Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

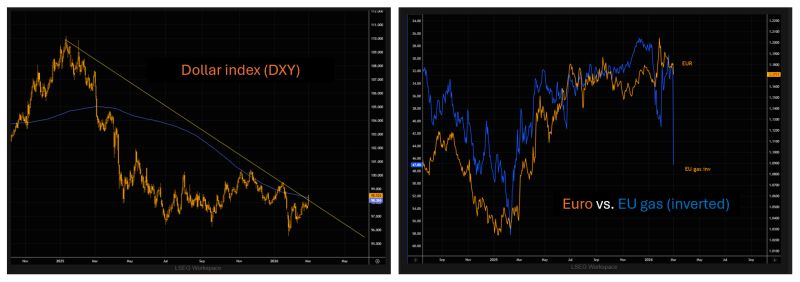

The dollar index $DXY is now flirting with the downtrend line that has been in place since early 2025 (chart on the left).

It is breaking above the 200-day moving average. A close slightly higher from here, and we could be staring at a proper dollar squeeze. Meanwhile, the EUR has tracked EU gas almost perfectly, and the gap now is massive. The chart on the right shows EUR versus EU gas (inverted). That gap is huge. Source: The Market Ear, LSEG

Kospi -6%, bigger drop than Liberation day, worst day since August 2024 carry trade unwind

Source: www.zerohedge.com, Bloomberg

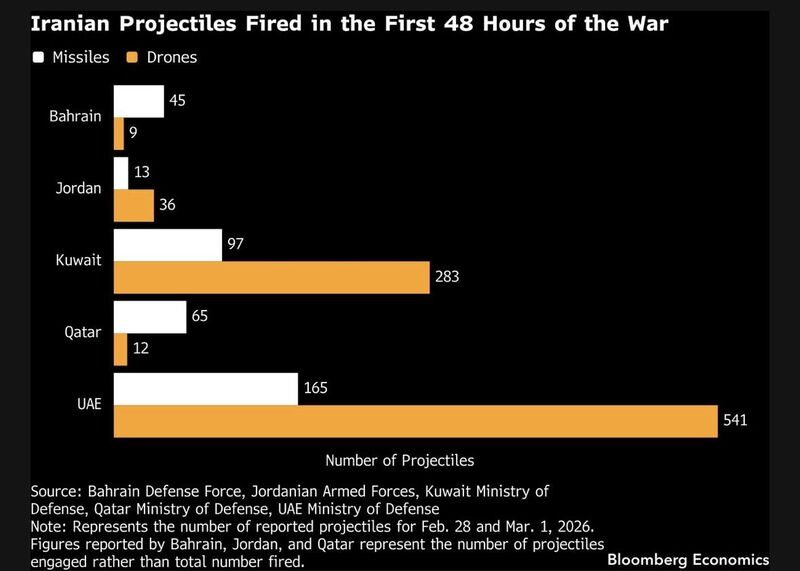

Iran fired 1200+ projectiles at five countries in the first 48 hours.

Most were drones. These saturation attacks aim to overwhelm air defenses and drain interceptors. $20-50k Shahed drones vs. $4.19M PAC-3 interceptors put US and its partners on the wrong side of the cost curve. Source: Bloomberg, Becca Wasser

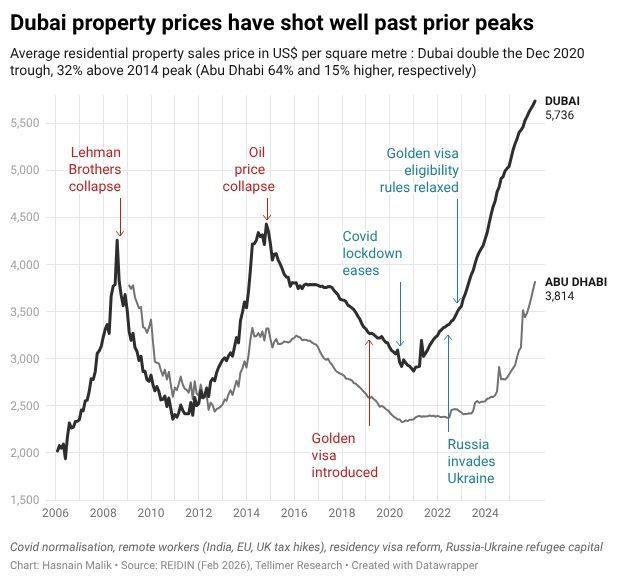

Dubai and Abu Dhabi: a reminder of property prices (as of the end of January)

Source: Hasnain Malik

$EWY iShares South Korea is up 54% in 39 trading days in 2026

Source: TrendSpider

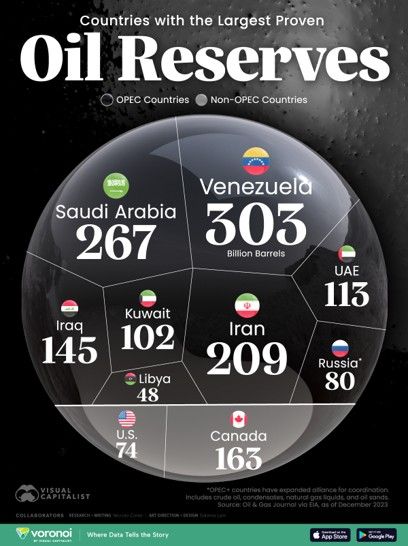

It Was Never About Iran or Venezuela. It’s About China.

+$15 for a full one-month closure if there are no offsets (e.g. utilization of spare pipeline capacity, SPR release) +$12 for a full one-month closure if all estimated 4mb/d spare pipeline capacity is used +$10 for a full one-month closure if all estimated spare pipeline capacity is used and global SPRs are released for one month at a 2mb/d pace +$4 for a partial 50% one-month closure if all estimated spare pipeline capacity is used +$1 for a partial 25% one-month closure if all estimated spare pipeline capacity is usedChina’s rise has a quiet weakness: energy dependence. 🇨🇳 China imports 70%+ of its oil 🛢️ And that oil comes from a very small club of countries Here’s the part most people miss: Venezuela (#1), Saudi Arabia (#2), and Iran (#3) Together control ~45% of the world’s proven oil reserves Now connect the dots. The public narratives are familiar: • Remove dictators • Stop drug trafficking • Prevent nuclear weapons All valid concerns. But they don’t explain the pattern. 🔹 If drugs were the real reason, Mexico would be the main target 🔹 If nukes were the red line, North Korea would be regime-changed 🔹 If authoritarianism was intolerable, the list would be much longer So why Iran and Venezuela? Because both sit on massive oil reserves And both have been energy lifelines for China This isn’t about invasion or ownership. It’s about influence: • Who they trade with • Who they align with • Who gets access when supply tightens You don’t need to control oil. You just need to shape who can’t access it. Seen through that lens, the strategy becomes clear: 🧠 Pressure China without firing at China 🌍 Reshape global energy leverage ♟️ Play the long game, quietly Source: SoveyX Source: Goldman Sachs, zerohedge

Investing with intelligence

Our latest research, commentary and market outlooks