Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- gold

- performance

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- Volatility

- nasdaq

- magnificent-7

- apple

- emerging-markets

- energy

- Alternatives

- china

- switzerland

- trading

- tesla

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- amazon

- ethereum

- meta

- microsoft

- bankruptcy

- Healthcare

- Industrial-production

- Turkey

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

🚨 US MACRO DATA & NFP RELEASED!

SOME SIGNS OF ECONOMIC SLOWDOWN BUT JOB MARKET AND CONSUMERS STAY STRONG 🚀 🔴 US GDP (Q4), 2.3% Vs. 2.6% Est (prev. 3.1%) Q4 GDP rose at an annualized rate of just 2.3% (lowest in 3 quarters), powered by a 4.3% surge in personal spending. Here are the details: - Personal consumption: 4.2% vs. 3.2% est. - Non-residential fixed investment: -2.2% (Q3: +4%) - Housing investment: +5.3% (Q3: -4.3%) - Exports: -0.8% (Q3: +9.6%) - Imports: -0.8% (Q3: +10.7%) 👉 Bottom-line: Consumption strong, but trade and business investment drag. 🔴PCE 4.2%, Exp. 3.2% (prev. 3.7%) Core PCE 2.5%, Exp. 2.5% (prev. 2.2%) 🔴US Jobless Claims, 207K Vs. 225K Est. (prev. 223K) 👉 Job market remains resilient ➡️ Overall, this still sounds like goldilocks. Growth is slowing down but remains resilient overall and the consumer is in good shape. Inflation risk remains but is not accelerating meaningfully with Core PCE in line with expectations.

BOC (Bank of Canada) ANNOUNCES AN END OF QUANTITATIVE TIGHTENING

AND WILL GRADUALLY RESTART ASSET PURCHASES IN EARLY MARCH. Who will be next?

BREAKING: All federal employees who do not work in person by February 6 will get FIRED - President Donald J. Trump

President Donald Trump warned US federal employees to return to in-person work by February 6 or face termination. The government is offering buyouts, with departures permitted under a deferred resignation programme. Trump aims to reduce the federal workforce. "If they do not agree to show up to work in their office by February 6, they will be terminated. Therefore, we will be downscaling our government, which is something that the last 10 presidents have tried very hard to do, but failed," Trump said. "We think a very substantial number of people will not show up to work, and, therefore, our government will get smaller and more efficient," Trump told reporters on Wednesday. "And that's what we've been looking to do for many, many decades," he added. We may ask these people to prove that they didn't have another job during their so-called employment with the United States of America, because if they did, that would be unlawful," Trump said Source: India Today Source image: Graphic of Donald J. Trump saying "You're fired". The Spiggle Law Firm Marketing Team thru Forbes

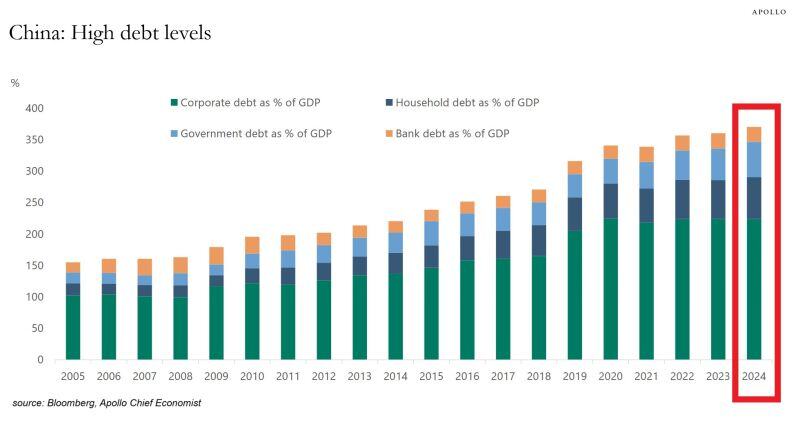

Chinese debt pile is GIGANTIC: China's total debt to GDP rose to a RECORD of ~370%.

The share has DOUBLED over the last 14 years. This does not include shadow banking (outside traditional banking sector). China has a massive debt problem and it will not go away soon. Source: Apollo, Bloomberg, Global Markets Investor

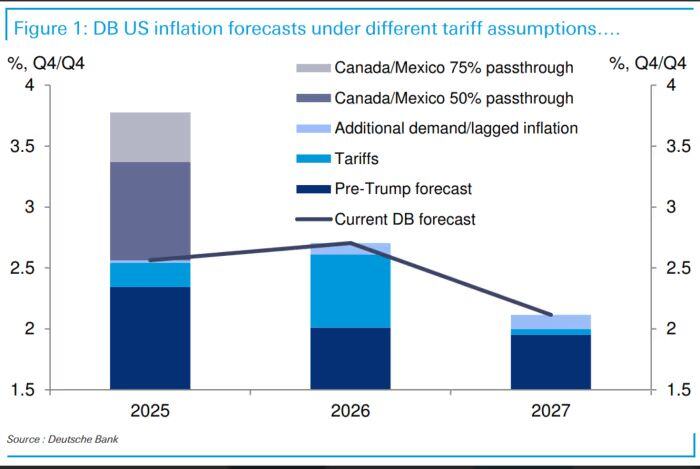

Deutsche Bank recently updated their Trump tariff inflation forecasts as shown below:

If the 25% tariffs on Canada/Mexico have a 50% pass-through, PCE inflation would rise 80 bps. A 75% pass-through would add 110 bps to PCE inflation. The Fed won't like this. Source: The Kobeissi Letter

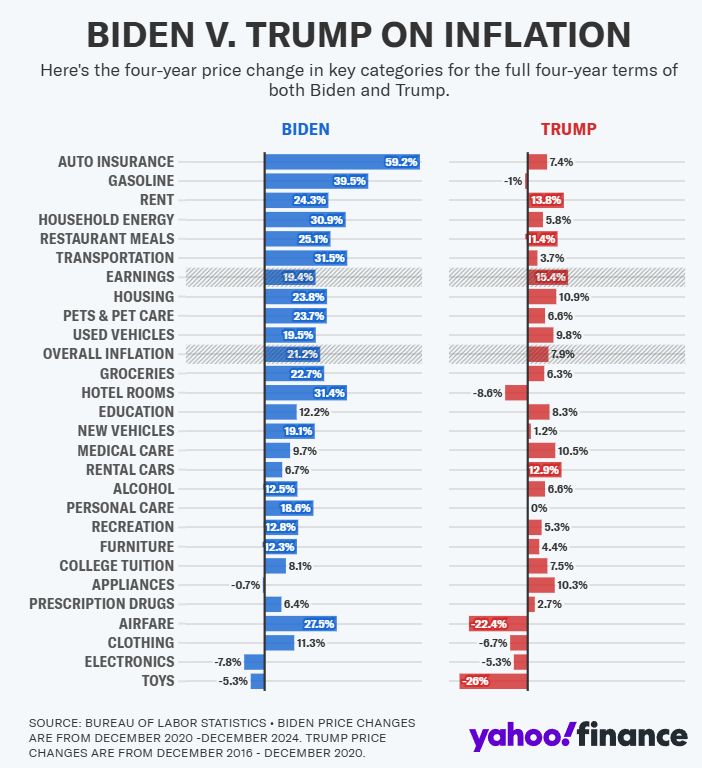

Biden vs Trump on Inflation

During Biden’s presidency, Yahoo Finance tracked inflation in 26 categories that account for most of the things people spend money on. In 12 of those categories, prices rose by more than incomes during Biden’s four years overall. That included housing, transportation, and food, the three things the typical family spends the most on. During Trump’s four years, earnings rose by more than prices in every single one of those 26 categories. source : yahoo!finance

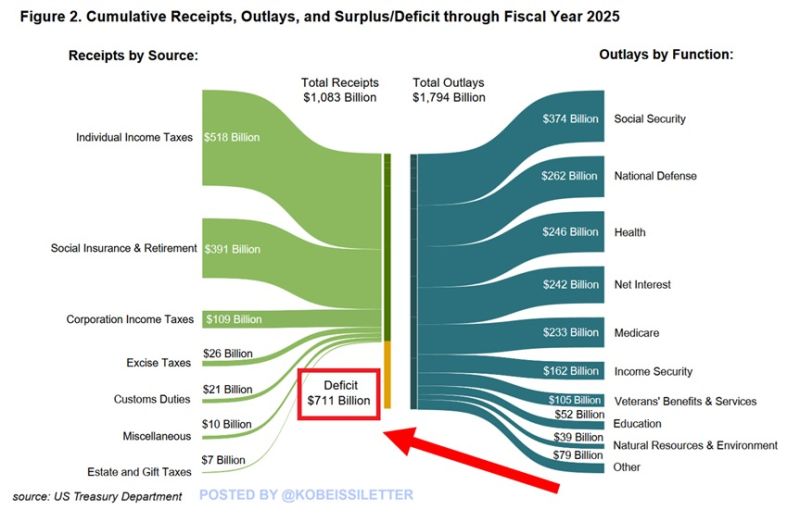

BREAKING: The US budget deficit hit a massive $711 BILLION for the first 3 months of Fiscal Year 2025.

This is ~$200 billion, or 39%, higher than in the same period last year. The deficit reached $2.0 TRILLION for the full calendar year 2024, up $248 billion YoY. Also, deficit spending rose from 6.4% to 6.9% GDP in 2024. Such a high percentage has never been seen outside of wars or major economic crises. Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks