Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- performance

- tech

- gold

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- Volatility

- magnificent-7

- nasdaq

- apple

- china

- emerging-markets

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

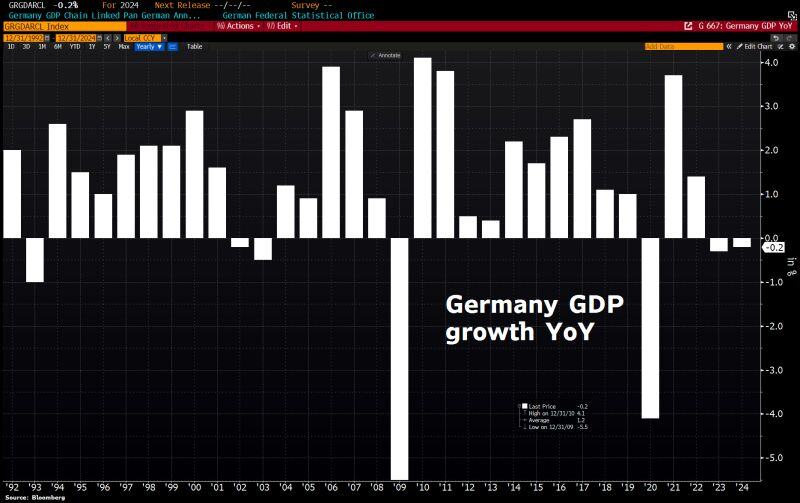

The German economy has shrunk for 2nd year in a row ahead of elections, driven by both cyclical & structural challenges

German GDP declined by 0.2% in 2024, following a 0.3% drop in 2023. This marks only 2nd time since 1950 that econ has contracted for 2 consecutive yrs. Germany's prospects for 2025 remain bleak. Bundesbank predicts growth of just 0.2% and warns that another contraction is even possible if US President-elect Trump follows through on his tariff threats. Source: HolgerZ, Bloomberg

Mortgage demand is collapsing:

US mortgage applications for single-family homes fell 3.7% last week, marking their 4th consecutive weekly decline. As a result, the mortgage demand index has fallen to the lowest since February 2024 and its 3rd lowest level in nearly 30 years. The index has now fallen a whopping -63% over the last 4 years. This comes as home financing costs have rapidly surged while prices remain at all-time highs. Since mid-September, 30-year fixed mortgage rates have risen ~110 basis points and are back above 7%. Mortgage demand is at 1990s levels. Source: The Kobeissi Letter, MBA Purchase index

Government spending is now half of the economy in most of the developed world....

Source: The Long View @HayekAndKeynes

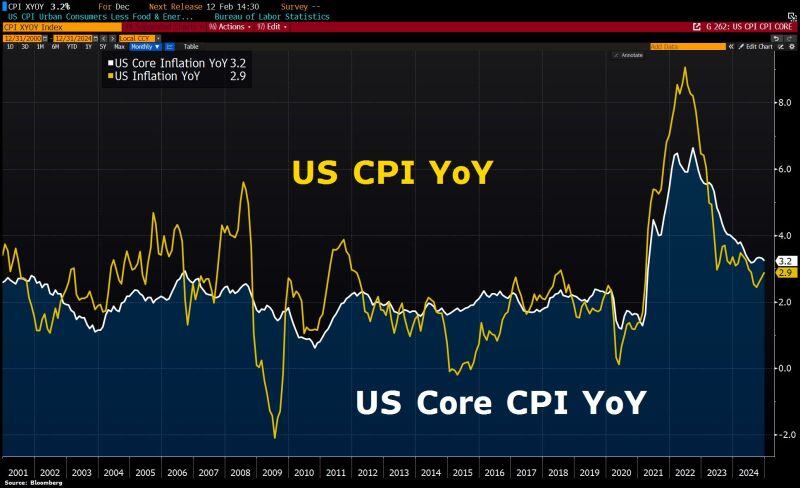

Good news are coming... while US Q4 earnings season is off to a strong start thanks to banks beating estimates, US inflation numbers came in somewhat cooler than expected:

Core CPI slows to 3.2% in December from 3.3% in November. Analysts had expected the rate to remain unchanged at 3.3%. Overall CPI is unchanged at 2.9% as forecasted. Headline CPI inflation is up for 3 straight months, but core inflation is falling again. It seems enough to please investors: S&P 500 futures are surging over +85 points - the equivalent of a $750B market cap gain - as 10y US bond yields are tumbling by 10 basis points. The dollar is easing, gold is shining and cryptos is surging with bitcoin back to $99K. Alles gut... Source: Bloomberg

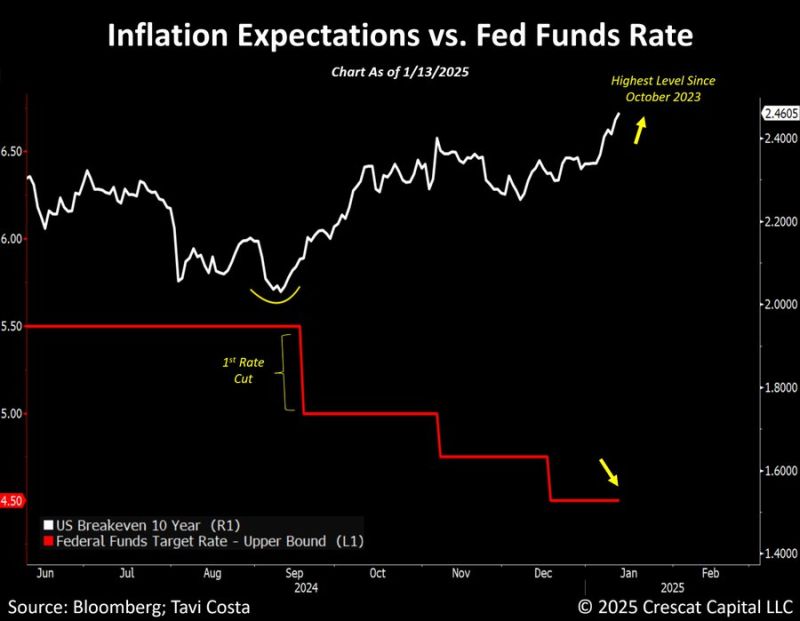

Inflation expectations have almost perfectly bottomed exactly when the Fed started to cut rates.

10-year breakeven rates are now at its highest level since October 2023. As highlighted by Tavi Costa, this is a reminder that when debt limits a monetary authorities actions, inflation becomes the path of least resistance. Source: Tavi Costa, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks