Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- UK

- assetmanagement

- ESG

- Middle East

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

Apollo made a HUGE call on Sunday:

For the first time since the "Fed pivot" began, Apollo has officially declared inflation back on the rise. They warn of a potential repeat the 1970s as the Fed cuts rates into rising inflation. Apollo says the probability of the Fed RAISING interest rates in 2025 is now rising. Here's why: 👉 First, measures of inflation stickiness are all now well above the Fed's 2% target. In fact, the Atlanta Fed Core Sticky CPI index has leveled off near 4%. ALL major measures of CPI stickiness are now above 3%. 👉 Meanwhile, core CPI has levelled off at 3.3% fore multiple months in a row. This was "fine" because headline CPI was moving in a straight-line to 2% all year. However, as of the latest CPI inflation data, it's now RISING and back to 2.7%. Source: The Kobeissi Letter, Apollo

Has the era o stagflation begun?

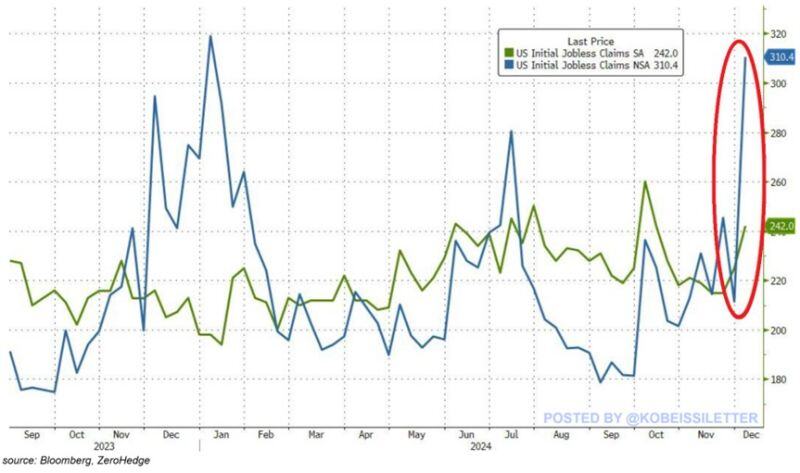

Initial jobless claims spiked by 17,000 to 242,000 last week, the highest since the first week of October. Non-seasonally adjusted claims skyrocketed by 99,140 to 310,366, the highest since January. This marks a whopping 30% year-over-year increase. At the same time, the number of people receiving jobless benefits surged to 1.89 million, near the 3-year high. To put this into perspective, continuing jobless claims are now 14% above the 2018-2019 pre-pandemic levels. All while CPI, PCE, and PPI inflation are all back on the rise. We have a weakening labour market with rising inflation. Source: The Kobeissi Letter

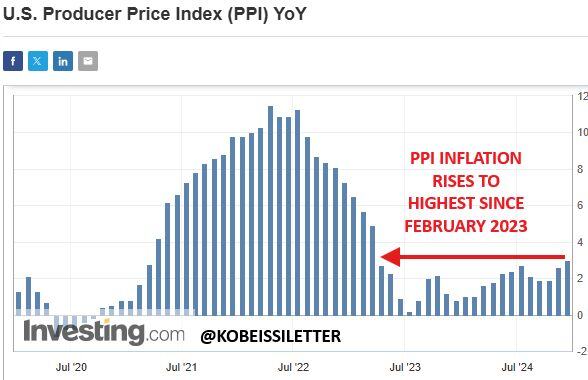

BREAKING: November PPI inflation RISES to 3.0%, above expectations of 2.6%. Core PPI inflation RISES to 3.4%, above expectations of 3.2%.

Moreover, the US Bureau of Labor Statistics has revised October PPI inflation HIGHER, from 2.4% to 2.6%. Also, Core PPI inflation for October has been revised HIGHER from 3.1% to 3.4%. This means that 6 out of the last 7 PPI inflation reports have now been revised higher. With today's 3.0% PPI inflation print, PPI inflation is now at its highest level since February 2023. CPI, PPI, and PCE inflation are all officially back on the rise in the United States... Source: The Kobeissi Letter

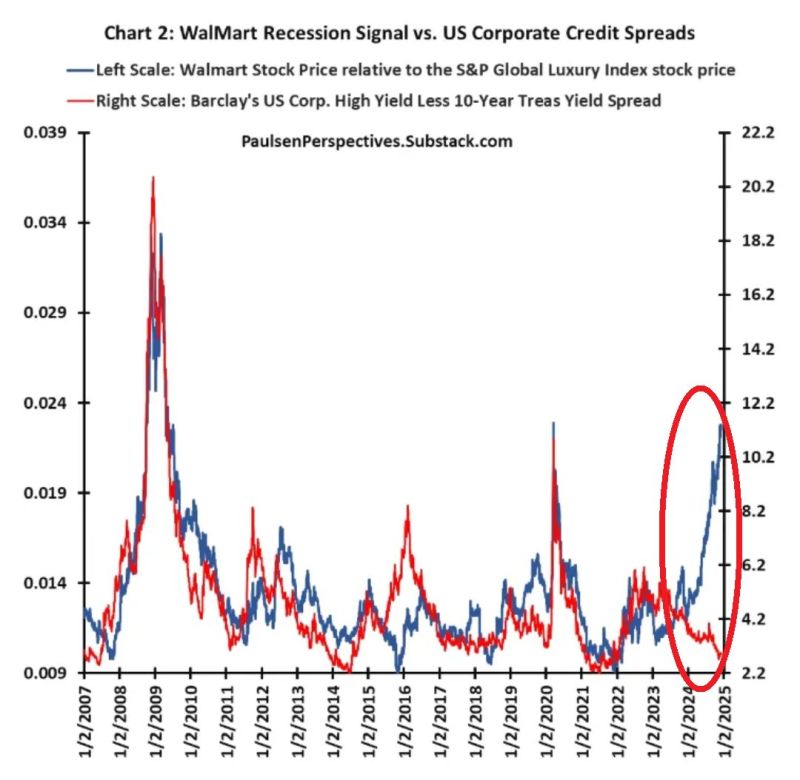

⁉️ WALMART RECESSION SIGNAL IS FLASHING RED BUT CREDIT SPREADS ARE AT THE TIGHTEST. WHO'S RIGHT ?

Walmart, $WMT, share price divided by the S&P Global Luxury Index price jumped to near the highest since the 2008 Financial Crisis. However, US corporate bond spreads stay at historically low levels. Is this indicator still valid? Source: Global Markets Investor

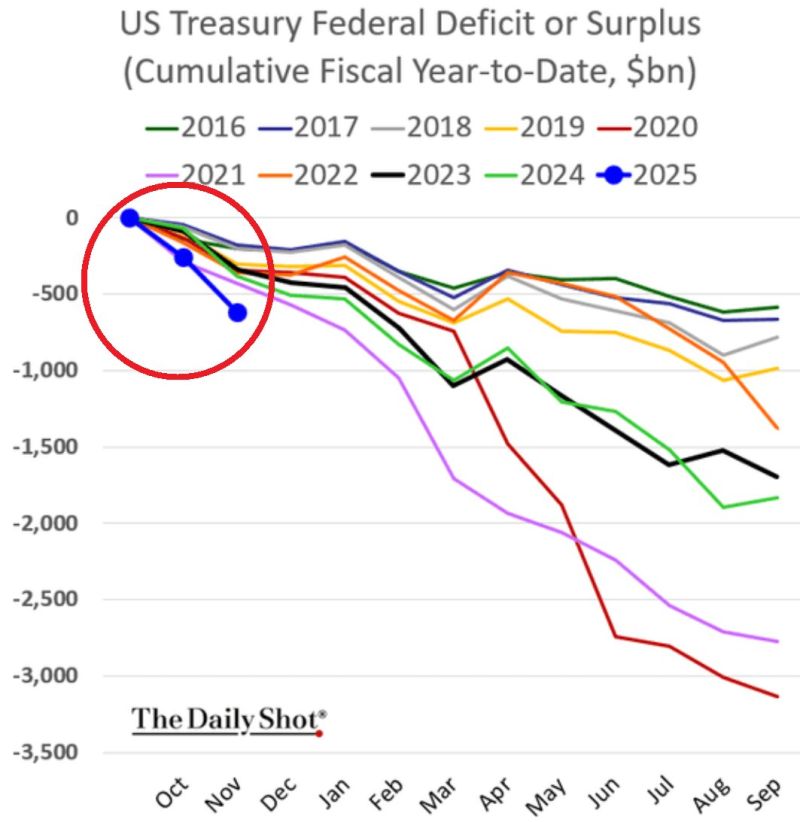

‼️ US budget deficit hit a GIGANTIC $367 BILLION in November 2024.

This puts the total deficit for the first 2 months of the Fiscal Year 2025 to a TREMENDOUS $624 BILLION, the highest EVER. This has even surpassed the 2020 CRISIS LEVELS. Source: Global Markets Investor, The Daily Shot

Investing with intelligence

Our latest research, commentary and market outlooks