Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Everyone keeps saying AI is a bubble.

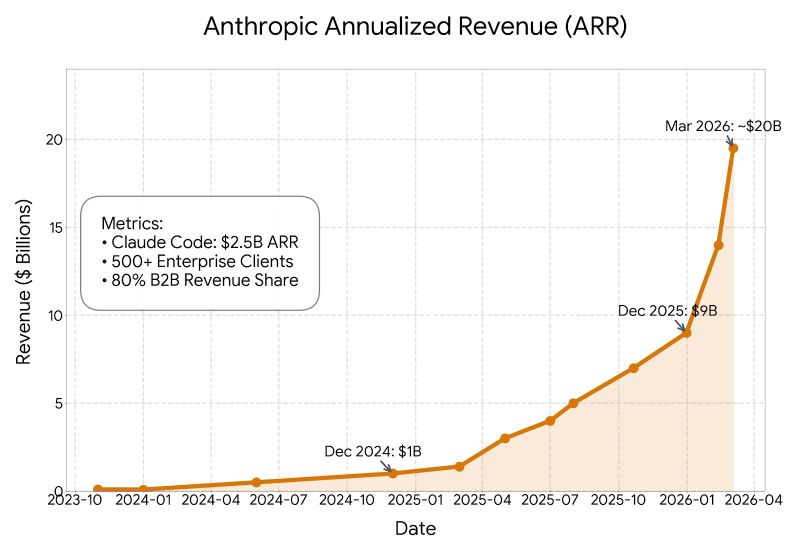

We hear it on repeat. “Hyperscalers are spending too much.” “AI demand isn’t real.” “This won’t justify the investment.” Maybe. But pause the debate for a second. Have you looked at Anthropic’s ARR chart recently? The company behind Claude is sprinting toward $20B in annual recurring revenue. And the curve is… absurd. Not steady growth. Not normal SaaS growth. This looks like a vertical takeoff. If the trajectory holds, it might become the fastest company in history to reach $20B ARR. Source: Andreas Steno Larsen

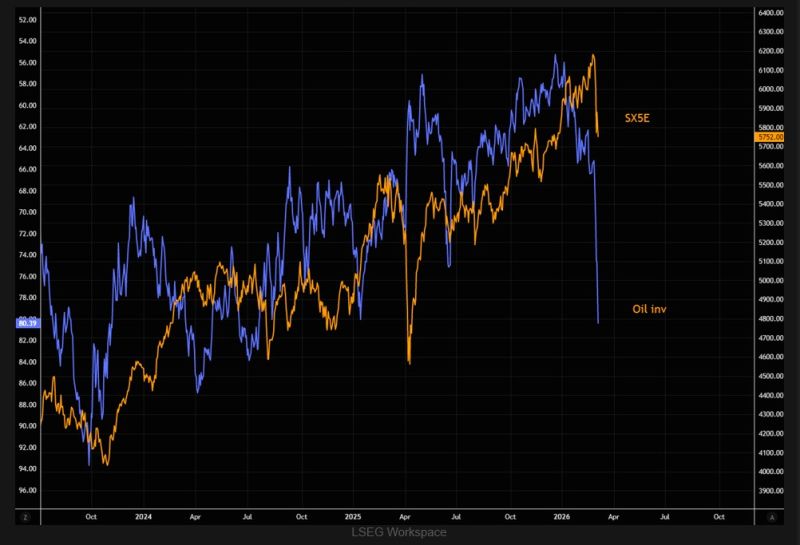

Iran war ➡️ Bloomberg sees 2 most likely scenarios: limited energy attacks pushing oil to $80, or a ceasefire bringing it back to $65.

For Europe, sustained higher energy prices would push the economy to the brink of recession. Source: Bloomberg Economics

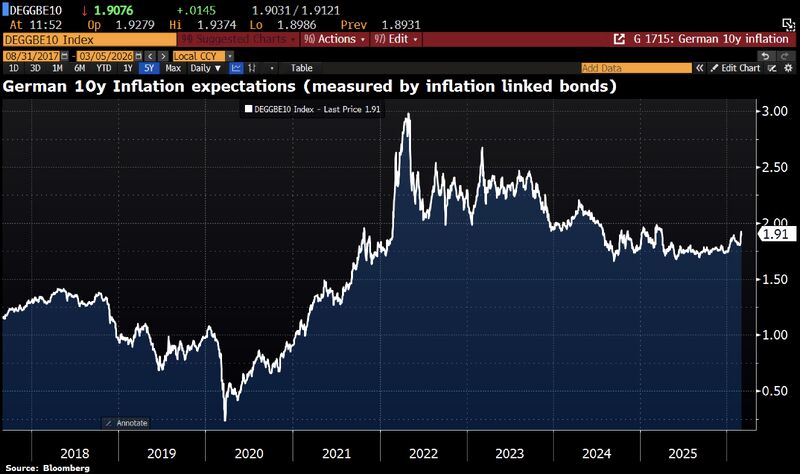

Long-term inflation expectations in Germany have barely moved despite the recent escalation in the Middle East.

