Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- performance

- gold

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- Volatility

- nasdaq

- magnificent-7

- apple

- emerging-markets

- energy

- Alternatives

- china

- switzerland

- trading

- tesla

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- amazon

- ethereum

- meta

- microsoft

- bankruptcy

- Healthcare

- Industrial-production

- Turkey

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

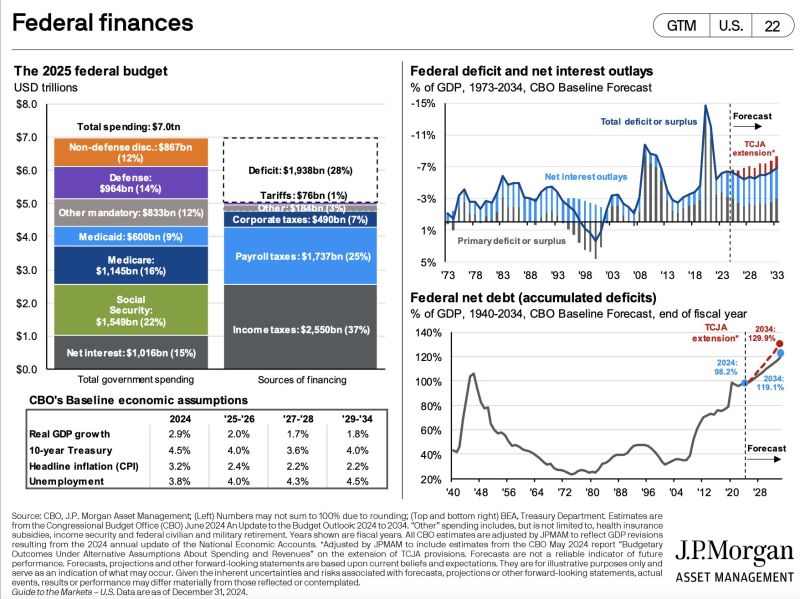

🚨US PPI DATA SHOULD PLEASE POWELL! December US PPI annual inflation rises 3.3%, below expectations for 3.5%.

vCore PPI inflation increased 3.5% Y/Y, compared to forecasts for a gain of 3.8%. BULLISH🚀 YoY Growth: 🇺🇸 PPI (Dec), 3.3% Vs. 3.5% Est. (prev. 3.0%) 🇺🇸 Core PPI, 3.5% Vs. 3.8% Est. (prev. 3.4%) MoM Growth: 🇺🇸 PPI (Dec), 0.2% Vs. 0.4% Est. (prev. 0.4%) 🇺🇸 Core PPI, 0.0% Vs. 0.3% Est. (prev. 0.2%)

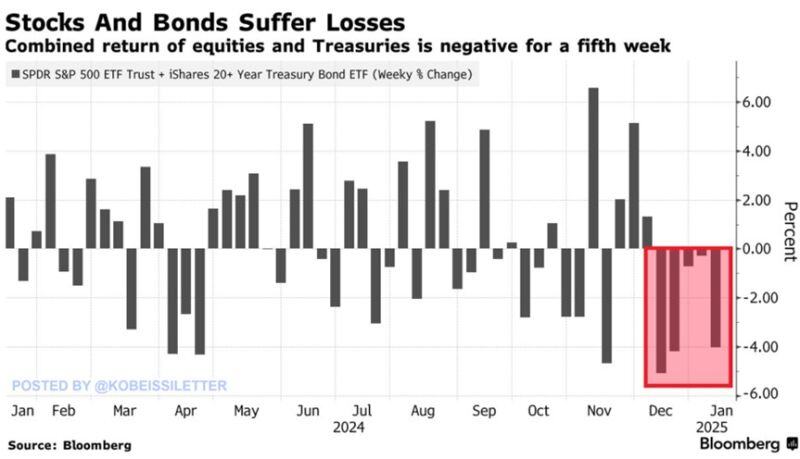

Markets do not like interest rate uncertainty: Stocks and long-term bonds have declined for 5-straight weeks, the longest streak in at least 13 months.

During this period, the S&P 500 ETF, $SPY, has fallen 4.2% to the lowest since November 6th, a day after the Presidential election. At the same time, the popular bond tracking ETF, $TLT, has dropped 9.1% to the lowest since May 2024. Source: The Kobeissi Letter, Bloomberg

