Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

According to StockMarket.news

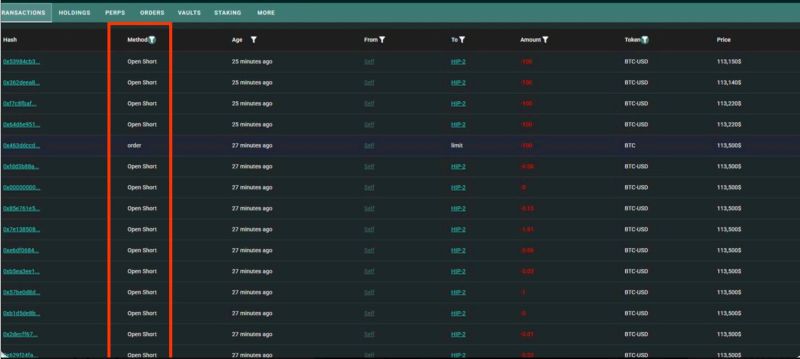

The same trader who made $192M last week thanks to almost perfect timing in his/her shorts on cryptos just opened another massive round of shorts on Hyperliquid reportedly over $160M worth. The timing is uncanny. Does he/she know something we don’t?

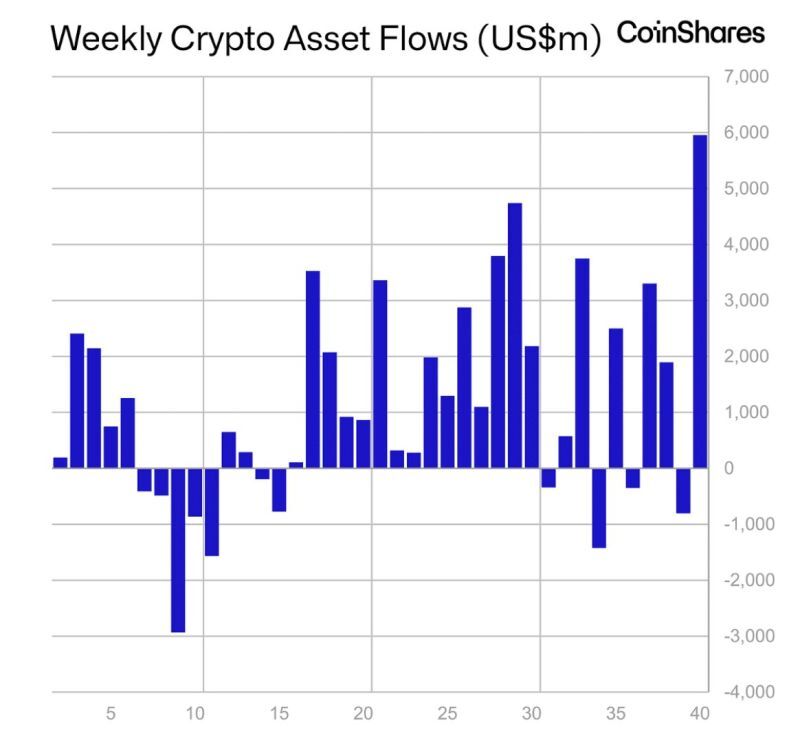

Crypto saw an inflow of nearly $6 Billion last week, the largest weekly inflow in history 🚨🚨

Source: Barchart, Coinshares

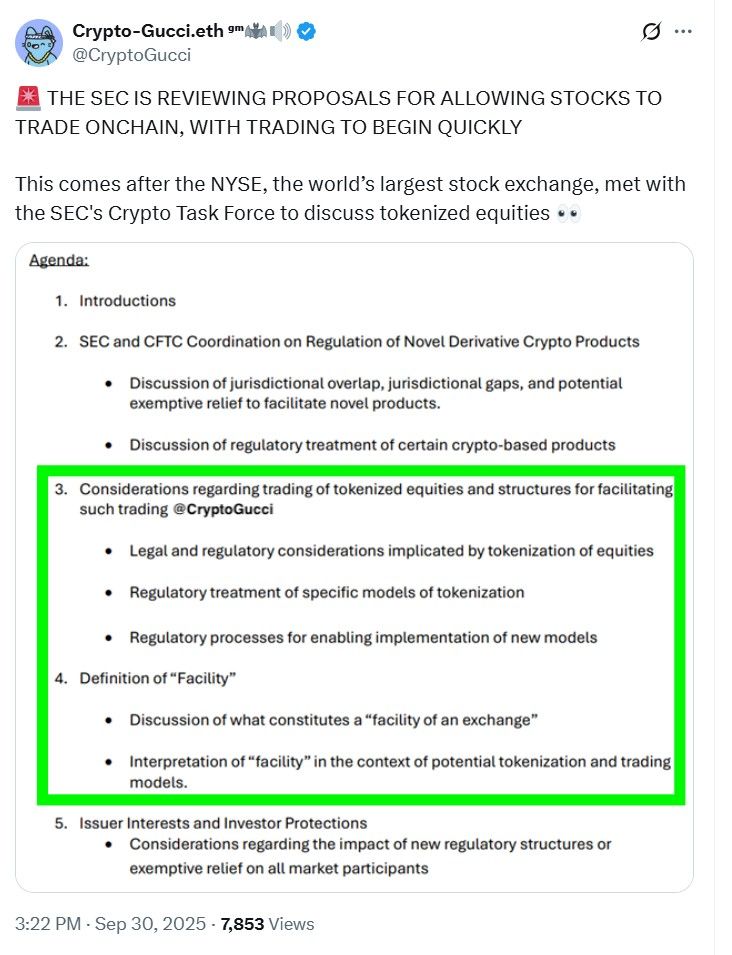

The U.S. Securities and Exchange Commission (SEC) is reportedly developing a plan to allow stocks to trade like crypto on the blockchain

It will treat shares of companies like Apple, Tesla, and Nvidia as digital tokens similar to how cryptocurrencies operate. While the initiative has gained support from crypto exchanges and fintech platforms, it faces pushback from traditional financial institutions that profit from the existing market structure. According to a report by The Information, the SEC is already consulting with market participants on regulatory changes that would make these tokenized securities possible. Source: cryptonews.com

Tether is looking to raise between $15 billion and $20 billion in private funding, aiming to lock in a valuation near $500 billion, according to Bloomberg.

If Tether raised money at a $500 Billion valuation its chairman Giancarlo Devasini would be worth almost $224 billion. That would make Devasini the 5th richest person in the world in front of people like Warren Buffett, Larry Page, Sergey Brin, and Jensen Huang Source: Evan

Investing with intelligence

Our latest research, commentary and market outlooks