The 10y breakeven inflation rate, a common market measure of expected inflation over the next decade, only nudged to 1.91%; still below the 2% threshold and well under the roughly 3% levels seen after Russia invaded Ukraine. This suggests that markets do not currently expect the conflict to have lasting inflationary effects. Source: Bloomberg, HolgerZ

Reports are circulating that Saudi Arabia, the UAE, Kuwait, and Qatar are discussing withdrawing from US contracts and cancelling future investment commitments

According to the Financial Times, the Gulf states are facing growing budget pressure due to the US-Israeli war with Iran, which is disrupting their economies. The conflict has reduced energy revenues, slowed shipping through the Strait of Hormuz, damaged oil and gas infrastructure, hurt tourism and aviation, and increased defence spending. As a precaution, some Gulf governments are reviewing overseas investments and financial commitments, including investment pledges, business contracts, sports sponsorships, and asset holdings. They may also consider invoking force majeure clauses in contracts. The review could affect major global investments, including hundreds of billions of dollars pledged to the US, attracting attention from the White House. According to the FT, Gulf leaders had urged diplomacy before the war and are now frustrated about being drawn into the conflict, questioning whether their financial support for regional initiatives is being used for peace or war. Saudi Arabia held 254 billion riyals in U.S. equity exposure as of Q4 2025. Across the Gulf Cooperation Council (GCC), total financial commitments linked to the United States are estimated at $3–4 trillion, spanning sovereign wealth fund investments, defense procurement, infrastructure partnerships, and bilateral investment agreements. The United Arab Emirates alone has pledged $1.4 trillion in U.S. investments over the next decade, under an economic framework announced during Donald Trump’s first 100 days in office. These figures are not merely financial statistics—they form the economic backbone of the U.S.–Gulf security partnership. In effect, they underpin the strategic relationship that allows the Pentagon to maintain its military presence in the region, including deploying carrier strike groups in the Arabian Gulf. Bottom line: If the war continues, Gulf states may scale back global investments and financial commitments, which could have significant economic and geopolitical consequences, including pressure on the US to pursue diplomacy.

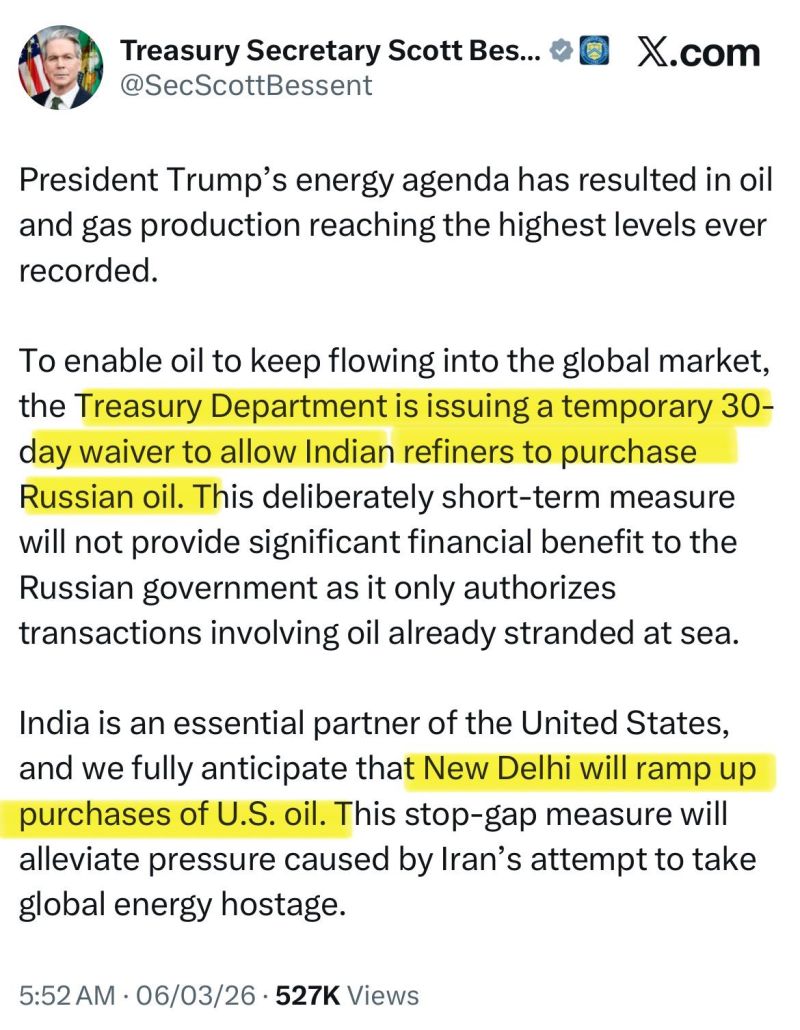

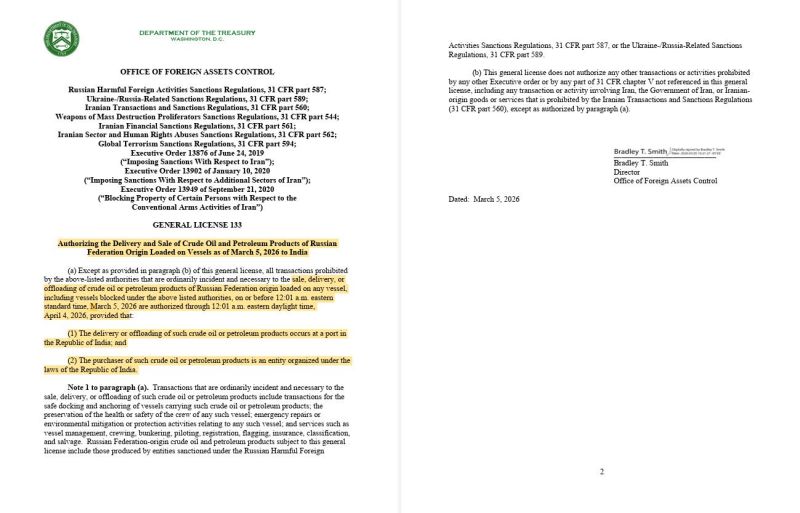

Is Putin the clear a winner in a war that otherwise only have losers?

Apart from higher oil prices 🇺🇸 now eases up on sanctions and lets India and probably others buy more of oil. Source: Carl Bildt

Investing with intelligence

Our latest research, commentary and market outlooks