Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- performance

- gold

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- magnificent-7

- Volatility

- nasdaq

- apple

- emerging-markets

- energy

- china

- Alternatives

- switzerland

- tesla

- trading

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

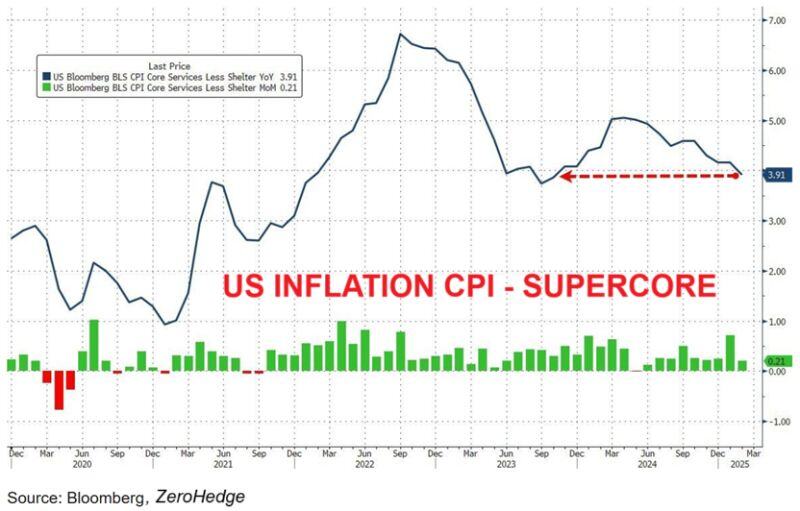

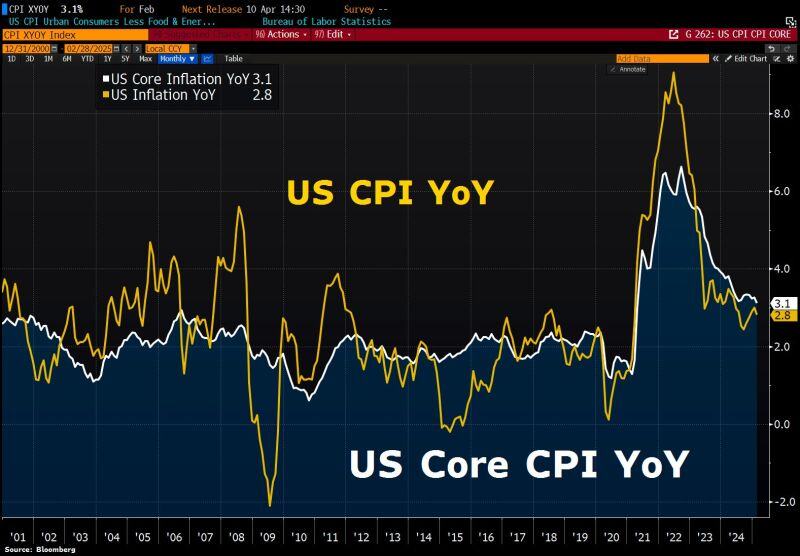

🚨US inflation rate is FALLING as expected and there is more to come:

US CPI Core Inflation dropped to 3.1% in February, the lowest in 4 YEARS. Supercore CPI fell to 3.9%, the lowest since October 2023 (driven by Airfares). All metrics came below forecasts. Expect more progress as economy slows. Source: zerohedge

long-term yields continue to rise following the announcement of a major debt package, with 10y yield on the way to 3%.

Financial markets expect neither the Greens nor the Federal Constitutional Court to block the package. While a two-thirds majority is needed in parliament, legal challenges are still pending before the court. Source: Bloomberg, HolgerZ

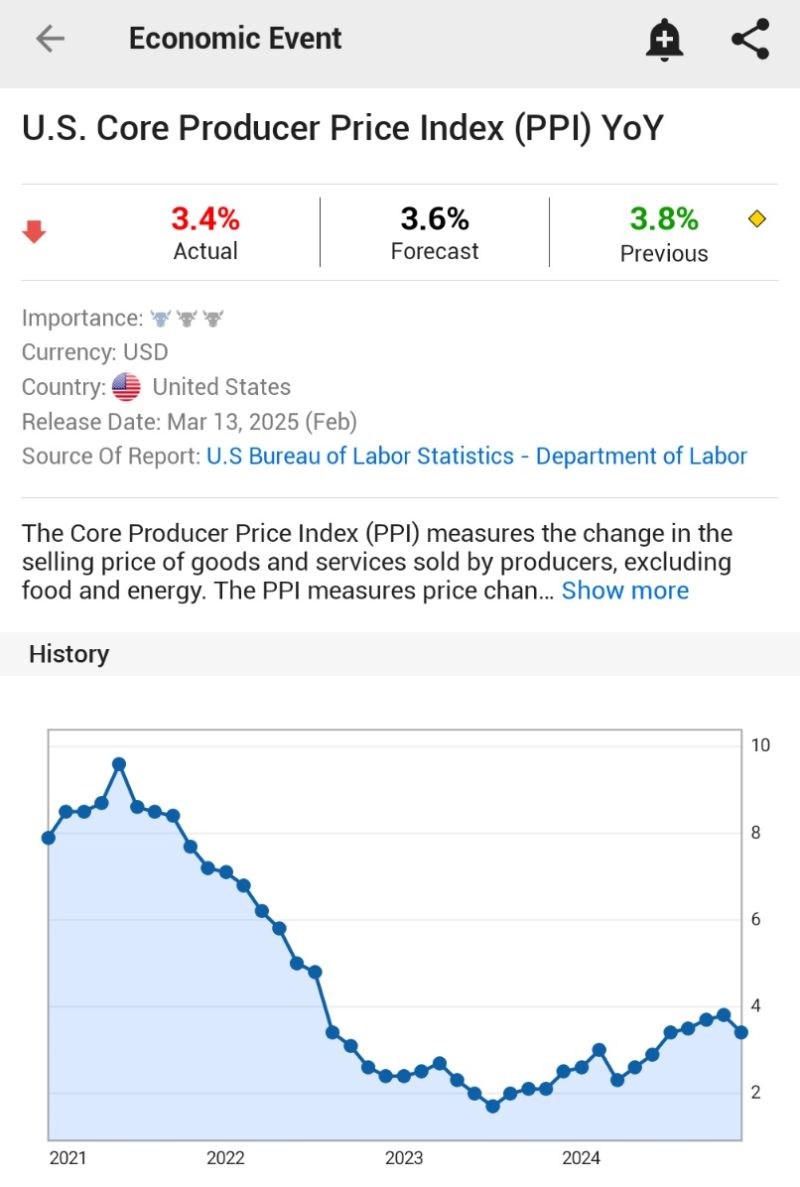

US inflation comes in lower than forecast:

Headline CPI slows to 2.8% in Feb from 3% in Jan, smallest since Nov2024, Core CPI cools to 3.1%, lowest since Apr2021. Housing inflation cools; airfares and pump prices drop. BUT: Inflation data doesn’t yet reflect tariff impact. Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks