Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

US SENATE VOTING ON CLARITY ACT CANCELLED 🚨 Most people don't know the real reason behind this.

The Senate Banking Committee has pulled the vote on the Clarity Act after major pushback from the crypto industry, including Coinbase’s announcement that it won’t support the Crypto Market Structure Bill. Key points of concern: Stablecoin Yields Crushed The Act would ban interest payments on stablecoins, benefiting big banks by eliminating competition and protecting their deposit monopoly. Tokenized Equities Restricted Tokenized stocks would fall under the SEC’s strict securities rules, effectively blocking peer-to-peer or DeFi-style stock tokenization. Permissionless DeFi Threatened AML/KYC rules would require identity verification and monitoring, undermining DeFi’s core principles of anonymity and open access.

So what's going on in markets this morning? Why are Cryptos tumbling again?

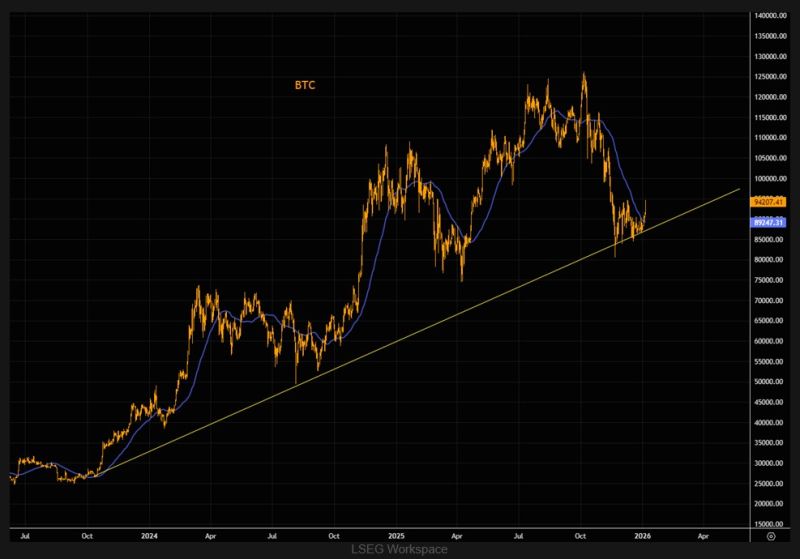

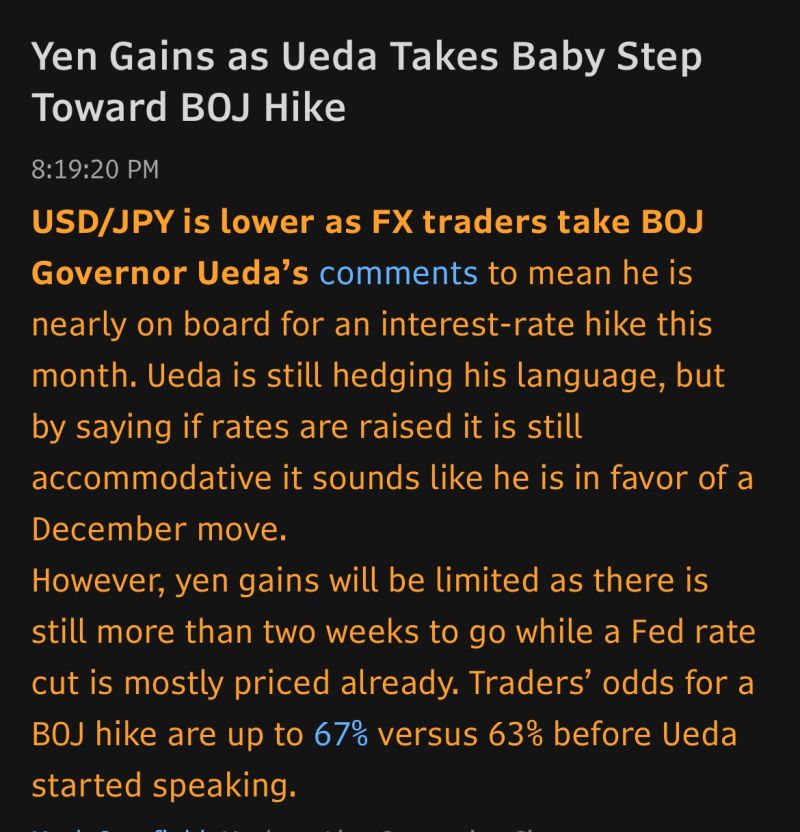

A ris-off signal to start December? Well, it seems that the spike in Japanese bonds yields is the culprit... Indeed, Japanese bonds are puking on renewed expectations of rate hike, as the 2Yr JGB yield is above 1% for the first time since 2008. The yen is firming and the Nikkei 225 index is tumbling. And since nowadays Bitcoin always correlates with anything that's down, we have a 5% dump in Bitcoin in Asian trading to $85k.... In the middle of Asian session, BoJ Governor Ueda said he was consider the "pros and cons" of raising interest rates at the BoJ's December and idea that the market got hold of last week as the odds of a BoJ Dec rate hike increased from 30% to 50%. Source: Bloomberg, zerohedge

🚨 THE REAL REASON BEHIND THE OCT 10 CRYPTO CRASH JUST DROPPED

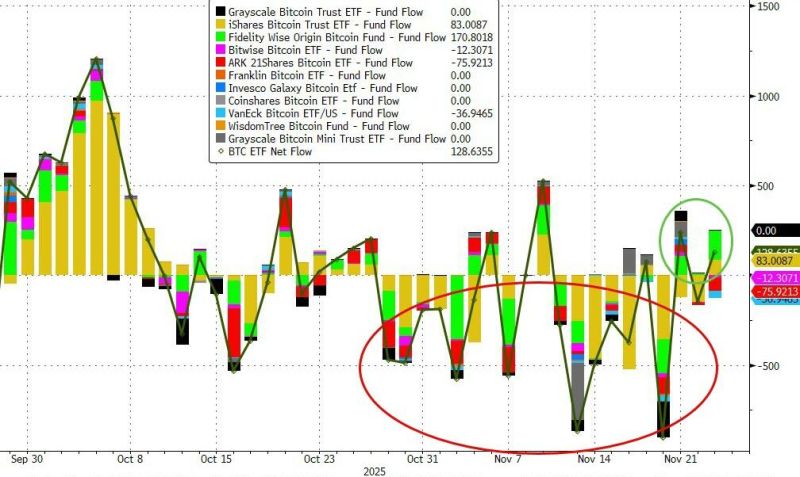

For weeks, everyone kept asking: “Why did the market nuke on Oct 10 with ZERO news?” A thread on X by Bull Theory explains why it happened and how it changes the whole narrative. 1️⃣ MSCI quietly triggered a structural panic On the same evening the crash began, MSCI released a consultation note almost nobody in crypto saw. Their proposal: If a company holds 50%+ of its assets in Bitcoin/digital assets AND behaves like a digital-asset treasury… 👉 it can be excluded from MSCI global indexes. Translation? MicroStrategy and other BTC-heavy companies were suddenly at risk. 2️⃣ Why this is a big deal If MSCI excludes them: • Index funds must sell — instantly No debating. No picking. Pure forced liquidation. • MicroStrategy becomes a target If $MSTR is treated as “fund-like,” indexed funds would be required to reduce or exit. • And when MSTR sells → Bitcoin feels it immediately Weakness in MSTR = lower confidence = higher BTC correlation = more retail panic = liquidation wave. 3️⃣ The Oct 10 cascade suddenly makes sense The market was already fragile: Trump tariffs, a weak Nasdaq, overcrowded BTC leverage, cycle-top fear. MSCI’s note added a new fear: 👉 “If index funds dump MSTR, BTC could get hit next.” That was enough to trigger one of the largest liquidation waves in crypto history. 4️⃣ Then JPMorgan poured gasoline on the fire Three days ago, JPMorgan dropped a bearish note echoing the same MSCI risk — right when: • MSTR weak • BTC weak • Liquidity thin • Sentiment fragile A classic Wall Street playbook: Bearish at the bottom. Bullish at the top. Never random. 5️⃣ Saylor finally enters the chat As fear peaked, Saylor publicly clarified: “We are NOT a fund. We are an operating software company with an innovative Bitcoin treasury strategy.” He highlighted new credit products, ongoing software revenue, and billions in structured instrument issuance. Message received: 👉 MicroStrategy ≠ passive BTC holder. 👉 Index labels don’t define innovation. 6️⃣ What this means going forward ✔ The Oct 10 crash wasn’t random — it aligns perfectly with MSCI’s announcement. ✔ Forced-selling fears created a liquidity shock. ✔ JPMorgan amplified it at the worst possible moment. ✔ Saylor restored confidence, but… ✔ Final MSCI decision comes January 15, 2026. Volatility until then? Highly likely. 🔍 Final Take Oct 10 wasn’t a fundamental breakdown. It was a structural shock hitting a fragile market — and institutions used it to shape sentiment. But the long-term picture hasn’t changed: • Bitcoin adoption strong • Corporate interest rising • Saylor building • Institutions accumulating • ETFs stabilizing • Liquidity cycles returning MSCI isn’t stopping Bitcoin. It just created volatility that smart money is already exploiting. Source: Bull Theory @BullTheoryio zerohedge

Investing with intelligence

Our latest research, commentary and market outlooks