Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The worst performers in the S&P 500 this year--software cos like Workday, Intuit and private credit giants Apollo, Blackstone, Ares

Source: Gunjan Banerji

🚨HAVE US TECH STOCKS PEAKED?

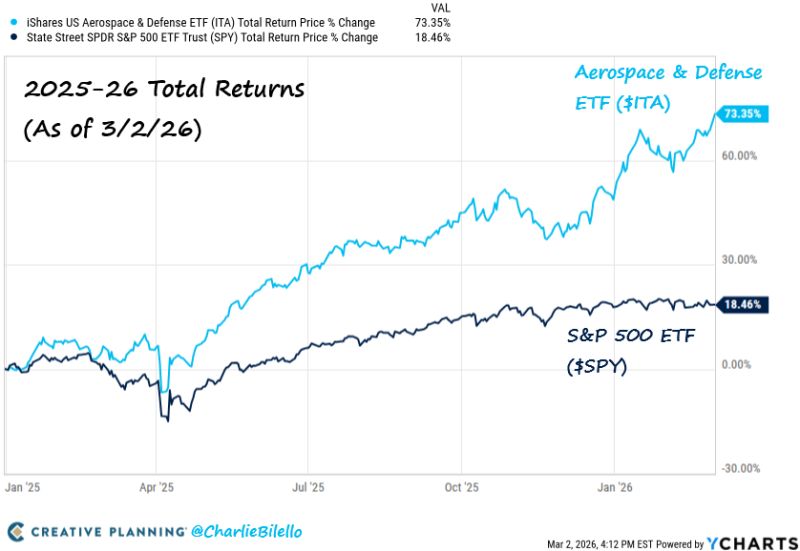

Tech, telecom, and healthcare stocks now make up 44% of global market cap, matching the 2000 Dot-Com bubble peak. Back then, this level marked a major turning point, followed by years of underperformance. Meanwhile, financials, energy, and materials have risen to 25%, mirroring the same early-cycle recovery pattern seen after the Dot-Com peak. Will industrials OUTPERFORM over the upcoming decade? Source: Global Markets Investor

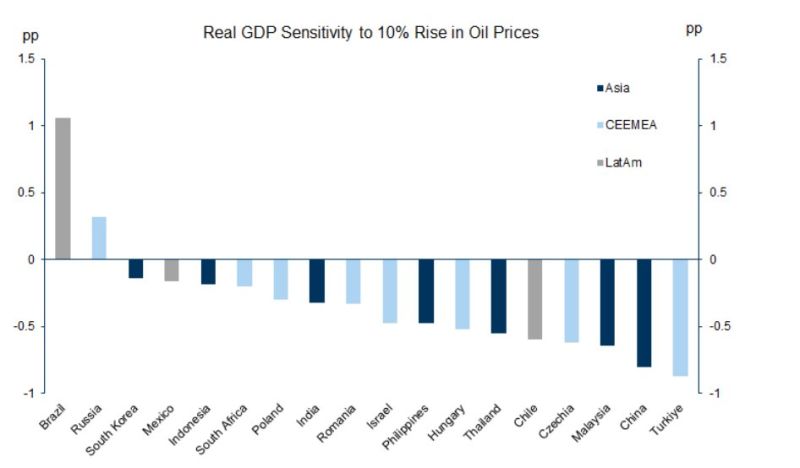

Research from Goldman shows that rising oil prices hurt emerging market economies as a whole.

While emerging markets typically depend more heavily on commodity exports compared to developed markets, they also use a greater share of commodities relative to their GDP. This makes them vulnerable to the indirect consequences of higher oil prices, such as slowed global economic growth. Noteworthy exceptions include Brazil and Russia. Source: Goldman Sachs, Markets & Mayhem

Bloomberg Commodity index $BCOM vs. US 10-year breakevens is now trading with a massive gap

A divergence we rarely see. Source: TME, LSEG

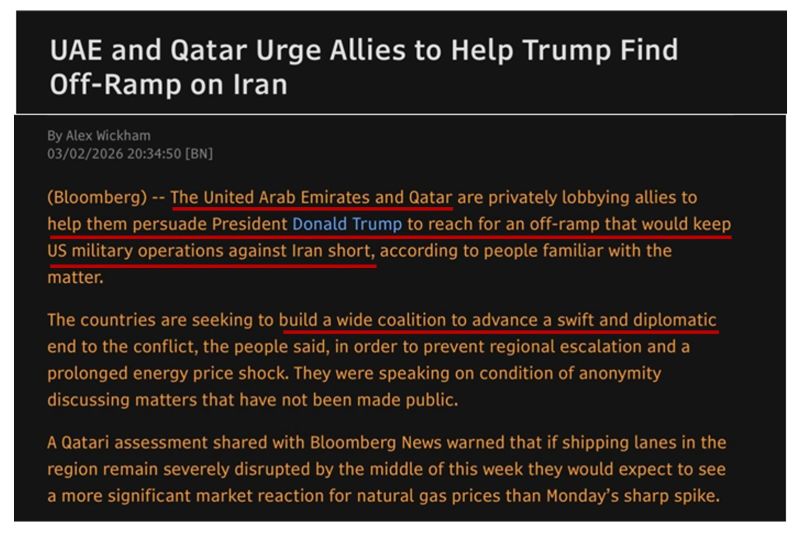

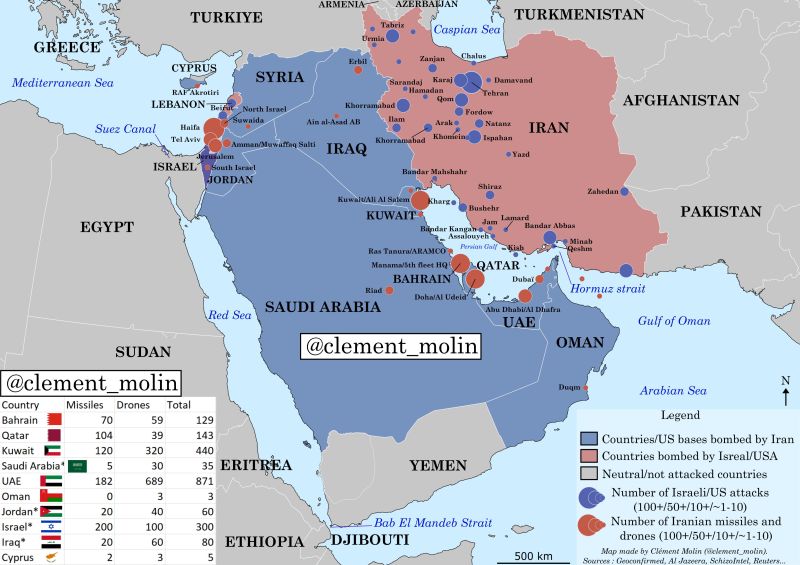

Day 4. Middle East.

As expected, there is some escalation as the war between the U.S. + Israel and Iran is intensifying. Here’s what changed in the last 24 hours: ✈️ Air Superiority Established US and Israeli air forces now hold near-total air control over Iran. Dozens of missile launchers, rear bases, and command centers were hit — especially in Tehran. 🎯 But Iran is far from neutralized Iran continues launching drones and missiles across the region. Some reached critical U.S. bases. Now the conflict has expanded geographically: • Hezbollah joined the fight from Lebanon • Israeli airstrikes followed inside Lebanon • Iranian strikes hit Saudi Arabia (including Ras Tanura / ARAMCO refinery) • US Embassy in Riyadh targeted • Ongoing strikes across Iraq, Kuwait, Bahrain, Qatar, UAE, Jordan, Cyprus, and Israel ⚠️ Notably: 3 American F-16s were reportedly shot down in Kuwait — by error. The Regional Fallout • Protests erupted around U.S. embassies in Iraq and Bahrain • The U.S. has called on all American citizens to leave the region • 20 U.S. cargo aircraft are en route to reinforce logistics and defense systems Strategic Questions Now Emerging ▫️ Despite 4 days of heavy bombardment, the Iranian regime remains intact ▫️ Iranian counter-strikes continue — but how deep are their missile stocks? ▫️ Gulf countries and Israel may soon face air-defense missile shortages This is no longer a contained confrontation. It’s a multi-front regional escalation with air dominance on one side and missile saturation strategy on the other. The coming days will likely determine whether this stabilizes… or spreads further. Source: @Clément Molin on X

Investing with intelligence

Our latest research, commentary and market outlooks