Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- performance

- gold

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- magnificent-7

- Volatility

- nasdaq

- apple

- emerging-markets

- energy

- china

- Alternatives

- switzerland

- tesla

- trading

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

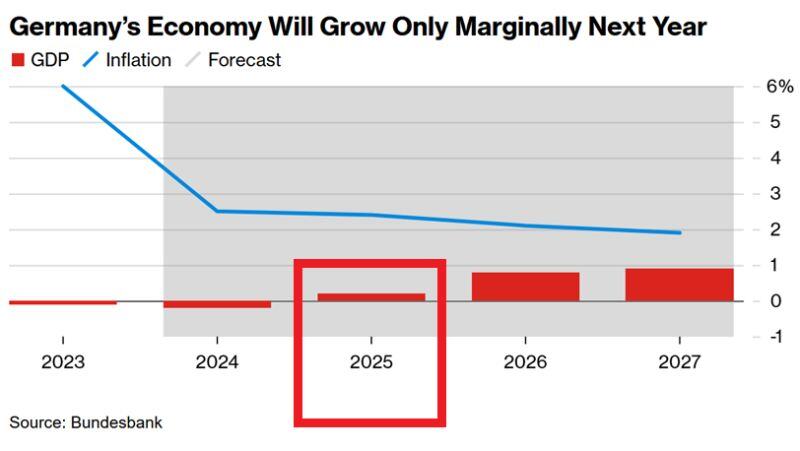

⚠️German economic outlooks remains DIRE:

In 2024 the world's 3rd largest economy FELL by 0.2% following a 0.3% decline in 2023. This is the 2nd time since 1950 that GDP contracted for 2 years in a row. German IFO Economic Research Institute expects just 0.2% growth in 2025. Source. Global Markets Investor

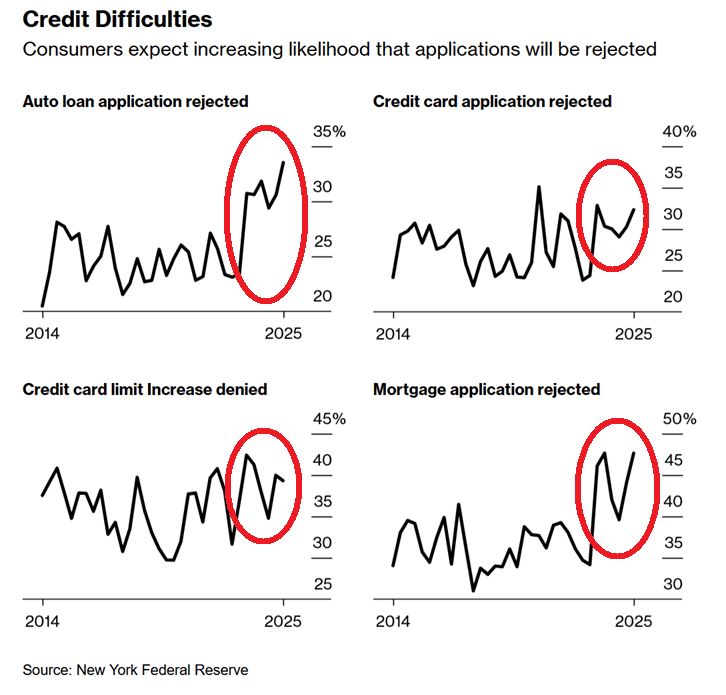

Americans expect credit application REJECTIONS at a higher rate than ever:

The perceived likelihood of credit application rejections: Auto loan: 34%, the highest on record Mortgage: 48%, the highest on record Credit card: 32%, the 3rd-highest ever Card limit increase: 39% Source: Global Market Investors, Bloomberg

Swiss Government Lowers Growth Forecasts Ahead of SNB Decision

The Swiss government has trimmed its economic growth outlook for 2025 and 2026, citing global trade tensions. SECO now expects: 📉 2025 GDP: 1.4% (previously 1.5%) 📉 2026 GDP: 1.6% (previously 1.7%) While growth remains below the long-term average of 1.8%, Switzerland is still expected to avoid a recession. This adjustment comes just before the Swiss National Bank’s policy decision on Thursday—a key event to watch. source : reuters

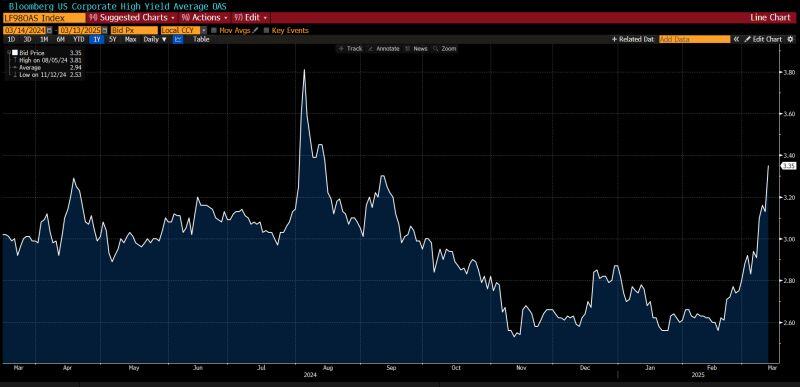

Riskier credit markets are starting to respond more significantly to the dislocation in US equity markets

Spreads on high-yield bonds rose the most since August yesterday. They're still relatively low on a historical basis, but the trajectory is catching many people's attention. Source: Lisa Abramowicz @lisaabramowicz1, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks