Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- performance

- tech

- gold

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

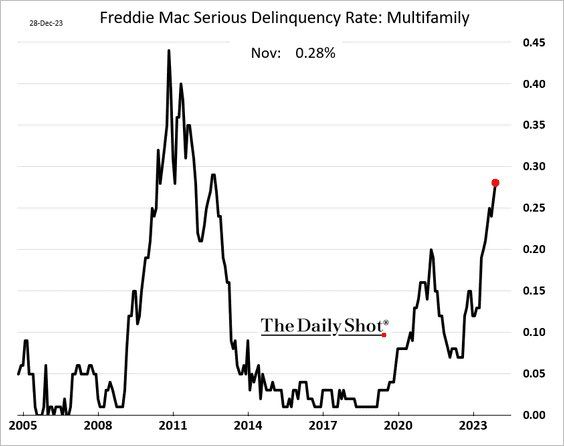

- Real Estate

- oil

- banking

- Volatility

- magnificent-7

- nasdaq

- apple

- china

- emerging-markets

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

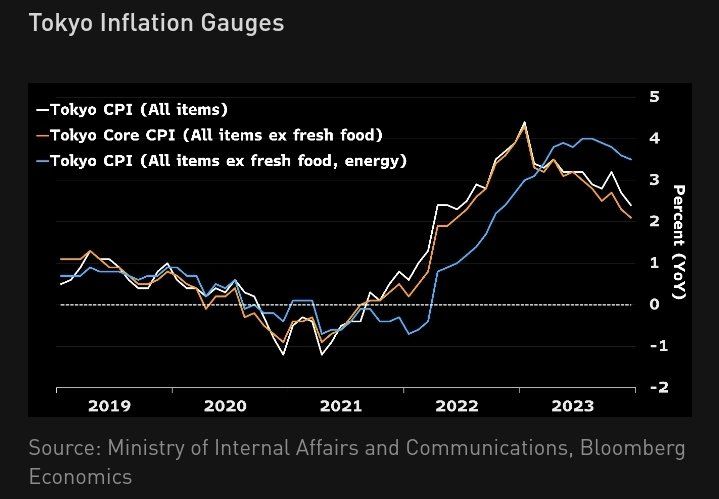

Tokyo CPI down again supports BOJ dovish stance for now

Source: Bloomberg

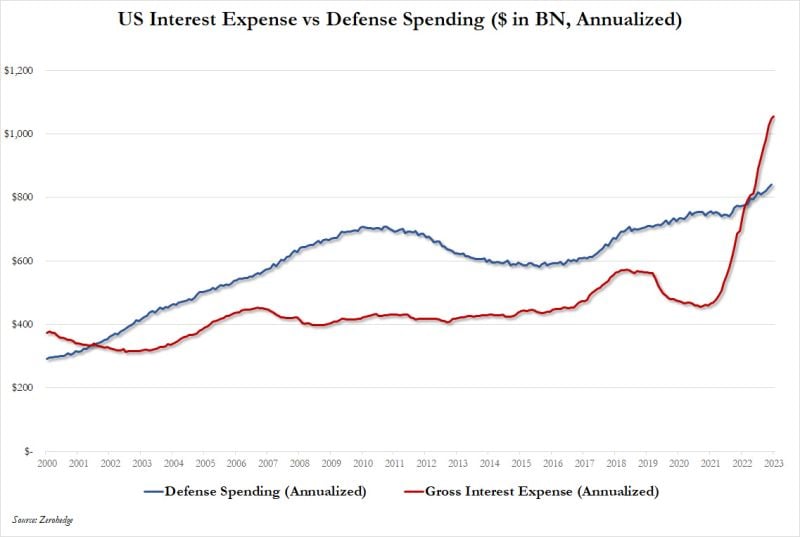

US defense spending vs interest on Federal debt

Source: www.zerohedge.com

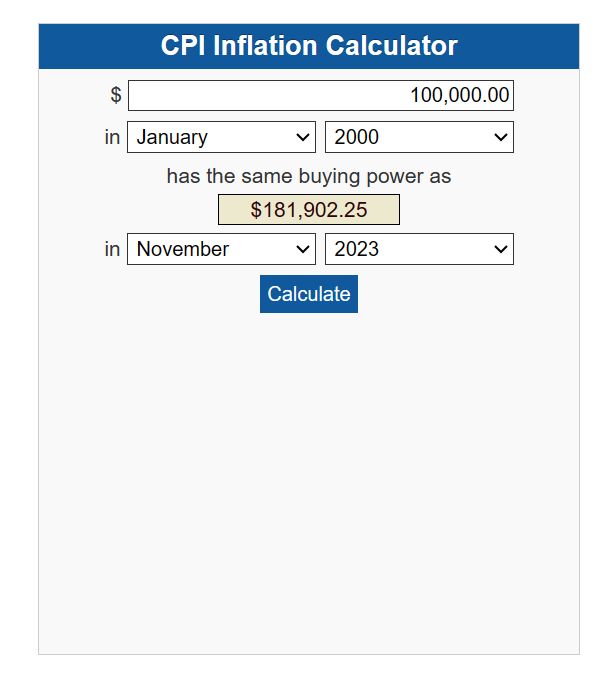

You can measure the concrete effects of inflation on your purchasing power over time by using this CPI Inflation calculator

https://lnkd.in/eFFzyTpu (This applies to the US only)

BREAKING: The US job market remains strong

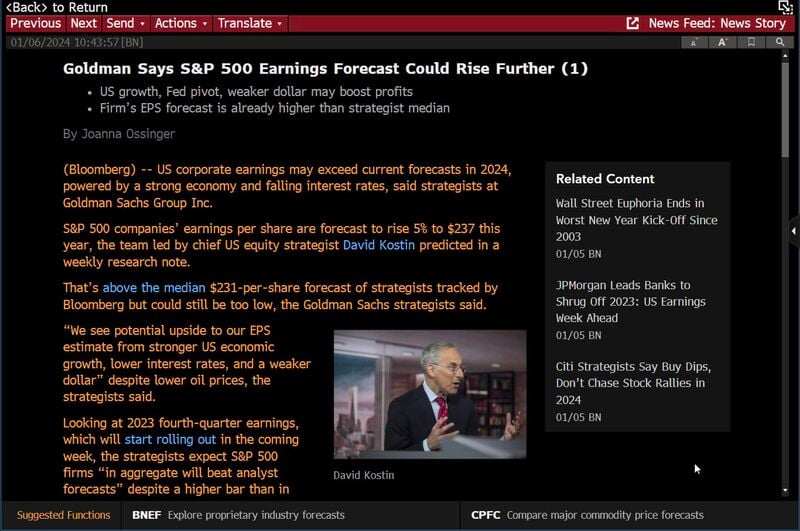

In December, the US economy added 216,000 jobs, above expectations of 170,000. This means that the US economy has now added jobs for 36 consecutive months. The US Unemployment Rate held steady at 3.7% in December (consensus estimate was for an increase to 3.8%). Wages actually increased to 4.1% year over year from 4% in November. The market reaction is as you'd expect - yields higher, with fewer rate cuts being priced in for 2024. In light of these numbers, there is a problem with the number of FED rate cuts being priced in. Source: Bloomberg

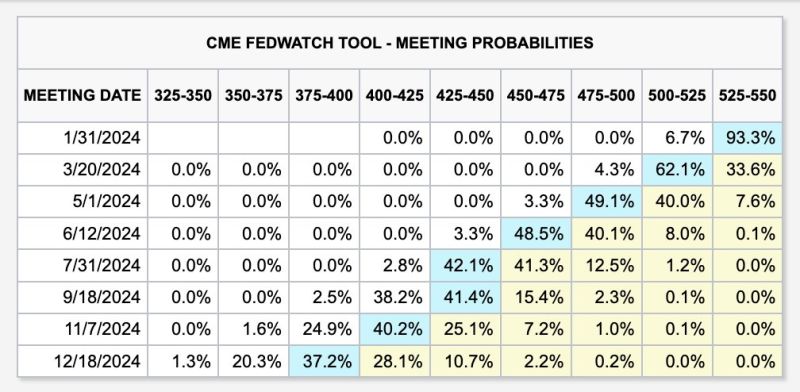

US interest rate futures are beginning to shift back in the less dovish direction

Odds of 7 or 8 interest rate cuts in 2024 have halved this week. Also, odds of rate cuts beginning this month are down to just 7%. However, the base case still shows 6 rate cuts for a total of 150 basis points in 2024. This is double the 3 rate cuts forecasted at the Fed's latest meeting. Source: The Kobeissi Letter

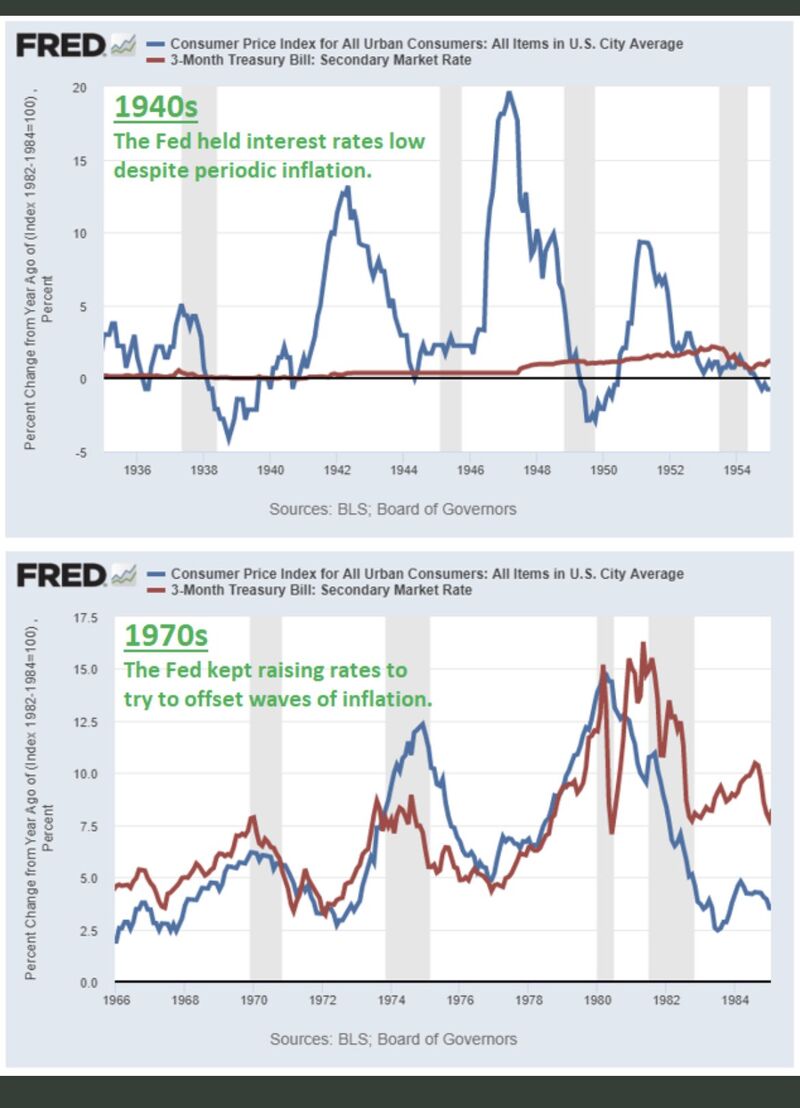

While many economists and financial analysts look at the 1970s as a potential playbook for the current decade, the 1940s could be an interesting reference to consider as well

The 40s was a decade of war and high budget deficit and rising debt level in the US. Monetary policy was mainly about financial repression, i.e keeping rates low despite temporarily high inflation. Overall, it was positive for risk assets. Source: Win Smart, FRED

Investing with intelligence

Our latest research, commentary and market outlooks