Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- performance

- tech

- gold

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- Volatility

- magnificent-7

- nasdaq

- apple

- china

- emerging-markets

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

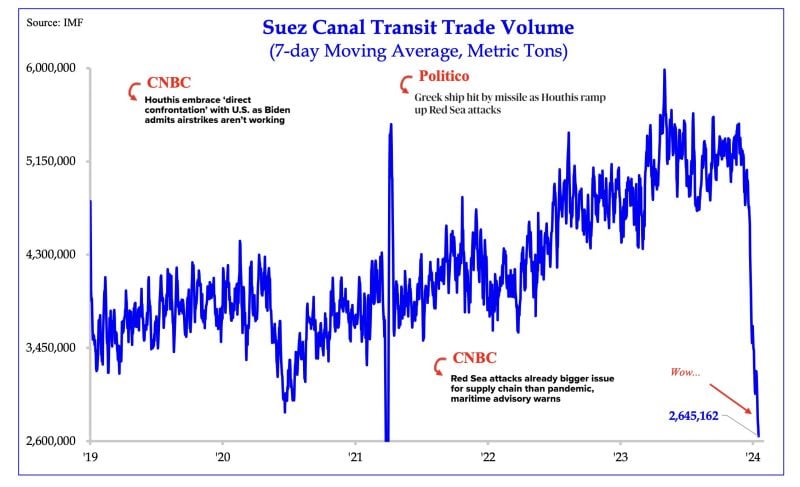

Suez Canal Transit Volume continues to plunge (Chart via SRP)

Source: HolgerZ

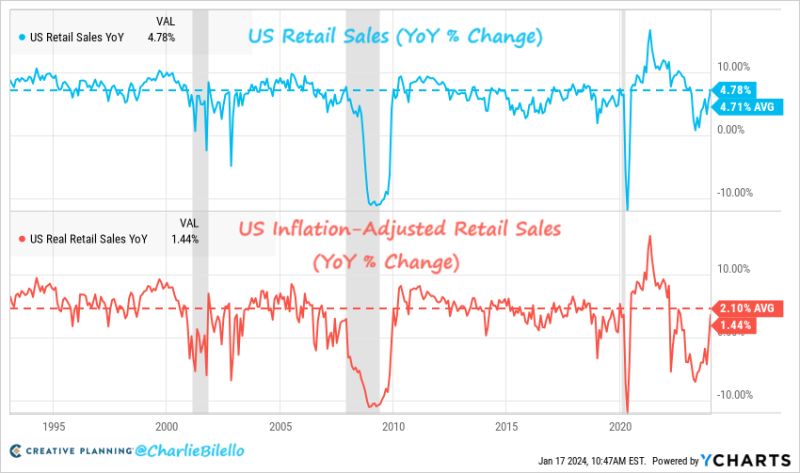

After 13 consecutive YoY declines, US inflation-adjusted retail sales rose 1.4% YoY in December, The first YoY increase since Oct 2022.

Nominal Retail Sales grew 4.78% over the last year, rising just above the historical average of 4.71%. Source: Charlie Bilello

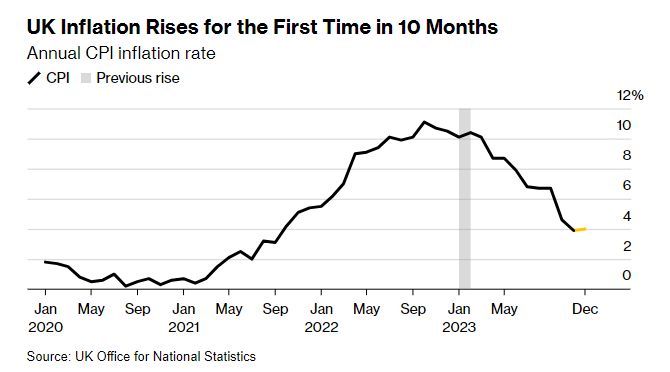

UK Inflation Rises Unexpectedly, Tempering Talk of Rate Cuts

UK inflation disappoints at both the headline and core levels: Headline inflation rose to 4.0% in December, above the consensus forecast looking for it to fall from 3.9% to 3.8%. Core inflation, which was also expected to fall, remained unchanged at 5.1%. Source: Bloomberg

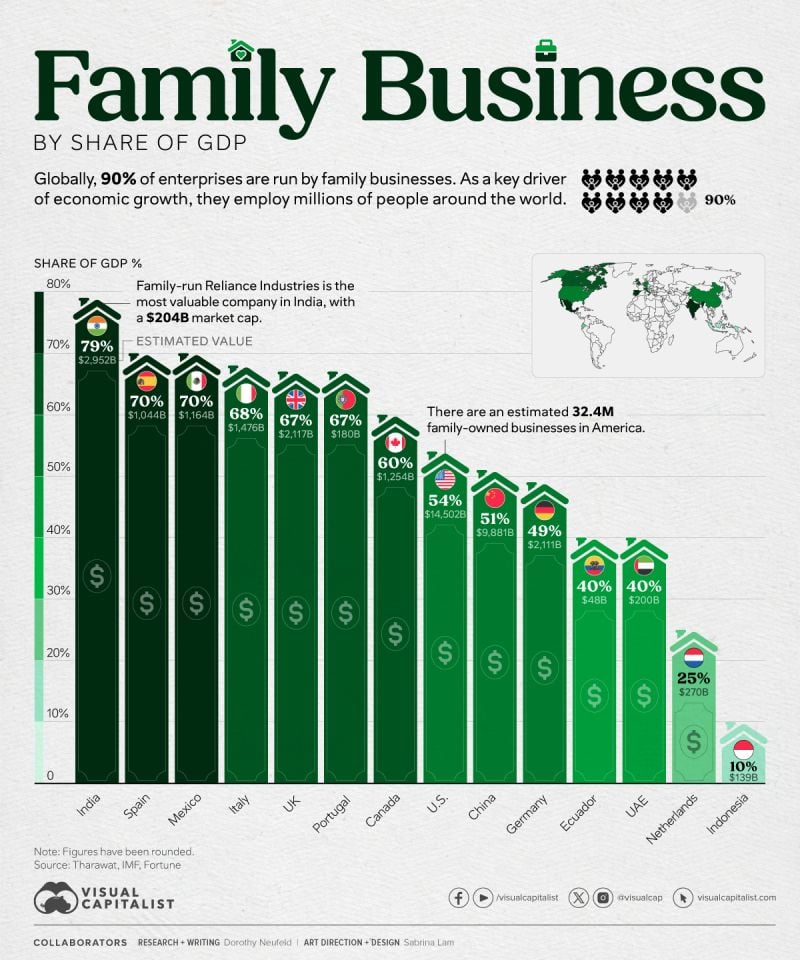

The Influence of Family-Owned Businesses, by Share of GDP

by The Visual Capitalist

On the timing of the first cut, Waller said he believes that the FOMC will be able to lower the funds rate “this year.”

Main culprits from yesterday's pullback in Wall Street were comments by Governor Waller in a speech and discussion as they raised the risk that the first cut could come slightly later than the market's expectation of March and that the pace of cuts could be quarterly from the outset, rather than the market's more aggressive forecast of three initial consecutive cuts followed by a switch to a quarterly pace. On the speed of cuts, Waller said the funds rate “can and should be lowered methodically and carefully” and that he sees “no reason to move as quickly or cut as rapidly as in the past,” when the FOMC was combating recessions. Waller also noted that next month's scheduled revisions to CPI inflation (the seasonal factors will be revised on February 9) could influence his thinking on rates cuts, especially if the revised data show a less clear deceleration recently. The result was most evident in the drop in the market's expectations for a rate-cut in March...

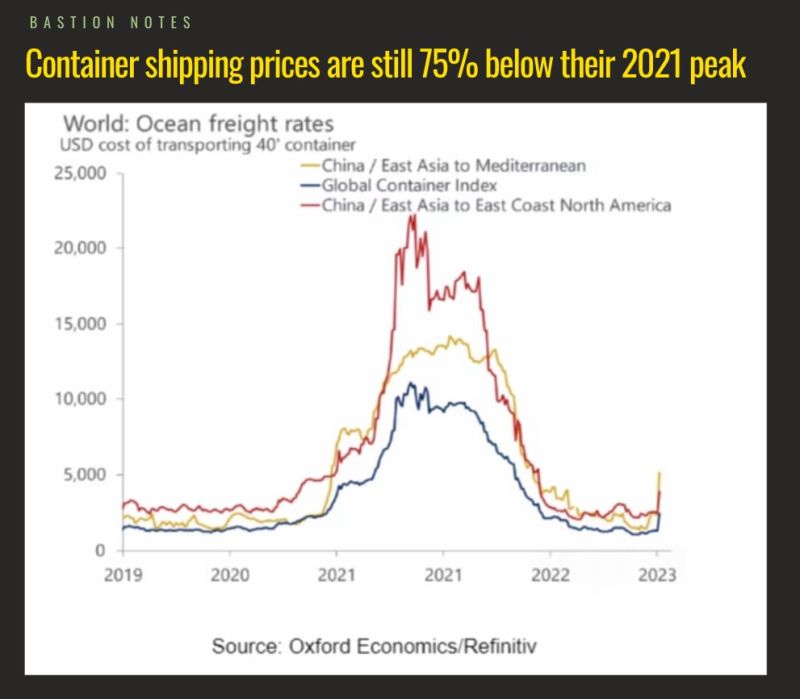

Container transportation costs have indeed doubled over the past 6 weeks but it is important to see the full picture. Relative to the pandemic peaks, transportation prices are still 75% lower...

Source: Bastion notes, Oxford Economics

44% of office loans carry outstanding loan balances higher than the property value and are at risk of default according to a paper from the National Bureau of Economic Research

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks