Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- tech

- nvidia

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- assetmanagement

- France

- UK

- china

- ESG

- Middle East

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

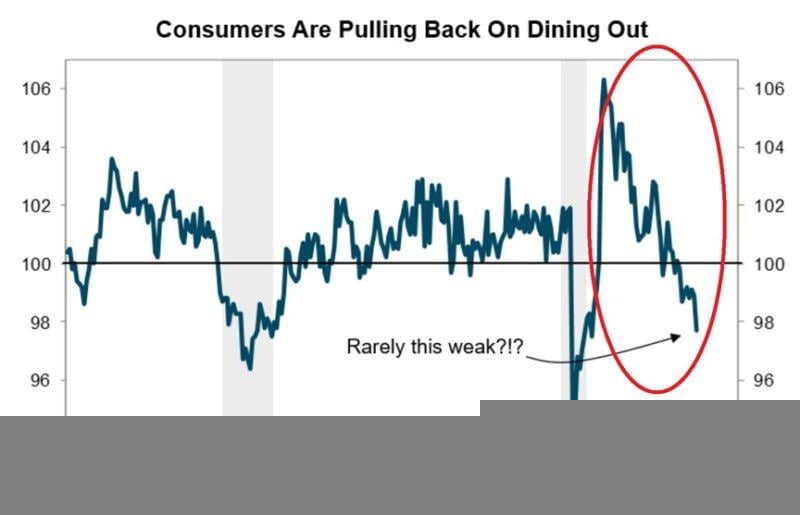

BREAKING: The Restaurant Performance Index (RPI) fell -1.3% in July to 97.7 points, the lowest level since the 2020 lockdowns

This index tracks the health of the restaurant industry in the US by measuring sales, customer traffic, labor, and overall business conditions. Since 2021, this metric has fallen by ~8.0%, marking the largest drop since it was launched in 2002. Such a low level in the index has only been seen during recessions. Americans are pulling back on dining out as prices have been sharply rising and recently hit new all-time highs. Since 2020, food prices away from home have increased by 27.0%, and fast food prices have jumped by 31.0%. Eating out is becoming a luxury... Source: The Kobeissi Letter, Trahan Macro Research

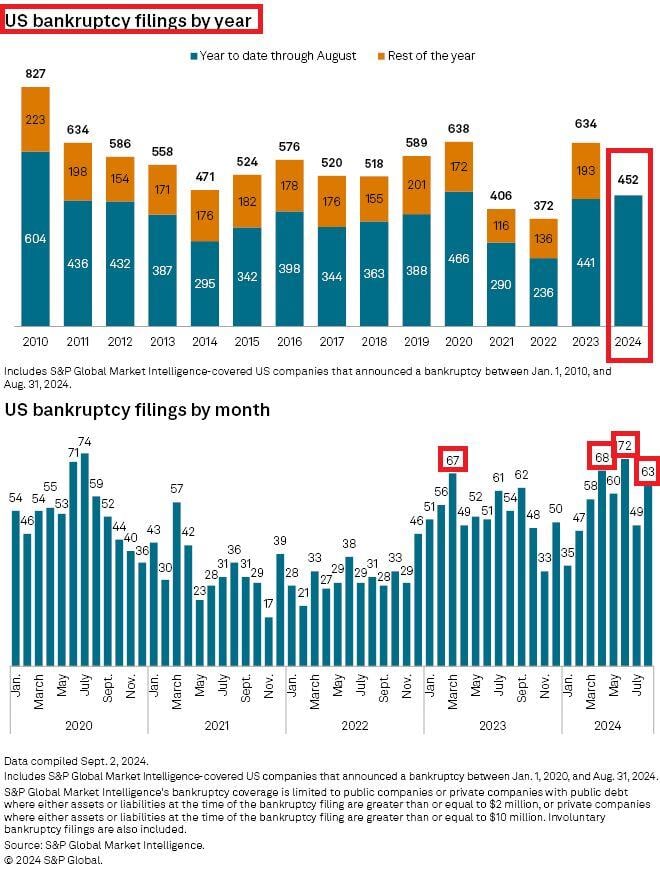

🚨US BANKRUPTCIES ARE ON THE RISE🚨

The number of bankruptcy filings hit 452 year-to-date, the 2nd largest in 13 YEARS. In August alone, 63 companies went under, the 4th LARGEST since the COVID CRISIS. Most bankruptcies have been seen in the consumer discretionary sector. Source: Global Markets Investor

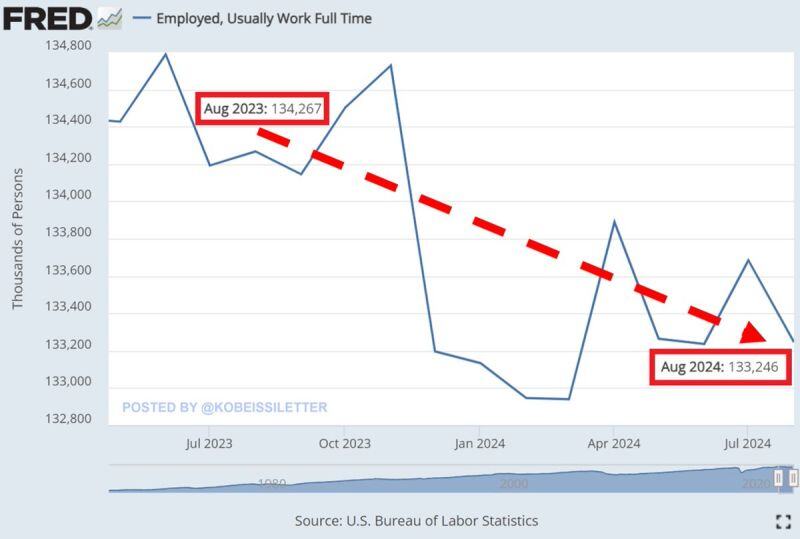

Full-time employment DROPPED by 1 million workers in August on a year-over year basis, marking the 7th consecutive monthly decline.

Since the June 2023 peak, full-time job count in the US has fallen by a whopping 1.5 million. Meanwhile, part-time employment rose by 1 million year-over-year in August. Additionally, the number of permanent job losers jumped by 324,000 year-over-year, to 2.5 million, the highest since November 2021. This was the 16th straight month of part-time job gains, the longest streak since the 2008 Financial Crisis. The US job market is cooling down. Source: FRED, The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks