Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- gold

- performance

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- Volatility

- nasdaq

- magnificent-7

- apple

- emerging-markets

- energy

- Alternatives

- china

- switzerland

- trading

- tesla

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- amazon

- ethereum

- meta

- microsoft

- bankruptcy

- Healthcare

- Industrial-production

- Turkey

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

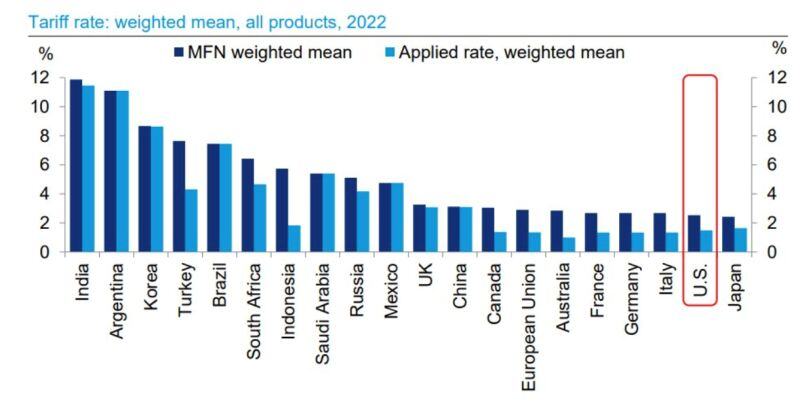

Believe it or not, but the us has one one of the lowest tariff rates in the developed world... See chart below courtesy of DB.

NB: Most favored nations (MFN) Weighted mean tariff is the average of most favored nation rates weighted by the product import shares corresponding to each partner country.

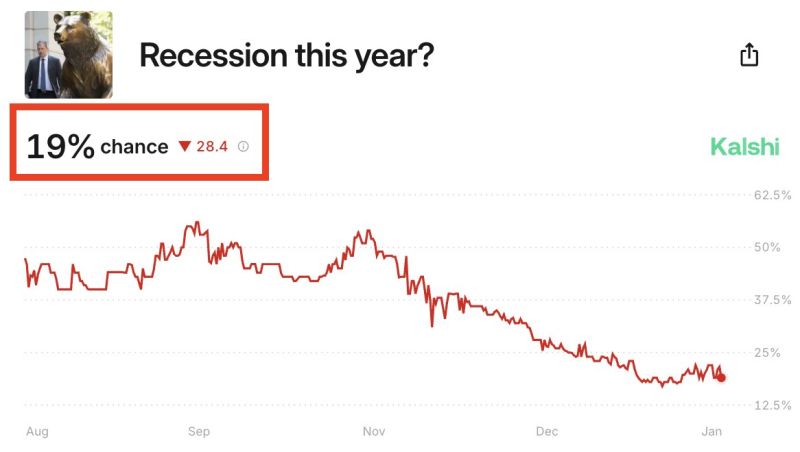

The odds of the US economy entering a recession in 2025 have fallen to a fresh low of just 19%.

Since Election Day, the odds of the US economy entering a recession are down 35 percentage points, per @Kalshi .This comes after the preliminary reading of Q4 2024 GPD showed the US economy grew by 2.3%. Even as interest rates remain elevated and inflation rebounds, the US economy is growing. Source: The Kobeissi Letter

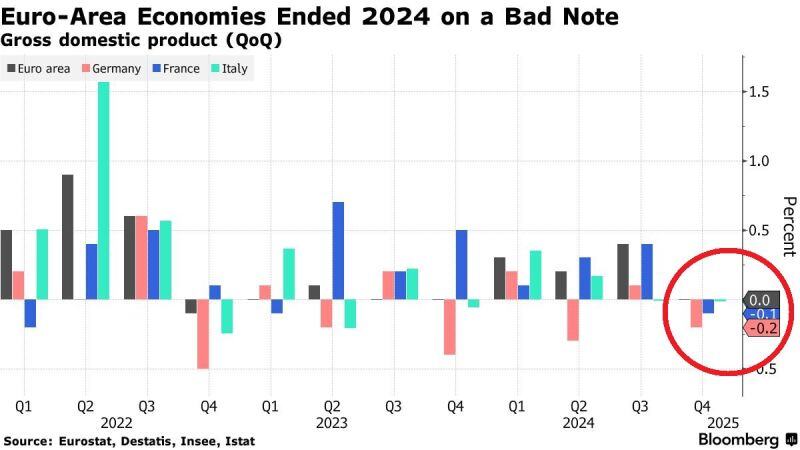

🚨What is happening with the eurozone economy?

Germany and France GDP fell 0.2% and 0.1% in Q4 2024. Italy's GDP was flat for the 2nd consecutive quarter. In effect, Euro-area economy did not grow in Q4 2024. Germany has contracted for 2 consecutive years in 2023 and 2024... Source: Bloomberg, Global Markets

Investing with intelligence

Our latest research, commentary and market outlooks