Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- UK

- assetmanagement

- ESG

- Middle East

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

🚨 JUST IN: CANADA SLASHES RATES BY 50 BPS

Fifth cut in a row... Dropping the policy rate from 5% to 3.25% in 2024—150 bps total. But it’s not working fast enough: -Unemployment: 6.8% (highest in 8 years). -GDP per capita: Down 6 straight quarters. -Canadian Dollar $CAD at 4.5-year low -Former BOC Governor says “We’re already in a recession.” Market is pricing in another ~50bps of cuts by July 2025 ➡️ 2.75% overnight rate. Source: Genevieve Roch-Decter, CFA, Bloomberg

Swiss National Bank (SNB) halved its interest rate with 50bps cut,

in the current context of weak inflation, upward pressures on the Swiss franc and worrying dynamics in neighboring European countries. The 50bp rate cut is half-a-surprise for financial markets, that were not fully convinced of the possibility of such large movement and were rather pricing a 25bp rate cut. swiss franc initially weakened 0.5% vs the Euro. But it is already back to 0.93. OUR TAKE (based on our Chief Economist Adrien Pichoud views) 👉 Swiss CPI inflation has slipped below 1% in the 4th quarter of 2024 (+0.7% in November) and it is expected to slow further in 2025. The SNB expects inflation to hover just above zero (+0.2%/+0.3%) for most of next year before picking up slightly as 2026 draws near. By averaging +0.3% in 2025, the inflation rate would be at the very bottom of the 0-to-2% range that the SNB targets. 👉 As the Swiss economy faces headwinds from the strength of the Swiss franc and the weakness of economic activity in Germany and most other European economies, monetary policy has no reason to be restrictive and had to be adjusted. After today’s rate cut, the monetary policy stance is about neutral (with a real short-term rate close to 0%). 👉 Looking ahead, more rate cuts are to be expected in 2025. We expect the CHF short-term rate to be lowered to 0.0% by June next year, with 25bp rate cuts at the March and June meetings. 👉 Will Switzerland move back to NEGATIVE RATES? This is not our scenario at this stage, even if it wasn’t ruled out by Mr Schlegel recently. Potential undue upward pressures on the CHF will then likely be addressed with interventions on the FX market and a possible expansion of the SNB’s balance sheet size. It would require a significant deterioration in global growth and inflation dynamics next year for the SNB to be pushed back into negative interest rate policies. Source chart: Bloomberg

China consumer inflation rate drops to a five-month low, missing expectations as economy slows. ARE MORE STIMULUS COMING?

China’s consumer prices rose less-than-expected in November, climbing 0.2% from a year ago, according to data from the National Bureau of Statistics released Monday. Analysts polled by Reuters had expected a slight pickup in the consumer price index to 0.5% in November from a year ago, versus 0.3% in October. China’s producer price index declined for the 26th month. Producer inflation fell by 2.5% year on year in November, less than the estimated 2.8% decline as per the Reuters poll. Source: CNBC, Evan

🚨BIG WEEK FOR CENTRAL BANK DECISIONS AHEAD🚨

The European Central Bank, the Bank of Canada, the Swiss National Bank and the Reserve Bank of Australia will announce rate decisions. ECB and SNB are expected to cut by 0.25%, and BoC by 0.50%, while RBA to leave rates unchanged. Source; Global Markets Investor @GlobalMktObserv, Bloomberg

China ups stimulus response, shifts monetary policy stance for the first time in 14 years.

Politburo vows to stabilise both housing and stock markets. China stocks, commodities prices jump. CHINA EASES MONETARY POLICY STANCE FOR FIRST TIME SINCE 2011 *POLITBURO: CHINA MONETARY POLICY TO BE MODERATELY LOOSE *POLITBURO: CHINA'S FISCAL POLICY TO BE MORE PROACTIVE NEXT YEAR *POLITBURO: WILL STABILIZE THE PROPERTY AND STOCK MARKETS Source: Bloomberg, David Ingles

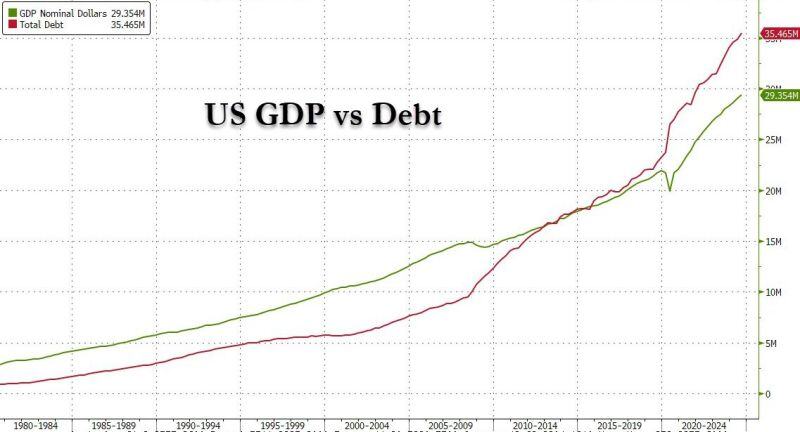

The problem in one chart

More $debt is needed to generate $1 of GDP Source: zerohedge

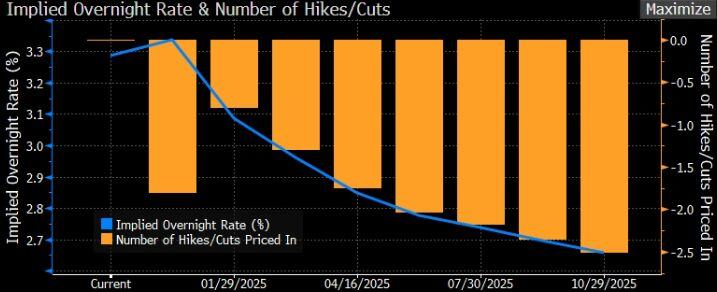

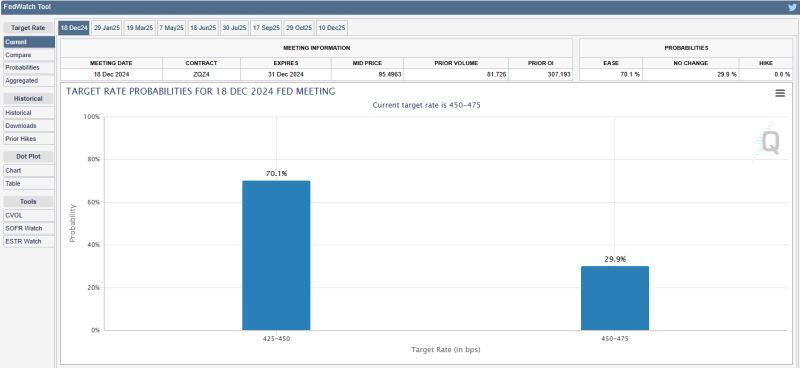

There is now a 70% chance of a 25 bps interest rate cut at this month's FOMC meeting 🚨

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks