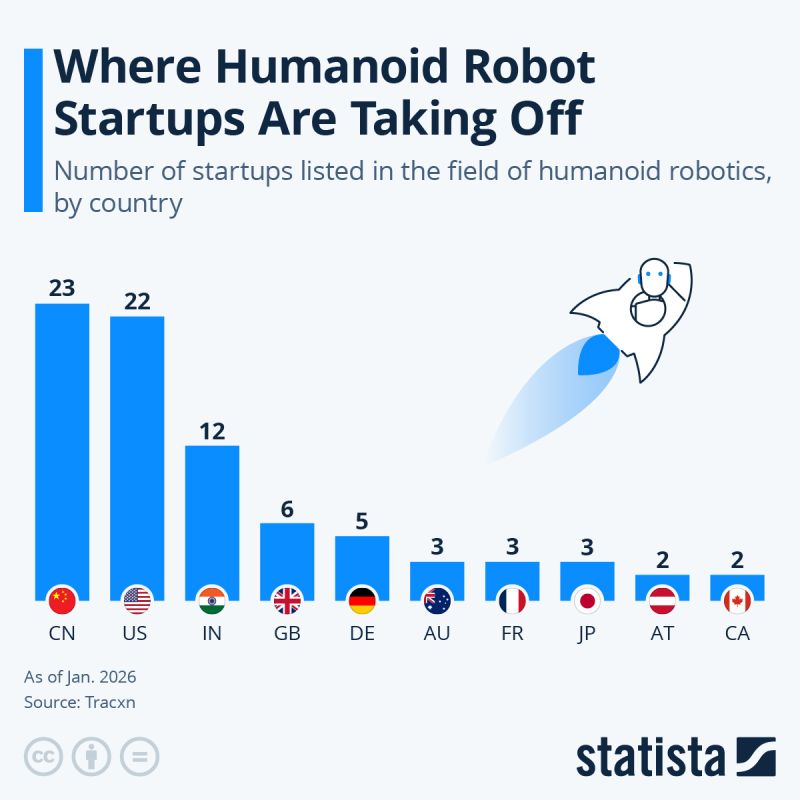

The "Humanoid Revolution" just hit escape velocity.

If you thought humanoid robots were still "science fiction," the 2025 investment data is a massive wake-up call. We aren't just dreaming about the future anymore—we’re funding it at a record-breaking scale. The $2.65 Billion "All-In" Moment: In 2025 alone, investors poured $2.65 billion into humanoid startups. To put that in perspective: That is more than the previous six years combined. The smart money has officially decided: Humanoids are no longer "lab experiments." They are commercial assets. The Global Leaderboard: It’s a two-horse race at the top, but the gap is closing fast: 🇨🇳 China: Leading with 23 specialized startups. Companies like Unitree and Agibot are already churning out 5,000+ units a year. 🇺🇸 USA: Right behind with 22 startups. Big names like Tesla (Optimus) and Boston Dynamics (Atlas) are gearing up for a massive 2026 industrial rollout. 🇮🇳 India: The surprise "dark horse" in 3rd place with 12 startups. 🇪🇺 Europe: Holding steady with hubs in the UK (6), Germany (5), and France (3). Why this matters now: We are moving from the "Look what it can do!" phase to the "Look how many we can build" phase. With China leading on sheer volume and the US leading on high-end integration, the race for the "labor force of the future" is officially on. Source: Zerohedge, statista

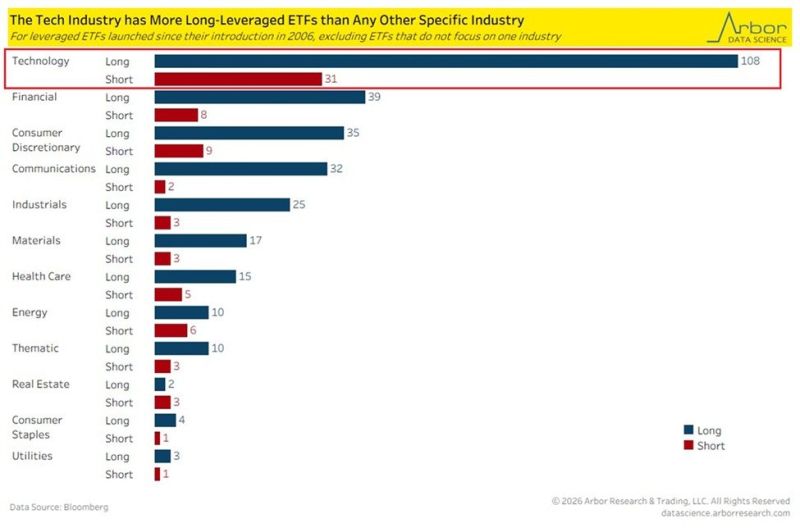

Is the tech sector building a house of cards?

There are now 139 tech-related leveraged ETFs (108 long, 31 short). That is 3x more than the next largest sector (Financials). To put that in perspective: Tech now has more leveraged ETFs than Financials, Consumer Discretionary, and Communication Services COMBINED. 🤯 We’ve moved past simple indexing into a world of hyper-fragmented, high-octane gambling vehicles. Source: The Kobeissi Letter, Arbor Research & Trading

The AI action is in Asia

See below chart with SK Hynix, Samsung or Advantest all sky rocketing. Meanwhile, Nvidia $NVDA (below line in yellow) remains stuck Source: LESG, TME

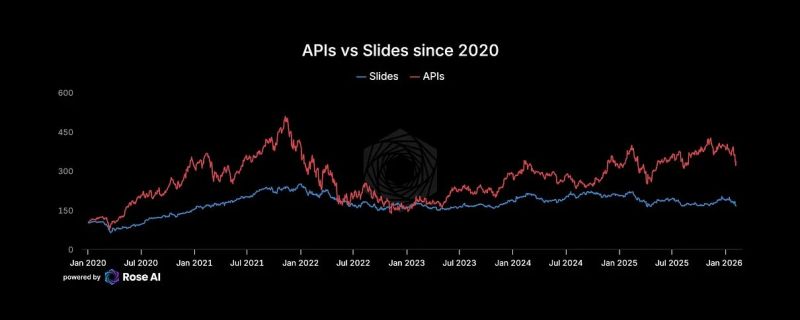

"A pair trade for the AI transition: long API / short slides"

🚨 The "Software is Dead" Narrative is Wrong. You’re Just Looking at the Wrong Software. The market is panicking. The $IGV hashtag#etf is down 30%. The headlines say AI is writing code now, so software companies are toast. 📉 They’re making a massive Category Error. If you're investing without looking at the "plumbing," you're missing the biggest bifurcation of the decade. Here is how the "Singularity" is actually playing out: 1. The Victim: Human-UI SaaS (Type 1) 🖱️ If your software requires a human to stare at a dashboard for 8 hours, you have a target on your back. The Logic: AI agents replace humans. One less Customer Service rep = one less Zendesk seat. One less PM = one less Monday.com seat. The Result: Seat-based SaaS compresses as headcount shrinks. 2. The Winner: Bot-Infrastructure (Type 2) 🤖 AI agents don't have eyes. They use APIs. They don't click; they call. The Logic: One human generates a few clicks an hour. One AI agent generates thousands of API calls per minute. The Winners: The "Tollbooth Operators"—Okta, MongoDB, Snowflake, Datadog. They don't care if the user is a human or a bot; they charge per unit of consumption. Bots consume orders of magnitude more than we do. 🪦 The Real Casualty: The "Body Shops" The IT outsourcing model (Infosys, Wipro, Cognizant) is built on Labor Arbitrage. Hire for $15/hr in Bangalore, bill for $80/hr in NYC. The Problem: AI makes labor arbitrage worthless. You can’t get cheaper than "nearly free." The Proof: India's Big 4 are already cutting thousands of heads. The hiring machine has stopped. 🛑 The Bottom Line: The market is selling "Technology" as a monolith. This is a mistake. AI replaces Road Workers (IT services/Human-UI). AI pays Tolls (Infrastructure/APIs). The Play: Buy the dip in APIs. Short the slides. The infrastructure layer is the only place to hide when the bots take over.

