Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- performance

- tech

- gold

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- Volatility

- magnificent-7

- nasdaq

- apple

- china

- emerging-markets

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

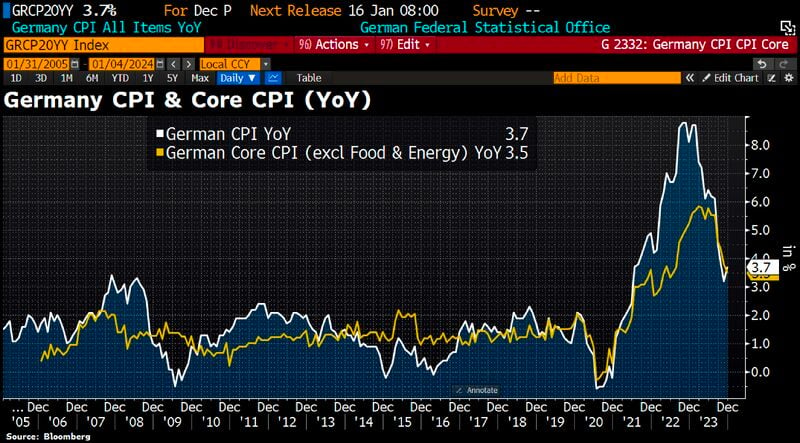

German inflation has accelerated again, at least the headline rate

CPI rose to 3.7% in December from 3.2% in November due to base effect. But Core CPI has fallen further to 3.5% in Dec from 3.8% in November. This means that core inflation is once again below headline inflation. Source: HolgerZ, Bloomberg