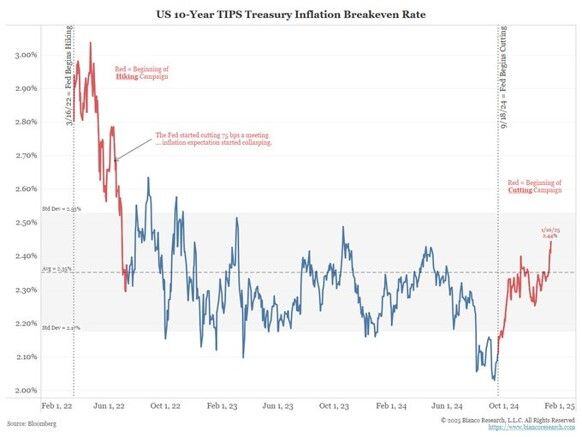

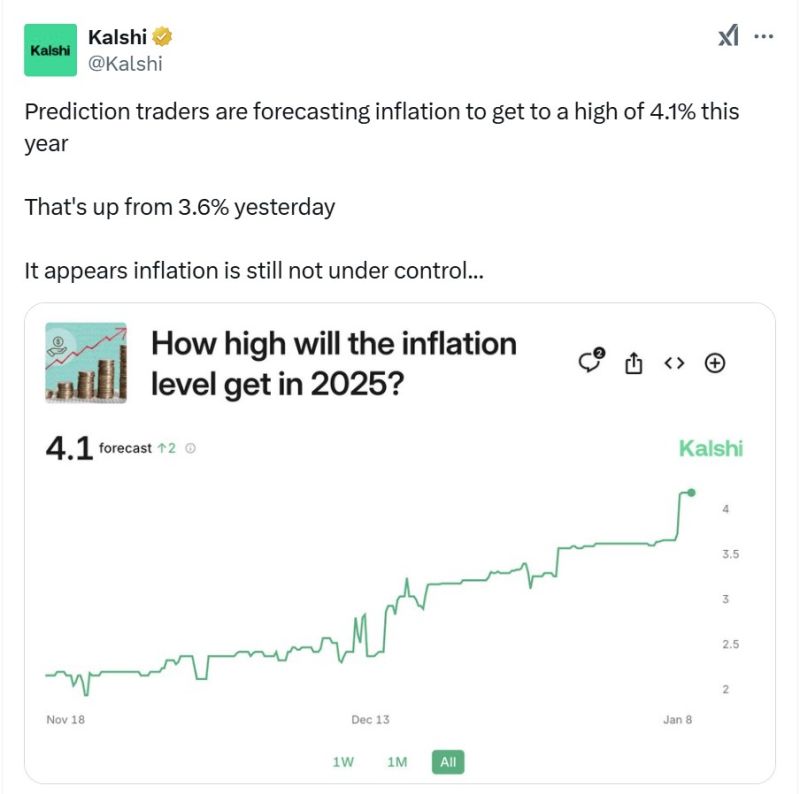

🚨 Great chart and post by James Bianco about US 10-year TIPS breakeven during inflationary time.

👉 The chart below shows the 10-year TIPS breakeven. The LEFT part of the line in RED shows the first 115 days after the Fed started HIKING in 2022. Expectations went straight DOWN. See the RIGHT part of the line in RED, the first 115 days after the Fed started CUTTING in September. Expectations are going straight UP and are at a 15-month high. 👉 Restated, the Fed hikes and inflation expectations GO DOWN. The Fed cuts and inflation expectations GO UP. This is classic "inflationary environment" behavior. 👉Markets were disappointed that the Fed did not cut enough is a previous cycle (pre-2020) reaction. This cycle (post-2020) is about dealing with inflation, and cutting is NOT dealing with inflation. Source: Bianco Research

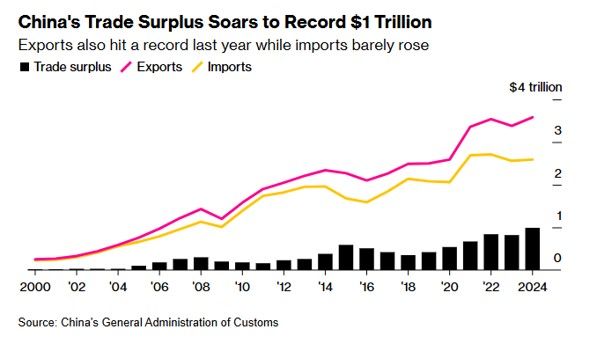

China trade surplus soared to $1 Trillion on Pre-Trump exports

👉 China’s trade data in December beat expectations by a large margin, with exporters continuing to frontload shipments as worries over additional tariffs mount, while the country’s stimulus measures appear to be supporting demand in the industrial sector. 👉 Exports in December jumped 10.7% in U.S. dollar terms from a year earlier, beating expectations of a 7.3% growth in a Reuters poll. That compares with a 6.7% growth in November and a spike of 12.7% in October. 👉Imports rose 1.0% last month from a year earlier, reversing from the contraction in the preceding two months. Analysts had forecast imports to fall 1.5% on year. That compares with a bigger drop of 3.9% in November and 2.3% in October. Source: Bloomberg, CNBC

Yields on 10-yr Treasuries are now the highest vs 2-year rates since 2022.

It's unclear whether this is a healthy normalization - a reversion back to the typical relationship of long-term yields being higher than short-term ones - or a sign of stickier inflation and deficit fears. Souce: Bloomberg, Lisa Abramowicz

Investing with intelligence

Our latest research, commentary and market outlooks