Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- gold

- performance

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- Volatility

- nasdaq

- magnificent-7

- apple

- emerging-markets

- energy

- Alternatives

- china

- switzerland

- trading

- tesla

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- amazon

- ethereum

- meta

- microsoft

- bankruptcy

- Healthcare

- Industrial-production

- Turkey

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

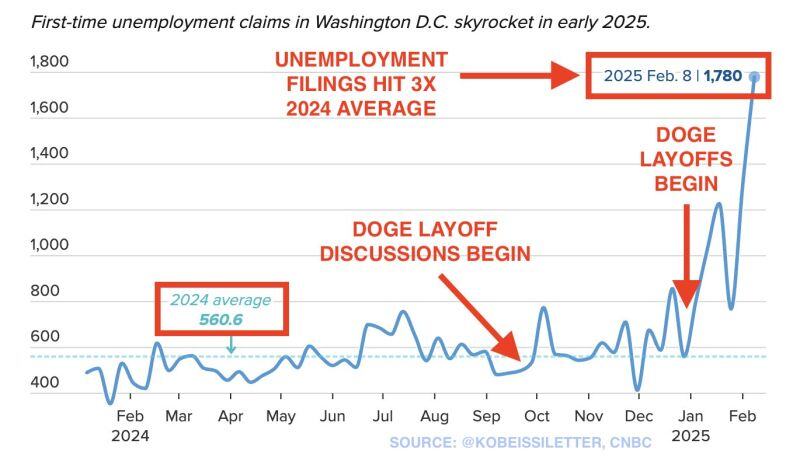

WOW. Washington DC's economy looks like 2008:

Unemployment filings in Washington DC just SURGED +36% in one week to 3 TIMES the 2024 average. Over the last 6 weeks, unemployment filings are up +55%, now ABOVE 2008 levels. Since January 20th, over 4,000 federal employees have filed first time unemployment claims in Washington DC. Furthermore, the year-to-date total has hit nearly 7,000. That's a whopping +55% increase over the previous 6 week period. Last week alone, claims surged +36%. Source: The Kobeissi Letter

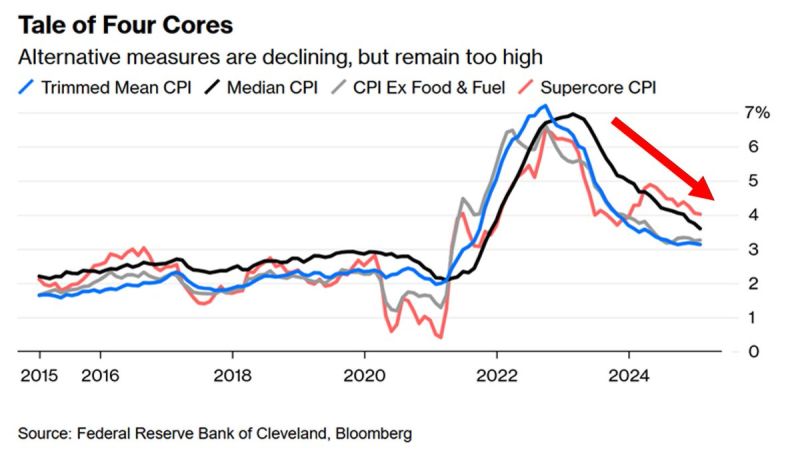

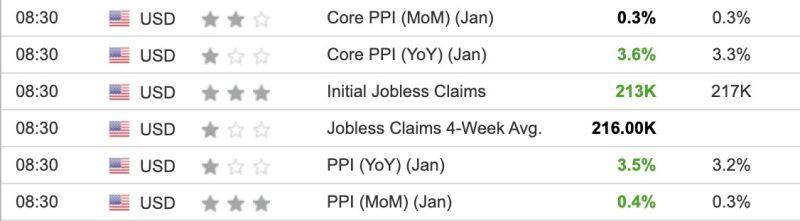

US inflation decline has slowed but is NOT re-surging:

US inflation metrics which exclude outliers and one-time bumps as still declining but at a slower rate. January is also the seasonally worst month as firms tend to announce price raises at the start of the calendar year. Source: Global Markets Investor

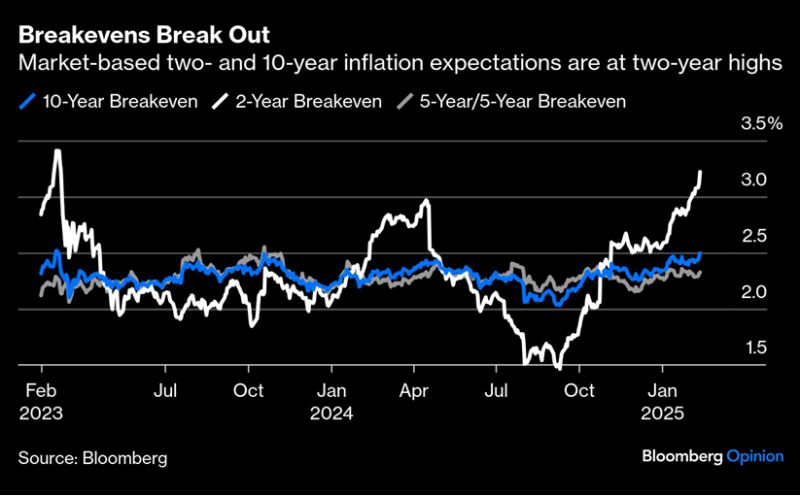

On US inflation expectations, from @johnauthers daily note:

"The two-year breakeven has broken above 3% (the upper range of the Fed’s target) to its highest in two years, while the 10-year is also at a two-year high after reaching 2.5%. The breakeven for the five years starting five years hence, which the Fed tracks closely, remains anchored, but it’s obvious that markets are growing more jumpy about inflation." Source: Bloomberg, Mo El-Erian