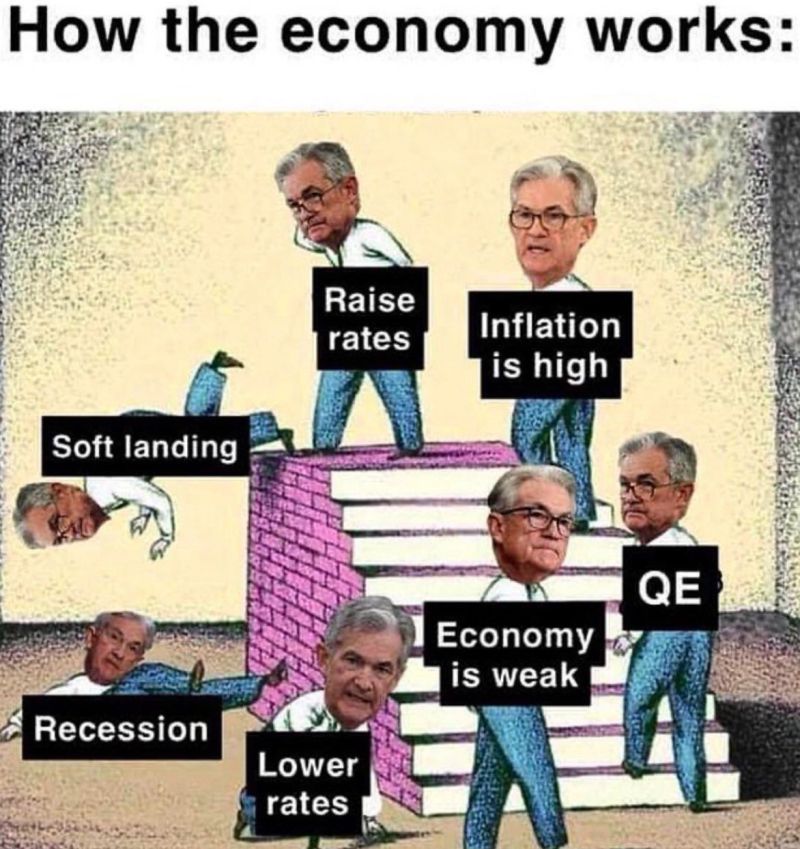

How the economy works... An over-simplistic but accurate chart

Source: Markets & Mayhem

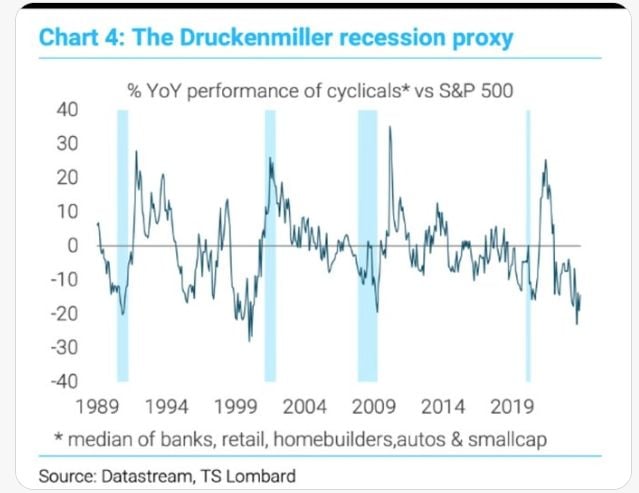

The Druckenmiller Recession indicator continues to plummet

Source: Win Smart, TS Lombard

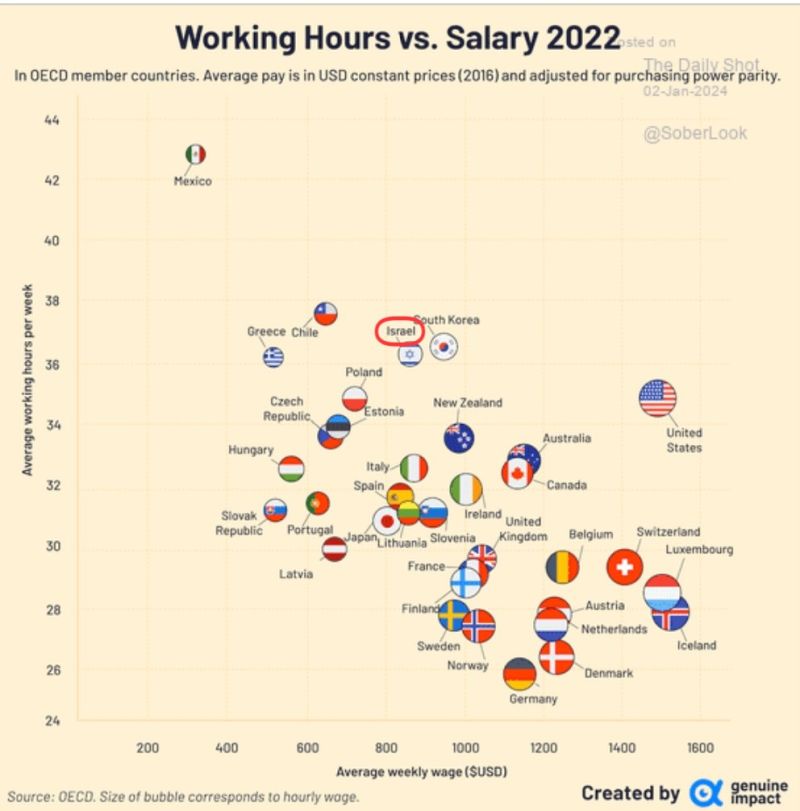

GLOBAL WAGES

Source: Win Smart, Genuine Impact and The Daily Shot

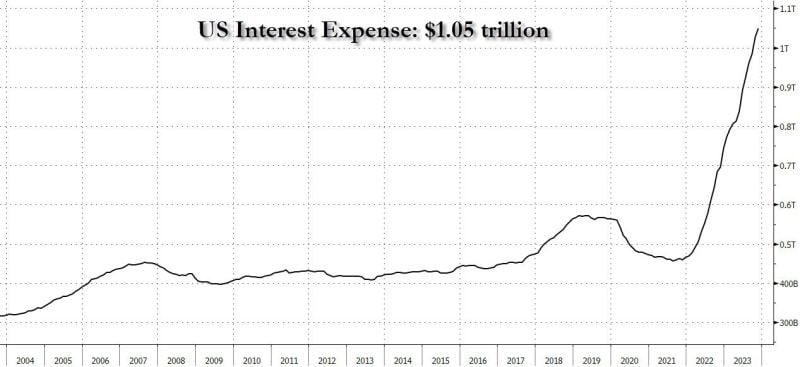

US Interest expense ~$1.1 trillion as of today

That's $250BN more than the Defense Budget; $250BN more than spending on Medicare, $200BN more than spending on health, and will surpass the $1.35 trillion spending on Social Security this year, becoming the single biggest outlay Source: www.zerohedge.com

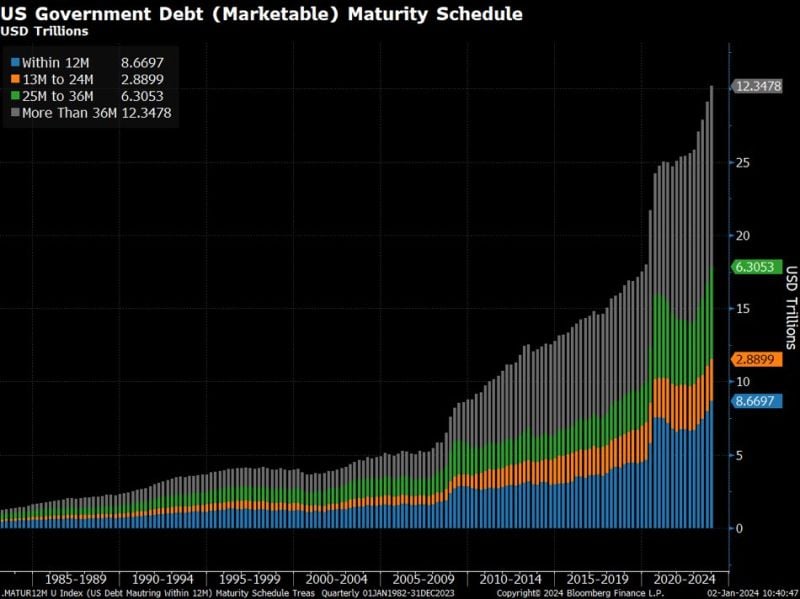

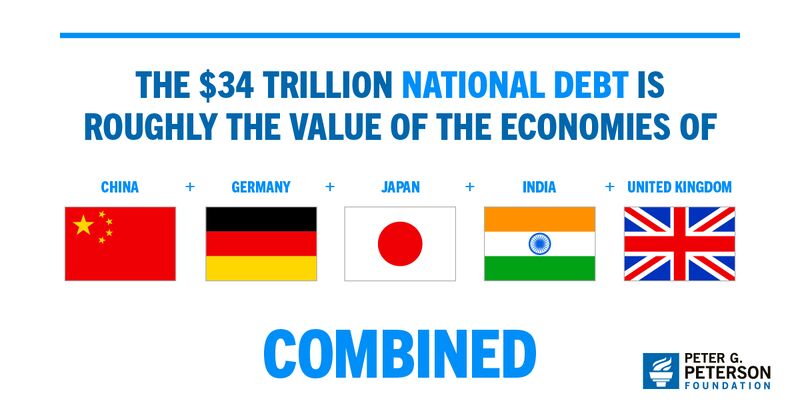

BREAKING: Total US debt hits $34 trillion for the first time in history, putting US debt up 100% since 2014

Since the debt ceiling "crisis" ended in June 2023, total US debt is up nearly $3 trillion. This debt balance is more than the value of the economies of China, Germany, Japan, India and the UK COMBINED. The US is now spending $2 billion PER DAY on interest expense alone. Debt per capita is at a record high of $101,000. Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks