Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

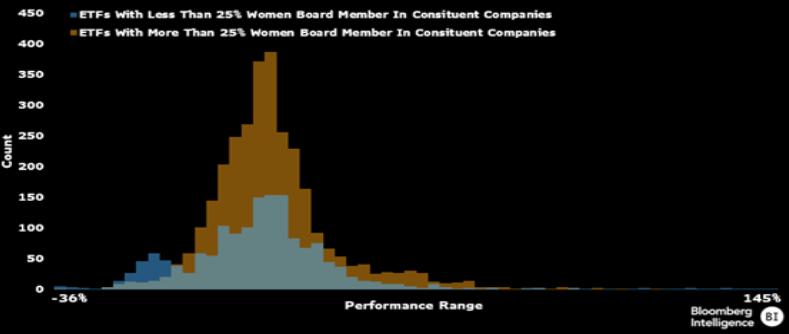

Higher female board presence may give ETFs 2.2% performance edge

ETFs that invest in companies with at least 25% women on their boards outperformed by 2.2% in 2023 rivals that invest in firms with fewer female directors. Statistical analysis suggests that relationship may be more causal than coincidental, adding to the value proposition of female corporate oversight.

Source: Bloomberg Intelligence

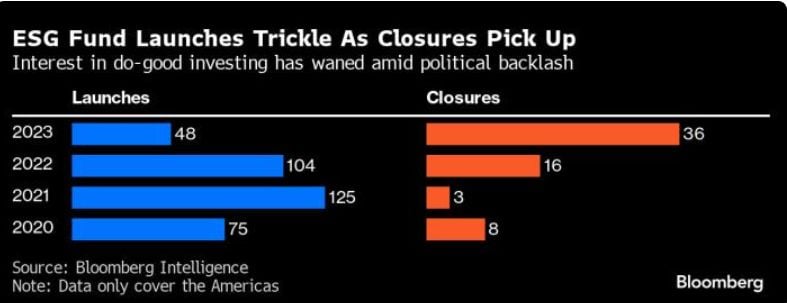

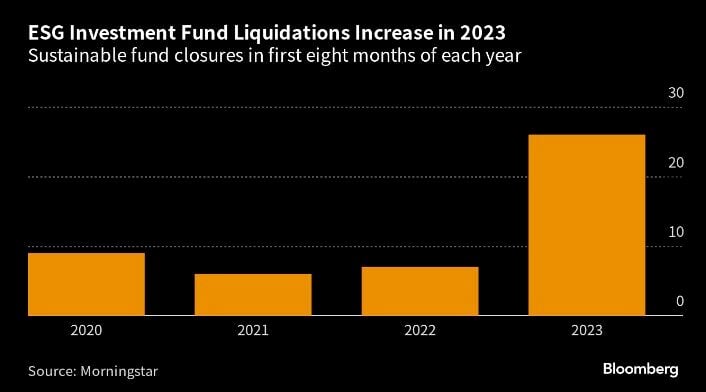

The ESG Backlash on Wall Street Spurs a Jump in ETF Closures

The dwindling demand is evident in the Americas from the slowdown in sales of new exchange-traded funds and the pickup in fund closures and outflows, according to senior ESG strategist at Bloomberg Intelligence. In 2023, the region saw just 48 new ETFs introduced, down from 104 in 2022 and 125 in 2021, data compiled by Bloomberg Intelligence show. A net $4.3 billion was pulled last year from ESG-focused ETFs in the US, marking the first-ever annual outflows. The $13 billion iShares ESG Aware MSCI USA ETF (ticker ESGU), the largest ESG-focused ETF, is seeing continued outflows this year, with $809 million yanked from the fund after a $9 billion exodus last year. Meanwhile, 36 ESG-labeled ETFs were liquidated in the Americas during 2023, more than double the prior year, data from Bloomberg Intelligence show. Almost 60% of the funds that were closed were actively managed. source : yahoo!finance, bloomberg

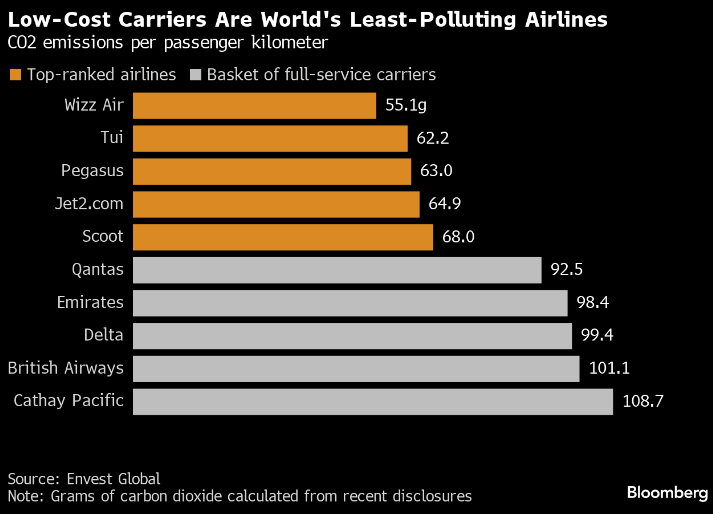

Low-Cost carriers are world's least-polluting airlines

The low-cost business model that democratized air travel in recent decades has now become an unlikely template for reducing pollution. That’s because budget airlines’ obsession with lowering weight in order to save fuel also happens to produce the best emissions metrics in the skies.

