Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- gold

- performance

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- magnificent-7

- Volatility

- nasdaq

- apple

- emerging-markets

- energy

- Alternatives

- china

- switzerland

- tesla

- trading

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

JUST IN 🚨: Robinhood suspends 24-hour trading market

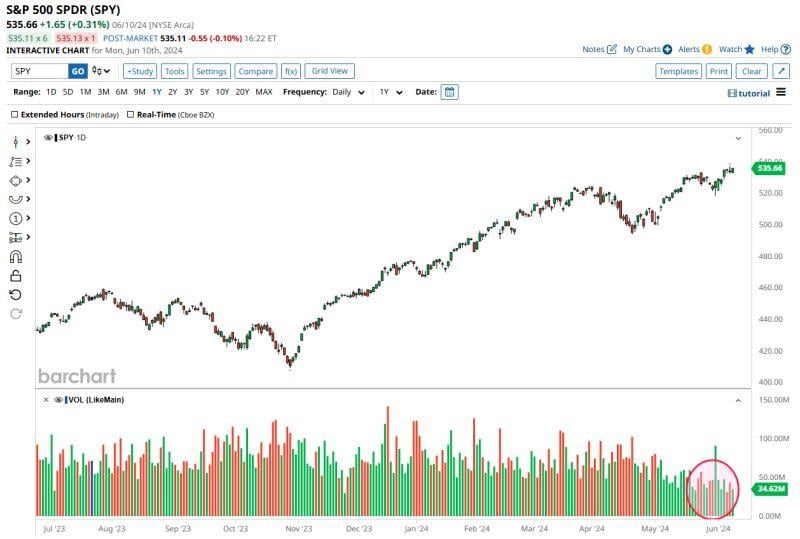

Source: Barchart

S&P 500 continues to hit record highs on EXTREMELY low volume.

Today was the 4th lowest volume day of the year for $SPY. Three of this year's four lowest volume days have come in the last week. All 4 of the lowest volume days have come in the last 3 weeks. Source: Barchart

JUST IN: The New York Stock Exchange is considering a proposal for 24/7 trading, according to FT.

In other words, the stock market would never close much like crypto markets are now. Should 24/7 trading be approved? Source: FT, The Kobeissi Letter

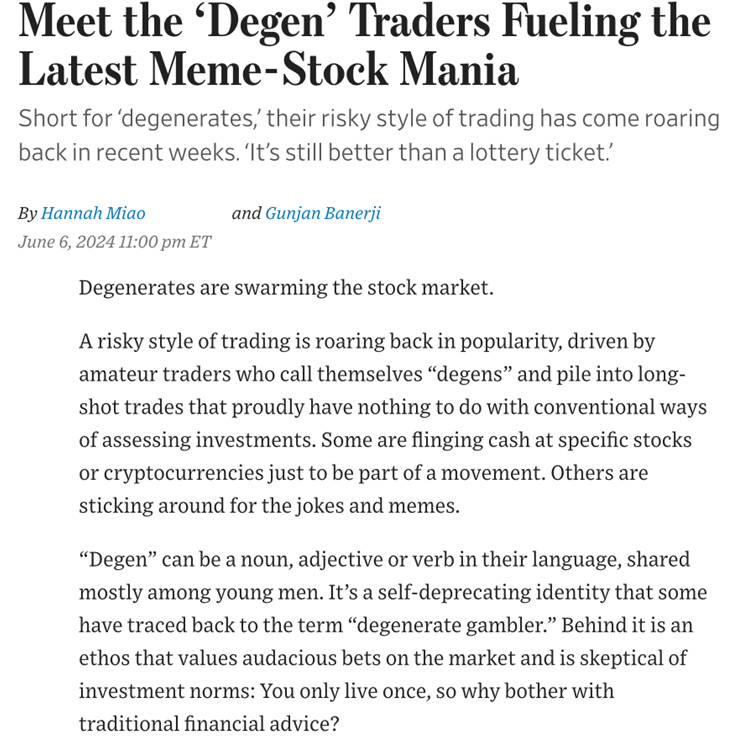

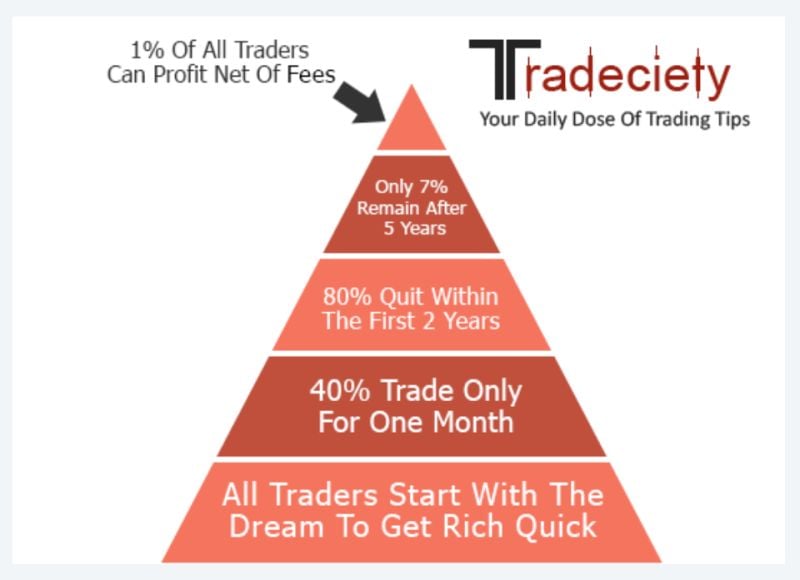

BEWARE OF SCALPING!

I see more and more amateur traders taking scalping training and lessons and engaging into day-trading activities hoping to make quick profits and a living from it. They need to be aware that the vast majority of hashtag#trading strategy are money losing (see this article: https://lnkd.in/e4vb2Nde). The best investment strategy is long-term investing, sticking to a pre-defined strategic assetallocation and rebalancing after extreme moves. What is scalping? A scalping strategy is a short-term trading technique that aims to capitalize on small price movements in highly liquid markets. Traders who employ this strategy, known as scalpers, enter and exit trades quickly, usually within seconds or minutes, to take advantage of small price differentials. But scalping is hard and almost all scalpers end up losing. Scalping is a waste of time because it involves competing with better-equipped traders and institutions and you need to deal with lots of randomness and noise in the market. Most likely you end up losing money.

Investing with intelligence

Our latest research, commentary and market outlooks