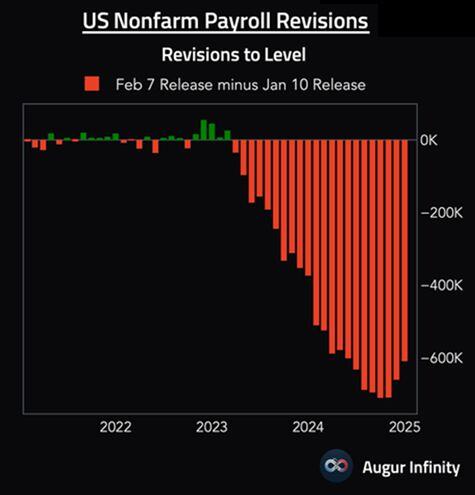

Lower wage inflation and higher US unemployment rate ahead?

🚨 One US job market leading indicator is plummeting: The average weekly hours worked by Americans fell to 34.1, the lowest since the Great Financial Crisis and in line with the 2020 crisis low. Typically, hours worked decrease before LAYOFFS pick up...👇 Source: Global Markets Investor, Augur infinity

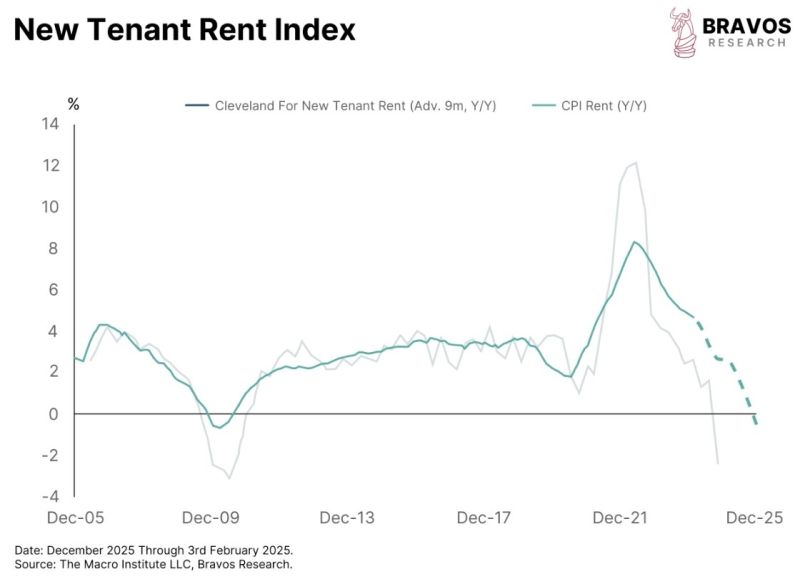

ALERT: New tenant rent data predicts CPI rent inflation by about 9 months

Currently, it’s pointing to a continued decline in rent inflation. And since rent is one of the biggest components of inflation, it suggests that inflation will keep trending lower Source: Bravos Research

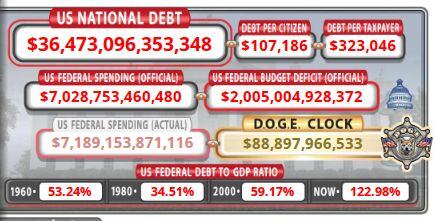

The D.O.G.E clock is ticking... 🚨‼️

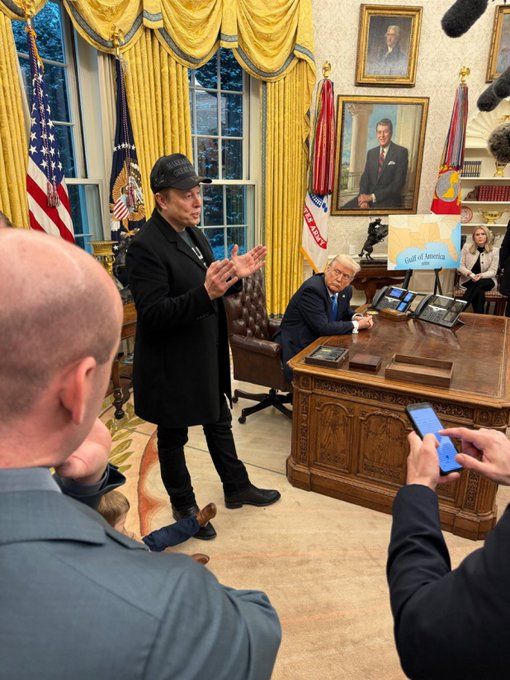

JUST IN: President Trump commends Elon, announces a news conference set for Thursday (TODAY) — during which he will read list of names of recipients of waste, fraud and abuse. "I'm going to read to you some of the names that hundreds of millions and even billions of dollars have been given to." “I say it in front of our our attorney general. There's no chance that there's not kickbacks or something going on. When you give millions and millions of dollars to somebody that stands to look at something for 15 minutes and walks away with millions of dollars. That money's coming back in some form. And that's only one form of corruption." "I went through a list of 200 expenditures that were made, and I found three that looked like they were reasonable. Okay, three and, we'll be talking about that tomorrow (read TODAY)." Teh debt clock below now features a D.O.G.E clock with all the savings already planned through the D.O.G.E program.

ELON IS IN THE OVAL OFFICE AND WARNS: "IT’S NOT OPTIONAL TO CUT FEDERAL SPENDING—IT’S ESSENTIAL".

Elon said he wants to add "common sense controls" to the government, adding they haven’t been present. He says taxpayer dollars must be spent wisely. It’s just common sense, he says, not "draconian." Source: CBS, Mario Nawfal on X

Investing with intelligence

Our latest research, commentary and market outlooks