Source Bloomberg, Envest Global

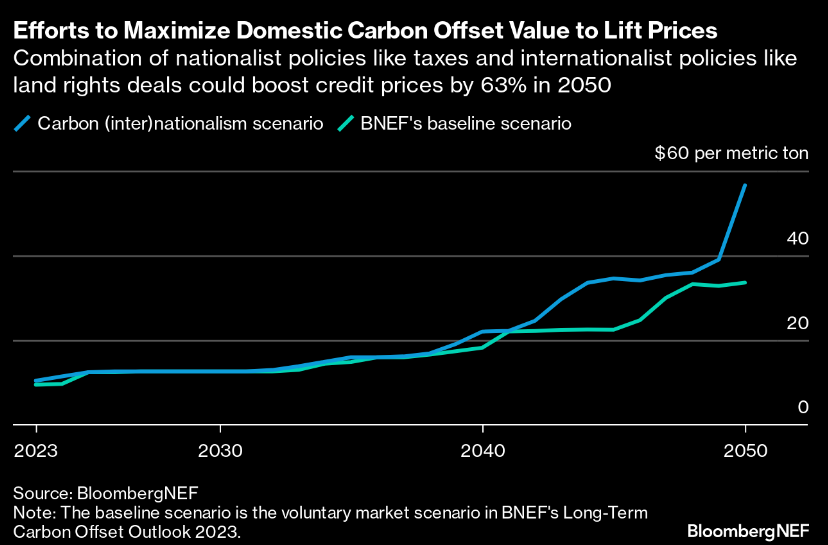

Goldman, Citi ready Trading Desks for new wave of Carbon deals

As the carbon offset market gets a new lease on life from the COP28 climate summit in Dubai, bankers from Wall Street and the City of London are positioning themselves to get a chunk of the dealmaking they say is coming.

Banks that have been building up carbon trading and finance desks include Goldman Sachs Group, Citigroup, JPMorgan Chase and Barclays.

Source: Bloomberg

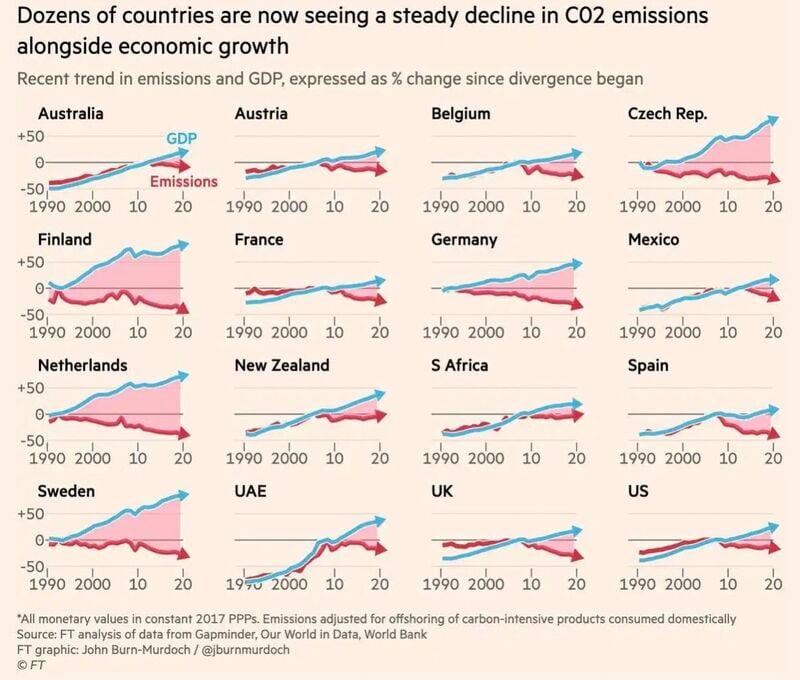

Dozen of countries are now seeing a steady decline in C02 emissions alongside economic growth

Another tangible proof that being green (or at least greener) does not mean de-growth Source: FT

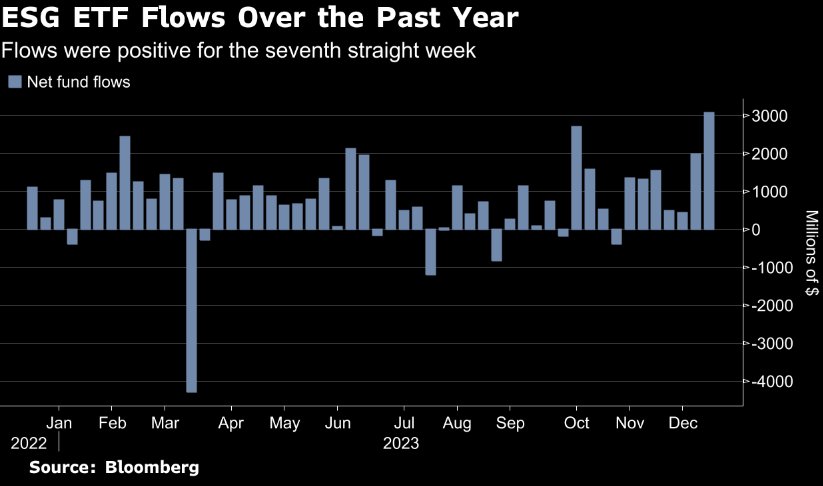

What’s the BIG SHORT right now? ESG Stocks.

Hedge funds are calling out fake green claims and overblown valuations boosted by stimulus. Blackrock & State Street are shutting down some ESG funds. Liquidation of ESG funds in 2023 is already larger than the last 3 years combined, And the year is not over.... Source: Genevieve Roch-Decter, CFA, Bloomberg

EU watchdog monitors surge of cash going into biodiversity funds

The surge in money going into biodiversity funds is the "next frontier" of ESG investing and warrants increased monitoring to avoid greenwashing, the European Union's securities regulator said.

The cumulative flow of money into biodiversity funds reached 854 million euros ($931 million) in the two years to June 2023, with 73% of the funds launched since 2022.

Source: Reuters

Investing with intelligence

Our latest research, commentary and market outlooks