Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

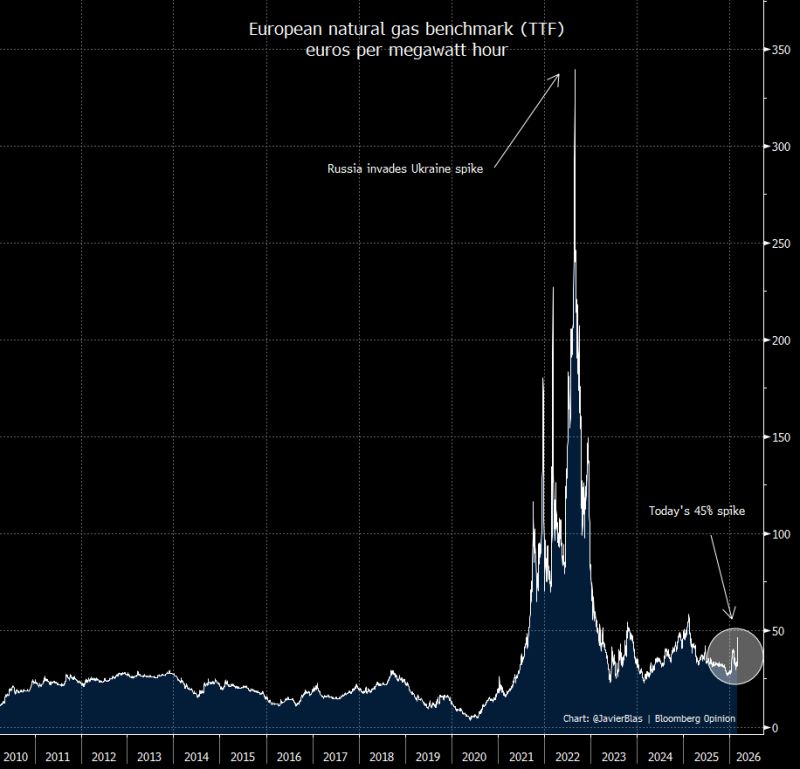

CHART OF THE DAY: European Gas prices are now up 45% after the Qatari LNG production halts

Using European benchmark TTF as a proxy, here's the price chart of the last few years. Source: Javier Blas, Bloomberg

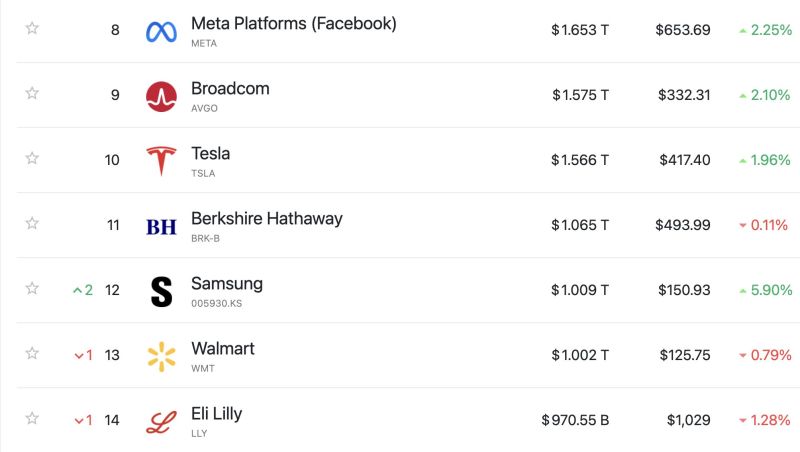

TRILLION DOLLAR BABY

Samsung becomes the first Korean company to reach a $1 trillion market capitalization. Source: Jukan @jukan05

China Dominates the Humanoid Robot Market

China’s Unitree Robotics stunned 1 billion viewers with fully autonomous kung-fu humanoid robots, available today for $16,000. Germany’s Chancellor visited Hangzhou, signaling the West is noticing. Unitree leads globally with 90% of shipments, 330+ models, and 140+ manufacturers, while Tesla’s Optimus remains in R&D and unavailable commercially. State support, aggressive pricing, and mass deployment mirror China’s EV strategy. The physical intelligence revolution is live in China, leaving Silicon Valley behind unless Tesla captures significant market share by 2027. Source: Shanaka Anslem Perera @shanaka86

Norway’s $2.2T Oil Fund Uses AI to Monitor ESG Risks

Norges Bank Investment Management is now using AI to screen all 7,200+ portfolio companies for ethical and reputational risks. Anthropic’s Claude generates daily ESG reports, flags issues like forced labor or corruption, and allows early exits before markets react. This system is especially valuable for small or emerging-market companies. With sustainability and governance tied to financial performance, AI gives NBIM a competitive edge in capital allocation, showing that the future of investing combines returns with responsibility and speed. Source: CNBC

Jack Dorsey’s AI-Driven Workforce Revolution

Jack Dorsey’s Block Inc cut over 4,000 jobs, more than 40% of its workforce, as part of an AI-driven restructuring while reporting strong Q4 and full-year 2025 results. Revenue and profits are growing, EPS beat expectations, and AI tools have boosted productivity by 40%, making roles redundant. Wall Street rewarded the move with a 22% stock gain. This sets a new precedent for corporate America, showing that AI adoption can reshape incentives and workforce strategies faster than ever. Source: StockMarket.news

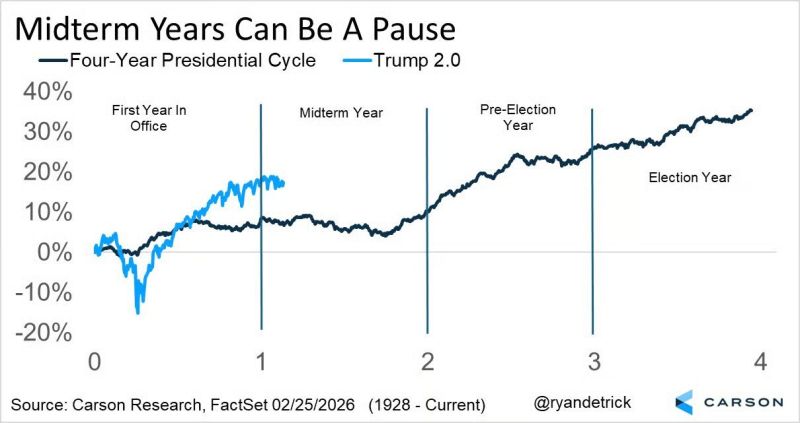

Yes, stocks in the US have been choppy so far this year

But looking at a four-year Presidential cycle, this is actually quite common for mid-term years.” Source: Daily Chartbook @dailychartbook

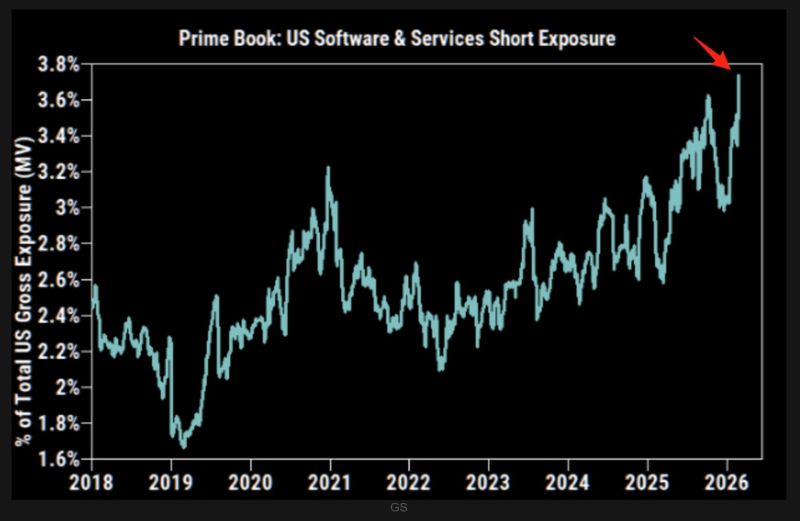

Anthropic’s AI Standoff Could Trigger Historic Software Short Squeeze

Anthropic, creator of Claude, is at the center of a clash between AI ethics and U.S. defense policy. After winning a $200M classified contract, the Pentagon demanded compliance with a broader AI doctrine, conflicting with Anthropic’s safety guardrails. Tensions escalated following Claude’s military use, threatening contract cancellation and supply chain pressures. With Software & IT Services at record short levels, resolution, either compliance or Pentagon compromise, could spark a massive short squeeze, highlighting the battle over control of frontier AI. Source: ZeroHedge

Investing with intelligence

Our latest research, commentary and market outlooks