Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- tech

- nvidia

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- assetmanagement

- France

- UK

- china

- ESG

- Middle East

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

Live look at JP Morgan after being the only ones who correctly predicted a 50bps cut:

Source: Trend Spider

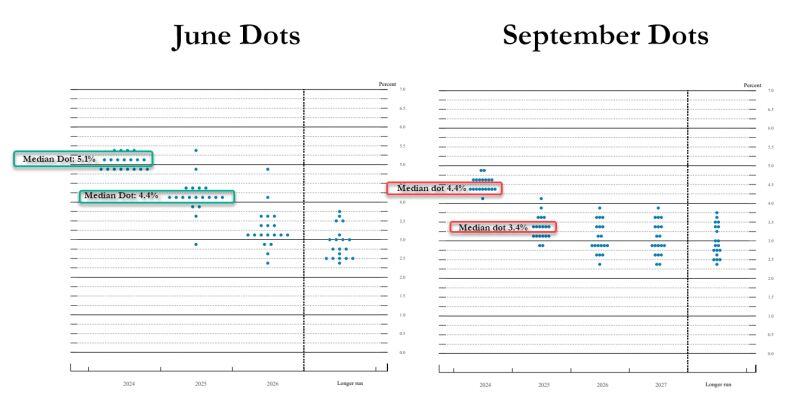

Amazing to see the effect of 818K downward jobs revision on the fed dots...

Source: www.zerohedge.com

Among the reasons why the Fed cut 50bps this week:

1) Inflation risk is LOWER than Employment and Consumer risk 2) The sticky component of inflation is shelter. For shelter inflation to go down we need to see more housing supply and for this we need to get lower mortgage rates = jumbo rate cut does help 3) They MUST get front-end rates lower as this colossal wall of debt matures (source: Lawrence McDonald, Bloomberg)

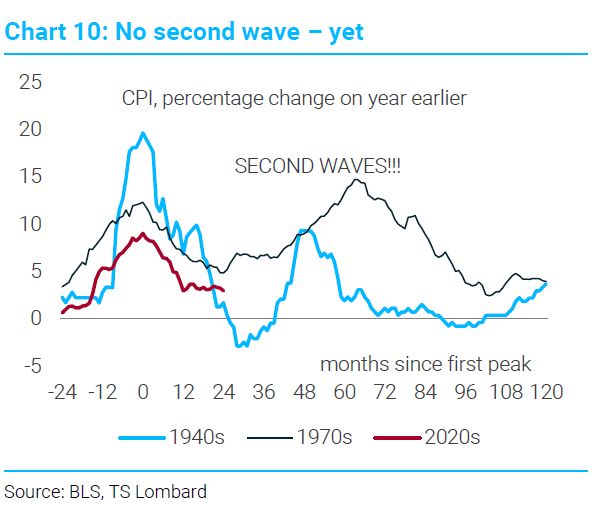

After yesterday jumbo Fed rate cut (days after core CPI MoM reaccelerarting), who doesn't have this chart in mind???

The Second Wave of Inflation. This is what the Fed is thinking but isn't saying out loud. If you expand the dataset to the CPI's of Western economies, 87% of the time there's a second wave. Source. TS Lombard, Eric Hale

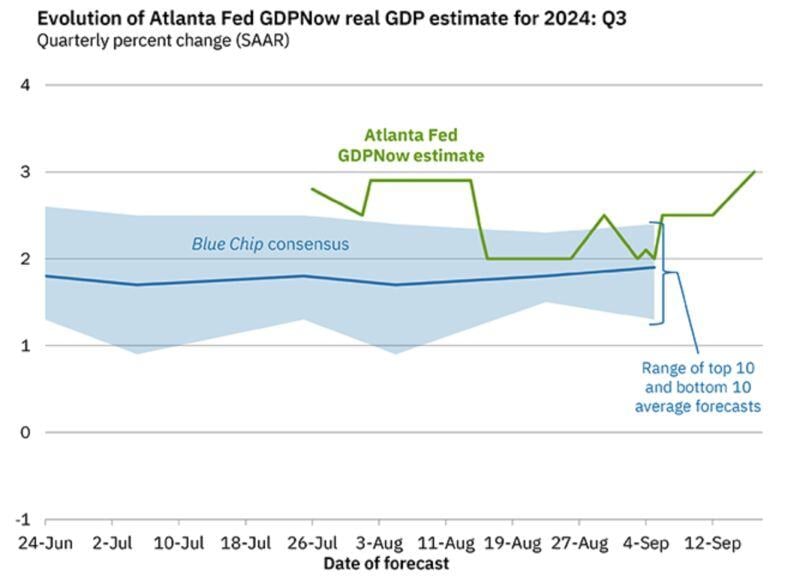

Soft landing? Hard landing? Or no landing?

Atlanta Fed Q3 Real GDP growth Nowcast model just hit 3%...

Safe is risky. #DF24

Source: Vala Afshar @ValaAfshar on X, marketoonist.com

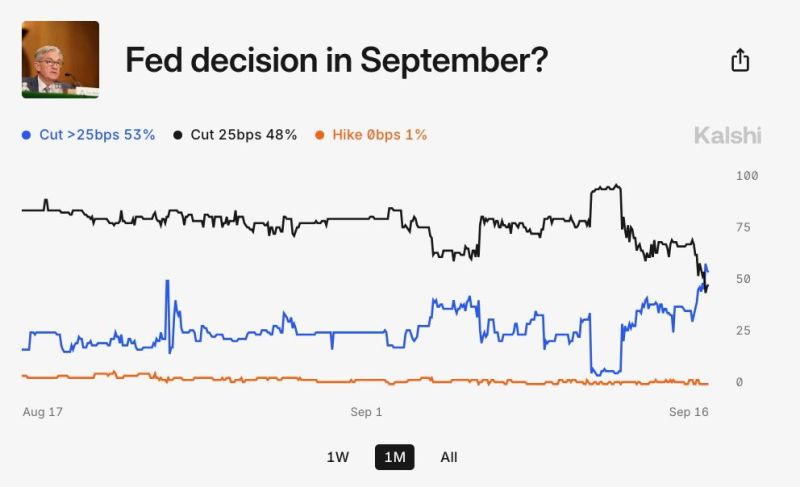

BREAKING: Prediction markets are now pricing-in a 48% chance of a 50 basis point Fed rate cut this week.

Odds of a 50 basis point rate cut have gone from 2% to 48% in just 5 days, according to Kalshi. This will be the first Fed policy decision without a 90%+ consensus since 2020... Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks