Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

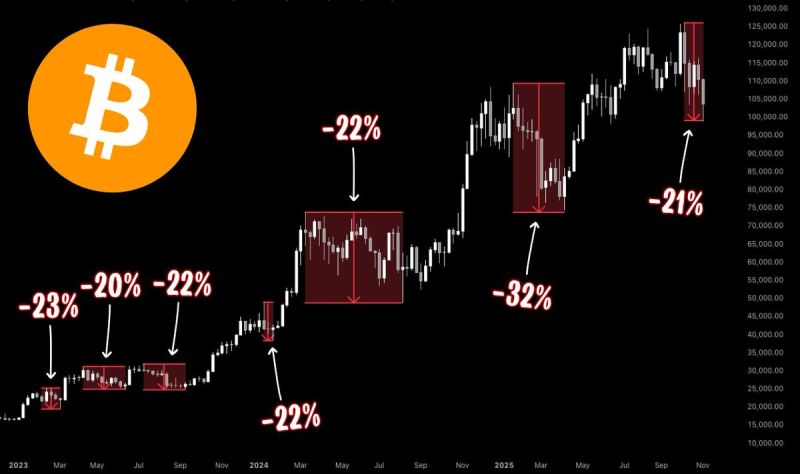

Bitcoin's 50-day moving average is a few days from crossing below the 200-day moving average.

Each cross marked a local bottom: • September '23 • September '24 • April '25 If BTC is still in a bull market, the local bottom is forming. Holding $100,000 remains crucial. Source: Joe Consorti, Bloomberg

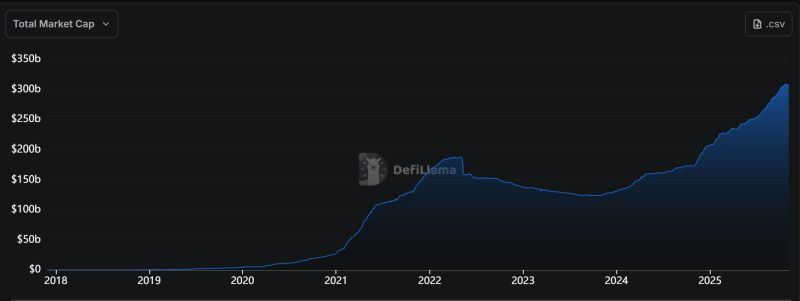

While everyone’s watching bitcoin… stablecoins quietly crossed $311 BILLION in circulation — processing more payments than Visa this year.

And nobody’s talking about it. Tether & Circle now hold $200B+ in U.S. Treasuries, earning $15B/year in interest — while moving $10 TRILLION across a system Wall Street can’t even see. Every stablecoin = a Treasury bond purchased. Every transaction = U.S. dollar dominance extended. Latin America runs on USD stables. The Middle East moves crisis liquidity through them. Corporates slash cross-border costs 70% — no banks, no permission, no friction. Welcome to the Eurodollar 2.0 era: faster, traceable, and Congress-approved. 📊 The numbers don’t lie: $1.5T Treasury demand by 2027 $50B+ in annual U.S. debt savings 55% growth in ten months 1-second settlement Meanwhile… China’s digital yuan? still not there. Where could we be heading by 2028? 💵 $2T in circulation? 🌍 25% of global remittances? 🏦 Trillions in tokenized assets? 🔗 A fully re-plumbed global financial system? The U.S. Dollar went digital — and didn’t even ask permission. Source: Shanaka Anslem Perera ⚡ @shanaka86 on X

S&P Global: "we are likely to continue to view capital as a weakness, because Strategy's bitcoin holdings are likely to grow materially"

So basically "the more Bitcoin they buy, the weaker their capital becomes.” If Strategy held U.S. Treasuries, S&P would call it “high-quality capital.” But if Strategy holds bitcoin, they mark it as negative equity. Incredible Source: @AdamBLiv

US Treasury yields are falling — but this time, it’s not about fear. It’s about confidence. 💡

The Trump–Bessent supply-side mix, tariff revenues, and AI-driven growth are reshaping the bond market story. 💵 Tariffs are turning out to be less inflationary than initially feared (at least for now) and deficit-friendly. 💰 Stablecoins now hold $180B+ in Treasuries, quietly anchoring the short end of the curve. 🚀 The U.S. productivity boom powered by AI is leaving others behind — while Europe unravels fiscally, Britain wrestles with debt, and China sinks deeper into deflation. As global credit stress rises, U.S. bonds are the safe haven again. The curve’s bull flattening isn’t a warning — it’s (almost) a vote of confidence. The U.S. is once again the "least worst" house in a bad neighborhood of indebted peers. Source: Bloomberg, James E. Thorne @DrJStrategy

When AWS goes down…the fiat world breaks

Source: Neil Jacobs - FOMO21.com - Bitcoin

FT investigation: "How the Trump companies made $1bn from crypto"

>>> https://lnkd.in/eSXMsMra The president and his family have built a rapidly growing digital assets empire which has been fuelled by the administration’s industry-friendly policies. Source: FT

Investing with intelligence

Our latest research, commentary and market outlooks