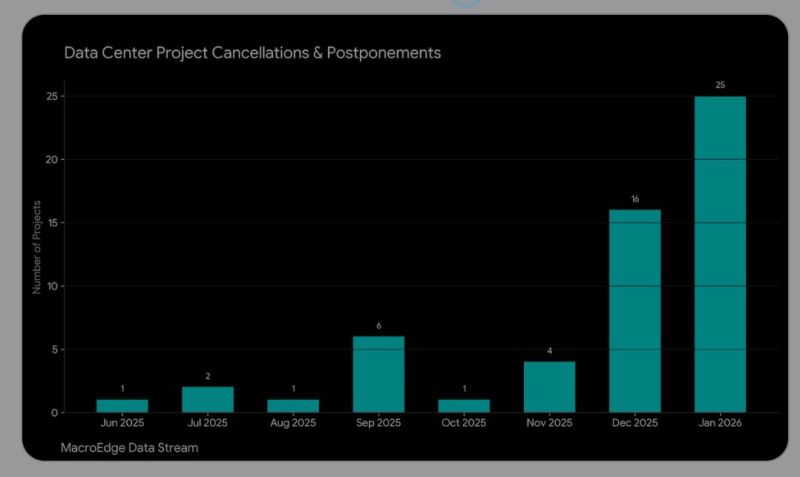

Already 25 data center cancellations and postponements this month, expecting to see a 100+ month towards midterms (excludes local/county moratoriums)

Source: Don Johnson @DonMiami3 on X

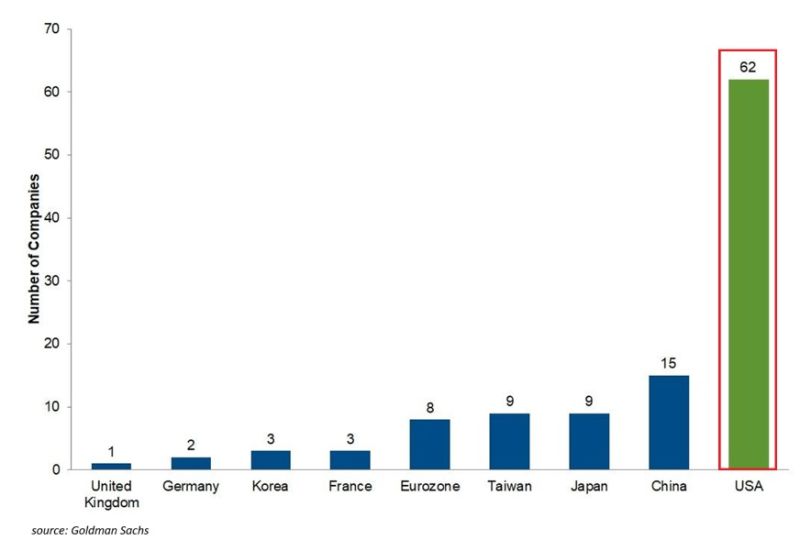

The US is innovating at an unprecedented rate 🚀

We talk about global competition, but the data tells a much more lopsided story. Check these numbers: 1. The Profit Gap The US has 62 technology companies netting over $1B in annual profit. China? Only 15. That’s a 4x lead over the world’s second-largest economy. 2. The Global Comparison The US has 21 more elite tech firms than China, Japan, Taiwan, and the Eurozone combined. Read that again. One country is out-scaling entire continents. 3. The Leaderboard Of the world’s 10 largest companies, 8 are US tech firms. Of the world’s 10 most innovative companies, 8 are US-based. "Dominance" is no longer the right word. We are witnessing a level of industrial concentration we’ve never seen before. The US isn’t just participating in the future. It’s architecting it. Is the gap between the US and the rest of the world becoming unbridgeable? Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks